Talk about the operating characteristics of the data center industry, part of the data center investment series

I have been investing in the new infrastructure industry for the past two years. I want to talk about the data center from the perspective of investment, and I am going to write two or three essays. The first essay first talks about several characteristics of the data center industry.

one The data center is a heavy asset business.

The main characteristics are: mature industry, heavy assets, long cycle High annual depreciation 。 Seeing these five words, it is estimated that some data center bosses will show a knowing smile.

two The data center industry is a mature technology service industry.

The data center takes land, factory buildings and cabinets as space carriers, and takes mechanical and electronic equipment such as wind, fire, water and electricity networks as technical tools to provide placement space and safe operation environment for servers and network equipment, and ensures the continuous stability, safety and reliability of the operation environment with standardized high-level operation and maintenance services. As a metaphor, the data center is very similar to the mass selling KTV, which is a building with many rooms and a bunch of electromechanical equipment. The mass selling KTV building has central air conditioning, power supply and water supply equipment; KTV room has some electromechanical equipment, such as song player, LCD large screen TV, microphone, power amplifier, speakers and speakers, and a group of waiters, brothers and sisters. The basic principle of the data center is exactly the same as that of the mass selling KTV, that is, room+electromechanical equipment+operation and maintenance engineer. The biggest difference between the two is that there is no beautiful little sister in the data center, only a group of inarticulate straight men.

three Investment and profit model of data center project

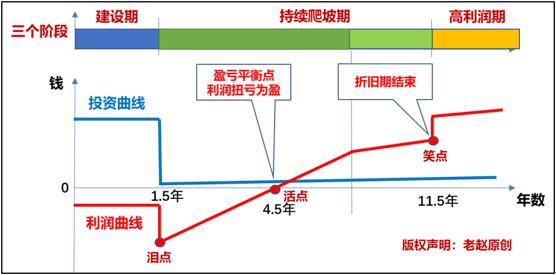

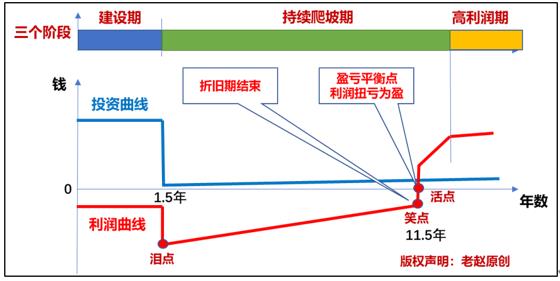

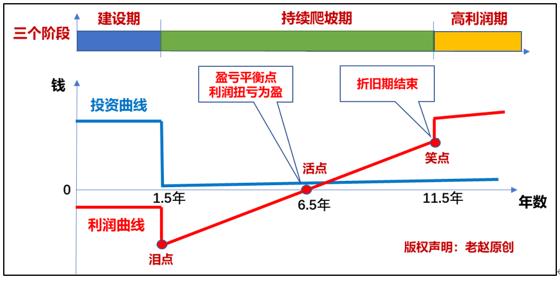

Investment model and profit model of data center , can be summarized as“ Two curves, three phases, three keys ”, referred to as“ Two line, three section and three point model ”The drawing is called“ Two lines, three sections and three points diagram ”。 But I personally prefer to call this picture“ Kitchen knife chart ”。 Why is it called kitchen knife drawing? I'll talk about it later.

For“ Two line, three section and three point model ”In fact, many bosses, managers and industry experts in the data center are very clear and have made many statements, but they may not have done systematic induction or formed a model before. Combining my experience and understanding accumulated in project investment and operation, I made some refinements to form a basic model and draw the following model diagram.

Figure 1: "Two lines, three sections and three points model" of data center

The two curves are investment curve and profit curve.

Investment curve The heavy asset investment of the data center mainly includes land, plant, power engineering, electromechanical equipment, network communication system and other assets. The first phase of a data center project is the construction period. Normally, The project is invested in a large scale at one time during the construction period, and there is no need to invest in a large amount later 。 The depreciation period of electromechanical equipment assets is usually set as 10 years, The service life of large electromechanical equipment can exceed 30 years under the premise of good maintenance 。

Profit curve : Yes“ Two line, three section and three point model ”The core of is also to understand the key curve of data center operation.

The first stage of data center project investment is Construction period It takes about 1.5 to 2 years, mainly including land acquisition, design, building, electromechanical engineering construction, completion, testing, acceptance, delivery and other links.

Lacrimal puncta : After project acceptance and delivery, land, houses and equipment will be included in the fixed assets statement and the operating financial statement Start to calculate depreciation of fixed assets 。 Since the data center project is a heavy asset investment, the annual depreciation amount of fixed assets is very large, but there are few customers and sales revenue at the initial stage of project production Starting point of climbing period The profit in the annual financial statements is a huge loss. When the boss saw the number of huge losses, his head was anxious, his heart was cold, he held back his sadness, gave a false smile of confidence, firmness and optimism in the company's face, and cried after returning home. So it is called "tear point".

The second stage of investment is Climbing period Starting from the teardrop, it took about two to seven years. Through the efforts of the boss and the sales team, the cabinets were gradually rented out. Customers continued to increase, the rental rate of cabinets continued to increase, and the revenue continued to grow. The cabinet rental rate of the data center reached 90%, and the climbing period ended.

Live point (break even point) : During the climbing period, with the increase of the rental rate of the cabinets and the continuous growth of the sales revenue, one day the rental rate of the cabinets/the listing rate reached about 50%~60%. After the project income offset the cost, depreciation, expenses, financing repayment principal and interest, the project realized the balance of profit and loss, the project profits began to turn positive, the operation went out of the loss situation, and the project was alive. Since then, the pressure and anxiety of the boss of the company have been greatly reduced, and he no longer has to go home and cry.

from Lacrimal puncta reach Live point The general retail data center usually takes about 2-5 years. With a good foundation of the project and the support of the management and sales team, more than 50% of the cabinets can be put on shelves as soon as more than 2 years, and the break even point can be achieved. If the basic conditions of the project itself are insufficient, and the operation and sales team are not strong enough, it may take more than 5 years for the shelf availability rate of cabinets to reach 50%~60%, reaching the break even point. Therefore, at this stage, the basic conditions of the project are established, and a strong operation and sales team becomes the key to whether the project can reach the break even point (living point) as soon as possible.

The project arrives from the tear point Live point The shorter the time, the better. If the time is too long, the data center project may not survive. I have really seen that there are data center projects that have never reached the living point. But I have also seen another situation. Because of the strong strength of the parent company, although the data center has been losing money, the parent company has always been blood transfusion, incarnating the strongest nurse in the loss data center.

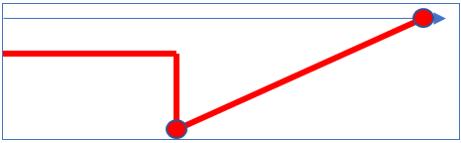

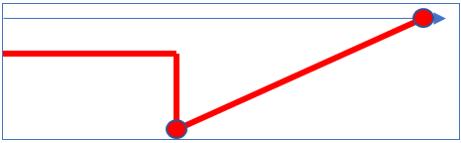

Look at this picture. Does it look like a kitchen knife? It is“ Two line, three section and three point model ”The key part of“ Kitchen knife chart ”。

In this kitchen knife chart, the blue thin line on the top is the zero line of profit break even, and the red line below is the annual loss. The part between the two lines is the net loss, so it can also be called“ Pit map ”。

After the data center was put into production, the profits of the first three years were basically losses. The core task of the sales team is Pit filling Fill up the loss pit in the shortest time, and the project will reach the break even point. If the pit is not filled, it means that the project operation continues to lose money, which is a lovely “ kitchen knife ”Will continue to cut flesh and blood for the financial statements of data center enterprises 。

Therefore, for a data center project, The time from the tear point to the survival point can almost be said to be a test of life and death. This requires data center enterprises to establish a strong marketing team, sell more cabinets, sign more contracts, and get more sales revenue in the shortest possible time to Fill the pit as quickly as possible Realize the break even point and stop the bleeding of kitchen knife.

so-called "Time is money, time is life" During the operation of the data center's heavy asset project, I felt the most unforgettable, especially in the first three years after the production, facing the heavy pressure of depreciation of fixed assets, it was simply an experience of scraping bones and curing poison.

I have to say that in the From tear point to live point, this stage of pit filling in the climbing period It is often necessary to hang up one or even two or three marketing teams. If the board of directors is not satisfied, it may even hang up two or three CEOs. Normally, the first round of management team is likely to sacrifice all of them to fill the pot for project losses, and the CEO is killed by the Board of Directors. In the second round of the management team, if the sales growth and listing rate cannot meet the requirements, then the probability of sacrifice is also great. The dedication and sacrifice of the first two rounds of marketing teams have become the stepping stone for the third round of teams. During the tenure of the third round of management team, the project finally reached the break even point and climbed out of the pit.

In order to avoid the CEO being killed by the Board of Directors, the usual solution is to recruit a sales general manager or deputy general manager with a high salary to undertake the sales task KPI, establish an industry sales team, such as the Internet, government and state-owned enterprises, financial investment, operators, education, etc., and launch sales exhibitions. If the sales performance KPI fails to meet the standard, the General Manager/Deputy General Manager of Sales will be killed.

stay The pit filling stage from the tear point to the live point during the climbing period The Board of Directors is also willing to pay high salaries and high commissions for professional managers, CEOs, general sales managers, and excellent sales who can sign large orders. Because compared with the huge amount of heavy assets depreciation, paying such salary and commission is really nothing. For enterprises at this stage, excellent team managers and big sales who can sign big orders with important customer relationships are the most valuable assets. At this stage, sales performance is the most important measure of employment. The sales team recruits and starts quickly. Whether it is the sales general manager or the sales staff, they will be graduated soon if their performance is not good. The project company has to rush forward to survive, and will not tolerate the sales team leader and sales personnel with poor performance.

So, It is of great significance to quickly reach the living point from the tear point The key to the profit, loss and survival of the project lies in this stage. Whether the positions of CEO, sales general manager and sales team can be maintained depends on whether the sales revenue of the project can be rapidly increased Achieve the living point as soon as possible, and realize the profit and loss balance of the enterprise as soon as possible 。

from Lacrimal puncta reach Live point The key is thirty Characters :

Team, team, team!

Sales, sales, sales!

Sign, sign, sign!

Go on sale, go on sale, go on sale!

Collection, collection, collection!

This is the meaning of "kitchen knife diagram".

Therefore, for a data center project, The selection and employment of the management team by the Board of Directors is extremely critical. After the project is put into production, if the number of customers, listing rate and sales revenue cannot rise rapidly, then shareholders will get a wonderful feeling of scraping bone and curing poison! Similarly, if a salesperson wants to join a data center company to do sales work, he or she should first see how the basic conditions of the data center project are. If the basic conditions are good, the sales work will get twice the result with half the effort. On the contrary, if the basic conditions of the data center project are poor, it will be more difficult to sell and make achievements, and it will be eliminated if you don't sign the bill all the time.

For data center enterprises, Strive for achievements and employ talents with high salary; Poor performance, quick and merciless!

For sales and marketing personnel Good birds can become flying pigs only when they stand on the wind outlet.

On February 1, I saw a news, Xiaopeng Auto announced that Wang Fengying, the former General Manager of Great Wall Motors, officially joined Xiaopeng Auto as President, and was fully responsible for the company's product planning, product matrix and sales system. According to the news report of Xiaopeng Auto, on November 30, 2022, Xiaopeng Auto announced its unaudited financial data for the third quarter as of September 30, 2022, with a total revenue of 6.82 billion yuan and a net loss of 2.38 billion yuan. The sales volume of Xiaopeng Auto fell below 10000 units for four consecutive months from August to November, and it is estimated that a huge loss will still occur in 2022.

The automobile industry has some similarities with the data center industry. It is also a long cycle, heavy asset, and its sales volume has to climb from zero. There are also "tears" and "live spots". In the climbing period from tears to vitality, the company suffered serious losses. The Board of Directors hired a professional manager with rich industry experience and strong leadership as the CEO to lead the company's team, which is a necessary means to solve the problems of the company's product system and sales growth, reach the "vitality" as soon as possible, and achieve profit and loss balance. Shopping malls are like battlefields, and weapons are very important. But brave generals and brave and tenacious soldiers are more important to the victory of the battle. People are the key to victory.

Project company success Climb over the living point and make profits become regular , start From living point to laughing point 。 At this stage, the survival pressure of the company has basically disappeared, followed by the question of how much profit and growth rate. With the continuous improvement of the shelf availability rate of cabinets, the sales revenue continues to increase, and the total profit of the project continues to maintain a stable growth. The pressure of the sales team is reduced, and the CEO and the general manager of sales are also restored from crazy primitive people to normal people. When the rental rate (or shelf availability rate) of cabinets reaches more than 90%, they are basically sold out, customers tend to be stable, and sales revenue growth slows down significantly, Climbing period It's almost over 。

The revenue peak of a data center is that the shelf availability rate of cabinets reaches 95%, which is basically full. Just like a bus, it can only hold 50 people at most, and no more people can fit it. If you insist on holding more people, you may be in danger.

the punchline : After the fixed assets of the data center have been depreciated for 10 years, no depreciation will be accrued from the 11th year. The annual depreciation amount of heavy assets in the previous 10 years has almost been converted into gross profit since the 11th year. Although the sales revenue of the project company is no longer growing significantly, the total gross profit and total net profit of the project have increased significantly, and the company's profit rate and return on equity figures are very beautiful. After seeing the profit figures, the board of directors and shareholders remained calm and hypocritical, and could not help giggling when they returned home. So it's called“ the punchline ”。

from the punchline At the beginning, data center project operation entered Stage 3: High profit period 。 At this time, the sales staff can achieve good sales performance even if they lie flat. However, the company's sales management system began to adjust the KPI assessment method from "total sales revenue" to "incremental sales revenue". So the sales staff all felt that the boss had changed his mind and he had changed from Britney Spears to Mrs. Niu.

Smart salesmen should consider whether they can put aside their vested interests and choose a new data center project at this time. They should rely on their industry experience and customer relationship resources to seek higher positions and salaries, and change from salesmen to managers to lead the sales team.

If an employee Lacrimal puncta I joined the company at the age of 30. I was very lucky that I didn't die halfway. I kept working until the punchline If he does not leave, he will be 40 years old, and the most valuable stage of his life will be devoted to the enterprise. 40 is the best stage for job hopping and promotion.

four Key risks of data center : cash flow

At present, data center enterprise financing is widespread“ High leverage ”The situation. Specifically, it is mainly through financial leasing to solve the problem of electromechanical equipment procurement in the data center. Financial leasing can last for 8 or even 10 years, far longer than bank credit (3 or 5 years), so it is the most common financing method used in the data center industry.

Financial leasing companies can provide 60%~80% of the total investment in electromechanical equipment for projects, with a leverage ratio of 1:3 or 1:4. The project owner can leverage the project investment of a larger data center with less self owned funds. The price paid is that the project owner will pledge the company's equity, asset property rights, usufruct, and certain specific rights and interests to the financial leasing company, and pay the interest and principal on time according to the agreed terms of the financial leasing contract.

The finance lease contract can stipulate that only interest will be paid in the first 24 months, and no principal will be repaid; The principal and interest will be repaid from the 25th month. According to the financial leasing contract, the data center project company should pay a large amount of principal plus interest repayment to the financial leasing company on a regular basis every quarter.

Long term financing often means higher risk, so the interest of financial leasing is about 7.5%~10%, which is far higher than bank loans. Therefore, the data center enterprises have great pressure to repay the principal and interest. If we can find some low-cost funds to replace some of the financial leasing debt, it will effectively reduce the pressure on interest payment of capital costs. And what kind of capital is the cheapest? The answer, of course, is“ Shareholders' money ”。 So, Data center investment must be closely coupled with the capital market, and a data center enterprise must have a listing plan. The larger the data center project, the sooner it will enter the capital market. This sentence is more than real gold. If you don't believe my words and blindly invest in the data center project, the enterprise will not be listed as soon as possible, and there is no good father or rich father to act as a backer for blood transfusion and money. The project will be operated under high leverage, high debt, and tight cash flow, which will bring great pressure to the enterprise's operation. In case of unpredictable sudden risks, the project company's cash flow will be unexpectedly broken, The data center project company may die.

Some Internet companies often require a three-month accounting period. If a telecom operator signs a cabinet purchase contract on behalf of the Internet company, it may also require an additional 1-2 months of accounting period. Therefore, a data center enterprise should keep working capital in its bank account for at least 3-6 months to avoid the company's failure to pay electricity bills due to cash flow disruption.

For financial leasing, if the data center enterprise defaults due to continuous overdue repayment, it may suffer huge losses, and even lead to major shareholders losing control of the data center company. However, it must be noted that only through financial leasing can data center enterprises obtain financing for up to eight years. During these eight years, financial leasing companies are also faced with huge risks of changes in the capital market and inflation, so financial leasing will inevitably lead to higher capital costs. The high cost of capital leads to huge pressure on repayment of principal and interest, and also brings huge pressure on the cash flow of data center enterprises.

You can understand why The faster the time from the tear point to the living point, the better, and the shorter the time. Why does the general manager of sales and the sales team play a crucial role in this stage. Why at this stage“ Using the wrong person is very risky ”。 Why should the board of directors“ Strive for achievements and employ talents with high salary; Poor performance, no mercy! "

Because if it doesn't work well, the company will die and the major shareholders may be out!

Therefore, three conclusions:

First, the board of directors is very critical in employing people. Use the right person to order, and use the wrong person to scrape bone to cure poison.

Second, the quick signing of sales orders and the quick launching of cabinets are as important as life.

Third, try to find low-cost funds and reduce the cost of funds by all means.

Confucius said: One word is worth a thousand gold, and three words are worth ten thousand gold!

five Is the data center a good business?

The IRR of data center projects can reach 12%~18% due to various congenital and acquired factors. The main feature of the data center is that it is an operational business. Once the customer signs the bill, it is relatively stable and is not easy to lose. The project can obtain long-term and stable sales revenue and profits. It is a good business for the capital side that has the strength to invest in heavy asset business and pursue long-term stable income and profits.

The data center business is characterized by a long-term heavy asset business, so the key resource is that investors must have sufficient funds, Must be really rich, or have a rich father , Be able to withstand risks and fluctuations in the business process.

The operational risk of the data center lies in Lacrimal puncta reach Live point At this stage, whether the enterprise's sales revenue and operating cash flow can be supported. If the operating cash flow is unstable and the company's foundation is weak, then the data center enterprise may not be able to carry it halfway, and may enter bankruptcy (such as Lan Xun Xin Run), or major shareholders sell their shares to give up control. Investors with financial strength are invited to take over.

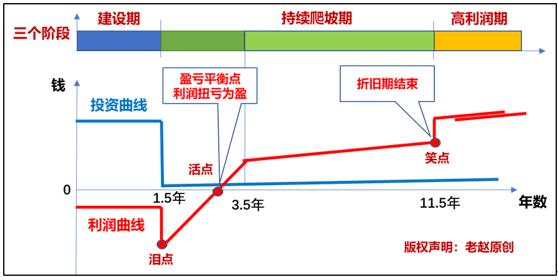

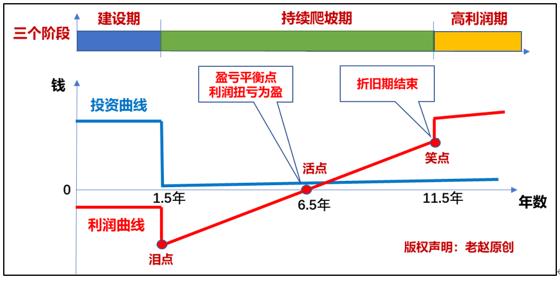

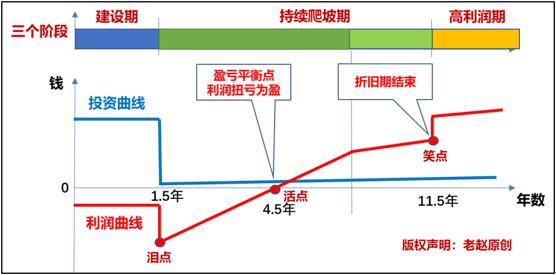

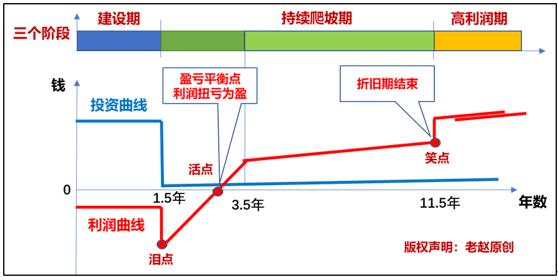

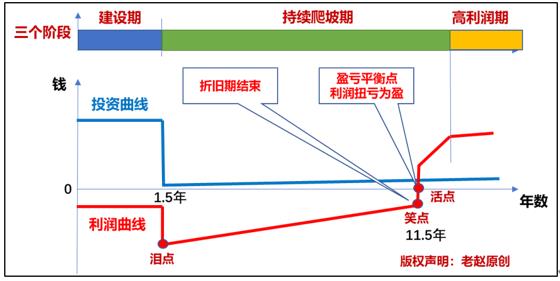

Here is “ Two line, three section and three point model ” Three of“ Variation kitchen knife diagram " , showing the operating characteristics of three types of market-oriented data centers.

Figure 2: Kitchen knife diagram of excellent data center project

Figure 3: Kitchen knife diagram of poor data center project

Figure 4: Kitchen knife diagram of Beicui data center project

Figure 1, Figure 2, Figure 3, Figure 4, four sheets Kitchen knife chart The main difference is Form of "lacrimal point" to "living point" in climbing period , respectively, described the operation patterns of four types of data centers: normal, high-quality, poor, and sad.

Comparing the four kitchen knife maps, we can see that there is one high-quality data center project“ Small scraper ”, there is one general project and one poor project“ Chopper " , there is a project called Beicui“ Large guillotine cutter ”。

Under the big guillotine knife, the death was extremely tragic.

Every data center enterprise can try to draw its own kitchen knife diagram.

The shape of the kitchen knife chart for enterprise operation mainly depends on two reasons. The first is the comprehensive basic conditions of the data center project itself, which is a congenital factor. The second is the management ability of the manager and the sales ability of the sales team, which is the acquired factor. Congenital factors are difficult to change, but acquired factors can change. Together, they determine the shape of a data center enterprise's kitchen knife chart.

Data center project High profit stage Normally, 12 years after the establishment of the project company (After the depreciation of fixed assets is completed, the original annual depreciation of fixed assets is almost all converted into profits) 。 Among them, it takes about 2-5 years from the tear point to the living point, and 10 years from the tear point to the laughing point. The management methods of the two stages are different. Therefore, when investing in and operating the data center business, in the face of huge losses in the early stage, we should not be impatient. We must respect the industry's law rate, maintain strategic concentration, continue to optimize the operation level, hire excellent talents, adopt appropriate incentive strategies, and quickly sign sales orders for listing and collecting payments. The data center industry may make a lot of money, but it certainly cannot make fast money. It is a long-term investment project.

Indeed, there are also data center projects. Investors do not understand the business laws of the industry, nor do they have strategic determination. Management decisions are wrong, leading to the collapse of the core operation team. For seven or eight years, they have been squatting in the pit and unable to climb out. The small scraper has become a big chopper, cutting flesh and blood for the group company year after year.

Investors should pay attention to the high risk of short-term funds investing in data center projects. The project owner has a short-term fund, so it is better not to invest in long-term business such as data center. If you risk using "Long term investment with short money and continuous borrowing to repay the old ” Invest in the data center project in a way that five cups and three lids flip back and forth, Often, the project has a high probability of final failure.

Investing in a data center project requires long-term funds, or the investor I'm rich , can also afford to play; Either one Rich dad , can send red packets and blood transfusion for a long time; Either the investor is Industry veteran Although they don't have much money, they have rich experience and play steadily (they do have such a boss, who is skilled in business, has good customer resources, has stable control, has strong determination, and is not greedy for merit, does not dare to advance, plays steadily, and can control the project well even if they don't have much money). Of course, no matter how you play, the final export of the project is the capital market.

Therefore, the data center project is a low-risk business for investors who really have money and grasp the laws of the industry; For investors who do not have much self owned capital, high financing costs, and do not grasp the laws of the industry, it is a high-risk business.

From the perspective of capital, do a good job Marketization data center project Key resources of:

The first is the requirement Investment shareholders are really rich, not fake 。

The second is data center project investment, which can find Low cost capital channel, which can obtain low-cost capital for a long time (low interest) , Greatly reduce capital cost 。

The third is to grasp the reliable capital market listing and export, so as to quickly enter the capital market 。 Marketization data center enterprise The way out or Independent listing , or the listed company merger 。 This is the inevitable choice and the will of the capital side. Not doing a good job in advance“ Enterprise listing and listing roadmap ”The planned data center project is likely to have problems due to unexpected operational risks and cash flow.

If the data center project is difficult to enter the capital market quickly, it may lead to: the boss has heavy pressure, the boss has a hard life, the boss is depressed, and the boss has no fun.

Capital or investment fund makes equity investment in a data center project, the most important Wager The condition is likely to be that the company's management will accept the deadline for listing in the capital market, whether it is an independent listing, backdoor listing, or mergers and acquisitions of listed companies, so as to realize the safe and profitable exit of the capital side.

six Data center project, child or pig?

There is a metaphor in the investment field: to invest in a project, do you want to be a son or a pig? It is necessary to raise a son, but no matter how big a son is, he is also a son.

The purpose of raising pigs is to sell pork. No matter how good it is for pigs, it is also to sell them at a good price.

Capital can also be simply divided into two categories: industrial capital and financial capital.

Industrial capital is to expand an industry and occupy a leading position in the industry.

The purpose of financial capital is to make more money and maximize the return on investment.

Therefore, industrial capital investment is usually to raise projects as sons. The purpose of financial capital investment is to obtain as much investment income as possible. The project company is a pig, which will not be kept all the time and will eventually be sold. Of course, financial capital will also treat the invested projects well and give them various resources to support their rapid growth and compliant operation, so as to achieve the smooth listing of the capital market and the safe exit of investors.

Do you have a hybrid? It's true!

In the past three years, the SASAC has promoted the reform of central enterprises and state-owned enterprises. State owned enterprises have invested in mergers and acquisitions of high-quality private scientific and technological innovation enterprises, forming a mixed ownership enterprise, and supported this mixed ownership enterprise to be listed in the domestic capital market. When the enterprise is listed, the parent company of the state-owned enterprise still holds a large proportion of the equity of the mixed ownership listed enterprise and will not sell it easily. Mixed ownership enterprises have been listed in the capital market, and have not been abandoned by their father. They are still sons.

I have seen such successful cases. My former boss succeeded in making one. I hope I can also make one in 2023.

Basic core model of data center investment

I once summarized a basic core model of data center investment, including“ Three cores and six key elements ”The key factors for a good data center project are clearly explained, which will not be discussed here due to space limitations. Dig a hole first and fill it in the following essay.

To sum up, the previous contents, from the simple to the deep, from the simple to the simple, from the simple to the deep, from the deep to the simple, from the deep to the shallow, from the in out, briefly explained the investment and operation of a data center project Basic model and main principles 。 I hope it can give you some inspiration and help.

From a single point of view, there are inevitably many fallacies. You are welcome to criticize and correct them.

This is the first essay in the data center investment series. There are two more essays to be written as soon as possible.

Essays by Lao Zhao

February 14, 2023