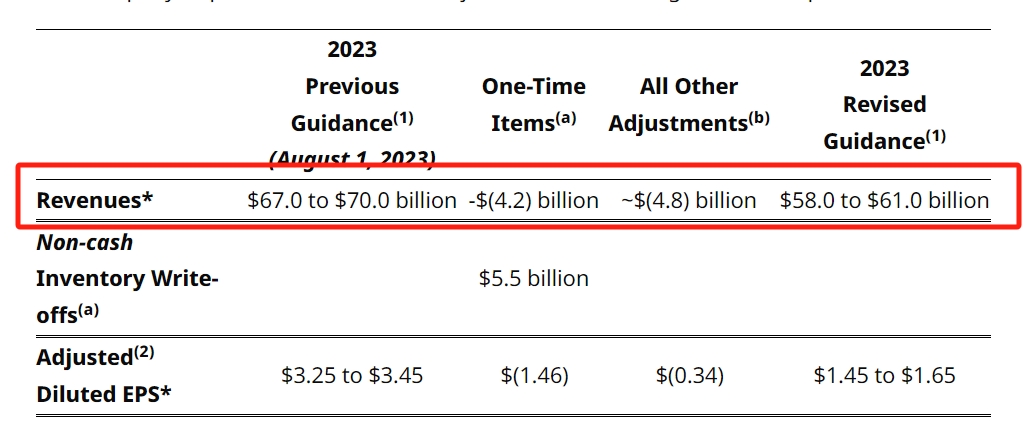

The decline of Pfizer's new crown products: the government unsubscribed, P drug reduced its revenue by $7 billion, or planned a major layoff

You may also be interested in:

-

The decline of Pfizer's new crown products: the government cancels the subscription, and P medicine reduces the revenue .. -

Xinhao Optoelectronics fell 2.39% to raise 1.98 billion Bo when it went public .. -

Sentai shares fell 2.89% when it went public, which means it raised 420 million yuan at the peak .. -

Baolidi fell by 3.61%, and its two capital raising reached 1.12 billion in 2020 -

Bosera Industries selected mixed fund manager Jin Yaocai .. -

In the first half of the year, AsiaInfo Security still suffered from losses. It will be listed in 2022, which is the peak .. -

Lithium battery sector rose 0.79%, new fiber and new material rose 10%, ranking first -

Chengrui Investment - Wing Lung's macro hedging strategy fell by 20% in year B

Today's Hot Spots

Recommended for you

Do you feel these changes in auto insurance

Futures market helps to build a new development pattern

CCB Suzhou builds a "warm harbor" around the people with practical actions

more

-

Luzhou, Sichuan: It is proposed to implement the same maximum loan amount for the first and second housing provident fund loans -

Qianxinan Prefecture, Guizhou Province: It is planned to tap the housing purchasing potential of migrant workers and guide migrant workers to return home to buy houses -

Bank of Communications solidly launched the "Financial Consumer Rights Protection Education and Publicity Month" activity -

State Administration of Market Supervision: Strictly investigate and deal with violations of laws and regulations in the food safety field and effectively prevent them .. -

Floor washer becomes a new favorite of household appliances consumption Industry: industry concentration will increase -

Liu Weiping: Deepen international exchanges and seek common development of water resources protection -

Cao Junjie: Innovating the Regional Modern Agricultural Development Model and Accelerating the Process of Agricultural Modernization -

Xinhua Insurance fell 7.75%, net sales of institutions reached 305 million yuan

more

-

Zunyi, Guizhou: We will encourage stronger central enterprises .. -

Financial knowledge is delivered to Xiamen International Bank. Bank, government and enterprises work together to carry out finance .. -

Yanzhiwu · National Women's Golf Tour, full of firepower, "bowl" and beautiful finish -

The average income of 86 10 billion private equity firms in the first three quarters was 1.44%, and the quantitative performance was eye-catching -

Qianxinan Prefecture, Guizhou Province: It is planned to tap the housing purchasing potential of migrant workers and guide migrant workers to return home to buy houses -

New Group Standard of Silymarin Extract Released New Standard for Selecting High quality Liver Care Products -

Dalian Thermoelectric plans to purchase Kanghui New Materials for 10.15 billion yuan and raise no more than 3 billion yuan -

Huiyun Titanium's net profit in the first half of the year dropped by 79%, and the two raised funds in 2020 totaled 854 million yuan

Ranking

-

The decline of Pfizer's new crown products: the government unsubscribed, P drug reduced its revenue by $7 billion, or planned a major layoff -

What is the common format of video files? What are the video file formats? -

What is the recommended lineup for the transition travelers to collapse the star vortex clearance? How about the intensity of the leapfrog tourist Goering? -

How to clear the browser cache? How to clear various browser caches? -

How to play the second chapter of the Dream Westward Tour Tour Tour Sugar Man Roulette? Dream Westward Journey, Hand Tour of Star River Fantasy .. -

How to install the network card driver of Win7 system? What is the method of installing the network card driver? -

What if there is no sound from the microphone? No sound from microphone Solution? -

How does the computer adjust the brightness of the display screen? How to adjust the brightness of laptop screen? -

What is the reason for the unrecognized USB device? How to solve the problem of unrecognized USB devices? -

Current speed reading: preliminary construction of China's biological natural gas standard system

Recent updates

-

The decline of Pfizer's new crown products: the government unsubscribed, P drug reduced its revenue by $7 billion, or planned a major layoff -

What is the common format of video files? What are the video file formats? -

What is the recommended lineup for the transition travelers to collapse the star vortex clearance? How about the intensity of the leapfrog tourist Goering? -

How to clear the browser cache? How to clear various browser caches? -

How to play the second chapter of the Dream Westward Tour Tour Tour Sugar Man Roulette? Dream Westward Journey, Hand Tour of Star River Fantasy .. -

How to install the network card driver of Win7 system? What is the method of installing the network card driver? -

What if there is no sound from the microphone? No sound from microphone Solution? -

How does the computer adjust the brightness of the display screen? How to adjust the brightness of laptop screen? -

What is the reason for the unrecognized USB device? How to solve the problem of unrecognized USB devices? -

Current speed reading: preliminary construction of China's biological natural gas standard system

this Daily news

-

International perspective: strengthen innovative cooperation and promote the transformation and upgrading of the global automobile industry -

Do you feel these changes in auto insurance -

Futures market helps to build a new development pattern -

CCB Suzhou builds a "warm harbor" around the people with practical actions -

Bank of Communications and iFLYTEK Artificial Intelligence Joint Innovation Laboratory officially unveiled! -

The innovation of digital economy drives the creation of new growth points for urban economic development -

The Enterprise Standardization Promotion Measures will be officially implemented in 2024 -

2023 National Cyber Security Publicity Week Opens in Fuzhou -

Follow up to "Group Sailing": Close "Chain" in Win win Cooperation -

The 18th World Water Resources Conference opened in Beijing, and many experts discussed water management strategies