In the first quarter of 2019, the revenue of the global server market increased by 4.4% year on year

According to IDC's quarterly tracking report on global servers, in the first quarter of 2019, the revenue of global server market vendors increased by 4.4% year on year to $19.8 billion, and the global server shipments decreased by 5.1% year on year to 2.6 million units.

In the first quarter of 2019, the whole server market began to slow down after six consecutive quarters of double-digit revenue growth, but the growth was still relatively strong. The revenue of servers shipped in bulk increased by 4.2% to US $16.7 billion, while the revenue of mid tier servers increased by 30.2% to US $2.1 billion. The revenue of high-end servers shrank for the second consecutive quarter, down 24.7% year-on-year to US $976 million.

Sebastian Lagana, IDC infrastructure platform and technology research manager, said: "The demand of enterprise buyers and large-scale data centers to purchase through ODM has decreased compared with previous quarters, and it is difficult to compare with the same period last year, which affected the growth rate of the market in the first quarter. This can be clearly seen from the decline of shipments in the first quarter. Although the average sales price (ASP) increased year on year, many manufacturers achieved revenue growth. As long as the market still has demand for servers with rich configurations, it can further promote the growth of the average sales price, partially offsetting the decline in shipments. "

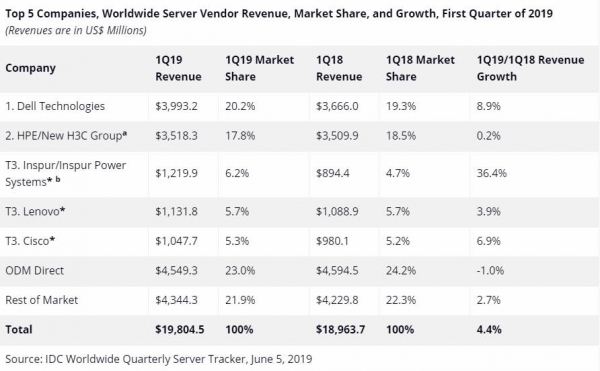

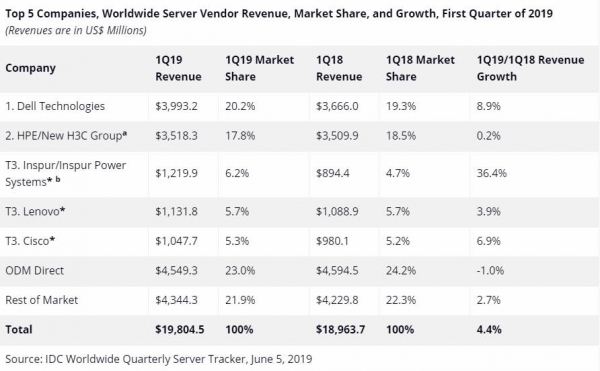

Ranking of overall server market manufacturers

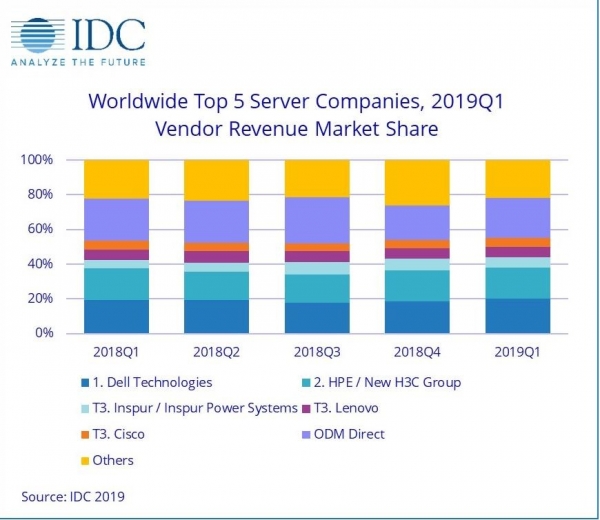

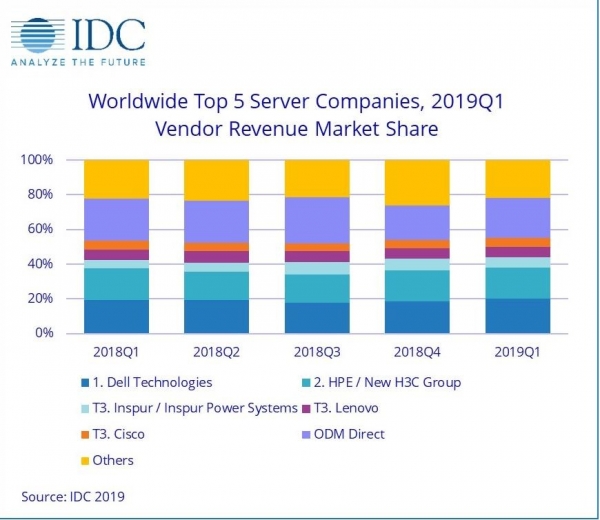

In the first quarter of 2019, Dell ranked first in the global server market with a revenue share of 20.2%, followed by HPE/Xinhua Group III with a revenue share of 17.8%. Dell's revenue increased by 8.9% year on year, while HPE/Xinhua Group III's revenue increased by 0.2% year on year. Inspur/Inspur Business Machines, Lenovo and Cisco ranked third, with revenue shares of 6.2%, 5.7% and 5.3%, and year-on-year growth rates of 36.4%, 3.9% and 6.9% respectively. ODM Direct vendors accounted for 23.0% of the total server market revenue, down 1.0% year on year to US $4.55 billion.

notes:

When the revenue or shipment share of two or more vendors in the global server market is less than or equal to 1%, IDC determines that these vendors are in a parallel position.

Due to the existing joint venture between HPE and Xinhua Group, IDC began to record the global market share of HPE and Xinhua Group as a whole as "HPE/Xinhua Group" in the second quarter of 2016.

Since IBM and Inspur established a joint venture, IDC began to record the external market share of the global market from the third quarter of 2018 by taking Inspur and Inspur commercial machines as a whole as "Inspur/Inspur commercial machines".

Dell led the global server market in terms of shipments in the quarter, accounting for 20.0% of the quarterly shipments.

notes:

When the revenue or shipment share of two or more vendors in the global server market is less than or equal to 1%, IDC determines that these vendors are in a parallel position.

Due to the existing joint venture between HPE and Xinhua Group, IDC began to record the global market share of HPE and Xinhua Group as a whole as "HPE/Xinhua Group" in the second quarter of 2016.

Since IBM and Inspur established a joint venture, IDC began to record the external market share of the global market from the third quarter of 2018 by taking Inspur and Inspur commercial machines as a whole as "Inspur/Inspur commercial machines".

Server market highlights

Regionally, Japan was the fastest growing region in the quarter, with revenue up 9.8% year on year. The Asia Pacific region (excluding Japan) grew by 7.4%, Europe, the Middle East and Africa (EMEA) by 4.1%, the United States by 3.5%, Canada by 9.6%, and Latin America by 14.9%. In the quarter, the revenue of Chinese manufacturers increased by 11.4% year on year.

In this quarter, the market demand for x86 servers increased by 6.0% to US $18.5 billion, while non x86 servers decreased by 13.7% to US $1.3 billion year on year.