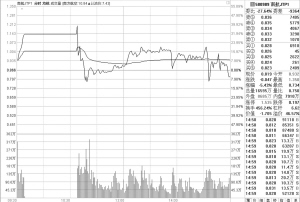

Trend chart of China Southern put warrants yesterday

Business Daily (reporter Zhou Kejing) China Southern JTP1 (580989, hereinafter referred to as "China Southern Airlines Put Warrant") went crazy again yesterday. After the opening of the market yesterday, the put warrant soared again, rising to 31.29% within 7 minutes, and was suspended. After the resumption of trading at 10:37, there was a roller coaster style diving market. Although the increase was once more than 47%, it began to fall sharply after that, and finally fell 5.43% to close.

The roller coaster style trend made its amplitude throughout the day reach 46.57%, and the turnover rate reached an astonishing 456.24%. High turnover is accompanied by high turnover. After the closing, statistics show that the put warrants of China Southern Airlines yesterday reached 15.624 billion yuan. This transaction exceeded half of the turnover of Shenzhen Stock Exchange (29.71 billion yuan) yesterday.

Although the put warrant of China Southern Airlines set a new high of 1.35 yuan in the current round of market yesterday, the insiders believe that the risk of the put warrant of China Southern Airlines is far greater than the return, and investors should pay full attention to the investment risk.

Yesterday, Qilu Securities Changjiang Securities Ping An Securities cancelled a total of 300 million put warrants of China Southern Airlines again, and the balance of creation warrants was 2.7 billion, 78% less than the original total of 12.148 billion. Sun Peng, an analyst with CSC Securities, said that according to the current situation, it is expected that innovative securities companies will continue to cancel the put warrants of China Southern Airlines. It is this continuous buying that supports the rising market of the put warrants of China Southern Airlines.

Yesterday, a long shadow line was left on the K-line chart of China Southern Airlines' put warrants, and its price also fell from the highest 1.35 yuan to 0.819 yuan at the closing, which also trapped the investors participating in the day. Sun Peng believes that the investors who set up above 1 yuan yesterday may have been difficult to solve the problem.

From the perspective of the remaining time, after deducting the Dragon Boat Festival holiday, the remaining trading time of China Southern Airlines' put warrants is only 8 trading days (the last trading day is June 13). In these 8 trading days, China Southern Airlines' put warrants will return from 0.819 yuan to 0 yuan no matter how they fluctuate in the middle. In this process, the put warrants of China Southern Airlines will decline at an average rate of 0.1 yuan per day, and investors who buy the put warrants of China Southern Airlines at any price will lose their money.

It is reported that at present, both the exchange and the securities company are carrying out the risk warning of the put warrant of China Southern Airlines. Yesterday, the trading of the warrant was suspended for one hour, which is exactly the risk warning of the exchange for investors speculating in the put warrant of China Southern Airlines. In addition, many securities companies also give risk warning to investors holding the warrant by sending short messages or direct phone calls.

Related news

SSE issues exercise notice

According to the Xinhua News Agency, the Shanghai Stock Exchange yesterday issued a notice on the cash settlement and exercise of China Southern Airlines put warrants. The notice said that if the put warrants of China Southern Airlines were in the money when they expired, they would automatically exercise, and investors did not need to take the initiative to declare the exercise. The automatic exercise date was June 20; If it is an out of the money warrant at maturity, it will not be exercised.

The settlement price of underlying securities of China Southern put warrants is: Southern airlines The arithmetic average of the daily closing price of the stock (600029) 10 trading days before the expiration date of the warrant, in which, if China Southern Airlines stock is suspended on a trading day, it will be pushed forward to the trading day that has not been suspended.