□ Financial Derivatives Department of CIC Securities

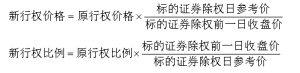

After the ex right and ex dividend of the underlying securities, the exercise price and exercise proportion of the warrants will be adjusted accordingly. Therefore, in addition to the initial exercise price and initial exercise proportion, the basic information of warrants also includes the latest exercise price and the latest exercise proportion. According to the current regulations, if the underlying securities are ex rights, the exercise price and exercise proportion of the warrants shall be adjusted according to the following formula:

Taking Guoan GAC1 as an example, its underlying securities CITIC Guoan On May 22, 2008, the equity registration date, we implemented the dividend plan of 1 yuan from 10 to 10. The closing price on May 22 was 30.74 yuan, the reference price on the ex right and ex dividend date was 15.32 yuan, the exercise price of Guoan GAC1 was adjusted from 35.5 yuan to 17.692 yuan (35.5 × 15.32/30.74), and the exercise ratio was adjusted from 0.5 to 1.003 (0.5 × 30.74/15.32).

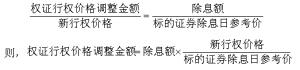

In case of ex dividend of the underlying securities, the exercise ratio remains unchanged, and the exercise price is adjusted according to the following formula:

Taking Sinopec CWB1 as an example, its underlying securities SINOPEC (China Petrochemical Corporation On June 13, 2008, the equity registration date, we implemented the dividend plan of "10 dividends" of 1.15. The closing price on that day was 11.26 yuan, the reference price on the ex right and ex dividend date was 11.15 yuan, and the exercise price of Sinopec CWB1 was adjusted from 19.68 yuan to 19.49 yuan (19.68 × 11.15/11.26).

Theoretically, the adjustment of the exercise price and the exercise proportion of warrants fully considers the impact of the ex right of the underlying securities. However, for the underlying securities that only pay dividends, the warrants only adjust the exercise price without taking into account the adjustment of the exercise proportion of the warrants after ex dividend, which often results in additional gains and losses. Adjustment formula after ex dividend:

Subtract 1 from both sides of the equation:

The exercise price adjustment amount of the warrant is equal to the original exercise price minus the new exercise price, and the ex dividend amount is equal to the closing price of the underlying securities on the day before ex dividend minus the reference price of the underlying securities on the ex dividend day, then the above equation can be written as:

It can be seen from the above formula that there is a proportional relationship between the adjusted amount of the exercise price of the warrants and the ex dividend amount, and the coefficient of this proportional relationship is equal to the ratio of the new exercise price of the warrants to the reference price of the underlying securities on the ex dividend date. If the new exercise price is greater than the reference price of the underlying securities on the ex dividend date, that is, for the warrants out of the price, the adjusted amount of the exercise price of the warrants is greater than the ex dividend amount, Because the scale coefficient is greater than 1; If the new exercise price is less than the reference price of the underlying securities on the ex dividend date, that is, the call warrants in the price, the adjusted amount of the exercise price of the warrants is less than the ex dividend amount, because the proportional coefficient is less than 1. In the current call warrant market, the higher the ex price degree of warrants, the larger the proportion coefficient, and the larger the amount of warrant exercise proportion adjustment than the ex dividend amount; The higher the in price degree of warrants, the smaller the proportion coefficient, and the smaller the amount of warrant exercise proportion adjustment than the ex dividend amount. For warrant investors, when the underlying securities are ex dividend, out of price warrants will gain additional income due to the adjustment of the exercise price, while in price warrants will suffer additional losses due to the adjustment of the exercise price. (The article is only for reference, and the profit and loss caused by investment based on it has nothing to do with it.)

Shanghai Stock Exchange investor education column