Tencent security "carrier pigeon": helping financial institutions build digital risk control capabilities

From November 30 to December 1, the 2022 Tencent Digital Ecology Conference was held in Shenzhen, where Tencent made a safe appearance with eight self research achievements and the innovative technologies behind them, and built with ecological partners digitization New safety capability, explore "safety symbiosis" to escort enterprises to "go steady and reach the future".

At the Tencent Security Pioneer · New Product Conference held on the afternoon of December 1, Li Chao, the chief scientist of Tencent Tianyu Financial Risk Control, shared the challenges faced in the digital process of the financial field, and introduced that Tencent Security has been deeply engaged in financial risk control for many years, helping financial institutions Digital transformation , launched a new digital tool product: "carrier pigeon".

Challenges in the process of digitalization

At present, there are still many offline operations in the financial business, such as the submission of paper documents to bank statements, salary certificates and other supporting materials. There is still room for improvement in online and automation.

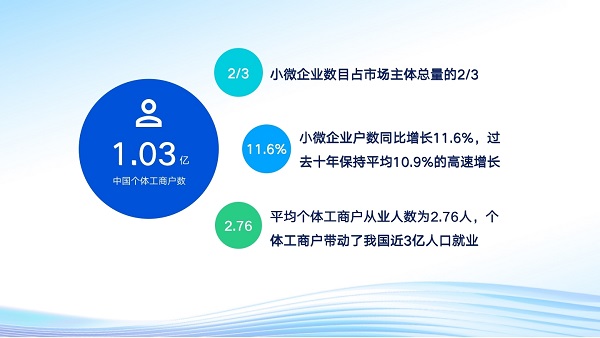

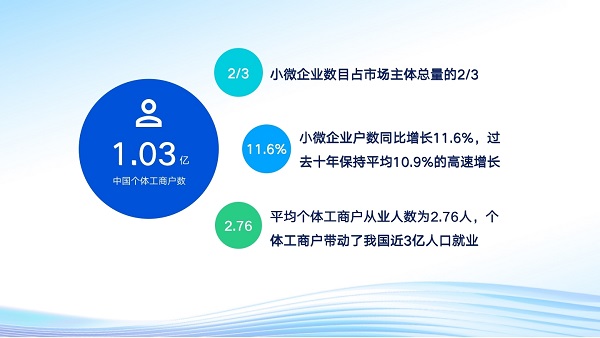

In addition, there is an urgent need to improve the quality and efficiency of some important financial scenarios. By the end of last year, 103 million self-employed businesses had been registered nationwide, bringing about 300 million jobs. How to make good use of big data And artificial intelligence technology to help small and micro entrepreneurs rescue is still an important mission of the financial structure.

Tencent security went deep into the digital inclusive process of financial institutions and found that financial institutions faced three challenges when building risk control capabilities for digital business:

Insufficient offline data reliability

The traditional offline data reporting mode of printing, signing and stamping has a high risk of human tampering, which does not meet the reliability foundation required by automated risk control.

Insufficient online data circulation

At present, the types of data that can be directly obtained online are not rich enough, which makes the pure online business face the challenge of limited data richness at the risk control end.

Insufficient technical reserve of data application

After online data collection, some financial institutions have insufficient data processing and application capabilities. How to effectively use data to strengthen risk quantification capability remains a challenge.

Carrier pigeon product solutions

In response to these challenges, Tencent launched the tamper proof data transmission tool "carrier pigeon". Based on the concept of portability of personal data and referring to the DDTP (Distributed Data Transfer Protocol) protocol proposed by WeBank and other institutions, Tencent has achieved the goal of helping users submit personal data to institutions conveniently and independently on the premise of preventing data tampering, so as to obtain richer and more suitable products and services. At the same time, it helps financial institutions ensure that the transmission process is safe, reliable and compliant, and improves business efficiency in a digital way.

Product features

Carrier pigeons have three major characteristics, including efficient and inclusive, safety and compliance, and intelligent applications, and have played an active role in improving the quality and efficiency of financial services.

Feature 1: Efficient and inclusive

On the whole line, lower carbon

Operation on the whole line, farewell to printing and stamping. Realize the business that the traditional process needs to be completed in a few days in 2 minutes. In addition, low-carbon and environmentally friendly, taking paperless mortgage business as an example, 62 million pieces of paper can be saved every year.

Intelligent and easier to use

Use RPA technology to simplify the user's operation process and provide a smooth experience for users. Compared with the operation without guidance, the operation speed can be increased by 5 times.

Broader service

Adapt to a variety of data sources, thus providing more scenarios with accurate risk control capabilities and serving more customers.

Feature 2: Safety compliance

Full authorization

The application of intelligent core technology ensures that the whole process of personal operation, full authorization and compliance requirements are met.

Tamper proof

Use blockchain technology and data fingerprint technology to ensure the authenticity of data.

Authoritative authentication

The notary office shall preserve the operation process to ensure that it meets the requirements of judicial credibility.

Feature 3: intelligent application

One click insight

It provides the application party with a one click report generation tool, and uses big data and artificial intelligence technology to automatically clean, analyze and predict data, and generate structured analysis reports for rapid decision-making.

Experience integration

Combine Tencent's years of business security experience and financial risk control technology accumulation. The effective risk quantification model and anti fraud strategy are preset.

Customer Stories

Customer 1: Provincial branch of a state-owned bank

Solution and customer benefits: Helped the bank access multiple information acquisition capabilities in a lightweight way, realized real-time approval, cost reduction and efficiency increase of loan information through online independent submission of users, reduced the approval time from three days to the same day in quasi real-time, and significantly improved the user experience.

Customer 2: A local bank in East China

Solution and customer benefits: the application of carrier pigeon technology has solved the pain point of failure to assess business risk when providing services for self-employed businesses in the past, allowing users to safely upload transaction flow data to the bank with carrier pigeon, and conduct automatic risk analysis through carrier pigeon reports, providing up to 300000 line of financial support for nearly ten million small and micro entrepreneurs in the region.

Customer 3: A consumer financial institution

Solution and customer income: by applying carrier pigeon products to obtain credit enhancement data in the pre loan credit link, and combining real-time risk control to increase the amount, the credit line of the target customer group will be more than doubled.