This website provides Linux server operation and maintenance, automated script writing and other services. If you need, please contact the blogger on WeChat: xiaozme

A few days ago, a netizen shared with me that he sent OCBC Remittance experience and service charges are reasonable. So I decided Reactivate my ICBC account , and has successfully completed the remittance. Now, I would like to share my experience for the reference of friends in need.

preparation

RMB foreign exchange purchase

After logging into ICBC APP, search for "foreign exchange settlement and sales" in the search box on the home page, and then select "RMB foreign exchange purchase" to find "SGD"

Continue to select "RMB to purchase SGD", then there is an "Application for Individual Foreign Exchange Purchase", and select "Read, I know the above content". Then fill in the following information:

- Amount of foreign exchange purchase: the amount of Singapore dollars (SGD) to be purchased

- The purpose of foreign exchange purchase shall be selected according to its own situation

- RMB payment account: this needs to check your first class account and ensure that the balance is sufficient (don't choose wrong)

Then a confirmation message will pop up. If there is no problem, click "Confirm", and the foreign exchange purchase will be successful.

Cross border remittance

After ICBC APP, search "cross-border remittance" in the search box on the home page, select "remittance to other overseas banks", and you will be asked to fill in the payee information.

The collection information of OCBC Singapore is as follows:

- Payee's name: fill in the pinyin. For example, if your name is Zhang San, fill in "ZHANG SAN"

- Collection currency: select "SGD"

- Receiving country/region: Singapore

- SWIFT/BIC:OCBCSGSG

- Collection account number: fill in your 360 Account/MSA/STS account of OCBC Bank (first activation of deposit suggestion STS account)

- Payee's address: the address of OCBC Bank directly filled in by me: 63 Chulia Street # 10-00, OCBC Centre East, Singapore 049514 (if the prompt does not support special symbols, remove the symbols)

Others shall follow the prompts.

Arrival time reference

I started the remittance at 20:49 on August 8, 2023-08, and the time of receipt was 09:11 on August 10, 2023-08, less than 2 working days later.

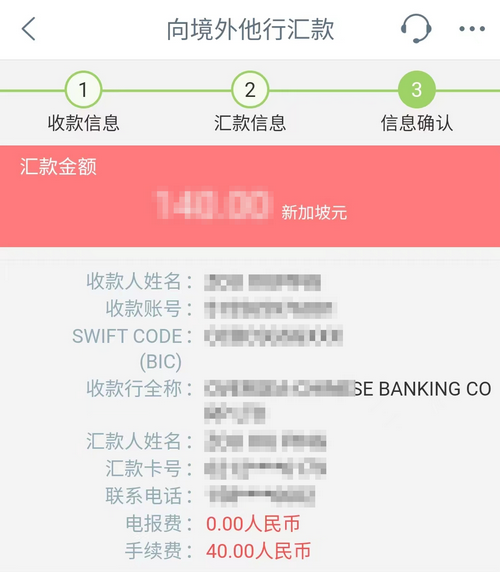

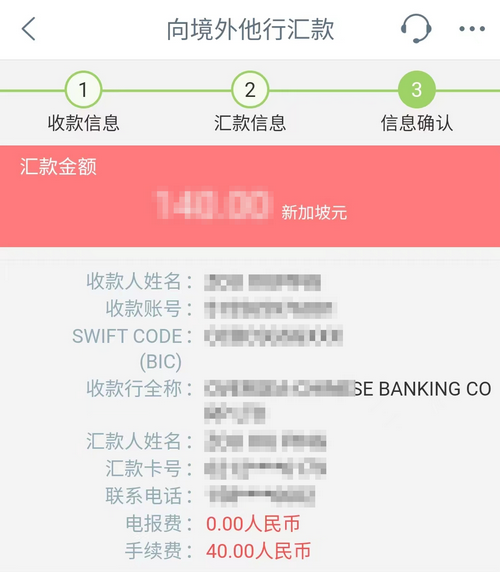

Service charge for remittance

ICBC APP will clearly show:

- Telegram fee: 0 yuan

- Service charge: 40 yuan

In addition to this, there is a hidden intermediary fee, which is invisible. I actually remitted 150 SGD, received 142 SGD, and the intermediary bank deducted 8 SGD, so the actual remittance service charge is: 40 yuan service charge+8 SGD (≈ 42 yuan) intermediary bank charge=82 yuan.

In addition, the netizen shared with me that he used ICBC to remit 1100 SGD, and ICBC deducted a service charge of 40 yuan. The OCBC received 1092 SGD. It can be seen from this that the intermediary banks seem to have fixed 8 SGD fees, so if the amount is too small, the remittance service charge is not cheap, and it is not recommended to remit small amounts of money, otherwise the service charge is not cost-effective.

Comparison between ICBC and Panda Express

Introduction to the registration and use of Panda Express: https://blog.xiaoz.org/archives/19496

- Panda Quick Remittance The remittance will arrive at OCBC in a few minutes on weekdays, faster than ICBC

- I compared the exchange rate of Panda Express, which is not as cost-effective as ICBC

- The service charge for a single remittance of Panda Bank is 80 yuan, which can be reduced if there are coupons. The service charge is about the same, but the industrial and commercial exchange rate is more friendly

- Industrial and Commercial Bank of China Remittance OCBC shows your name, but Panda Express does not. If the risk control of the receiving bank is relatively strict, it is recommended to use ICBC. After all, the remittance is of the same name, which is not easy to control risk.

matters needing attention

Some small problems were encountered during the remittance, which are summarized as follows.

Your current security authentication media has expired.

This may be because your account has been limited, and then the U Shield has expired. Go directly to ICBC APP "My Security Center Payment Limit" to increase the limit of "Transfer and Remittance".

Insufficient debit account balance

This is because the RMB balance of your ICBC is not enough to deduct the service charges. Just ensure that the account balance is sufficient.

Failed to purchase foreign exchange for Apple mobile phone

A small partner reported that there was an additional class I account on his industrial and commercial APP, which led to his failure to purchase foreign exchange. The ultimate reason is that this little partner tied the industrial and commercial debit card to Apple Pay, and Apple Pay automatically generated a virtual account, which was selected when purchasing foreign exchange. In this case, the ICBC debit card can be unbound from Apple Pay. Pay attention to selecting the correct account when purchasing foreign exchange.

Other instructions

At present, the blogger only tested ICBC's remittance of SGD to OCBC, which shows the deposit of the same account, so this method should be used to deposit WISE: https://blog.xiaoz.org/archives/18846

Communication group

In addition, I have created a TG communication group. If you have any questions, you can add group communication : https://t.me/usecardone