Yesterday, the market plummeted on a large scale, and a large number of stocks closed at a stop, causing investors to panic. According to the statistics of Orient Fortune, more than half of the 41 institutions predicted that the short-term market still had adjustment requirements for the view of the market trend on Wednesday.

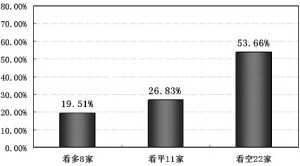

Less than 20% are bullish institutions. Eight institutions such as Huizheng Finance and Economics believe that the market has a strong rebound momentum after the sharp fall of the Shanghai and Shenzhen stock market on Tuesday. A slight bottoming on Wednesday will form a rebound market, while short-term stagflation and oversold stocks have a greater chance of short-term rebound.

More than 50% of the bearish organizations are united negotiable securities 22 other institutions believed that Tuesday's bald line indicated the emergence of the head in the medium term, which also indicated that the new high of 3049 points set in the early stage was a false breakthrough to lure more people. Due to the severe damage of the market vitality, the medium-term adjustment in the future is inevitable, and the adjustment will not end immediately.

Twenty six percent of the institutions are flat in the short term. 11 institutions, including Guangzhou Boxin, believe that due to the heavy fall of weight index stocks and fund stocks, and the rapid increase in the number of decline stops, both Shanghai and Shenzhen stock markets have received two long negative lines with a huge amount. It is expected that the short-term market will be volatile and consolidated. (Special writer)

Sina statement: The content of this article is purely the author's personal view, only for investors' reference, and does not constitute investment advice. Investors operate accordingly at their own risk.