FX168 Financial News (Hong Kong) - COMEX June gold in New York fell 2.1 dollars, or 0.16%, to 1289.4 dollars/ounce on Thursday (May 17). The US dollar continued to rise on Thursday, with the US Index hitting 93.58 as the highest; The stronger US dollar continues to exert great pressure on gold. The number of Americans applying for unemployment benefits for the week ending May 12 announced on the same day was 222000, slightly higher than the previous value and expectations, and still at a low level since December 1973, indicating that the labor market has become less weak, that is, the labor market has tightened, in line with economists' expectations, and the growth of industrial capital will accelerate in the second half of this year. The Philadelphia Federal Reserve's manufacturing index in May was 34.4, higher than the previous value and expectations; The monthly rate of the leading indicator of the Conference Board in April was 0.4%, higher than the previous value and in line with expectations.

In terms of the external market, the stock market of the world fluctuated overnight. When the United States opened in New York, it pointed to a low opening, and then rose and fell. On Thursday, US oil hit a three-and-a-half year high, stabilizing above $72/barrel, and Brent oil futures rose to $80/barrel. At the same time, the dollar index continued to remain strong and remained above the five week high. As of press release, the dollar index rose 0.08, or 0.08%, to 93.46. The Dow fell 0.09% to 24747.05; The S&P 500 index rose 2.79% to 2725.25; The Nasdaq Composite Index rose 0.11% to 7406.43. US oil rose 0.34% to US $71.73 per barrel, while oil distribution rose 1.19% to US $80.22 per barrel.

According to the analysis, the negative factor of gold is that the current market sentiment is relatively optimistic and the risk sentiment is heavy. However, in terms of geopolitics, there are still looming storms above the horizon. Once these storms break out, the market will flee to the safe haven assets such as gold and silver market. In the European market, Italy is now showing signs of leaving the EU, saying that if the EU does not reduce its financial debt, it may choose to leave the EU. This situation increased the recent selling pressure on the euro, which in turn supported the dollar. In addition, the delicate relationship between the United States and North Korea, as well as the uncertainty of North Korea's commitment to denuclearization, may cause investor anxiety in the coming weeks. At present, the gold market needs some news events to support the rise, and history has also confirmed that the market has never been calm. However, due to the imminent interest rate increase by the Federal Reserve, the continued rise of the US dollar and US Treasuries is still a great constraint on gold. Some analysts said that, Gold price At present, it is below the critical psychological level of $1300/ounce. Gold bulls must wait until the end of the Fed's tightening cycle to see a sharp rise in prices.

Technically, the trend of gold continues to deteriorate. The price of gold has been below the main moving average, and short sellers still hold the advantage to maintain potential energy. The next step will be to test and fall to 1280 and 1270. On the upside, 1300 has turned into a strong resistance level for bulls. To regain the upward trend, gold prices need to cross this threshold and return to the 200 day average and return to the key support level of 1316.48 dollars/ounce.

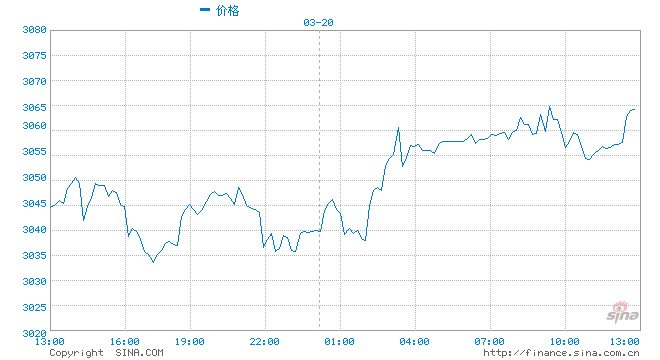

On Thursday (May 17), international spot gold opened at US $1290.60/ounce in the Asian market in the morning, with the lowest dip of US $1285.30/ounce, the highest rise to US $1294.20/ounce, and finally closed at US $1290.70/ounce, up 0.2 dollars, or 0.015%.

Fundamentals:

1. The total number of new housing starts in April in the United States announced on Wednesday (May 16) was 1.287 million, lower than the previous value of 131.9 and the expected 131; The total number of construction permits in the United States in April was 1.352 million, lower than the previous value of 137.9 and slightly higher than the expected 135. The commentary said that the total number of new housing starts in the United States fell sharply in April, and the total number of construction permits fell, which means that the housing market has not improved in the case of a shortage of land and skilled labor.

2. The data released on Friday (May 11) showed that the monthly rate of the US import price index in April was 0.3%, higher than the previous value of 0% but lower than the expected 0.5%. Comments said that the US import price index in April was lower than expected, because the increase in the price of imported oil was offset by the decrease in food prices; The price of imported oil rose 1.6% in April, and the price of imported food fell for two consecutive months.

3. The quarterly adjusted monthly CPI rate of the United States in April, announced on Thursday (May 10), was 0.2%, higher than the previous value of - 0.1% but lower than the expected 0.3%. The market expects that the Federal Reserve will not raise interest rates aggressively because inflation is still lower than expected.

4. On Wednesday (May 9), the monthly rate of the US April PPI index was 0.1% higher than that in March, and the core PPI excluding food and energy rose 0.2%. Both figures were expected to be 0.2%. Because of the slowdown in the growth of the cost of goods and services, the US producer prices barely rose in April after rising strongly in the first quarter, This may ease concerns about rapidly increasing inflationary pressures.

Fundamental negative factors:

1. The number of Americans applying for unemployment benefits for the week ending May 12 announced on Thursday (May 17) was 222000, slightly higher than the previous value and expectations, and still at a low level since December 1973, indicating that the labor market has weakened, that is, the labor market has tightened,

2. The Philadelphia Federal Reserve's manufacturing index in May released on Thursday (May 17) was 34.4, higher than the previous value and expectations; The monthly rate of the leading indicator of the Conference Board in April was 0.4%, higher than the previous value and in line with expectations.

3. Another data released on Wednesday (May 9) is that the monthly rate of US industrial output in April was 0.7%, higher than the previous value of 0.5% and the expected 0.6%; Comments said that the monthly rate of industrial output in the United States rose in April, which added uncertainty to the economic outlook.

4. On Tuesday (May 15), the so-called "terrorist data", the monthly rate of retail sales in the United States in April was 0.3%, lower than the previous value of 0.6% but in line with expectations of 0.3%, recording an increase for two consecutive months, indicating that American consumer spending seems to be still on the right track, and the data performance of the first quarter has slowed sharply.

Future prospects

1. The weekly gold survey released by Kitco last Friday (May 11) shows that both professionals and ordinary respondents are bullish on gold this week. In the survey of Wall Street professionals, 19 people participated in the survey, 15 people, or 79%, believed that gold would rise this week, 2 people, or 11%, believed that gold would fall this week, and 2 people, or 11%, believed that gold would consolidate. Market participants include gold traders, investment banks, futures traders and technical analysts. In the survey of ordinary investors, 2491 people participated in the survey, 2207 people, or 89%, believed that gold would rise this week, 185 people, or 7%, believed that gold would fall this week, and 99 people, or 4%, believed that gold would consolidate.

2. Luxman Otunuga, a FXTM research analyst, said in a report released on Thursday (May 17) that gold has fallen to the range of $60 in the past four months and is still "fragile". Otunuga said: "The main reason for the sharp decline of gold may be the increase in expectations that the Federal Reserve may raise interest rates four times this year."

3. In a report released on Thursday (May 17), Fortune Global INTL FCStone pointed out that gold has fallen to a new low this year and is lower than the main moving average. Comex June gold closed at US $1284/ounce, the lowest level since December. Fortis International said: "Due to the uncertainty of the situation in North Korea, the precious metal was blocked as a whole yesterday, but obviously the funds were not willing to stay in the long-term news vacuum for a long time. At the same time, as the moving average turned to bearish, the gold technology continued to deteriorate."

4. The report released by the information website Economies.com on Thursday (May 17) said that the gold price showed a decline at the key support level close to US $1285.90/ounce in the morning, waiting for the gold price to fall below this level and pushing up the decline wave to US $1267.00/ounce. Therefore, we maintain a bearish view within the day on the condition that the gold price needs to stabilize below 1301.20 dollars/ounce, and random fluctuations have gradually lost positive energy to support the downward expectation.

5. Simona Gambarini, macro commodity economist of Capital Investment, said in the report released on Thursday (May 17) that gold price is currently below the key psychological level of 1300 dollars/ounce, and gold bulls must wait until the end of the Fed's tightening cycle to see a sharp rise in prices.

6. Simona Gambarini said that "the gold price seems to be well supported near the current level. Therefore, we are satisfied with the forecast of 1300 dollars/ounce at the end of 2018. The Federal Reserve will raise interest rates three times this year, intuitively believing that this will be negative for the gold price, because higher interest rates will increase the opportunity cost of holding interest free assets." Gambarini added, Gold is likely to receive important support at the end of next year, and the Federal Reserve is one of the main driving forces.

7. In an article released on Wednesday, Commerzbank of Germany said, "We think the downward potential of gold is limited." The bank said that speculators in the futures market have cut their net long positions since the summer, so this form of selling pressure should be reduced. "At the same time, the low price level should stimulate the interest in buying physical goods," Commerzbank continued. "The geopolitical tensions in the Middle East (violent protests in the Gaza Strip, uncertainty in the Iran nuclear agreement) show that the demand for gold as a safe haven is really strong, and the South Korean conflict has broken out again." The North Korea canceled a high-level meeting and held a high-level summit with the South Korea, It is uncertain whether the planned summit between the leaders of the United States and North Korea will be held as scheduled next month.

Focus on Friday

20: 30 Canada April CPI monthly rate Canada March retail sales monthly rate

21:15 Governor of the Federal Reserve Brenner delivers a speech

01:00 Total number of oil wells drilled in the week from the United States to May 18

Editor in charge: He Kailing