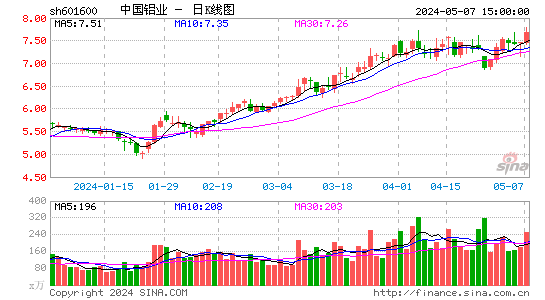

Chinalco: The industry's prosperity is low, leading to large losses

Guess you like it

-

News The first snow in 2012 -

Nanjing shooting case or not related to morale -

[Mobile] Find a person with the same name and surname -

Blessing Card To design artistic signatures -

Greeting Card Send a good letter to express love -

A romantic greeting card for your beloved Ta -

[Entertainment] Guan Ling has a baby today -

Healthy material and spiritual life between husband and wife -

[Beauty] Turn around and forget her -

Men's Sect who repair body shape at a quarter of an hour a day -

[Picture Bell] Look for a pure and beautiful girl -

Download the latest ringtones Mobile theme -

Blog Follow up the boss like a lover -

Combination of B2H business model platform and WAP -

[Game] The hottest Android game -

The latest online game download of iPhone

-

How to Avoid the Tragedy of Left behind Girls -

Difficulties of "Election" Poor Students -

Environmental pollution caused by mineral exploitation -

China will raise the threshold of blue sky -

Resource tax reform should not impact people's livelihood -

Jiyi Ecological Park Tibetan Refinery -

The old town of Beichuan is fully open -

Let the system help the elderly who fall -

Public toilets and private toilets are not allowed -

Urea in 10% swimming pools nationwide exceeds the standard -

Luxury stores suspected of abusing employees -

The rescue of a traveler who falls from a cliff is refused -

Hollow home behind the labor force -

RMB 20000 for 14 years -

Braille Library Waiting for Readers -

2012 Guangzhou Auto Show opened in November

-

"Condor Heroes" Sina High Quality Card -

Exclusive gift package of Sina for "Seeking defeat alone" -

"Demon Subduing" Royal Gift Card -

"Nine Yin Scripture" Huashan Sword Argument Card -

Rocky Hero Diamond Card -

"Ask" Tianwai Feixian Card -

Privileged Gift Bag of The Legend of Moon Shadow -

Sword Net 3 Platinum Refund Card -

Journey 2S Sina Privilege Card -

Top rookie card of NBA2KOL -

"Zhu Xian 2" Chinese Hero Card -

The Dragon in the Sky exclusive card of Sina -

Role play novice card -

Shooting game novice card -

Action game novice card -

Strategy game novice card

-

Love transmission, warm leukemia girl @ Lu Ruoqing -

In the microblog era, if you don't play with sharp tools, you will be out -

Friend interaction, file transfer, and quick use of Weibo desktop! -

The list of WeChat Charity Group was announced! -

Registered enterprise Weibo fast channel: three steps to face target users -

Sign in to 2012 Boarding Gathering Point 100 day countdown starts

-

[Finance] Stock market inquiry -

[Finance] Financial calculator -

[Technology] Digital product library -

[Video] The hottest movie -

[Tourism] Inquiry of domestic and foreign scenic spots -

[Child care] Child care utility library -

[Car] Model query -

[Women] cosmetics product library -

[Constellation] Constellation fortune query -

[Entertainment] Video query -

[Entertainment] TV program list -

[Education] University and college inquiry