The latest public cloud market pattern: the world's "five clouds" and China's "five clouds"

Recently, research institutions Synergy Research and IDC released reports successively, revealing the market pattern of public cloud manufacturers in the global and Chinese markets.

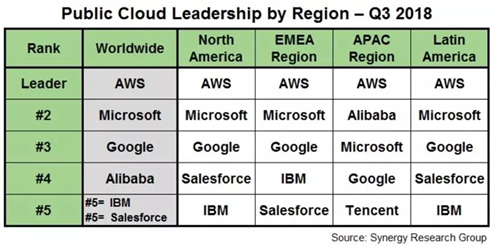

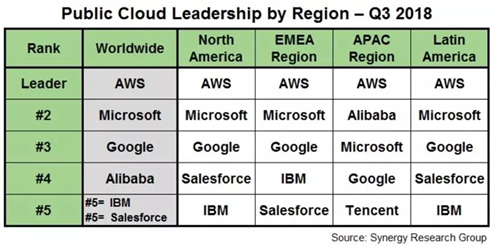

According to Synergy Research, in the third quarter of this year, the global "five cloud" providers were Amazon AWS, Microsoft, Google, Alibaba, IBM and Salesforce (both tied) by market share.

However, in the Asia Pacific region where China is located, Synergy Research data shows that Alibaba Cloud ranks second, surpassing Microsoft and Google Cloud. In addition, Tencent, another local cloud computing company in China, also entered the top five.

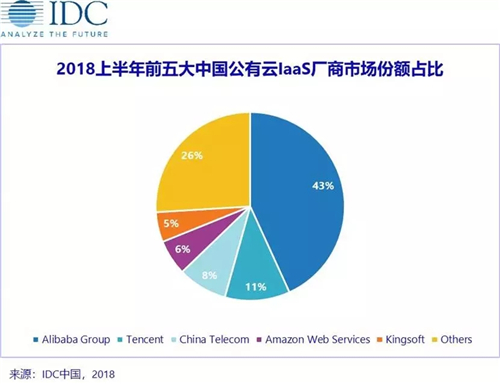

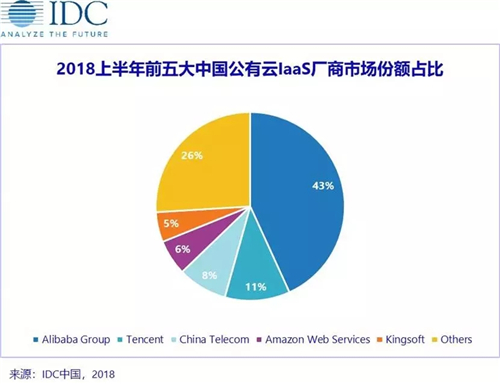

In China, according to IDC data up to the first half of this year, Alibaba, Tencent, China Telecom, AWS, and Jinshan are the largest "five clouds" providers in China. Among them, Alibaba is dominant. Among the top 5 providers, Alibaba Cloud's share is 13% more than the other four combined.

The report also pointed out that the overall market size of China's public cloud services (IaaS/PaaS/SaaS) exceeded US $3 billion in the first half of 2018, of which the growth rate of IaaS market hit a new high, with a year-on-year growth of 83%. In addition to market leaders, some new manufacturers, such as Baidu, Huawei, Inspur, JD, etc., continue to increase their capital and technology investment in the public cloud market, and achieve differentiated growth and intensify market competition by virtue of the technology in the subdivided fields, ecological or regional market advantages.

To sum up, only AWS and Alibaba Cloud overlap in the world's "Five Clouds" and China's "Five Clouds" providers, and AWS has outstanding performance in the global market; Although Microsoft and Google's public clouds are second only to AWS in the global echelon, they are not competitive with local manufacturers in the Chinese market. Ali, by virtue of its huge local advantages, also ranks among the top four in the world.

Synergy Research pointed out in its report that China now accounts for more than 1/3 of the market in the Asia Pacific region, and its share in the regional total is increasing every quarter. Data from IDC 2018 Global CloudView survey shows that 81% of the surveyed enterprises are using or plan to use public clouds. It can be seen that cloud computing is still in the fast lane of growth in both China and the world, and it is difficult to say that the market pattern has been finalized.

For example, at the Huawei Full Connectivity Conference last September, Guo Ping, the rotating CEO of Huawei, made a bold statement: "Huawei has the determination and ability to work with partners to create one of the world's' five clouds' in the era of intelligent society." Earlier, at the 14th Huawei Global Analyst Conference, Huawei made a statement: "Huawei's public cloud must surpass Alibaba Cloud in three years.".

In the past year, Huawei Cloud has also made frequent actions and gained great momentum; Tencent Cloud, the second place, is also sharpening its sword and vigorously transforming the ToB market; As a catcher, Alibaba Cloud has just announced that it will upgrade to Alibaba Cloud Intelligence... When the wind blows, will the "five clouds" pattern of the world and China be rewritten, and when will it change? Let's wait and see.