Article/Sina Financial Opinion Leader (WeChat official account kopleader), author of RIH conference, founder of RIH conference, president of Entropy College

Judging from the current situation, Vanke has a high chance of winning. At present, the only advantage of Baoneng Department is money, and the precondition is that China Resources will not do anything. Assuming that Baoneng intends to continue to increase its shareholding, it is only possible to continue to spend a lot of money on the market to raise the share price and collect minority shareholders' chips. However, as far as the current market situation is concerned, the available chips are very limited.

Why did Wang Shi fight to the end?

Why did Wang Shi fight to the end? yesterday Vanke A Limit up again. On the same day, Wang Shi [Weibo] Finally, the official speech made it clear that he and Vanke's 40000 employees did not welcome Baoneng to take over, and they took a bloody stance.

Wang Shi said: Vanke is a listed company. Once it is listed, it is impossible for Vanke to choose who is the shareholder of Vanke, but Vanke should be guided and should not be ignored. Because we are responsible for small and medium-sized shareholders, Vanke's equity is decentralized. We have relied on the system and team for so many years. Small and medium-sized shareholders have followed Vanke for so many years, and they also value this system and team. Baoneng can become the largest shareholder by borrowing heavily, or even privatization. But this may destroy Vanke's most valuable thing.

Just ten hours after Wang Shi's internal speech, Baoneng Department responded in the early morning of the 18th, saying that "we value every investment and believe in the power of the market".

The big play is getting better and better.

On the surface, there are five parties involved in Vanke's interest game:

1. Acquirer: Baoneng and its persons acting in concert.

2. Defender: the management team represented by Wang Shi and Yu Liang and the former largest shareholder China Resources.

3. Variable: Anbang Insurance with 5% shareholding.

4. Variable: Public funds and securities companies with a total shareholding of more than 5%.

5. Small and medium-sized retail investors.

In fact, there is a big variable. Is Yu Liang and Wang Shi really united?

What's the reason why Baoneng, an unknown treasure, wants to control Vanke? It uses very complex multi leverage financing means. According to the analysis of Hou Anyang's team, Baoneng has more than 10 billion cash in hand.

Today, the president recommended the latest analysis of Hou Anyang's team from the core members of RIH Investment Conference, the founder of Shangshan Ruoshui Asset Management Co., Ltd., which is the most detailed and professional article on Vanke campaign.

50 billion vs 600 billion, how can Xiaobao surprise Vanke?

Article source: Shangshan Ruoshui Assets (ssrsjijin)

Today, let's introduce the drama: Xiaobaoneng vs Davanke.

We carefully analyzed the whole event, rather than just listing the contents of the announcement. Due to incomplete information, there may be some incompleteness in it. Please correct.

Part I Strength Background of Baoneng and Vanke

Small Baoneng and big Vanke are relatively speaking, because Vanke is a giant. If Baoneng is a listed company, 2800 listed companies can rank near 160, which is not small at all Guohai Securities Scale. Vanke has 30 assets in A-share. The comparison between their total assets and net assets is like this.

Data shows that Vanke is a behemoth with a total assets of nearly 600 billion yuan and a net asset of 120 billion yuan. The data of Baoneng here is Jushenghua, because this is an important investment and financing platform of Baoneng, which has a lot of assets and is also the main force of Vanke this time. Under Jushenghua, there is another very important asset: Qianhai Life.

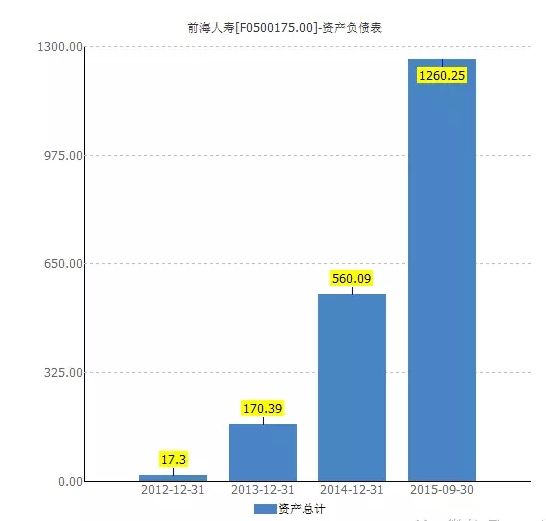

Qianhai Life Insurance has only been established for a few years, but its total assets have increased very rapidly. By September 30, 2015, it had reached 126 billion yuan.

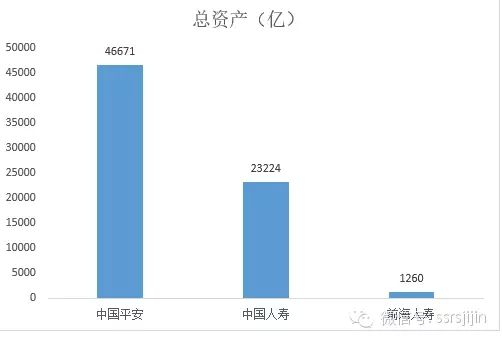

However, because of the business characteristics of insurance companies, this scale sounds scary, but it is very small in the industry. Compare Ping An, China 、 China Life I'll see. Here, Ping An, China [Weibo] The total assets of Ping An Bank It is roughly estimated that the asset scale of Ping An Insurance is also 2 trillion.

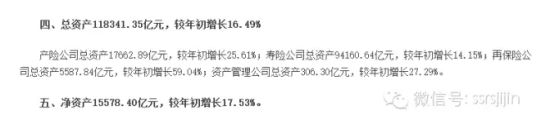

From the latest data disclosure of the CIRC, we can see the general situation of the entire insurance industry:

By the end of October this year, the total assets of the entire industry had reached 11.8 trillion yuan, and the net assets had reached 1.6 trillion yuan. In an industry of this scale, Qianhai Life Insurance has developed rapidly, but it is really an insurance junior brother.

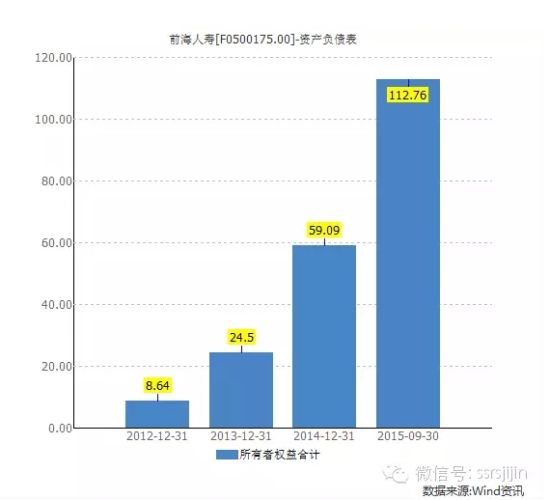

The core indicator of insurance companies is actually owner's equity. How much insurance can be sold depends on the owner's equity. The latest data shows that the owner's equity of Qianhai Life Insurance has reached 11.3 billion yuan.

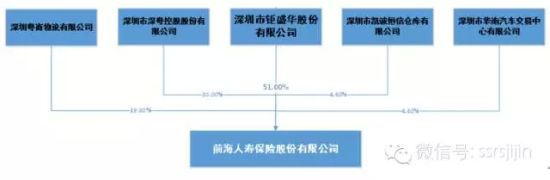

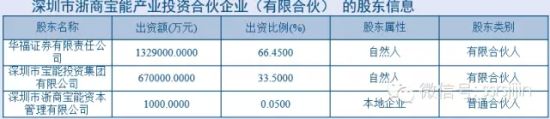

According to its latest disclosed data, his equity was originally like this:

That is, Jushenghua holds 51% of the equity of Qianhai Life, and is the actual controller of Qianhai Life.

However, according to the information we found in the industrial and commercial information, Jushenghua only held 20% before. Shenzhen Kaicheng, South China Auto and Guangzhou Libai (this is also a famous Chaoshanren enterprise, yes, the one that produces Libai detergent) transferred the equity of Qianhai Life Insurance to Jushenghua, up to 51%. From other public information, we found that almost all the small partners of Qianhai Life Insurance are Baoneng.

Many friends don't know why,

But we can first conclude that as the actual controller of Qianhai Life Insurance, Qianhai Life Insurance will become an important financing tool of Jushenghua.

In addition, after deducting the 51% shares, the small partners who hold 49% shares are also working with Jushenghua. It is proved that:

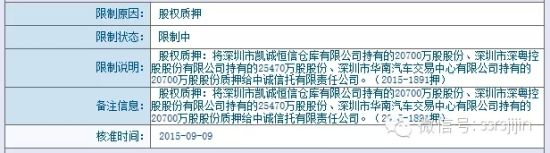

The small partner Yueshang Logistics pledged the equity of Qianhai Life Insurance in July this year:

Small partner Shenzhen Guangdong Holdings pledged the equity of Qianhai Life Insurance in August this year:

Little partner Kaicheng Hengxin pledged the equity of Qianhai Life in September this year:

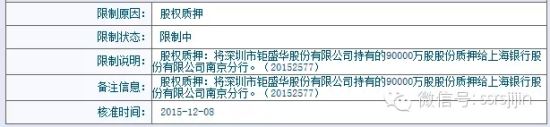

Big Boss Jushenghua pledged the equity of Qianhai Life in December this year:

Let's look back at the situation of Jushenghua. Since 2014, the paid in capital of Jushenghua has soared significantly. In the middle of 2014, it was only 1.76 billion yuan. The latest is 16.3 billion yuan.

The surge here can be found in other public information, which is the consolidated balance sheet disclosed by Jushenghua.

In 2014, Jushenghua increased its inventory by nearly 13 billion (142-12=130). From its own business and information in the statements, we can infer that some real estate properties have been put in, and these properties have changed from "inventory" to "investment real estate". A detailed analysis will be made later.

Part II How Baoneng Financed

Let's see how Jushenghua grew up first?

Step 1: Capital investment

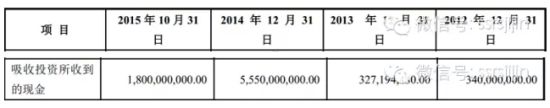

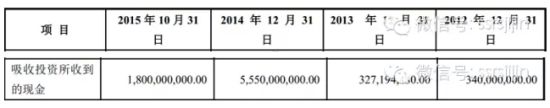

As has been analyzed previously, since 2014, the paid in capital of Jushenghua has soared significantly, which has expanded the share capital from 1.31 billion yuan to 10.1 billion yuan, making a sudden change in Jushenghua's balance sheet. As of October 2015, Baoneng Group had injected about 15 billion of paid in capital into Jushenghua. From the cash flow statement of Jushenghua, the "cash received from investment absorption" in 2014 and January October 2015 was only 7.35 billion yuan.

What is Baoneng's capital injection? The answer is: Commercial City 。 In 2014, the book inventory of Jushenghua reached 14.2 billion yuan, an increase of 13 billion yuan year on year, so this amount is close to 15 billion yuan. Why is this inventory a commercial city rather than a residential building? Because this inventory was carried forward in October 2015, not sold, because the revenue of Jushenghua in the first 10 months of 2015 was only 420 million yuan. In October 2015, the investment real estate jumped from 2.6 billion yuan to 18.8 billion yuan. Where did the new 16.2 billion yuan come from? Mainly due to the 14 billion inventory carried forward in 2014.

Investment real estate is generally leased out. According to the business situation of Baoneng Group, it can only be a commercial real estate project. But which project can be as big as 16.2 billion yuan? We reviewed the process of capital increase in 2014, and there were six times of capital increase. The amount of each time was different, indicating that the 16.2 billion project was not a single large project, but six projects were added separately. On average, each project is about 2.7 billion yuan, which is quite reasonable. Similarly, on October 31, 2015, the company was invested another 2 billion yuan, which was also formed by Baoneng's capital injection of commercial real estate projects into Jushenghua in 2015.

Step 2: External borrowing

Baoneng Group can get more at one stroke through the physical capital injection. On the one hand, it has expanded the assets of Jushenghua, laying the groundwork for its convenient financing. On the other hand, you don't have to pay cash. After taking the project, Jushenghua took the investment real estate and the equity of Qianhai Life to seek mortgage loans from financial institutions. On October 31, 2015, the total long-term and short-term borrowings increased by RMB 10.6 billion compared with the end of 2014.

In addition to borrowing money from financial structures, Jushenghua also borrowed a lot of money from related parties. At the end of October 2015, other payables soared to 11.2 billion, an increase of 9.5 billion. On the whole, Jushenghua raised 9.5 billion yuan from related parties or third parties. How could related parties or third parties be able to provide him with 3.1 billion yuan in cash? It will be mentioned later that this is the capital obtained by mortgage financing and leverage financing.

The net effect is that Jushenghua ultimately raised 3.1 billion yuan from related parties or third parties. With the 13.1 billion yuan he borrowed from the bank, the company raised 16.2 billion yuan. We will elaborate later.

Step 3: pledge financing

Through capital investment and external borrowing, Jushenghua received more than 20 billion yuan in cash. Where did Jushenghua spend this money? From the cash flow statement from January to October 2015, we can see that the total cash paid by Jushenghua Investment and other investment related activities is about 18 billion yuan. From the balance sheet on October 31, 2015, we can see that:

First, the available for sale financial assets of Jushenghua increased by 8.3 billion yuan, including OCT Zhongju High tech The three shares of CSG Group are worth about 5.5 billion yuan, and the other 2.7 billion yuan may be the market value of Vanke A shares that have been delivered by Jushenghua.

Secondly, the advance payment increased by 4.2 billion, which we speculate is most likely due to the participation Shaoneng The subscription amount was paid in advance for fixed increase.

Finally, we noticed that in December 2015, we purchased the equity of Qianhai Life from other shareholders, increasing their shareholding by 31%. The net asset of Qianhai Life Insurance is 11.2 billion yuan. If the transfer is carried out according to 1.5 times of PB, the transfer amount of 31% equity is about 5.2 billion yuan. We have certain confidence to speculate that Jushenghua has paid in advance for the equity acquisition of Qianhai Life Insurance.

Looking at Jushenghua's balance sheet, we not only have to ask, where did he get so much money to rush to buy Vanke's 30 billion market value? The answer is to add leverage to leverage.

Let's make a simple comb:

According to the above table and the current financing ratio of the financial market to the pledged object, we estimate that Jushenghua and the concerted action have raised a total of 8.9 billion yuan, Baoneng Group has raised 1.4 billion yuan, Yao Zhenhua has raised 1.8 billion yuan, and a total of 12.1 billion yuan.

Among them, Jushenghua and its partners raised a total of 2.7 billion yuan before October 31 (the latest reporting date we can see). It can be inferred that all of this money was used to support Jushenghua. The use of these funds has been described in detail in the previous report analysis.

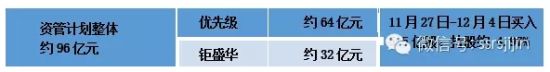

After October 31, a total of 9.4 billion yuan has been raised, but it is not finished. He is going to add leverage to leverage. How can he add leverage? He chose to set up Shenzhen Zheshang Baoneng Industrial Investment Partnership (Limited Partnership) on November 11, 2015. The company contributed 20 billion yuan, Baoneng Group contributed 6.7 billion yuan (9.4 billion yuan left 2.7 billion yuan), and Huafu Securities contributed 13.3 billion yuan (not necessarily its own funds). From November to December 2015, Zheshang Baoneng may inject the 20 billion yuan into Jushenghua through equity and debt.

The specific financing path is shown in the figure below:

Jushenghua has taken 20 billion yuan, how should we use it? The details are shown in the following table:

Jushenghua received 20 billion yuan from November to December, and paid 13 billion yuan in cash at the same time. The remaining 7 billion yuan was used to establish an asset management plan with priority: inferior=140:70. The total fund was 21 billion yuan, of which 9.9 billion yuan was spent directly buying Vanke shares in the secondary market. At present, the available limit of the asset management plan is 11.1 billion yuan. In addition, Baoneng and its related parties still have 2.7 billion yuan to use.

Part III Baoneng Buy Buy!

Jushenghua bought Vanke through two entities in three steps. First of all, Qianhai Life Insurance, the concerted actor of Jushenghua, bought Vanke through the secondary market, and raised the card on July 10. Later that month, Jushenghua and Qianhai Life continued to buy together. Jushenghua continued to increase its holdings, but Qianhai Life did not continue to increase its holdings after August, and raised the card together with Qianhai Life.

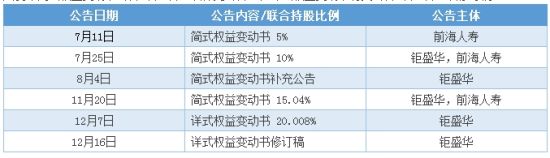

Qianhai Life Insurance and Jushenghua have bought Vanke shares through the secondary market since July. Since July 11, Qianhai Life Insurance raised its first listing, Jushenghua/Qianhai consortium has issued four announcements on the simplified statement of changes in equity (including one supplementary announcement), and two announcements on the detailed statement of changes in equity (including one revision):

Two flowers bloom, one for each. First, Qianhai Life Insurance.

1、 Purchase process of Qianhai Life Insurance

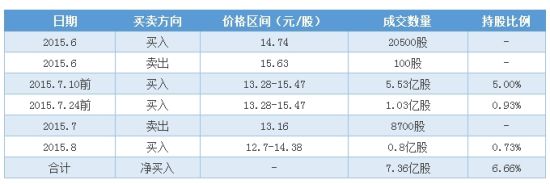

The purchase process of Qianhai Life Insurance to Vanke is relatively simple, and the trading mode is centralized bidding. Based on the information disclosed in the aforementioned announcement, the purchase process of Qianhai Life Insurance is summarized as follows. It can be seen that the transaction of Qianhai Life Insurance was completed in August.

Therefore, by reviewing the details of Vanke's shareholders in the third quarter report, we can roughly see the final status of Qianhai Life's holding of Vanke (as shown in the figure below). Qianhai bought it through its insurance products. The two products of the top ten shareholders hold 6.14% of the shares in total, which means that all the shareholders of Qianhai are here.

Now let's solemnly congratulate the partners who hold these two products. You are the glorious shareholders of Vanke, and you can buy them on JD Taobao. (The information comes from the network, not advertising here - Xiaoshan Note)

2、 Purchase process of Jushenghua

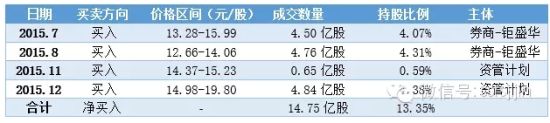

The purchase process of Jushenghua is much more complicated than that of Qianhai Life. According to the information disclosed in the announcement, at first glance, all the way singing:

When we study it deeply, we are very sentimental. The purchase of Vanke by Jushenghua is divided into three stages: A. July August income swap+margin trading; B. From October to November, buy back swap equity in large amount; C。 Purchase of asset management products. Four methods are used: margin trading, income swap, block trading, hierarchical asset management (about 1:2 lower priority).

In the first stage, from July to August 2015, Jushenghua bought through swaps (two batches) and two financials. When it completed, it held 8.34% of its shares. The shareholding structure is as follows.

In the second stage, from October to November 2015, Jushenghua conducted transactions in two batches, and bought back about 330 million shares of Vanke held through swap interests in large quantities from October 14 to 20, 2015; From October 27 to November 17, Vanke bought back about 560 million shares held through income swap in a large amount. These two batches of block transactions accounted for most of the block transactions of Vanke A from October to November:

During this period, Vanke announced on November 11 that its shareholder, Jushenghua, pledged 730 million Vanke A shares as it repurchased shares through block trading.

The third phase began on November 27, when Jushenghua purchased 4.97% of the shares through three asset management plans. The details were disclosed in the statement of changes in equity on December 16. The revised version further clarifies the source of funds, about 1:2 leverage.

Summary: The general buying process is as follows:

Recently, Baoneng went to the Hong Kong market to buy about 2% of the shares, and the cumulative purchase reached 22.5%. We speculate from the data and transaction situation that Baoneng is difficult to buy A-shares, so we choose to buy in Hong Kong in turn.

Part IV Situation faced by Baoneng and Vanke

The problem now is that the CIRC is wary of insurance companies - not only Qianhai Life Insurance, but also of the practice of abusing the equity of listed companies. After the media reported that Baoneng raised the brand of Vanke, the CIRC issued the Notice on Matters Related to Strengthening Prudential Supervision of Insurance Companies' Asset Allocation on December 11.

It mentioned that "in order to prevent the asset liability mismatch risk and liquidity risk of insurance companies under the new situation, strengthen the supervision of asset allocation behavior of insurance companies". In fact, it is the supervision of such behaviors.

Here, we also need to study what happened to the Vanke Board of Directors.

One of the important links in the process of controlling a listed company is to appoint directors to the board of directors and seek to control the board of directors. If Baoneng has obtained a sufficient proportion of equity, what environment should Baoneng face to put its own directors on the board of directors?.

Let's take a look at the current status of the board of directors. According to the public information, Vanke currently has 11 directors, including four independent directors.

According to the relevant provisions of Vanke's Articles of Association (June 2014): (1) Directors are elected or replaced by the General Meeting of Shareholders, and each term of office is three years. (2) Shareholders who individually or jointly hold more than 10% of the company's shares have the right to request the board of directors to convene an extraordinary shareholders' meeting. If the Board of Directors does not agree to convene an extraordinary general meeting of shareholders, or fails to give feedback within five days after receiving the request, shareholders who individually or collectively hold more than 10% of the company's shares have the right to propose to the Board of Supervisors to convene an extraordinary general meeting of shareholders. If the board of supervisors fails to issue the notice of the general meeting of shareholders within the prescribed time limit, it shall be deemed that the board of supervisors does not convene and preside over the general meeting of shareholders, and shareholders who individually or collectively hold more than 10% of the company's shares for more than 90 consecutive days may convene and preside over the meeting on their own.

From the above provisions, we can draw the following conclusions: (1) Baoneng has enough equity ratio to propose the convening of the general meeting of shareholders; (2) Under the most unfavorable circumstances, Baoneng can convene and preside over the general meeting of shareholders on its own after at least one quarter from the date when it first proposed to convene the extraordinary general meeting of shareholders.

We assume that Baoneng's request for holding an extraordinary general meeting of shareholders can be successfully realized. There is another link, namely, voting. This is a link full of changes. One of the main reasons for generating variables is the cumulative voting system. According to the Articles of Association of Vanke, the cumulative voting system means that when the shareholders' meeting of a listed company elects directors or supervisors, each ordinary share with voting rights has the same voting rights as the number of directors or supervisors elected, and the voting rights owned by shareholders can be used collectively. When electing directors and supervisors, the General Meeting of Shareholders adopts the cumulative voting system.

Under the cumulative voting system and the small difference in the shareholding ratio of the main players (Baoneng and Vanke's original control system), there are several variables in the game of director election:

First, how Baoneng allocated its votes to its elected directors; second, how Vanke's original control system allocated its votes to its elected directors; third, how key other shareholders (such as Anbang) allocated their votes to support the main players; fourth, how other institutions and retail investors allocated their votes to support the main players.

The key here is that, since all parties are back-to-back before voting, how to bet to ensure that the directors elected by their own side are selected is a particular art. If there is sufficient communication between institutions to distribute votes, then retail investors cannot communicate, The votes and/or votes they were solicited undoubtedly filled the results with enormous variables.

Let's talk about the financial institutions that may be involved.

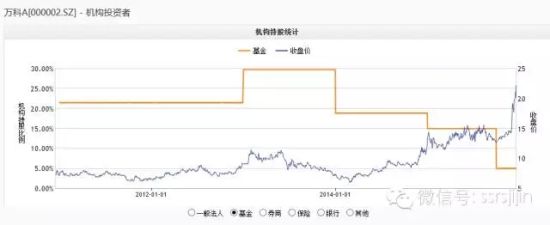

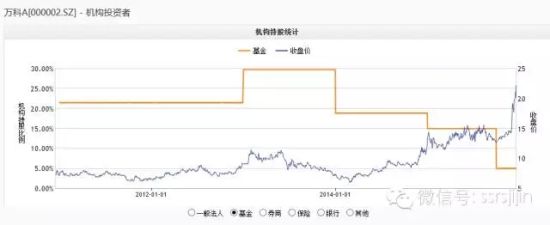

The attitude of financial institutions is crucial. From the information disclosed, as of the end of the third quarter, public funds held about 4.42% of Vanke's equity, while CSF held 2.99%. The attitude of financial institutions is very important for both sides to compete. In terms of the advantages of financial resources, Vanke's management has cultivated the market for many years, and with China Resources, the central enterprise, as the banner, of course, there will be many advantages. However, the funds have been wandering around on the GEM recently. It is likely that Vanke has reduced its holdings in a large amount before its big rise. I don't know how much remains.

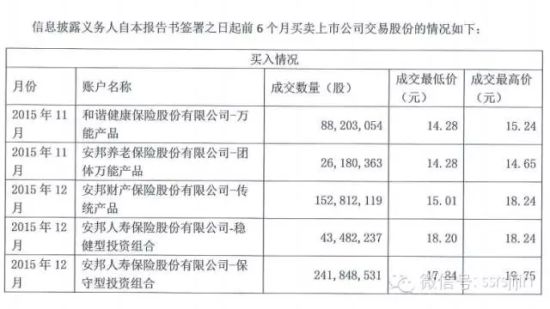

One ruthless role must be mentioned separately, that is, Anbang Insurance. It can be said that "Mantis catches cicadas, and yellow finches are behind". When Baoneng attacked Vanke, Anbang also came in to stir up. Moreover, it quickly bought 550 million shares in a short time, accounting for about 5% of Vanke's share capital. At present, Baoneng holds about 22.5% of the equity (it may continue to buy!), and China Resources and Vanke hold a total of 19.37% (15.23% of China Resources, 4.14% of Vanke executives). If the two parties dispute, Anbang's attitude will play a key role in the overall situation.

By the way, Baoneng's collection of Vanke chips was accompanied by a sharp decline in the number of shareholders. At the middle of this year, the number of shareholders was 650000, but by the third quarter, when the stock price had not soared significantly, it had become 330000. It's obviously smaller recently. If you do your homework early, you can earn money to carry the sedan chair.

Make a ranking according to the importance, and then make a summary:

In general, at present, China Resources and Vanke hold 19.37%, while Baoneng holds 22.5%. The game between the two sides has not been decided. The key now is to see the orientation of the remaining shareholders, that is, in addition to 5% of Anbang Insurance and the chips in the hands of CSF and public funds, there are also a wide range of small and medium-sized shareholders. From the above analysis, Vanke has a good chance of winning. At present, the only advantage of Baoneng Department is money, and the precondition is that China Resources will not do anything.

Assuming that Baoneng intends to continue to increase its shareholding, it is only possible to continue to spend a lot of money on the market to raise the share price and collect minority shareholders' chips. However, as far as the current market situation is concerned, the available chips are very limited. From the perspective of Baoneng's past investment history, it is a way for Baoneng to force major shareholders to take orders at a high position. But the problem is: Vanke is a plate with a market value of 100 billion yuan, which is not the original competitors.

(The author of this article introduces: senior financial media person, founder of RIH investment reading conference, and quantitative investor. The original Entropy College timing system accurately grasped all the big trends of A shares in history. WeChat official account RIH118.)