Stock speculation depends Jin Qilin analyst research report , authoritative, professional, timely and comprehensive, to help you tap potential theme opportunities!

Why did the lithium giant suddenly explode?

On the evening of April 23, lithium mining giants Tianqi Lithium (002466. SZ) announced that the company expected a net loss of 3.6 billion yuan to 4.3 billion yuan in the first quarter of 2024, compared with a profit of 4.875 billion yuan in the same period last year. On a month on month basis, Tianqi Lithium's net loss in the fourth quarter of 2023 was 801 million yuan, and the net loss in the first quarter of this year expanded significantly.

As for the reason for the explosion of performance in the first quarter, Tianqi Lithium explained in the announcement that the sales price of lithium products of the company dropped significantly compared with the same period of last year, and the gross profit of lithium products dropped significantly due to the impact of market fluctuations of lithium products; In addition, the tax dispute ruling of SQM, a lithium mining enterprise invested by Tianqi Lithium, is expected to reduce the net profit of SQM in the first quarter by about $1.1 billion. Therefore, the investment income recognized by Tianqi Lithium in the reporting period in SQM fell significantly compared with the same period last year.

At the end of the night of April 23, the Management Department I of the listed companies of Shenzhen Stock Exchange issued a letter of concern to Tianqi Lithium, requiring it to quantitatively analyze the reasons for the substantial increase in the loss in the first quarter of 2024 compared with the fourth quarter of 2023 in combination with the specific changes in the main business development, product production and sales, product prices, raw material purchase prices, costs, impairment accrual and other factors, And state whether there is any risk of continuous loss.

As a lithium giant, Tianqi Lithium's profitability is closely related to the price of lithium resources and is cyclical. In 2021-2023, when the price of lithium carbonate is relatively optimistic, the net profits of Tianqi Lithium will be 2.08 billion yuan, 24.12 billion yuan and 7.297 billion yuan respectively. In 2019 and 2020, Tianqi Lithium lost two consecutive years, with a cumulative loss of more than 7.8 billion yuan.

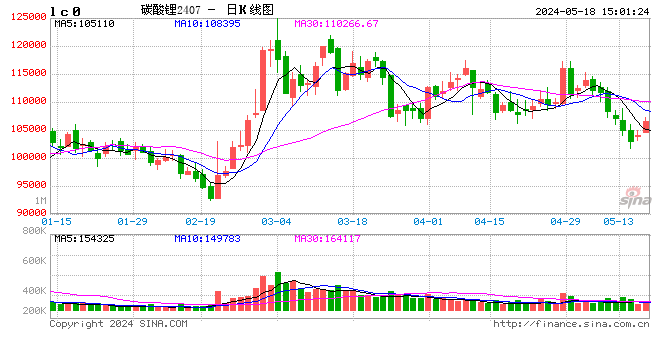

Since the beginning of this year, the price of lithium carbonate has remained low, and the futures price fluctuated at the level of 100000 yuan/ton.

In addition to being directly related to the price of lithium carbonate, the profitability of Tianqi Lithium is also related to the operation of its joint-stock company SQM. In December 2018, Tianqi Lithium decided to purchase 23.77% of the equity of Chile SQM Company at a price of 4 billion US dollars (about 25.8 billion yuan at that time). This company operates the world's largest lithium salt lake Atacama project.

The acquisition of SQM has made Tianqi Lithium one of the global lithium giants, but it has also taken greater risks. It is reported that SQM announced that the court in Santiago, Chile, ruled on its tax litigation for the 2017 and 2018 tax years in April 2024, revoking the ruling conclusion of the tax and customs court on the case on November 7, 2022. SQM reviewed the accounting treatment of all tax disputes based on the latest ruling, and it is estimated that its net profit in the first quarter of 2024 may be reduced by about $1.1 billion. If we calculate that Tianqi Lithium holds 23.77% of the equity, the loss caused by this ruling to Tianqi Lithium in the current quarter is about 260 million dollars (about 1.8 billion yuan).

In this regard, Shenzhen Stock Exchange also asked Tianqi Lithium to explain the specific situation and subsequent progress of the SQM tax dispute ruling, the amount of impact on the company's net profit in the first quarter and the basis for calculation. Tianqi Lithium will confirm whether the impact of the relevant tax dispute ruling in the first quarter meets the relevant provisions of the Accounting Standards for Enterprises.

When the stock market recovers, open an account first! Intelligent fixed investment, condition sheet, individual stock radar... for you>>

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: Zhang Jingdi