I Wheat Futures trading process (I) Wheat futures trading method and market release system Wheat futures are traded in the form of centralized bidding by computer trading system. During the prescribed trading hours, investors can INTERNET、 Professional information consulting companies and other channels obtain real-time futures market information, and issue trading orders to buy (sell) wheat futures contracts according to the market information. The trading orders of investors enter the futures trading system of the exchange through certain order placement channels to match and clinch deals, and obtain transaction feedback.

With the development of computer network communication, investors can participate in futures trading in a variety of ways, mainly online orders.

1. From the issue of trading orders, investors can choose to input trading orders independently or entrust to input trading orders. Autonomous input of trading instructions refers to the way in which investors enter trading instructions on the trading terminal of the member's remote trading center, or on the trading terminal located in the investor's office (connected to the member's remote trading server) to participate in trading; The entrusted trading instructions of investors can be reported to the over-the-counter exit representative office by telephone, or to the remote trading center of member companies.

2. From the communication mode of participating in the transaction, it can be divided into remote transaction and over-the-counter transaction. Remote transaction: by telephone INTERNET、 Data line and other communication methods, investors' trading instructions enter the trading system through the member server and remote trading channel; OTC trading: investors come to the market through telephone declaration, and the OTC market representatives input trading instructions into the futures trading system of the Exchange according to the entrustment of investors.

Similarly, there are many ways to obtain the futures market. Investors can query the delayed futures market through the website of Zheng Merchants Exchange (www.czce. com. cn). At the same time, the real-time futures market of Zheng Merchants Exchange is released to the domestic and foreign market through the satellite and Internet quotation systems of Reuters, Shihua, Wenhua Finance, Yisheng and other information companies. No matter where you are, as long as you can access the Internet, you can see the futures trading information through different channels. (2) Wheat futures trading process After investors place orders through remote or over-the-counter trading, the computer trading system processes the trading instructions and automatically returns the transaction notice to form a position. The trader can choose the opportunity to close the position of the contract held and close the transaction; When the contract expires, the member holding the contract shall be responsible for arranging physical delivery through the settlement department of the Exchange. The Exchange shall settle accounts with members, and members shall settle accounts with customers.

2、 Management Measures for Risk Control of Wheat Futures Trading (I) Margin System The margin ratio of wheat futures contracts is 5% of the contract value. The trading margin shall be managed at different levels. As the delivery period of futures contracts approaches and the amount of positions increases, the Exchange will gradually increase the trading margin.

Margin collection standard for futures contracts of hard winter white wheat and high-quality strong gluten wheat

| Classification |

Collection conditions of hard wheat margin |

Collection conditions of strong wheat margin |

Margin collection ratio |

| General contract month

|

Total bilateral positions by contract month (N, 10000 lots) |

N≤40 |

N≤30 |

5% |

| 40<N≤50 |

30<N≤40 |

7% |

| 50<N≤60 |

40<N≤50 |

10% |

| N>60 |

N>50 |

15% |

| Delivery month Previous month

|

|

Early ten days

|

Early ten days |

10% |

| Mid day |

Mid day |

20% |

| Late ten days |

Late ten days |

25% |

| Delivery month |

|

|

30%

|

Special tips:

1. If the positions of brokerage members, non brokerage members and investors (including hedging and arbitrage positions) in the month before the delivery month respectively reach 15%, 10% and 5% of the unilateral positions in the latest delivery month, the normal margin ratio will be increased by 5 percentage points;

1. The two-way positions of the same member, the same customer and the same month shall be collected as trading margin unilaterally;

2. The intertemporal arbitrage position is subject to unilateral collection of trading margin.

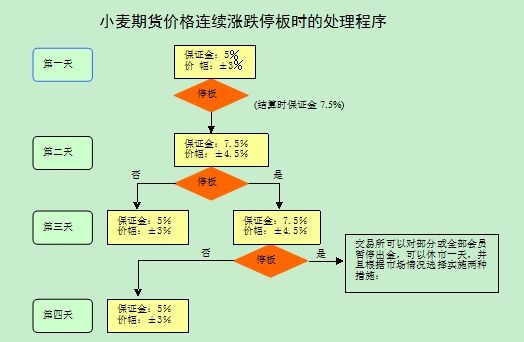

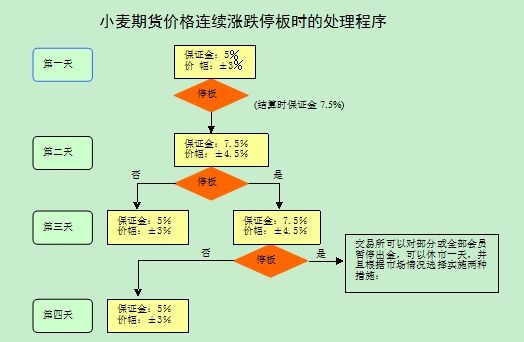

(2) Price limit system

The price limit refers to the maximum daily fluctuation range of the trading price allowed by the wheat futures contract. Any quotation exceeding the price limit will be deemed invalid and cannot be transacted.

When there is only a buy (sell) declaration at the closing price, and no sell (buy) declaration at the closing price within 5 minutes before the closing of a certain trading day, or when there is a sell (buy) declaration, the transaction is completed without opening the closing price, which is called unilateral no offer for the up (down) limit, or unilateral market.

Measures for unilateral cities

Measures for unilateral cities Measure 1: Compulsory reduction of positions. The Exchange will automatically match and close all positions with the profit positions of the contract in the specified way and method at the limit price of the day for the rise and fall of all positions declared at the limit price for closing positions that have not been closed, and the unit position loss is greater than or equal to 5% of the settlement price on the trading day. Before compulsory position reduction, investors (including investors of non brokerage members and brokerage members) automatically hedge their locked positions.

Measure 2: If members have settlement or delivery risks, which are having or will have a significant impact on the market, the Exchange can decide and announce unilateral or bilateral, the same or different proportion, some members or all members to increase their trading margins, suspend some or all members to open new positions, adjust the ratio of up and down limit, limit cash out, and close positions within a time limit, One or more of the measures, such as forced closing positions, postponing the delivery date, and extending the delivery time, can defuse market risks, but the proportion of the adjusted price limit shall not exceed 20%. After the Exchange announces to adjust the margin level, those with insufficient margin shall be added in place before the market opening on the trading day. If there is no unilateral market in the same direction for the futures contract on the same day, the rise and fall limit and trading margin ratio of the futures contract on the next trading day will return to the normal level; If the futures contract has a unilateral market in the same direction on the same day, the Exchange will declare it an abnormal situation and take risk control measures according to relevant regulations.

Special tips:

(1) The principle of price range expansion is to expand only in the direction of suspension.

(2) The contract price range and trading margin of the month of contract listing and delivery are not subject to the above restrictions. (3) The position limitation system refers to the maximum amount of speculative positions in wheat contracts that members or investors can hold according to the regulations of the Exchange and calculated unilaterally.

(3) Limited warehouse system

The position limit refers to the maximum amount of speculative positions in wheat contracts that members or investors can hold according to the regulations of the Exchange and calculated unilaterally.

Position limit of hard winter white wheat futures contract Unit: hand

| project |

Normal month |

One month before the delivery month |

Delivery month |

| Over 150000 unilateral positions |

Unilateral position below 150000 |

Early ten days |

Mid day |

Late ten days |

| Brokerage member |

≤ 15% |

twenty-four thousand |

sixteen thousand |

eight thousand |

four thousand |

three thousand |

| Non brokerage member |

≤ 10% |

sixteen thousand |

six thousand |

three thousand |

one thousand and five hundred |

one thousand |

| investor |

≤ 5% |

eight thousand |

three thousand |

one thousand and five hundred |

nine hundred |

five hundred |

Position limit of high-quality strong gluten wheat futures contract Unit: hand

| project |

Normal month |

One month before the delivery month |

Delivery month |

| Over 150000 unilateral positions |

Unilateral position below 150000 |

Early ten days |

Mid day |

Late ten days |

| Brokerage member |

≤ 15% |

twenty-four thousand |

sixteen thousand |

eight thousand |

four thousand |

three thousand |

| Non brokerage member |

≤ 10% |

sixteen thousand |

four thousand |

two thousand |

one thousand |

one thousand |

| investor |

≤ 5% |

eight thousand |

two thousand |

one thousand |

six hundred |

three hundred |

Note: The above position limit is only the speculative position limit, and the hedging approved by the Exchange is not subject to this limit, and the general monthly arbitrage position is not subject to this limit.

(4) Large account reporting system The Exchange implements the large account reporting system. When the speculative position of a member or investor in a certain type of position contract reaches more than 80% of the speculative position limit (including this number) stipulated by the Exchange, the member or investor shall report its capital situation and position to the Exchange, and the investor must report through the brokerage member. The positions of the same investor in different brokerage members are consolidated. The Exchange may change the position reporting level according to the market risk situation. (5) Compulsory position closing system Compulsory position closing refers to a compulsory measure taken by the Exchange to close positions when members and investors violate the rules.

The Exchange has the right to compulsorily close the positions of members and investors in any of the following circumstances:

1. The balance of the settlement reserve is less than zero and cannot be replenished within the specified time;

2. The position exceeds the position limit;

3. Being punished by the Exchange for compulsory position closing due to violation of regulations;

4. The position should be closed compulsorily according to the emergency measures of the Exchange;

5. Other positions that should be closed by force. (6) The risk warning system is to warn and defuse risks. When the Exchange deems it necessary, it can take one or more risk warning measures, such as requiring reporting, talking and reminding, and issuing risk warning letters.