CITIC Securities: Call put warrants fell across the board

http://www.sina.com.cn 05:34, September 29, 2006 China Securities Journal

■ Warrant stand

——- Comments on warrant market in recent 5 days

citic securities Wang Zhuo

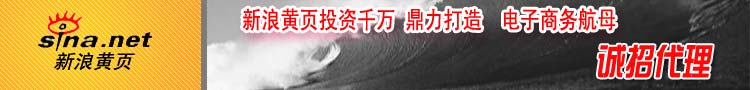

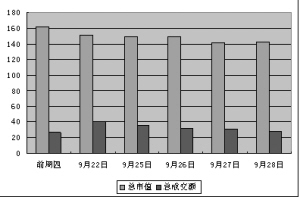

Recently, the volatility of the market has intensified. The Shanghai Composite Index dropped from 1740.90 to 1712.64, and then rose to 1736.96. Affected by the imminent expiration of some warrants, the warrant market continued to decline, with the total market value falling from 16.173 billion to 14.333 billion, and the daily turnover slightly rising from 2.721 billion to 2.819 billion. Subscription fell by 6.96% on average, while put fell even more, down 15.8%.

Shenneng JTP1 、 Airport JTP1 and WISCO JTB1 It is the warrant with the largest decline in recent years, with the decline of more than 20%. Among them, Shenzhen Energy JTP1 fell by 38%. All three warrants will expire within the year. The earliest maturing Shenzhen Energy JTP1 has only 10 trading days left, and its positive shares are still fluctuating near the exercise price, which makes the warrants active in the near future, with a daily turnover rate of more than 100%. As the duration decreases, the turnover rate of Shenzhen Energy JTP1 will still rise further.

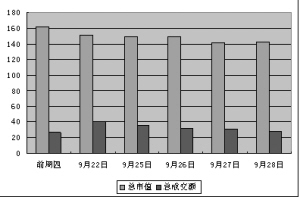

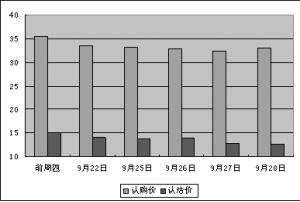

The sharp decline of warrants has led to a sharp decline in the market premium rate. The subscription premium rate decreased from 21% to 18.26%, and the put premium rate decreased from 26.4% to 23.37%. The largest increase in premium rate is CMB CMP1 , which is mainly due to the recent strong rise of regular stock G CMB, and CMB CMP1 has also become the warrant with the highest premium rate in the market. The biggest decline in premium rate is Baotou Steel JTP1 and WISCO JTP1 And the decline was more than 6%. Wanhua HXB1 and Valin JTP1 The premium rate of is still negative.

Relative to the duration, the market premium rate is still high. The value return of Shenzhen Energy JTP1 and other warrants still has a great impact on the market. Therefore, if there is no major event that affects the positive shares during the "National Day" period, the warrant market is more likely to continue to decline after the festival, and investors should also stay on the sidelines.

Considering the trend of various indicators and warrants and equity, Wanhua HXB1 and Wuliang JTB1 are still less risky varieties, and aggressive investors can pay due attention to them.

Warrant Valuation Table (2006-9-28)

Name of warrant warrant

Price History

Volatility theory

Value implication

Volatility premium rate

WISCO JTB10.49330% 0.076138% 23.93%

Baotou Steel JTB10.84547% 0.415127% 28.34%

Hangang JTB11.21549% 0.99580% 10.81%

First JTB11.90341% 0.737133% 34.68%

Wanhua HXB111.18251% 12.0110% - 3.24%

YAGO QCB12.99979% 2.418131% 18.49%

Changdian CWB12.59830% 2.21648% 20.97%

Guodian JTB11.88738% 0.93192% 31.38%

Ansteel JTC12.73740%2.230181%9.34%

Wuliang YGC17.12856% 6.87864% 7.93%

WISCO JTP10.43630% 0.33661% 4.60%

Airport JTP10.86425% 0.42959% 9.51%

CMB CMP10.34432% 0.02262% 47.59%

Shanghai Stock Exchange JTP10.94828% 0.85731% 8.15%

Baotou Steel JTP10.45747% 0.39058% 11.84%

Raw water CTP10.78337% 0.34074% 18.96%

Wanhua HXP11.1451% 0.30080% 43.13%

Yage QCP10.56479% 0.56280% 37.26%

Haier JTP10.58921% 0.07163% 25.38%

Maotai JCP10.91939% 0.10183% 43.12%

Steel vanadium PGP10.82447% 0.64859% 17.51%

Valin JTP11.12237% 1.35021% - 2.47%

Wuliang YGP11.0156% 0.81061% 46.95%

Shenneng JTP10.32534% 0.14460% 8.39%

CIMC ZYP10.942% 0.84244% 28.82%

Potash fertilizer JTP11.42240% 0.93550% 25.22%

Market price and volume trend of warrants in recent 5 days

Market price trend of warrants in recent 5 days

Sina statement: The content of this article is purely the author's personal view, only for investors' reference, and does not constitute investment advice. Investors operate accordingly at their own risk.