Price formation of steam coal

(1) Price trend

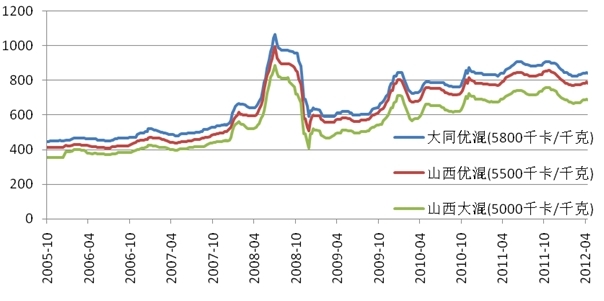

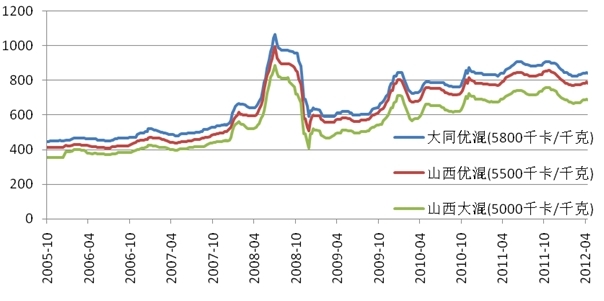

Qinhuangdao Port is an important foreign trade port in China and the world's largest coal export port and bulk cargo port at present. At present, Qinhuangdao Port, as the core hub port of "coal transportation from north to south" in China, its coal price reflects the supply and demand situation of power coal market in East China and southeast coastal areas to a certain extent, and has become the wind vane of the national power coal price. Moreover, the delivery and settlement price of steam coal futures is based on the price of 5500 kcal/kg steam coal in Qinhuangdao Port. According to different calorific value and place of origin, Qinhuangdao Port selects Datong Youhun, Shanxi Youhun, Shanxi Dahun, ordinary blended coal and other types of steam coal for quotation. Since 2005, the price trend of steam coal varieties of Qinhuangdao Port Datong Youhun (5800 kcal/kg), Shanxi Youhun (5500 kcal/kg) and Shanxi Dahun (5000 kcal/kg) is shown in the following figure:

Figure 6.3 Price of Qinhuangdao Steam Coal from 2005 to 2012

Unit: yuan/ton

Data source: China Coal Resources Network

From the perspective of the price of steam coal in Qinhuangdao transit area, the national macro-control has achieved initial results in 2005-2007, and the price of steam coal is relatively stable.

At the beginning of 2008, affected by the ice and snow disasters in the southern region, prices increased rapidly. In July 2008, Datong Youhun rose significantly, with the highest price reaching 1070 yuan/ton, 63.36% higher than the price in January; The highest closing price of Shanxi Youhun reached 1010 yuan/ton, up 68.07% from January. After August, affected by the world financial crisis, China's economic development slowed down, the demand for steam coal declined, the inventory of Qinhuangdao Port continued to rise, and the price of steam coal fell sharply.

In 2009, the price of steam coal at Qinhuangdao Port presented a situation of "falling first and then rising". In the first quarter, the price of steam coal remained stable. After the third quarter, affected by weather factors and industrial economic recovery, the price of steam coal showed a sharp rise. The tax inclusive price of Datong premium mix rose from 610 yuan/ton in August to 840 yuan/ton in December, up 37%.

In 2010, the price of steam coal generally showed a volatile upward trend, with a large seasonal impact factor. The trend of tax inclusive price of Datong premium blended coal was "high at both ends, low in the middle". During the period, the lowest price reached 725 yuan/ton, the highest was 875 yuan/ton, and the annual price fluctuation reached 13.8%.

In 2011, the average market price of 5500 kcal steam coal in Qinhuangdao Port was 819 yuan/ton. Compared with 2010, the price per ton increased by more than 70 yuan, or nearly 10%. The whole year showed a trend of "low at both ends and high in the middle", but the overall fluctuation range was still small, between 770 yuan/ton and 860 yuan/ton. In 2012, under the influence of the National Development and Reform Commission (NDRC) limiting the key contract coal price and the slowdown of economic growth at home and abroad, the price of thermal coal fell slightly and showed signs of recovery in early April.

(2) Influencing factors of steam coal price

one Basic factors

1) Coal production capacity

Coal production capacity determines the upper limit of effective supply of steam coal, thus becoming the most basic factor affecting the price of steam coal in China. In recent years, under the influence of the capacity expansion of state-owned large mines, the rapid inflow of private capital and relevant national policies, China's coal production capacity has expanded rapidly. The average growth rate of coal production has exceeded the average growth rate of coal consumption, and the situation of coal overcapacity has basically taken shape. Since 2009, Shanxi, Inner Mongolia, Shandong, Henan and other provinces (regions) have successively integrated their own coal resources, which has a certain inhibitory effect on coal overcapacity, thus affecting coal supply at a certain time and in some regions, and thus affecting coal prices.

2) Transportation cost

From the perspective of coal price structure, the coal price is mainly composed of production costs, transportation costs and profits of various departments involved. At present, the production cost of coal in China only accounts for more than 10% of the final consumption price, while the expenses and costs of intermediate links account for a large proportion. Especially, the transportation problem plays an important role in the coal price, which is one of the main factors affecting the coal market. At present, due to the reform of China's railway system and the reconstruction and construction of special berths for water transportation, China's coal transportation capacity has been greatly improved, and the bottleneck constraints and transportation contradictions of coal transportation have been effectively alleviated.

3) Consumption

The consumption demand of steam coal mainly depends on the following factors: First, the growth rate of the national economy. In recent years, China's national economy will still maintain a relatively stable growth rate. Second, the demand of power coal intensive industries such as electricity, metallurgy, building materials, and chemical industry. On the one hand, with the economic development, these four industries are maintaining steady development, and the consumption of power coal is steadily increasing The implementation of measures for the development of heavy polluting industries will reduce the energy consumption per unit GDP in China, thus slowing down the growth rate of demand for steam coal in these four industries. Third, the demand for bituminous coal suitable for urban central heating boilers and high-quality coal powder with low ash content and large calorific value is growing strongly. Therefore, the total social demand for coal will maintain a stable growth in the future.

two Specific factors

1) National policy

Although the state has liberalized the control of coal price, the impact of the state on coal price control has not been eliminated. In recent years, the country has issued a series of policies or systems to regulate the production of the coal industry, such as the Implementation Plan for Deepening the Pilot Reform of the Paid Use System of Coal Resources, the Coal Industry Policy, etc. With the implementation of these policies, the production costs of coal enterprises have increased significantly. For example, since the end of 2004, the taxes or special funds collected by the state on coal enterprises in Shanxi Province have increased the cost of coal prices, which has increased by 18.6 yuan/ton to 31.6 yuan/ton, affecting the price of coal in Shanxi to a certain extent. The reform direction of coal resource tax in the 12th Five Year Plan for the Development of the Coal Industry issued in 2012 - from volume based tax to price based tax will also have an important impact on coal production and traders in the future.

2) Supply and demand of upstream and downstream products

Upstream products affect the price of steam coal by affecting the production cost of steam coal. However, for steam coal, its price is mainly affected by downstream products. The production and demand of major coal consuming industries, especially power, building materials and chemical industries, are the most important factors affecting the coal market and determine the trend of coal prices. For example, since the beginning of winter in 2009, China has suffered from a rare strong cold air attack, the national electricity consumption has increased significantly, and the thermal power generation has increased significantly, driving the rise in the price of thermal coal, of which the price of Qinhuangdao thermal coal has risen by more than 40% at the highest.

3) International market coal price

With the further liberalization of the market, the impact of coal prices in the international market on the domestic market will be increasingly intensified, and the linkage of coal prices in the domestic and foreign markets will be further strengthened. Even at this stage, the coal price in the international market will also affect the coal export, and its impact will be reflected through the coal price. In 2011, China's coal import volume further increased, and the domestic coal price was more closely linked with the international price. In April 2012, affected by the significant growth of coal imports and output, the domestic port coal market was in a downturn, and even the coal price in the production area, which has always been relatively stable, also showed a significant decline, which can indicate that the current linkage between domestic and foreign coal prices has been strong, and the price analysis needs to pay attention to the situation at home and abroad at the same time.

4) Other energy prices

Coal and oil are the most basic energy sources. The rise in oil prices has also had an impact on the coal market. The sharp rise in oil prices has also contributed to the rise in coal prices. The impact of oil price on coal price is that the price comparison relationship promotes the rise of coal price, and the demand conversion of related products and industries for two kinds of energy products promotes the rise of coal price. As an important alternative energy source of petroleum at present, it is unrealistic for the price of coal to decline significantly against the background of soaring oil prices. The substitution role and advantages of coal will become increasingly prominent. The decline of traditional downstream demand will be filled by new demand. Therefore, in a long period of time in the future, The sharp rise in world oil prices will have a certain stimulating effect on coal prices.

5) Coal inventory

Coal inventory is the result of multiple factors such as coal production, transportation and consumption, which is basically the same as the factors of price formation, and plays a leading role in the change of coal price. In recent years, Qinhuangdao coal inventory has become the wind vane of steam coal price changes.

6) Coal import and export

The amount of coal import and export directly affects the supply and demand of the coal market, and then affects the price of coal. When the domestic supply remains unchanged and the import increases, if the demand remains unchanged, the increase in supply will inevitably lead to oversupply and price decline in the originally balanced market. Similarly, the export of coal will reduce the domestic supply, which will inevitably affect the supply and demand relationship of coal, and then affect the price. The mechanism is exactly the same.