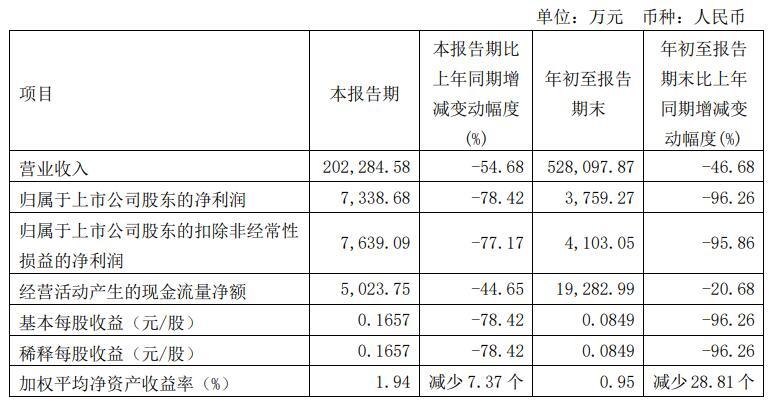

Zhenhua New Material's net profit in the first three quarters dropped by 96% in 2021, and is seeking a fixed increase of no more than 6 billion yuan

You may also be interested in:

-

Zhenhua New Material's net profit fell by 96% in the first three quarters 2021 is planning to go public -

The central bank continued to exceed 789 billion MLF in October: the interest rate remained unchanged -

Do not "share" privacy when sharing charging! These power packs -

With the "five guarantees and one tree" labor competition, we strive to be the first, and practice -

High quality development of "county" in progress | county development such as -

Walking in the ancient city of Kashgar, feeling the fusion of tradition and modernity -

French political research institutions: the United States in three key areas -

The "Bay Area Code" freight train from Shenzhen to Kashgar has become normal

Today's Hot Spots

Recommended for you

SFC agrees to register six commodity options including staple fiber

more

-

Ensure that financial funds are used effectively -

Li Qiang Chairs the Symposium of Experts and Entrepreneurs on Economic Situation -

Go to the Canton Fair: welcome all visitors and connect with the global market -

Scale rises quarter by quarter - foreign trade imports and exports are positive -

Central Bank: RMB loans increased by 19.75 trillion yuan in the first three quarters -

The hospital with an investment of 2.8 billion yuan in Xi'an has become "yellow", and another hospital with an investment of 7 billion yuan has not yet started construction -

Married three A-share listed companies in half a month, and Middle East Capital started a new round of goods sweeping in the Chinese market -

Luzhou, Sichuan: It is proposed to implement the same maximum loan amount for the first and second housing provident fund loans

more

-

The overall recovery of the mobile phone market still takes time -

Beijing Yingfu Ruitai Real Estate Development Co., Ltd. was fined -

IMF Chief Representative in China: China remains the largest engine of global economic growth -

Senior executives come together, science and technology are brilliant and unique, focusing on the elderly - everyone insurance group is actively opening -

Guizhou Zunyi: buy houses instead of loans, encourage stronger central enterprises -

Financial knowledge is delivered to the door, and Xiamen International Bank "banks, governments and enterprises" work together to carry out finance -

Yanzhiwu · National Women's Golf Tour, full of firepower, "bowl" and beautiful finish -

The average income of 86 10 billion private equity firms in the first three quarters was 1.44%, and the quantitative performance was eye-catching

Ranking

-

The central bank continued to make an excess of 789 billion MLF in October: 289 billion net investment with unchanged interest rate -

Please forgive me, I want to pour cold water on "Slam Dunk Master" -

Zhang Wenyu, Vice President and Secretary of Tianqi Lithium, won the title of Secretary of the 19th New Fortune Gold Medal -

Escort the closing of the 2023 Zhejiang Police Dog Technical Skills Competition for the Asian Games. Five police dog trainers -

How to enable administrator privileges for Win11 Home Edition? -

How does Win11 enable folder thumbnails? Where is the win11 folder option? -

The registered capital is 1 million yuan! BYD set up a new automobile sales company in Hangzhou -

How to manage the right-click new menu? How to right-click to create a menu option? -

How about seven rainbow graphics card? How about the quality of Seven Rainbow graphics card? -

Is CAD plane drawing easy to use? How to build 3D model in CAD?

Recent updates

-

The central bank continued to make an excess of 789 billion MLF in October: 289 billion net investment with unchanged interest rate -

Please forgive me, I want to pour cold water on "Slam Dunk Master" -

Zhang Wenyu, Vice President and Secretary of Tianqi Lithium, won the title of Secretary of the 19th New Fortune Gold Medal -

Escort the closing of the 2023 Zhejiang Police Dog Technical Skills Competition for the Asian Games. Five police dog trainers -

How to enable administrator privileges for Win11 Home Edition? -

How does Win11 enable folder thumbnails? Where is the win11 folder option? -

The registered capital is 1 million yuan! BYD set up a new automobile sales company in Hangzhou -

How to manage the right-click new menu? How to right-click to create a menu option? -

How about seven rainbow graphics card? How about the quality of Seven Rainbow graphics card? -

Is CAD plane drawing easy to use? How to build 3D model in CAD?

this Daily news

-

The 2023 New Town Business Annual Conference of "Deep Operation Strategy" was successfully concluded -

At that time, the action plan of Guangfa Bank for the comprehensive revitalization of Northeast China was released! -

Energy Chain Smart Power and Little Red Elephant New Energy reached cooperation to jointly build a regional public charging service network -

SFC agrees to register six commodity options including staple fiber -

The average annual growth rate of the total number of business entities is 8%, and the integrated development system of market supervision in the Yangtze River Delta is accelerated -

Stable prices and continuous recovery of consumption - focus on CPI and PPI data in September -

With "the largest country" in mind and "the people's expectations" in mind, China Life Insurance Company has done a solid job for the people -

Cohesion, Jointly Build, Share, and Develop Postal Savings Bank Beijing Haidian District Branch Successfully Held Cat Garden 2023 Camp Promotion Conference -

Create safe, convenient, efficient, green and economic sustainable transportation -

Opinions on Giving Full Play to the Basic Role of People's Mediation to Promote the Governance of Complaint Sources