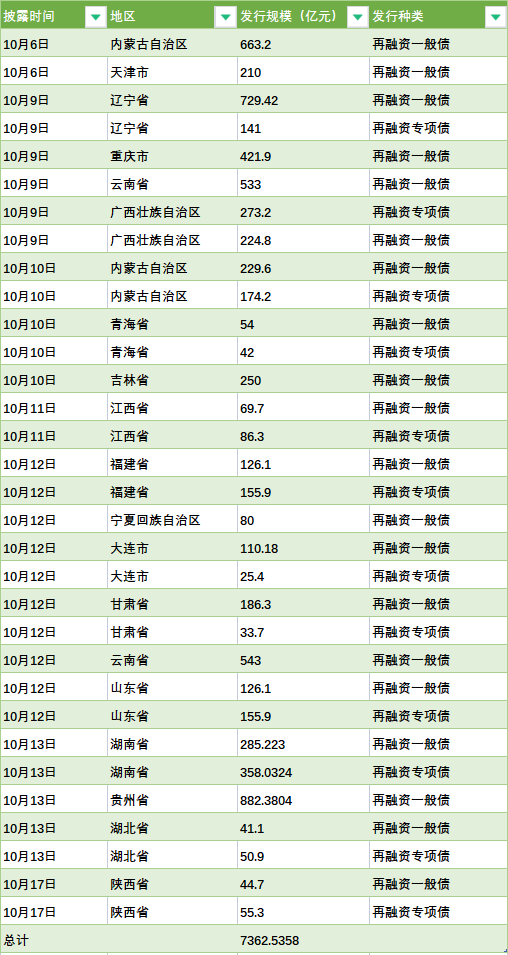

Shaanxi Join! 18 provinces and cities have planned to issue special refinancing bonds totaling more than 730 billion

You may also be interested in:

-

Shaanxi Join! 18 provinces and cities have planned to issue special refinancing -

Annual fee 199 yuan! The Oriental Select Membership System was officially launched, which can -

Quanjude turned losses in the third quarter on a year-on-year basis: the expected profit exceeded 40 million yuan -

East West Question, One Belt One Road Zhang Yansheng: Why "debt..." -

In the first half of the year, the passenger volume of the "Air Silk Road" accounted for 71% -

From January to August, the revenue of 31 provinces kept a positive growth year on year -

Beijing Branch of Bank of Jiangsu fully launched the 2023 financial consumer finance -

Xinhua News | The United States has hurt the world in the past 15 years of Lehman

Today's Hot Spots

Recommended for you

SFC agrees to register six commodity options including staple fiber

more

-

Ensure that financial funds are used effectively -

Li Qiang Chairs the Symposium of Experts and Entrepreneurs on Economic Situation -

Go to the Canton Fair: welcome all visitors and connect with the global market -

Scale rises quarter by quarter - foreign trade imports and exports are positive -

Central Bank: RMB loans increased by 19.75 trillion yuan in the first three quarters -

The hospital with an investment of 2.8 billion yuan in Xi'an has become "yellow", and another hospital with an investment of 7 billion yuan has not yet started construction -

Married three A-share listed companies in half a month, and Middle East Capital started a new round of goods sweeping in the Chinese market -

Luzhou, Sichuan: It is proposed to implement the same maximum loan amount for the first and second housing provident fund loans

more

-

The overall recovery of the mobile phone market still takes time -

Beijing Yingfu Ruitai Real Estate Development Co., Ltd. was fined -

IMF Chief Representative in China: China remains the largest engine of global economic growth -

Senior executives come together, science and technology are brilliant and unique, focusing on the elderly - everyone insurance group is actively opening -

Guizhou Zunyi: buy houses instead of loans, encourage stronger central enterprises -

Financial knowledge is delivered to the door, and Xiamen International Bank "banks, governments and enterprises" work together to carry out finance -

Yanzhiwu · National Women's Golf Tour, full of firepower, "bowl" and beautiful finish -

The average income of 86 10 billion private equity firms in the first three quarters was 1.44%, and the quantitative performance was eye-catching

Ranking

-

Question from East to West, the Belt and Road, Zhang Yansheng: Why is the "debt trap theory" untenable? -

How can I back up iTunes to my phone? How can I change the path of the backup file of iTunes? -

How can I tell if the iPhone is a refurbished machine? -

How much is the Apple 12 resolution? -

The new generation's home life conceals "longevity". See how Dyson can make us rest at ease -

Hot news: how KFC, the "good neighbor" of the community, makes "small customers" fall in love with reading -

AGM G2 GT was officially released, and the first 500 meter thermal imaging was launched, with the price starting from 5999 yuan -

Looking forward to CSL: Hainiu ushers in its new home debut Guo'anchong's first win of the season -

Chinese Stars | Pursue Dreams · Deep Space _ Current Scroll -

Did you hear? Do mobile cloud brands need to be refreshed?

Recent updates

-

Question from East to West, the Belt and Road, Zhang Yansheng: Why is the "debt trap theory" untenable? -

How can I back up iTunes to my phone? How can I change the path of the backup file of iTunes? -

How can I tell if the iPhone is a refurbished machine? -

How much is the Apple 12 resolution? -

The new generation's home life conceals "longevity". See how Dyson can make us rest at ease -

Hot news: how KFC, the "good neighbor" of the community, makes "small customers" fall in love with reading -

AGM G2 GT was officially released, and the first 500 meter thermal imaging was launched, with the price starting from 5999 yuan -

Looking forward to CSL: Hainiu ushers in its new home debut Guo'anchong's first win of the season -

Chinese Stars | Pursue Dreams · Deep Space _ Current Scroll -

Did you hear? Do mobile cloud brands need to be refreshed?

this Daily news

-

The 2023 New Town Business Annual Conference of "Deep Operation Strategy" was successfully concluded -

At that time, the action plan of Guangfa Bank for the comprehensive revitalization of Northeast China was released! -

Energy Chain Smart Power and Little Red Elephant New Energy reached cooperation to jointly build a regional public charging service network -

SFC agrees to register six commodity options including staple fiber -

The average annual growth rate of the total number of business entities is 8%, and the integrated development system of market supervision in the Yangtze River Delta is accelerated -

Stable prices and continuous recovery of consumption - focus on CPI and PPI data in September -

With "the largest country" in mind and "the people's expectations" in mind, China Life Insurance Company has done a solid job for the people -

Cohesion, Jointly Build, Share, and Develop Postal Savings Bank Beijing Haidian District Branch Successfully Held Cat Garden 2023 Camp Promotion Conference -

Create safe, convenient, efficient, green and economic sustainable transportation -

Opinions on Giving Full Play to the Basic Role of People's Mediation to Promote the Governance of Complaint Sources