Electric power futures

The so-called“ Electric power futures ", which can be derived from the definition of futures, refers to electricity commodity contracts that are bought and sold at a specific price, delivered at a specific time in the future, and delivered within a specific period of time; electricity futures trading refers to the buying and selling of electricity futures contracts. The object of power futures trading is power futures contracts, which are highly standardized forward contracts developed on the basis of power forward trading.

American Power Futures Contract

Main features of power futures contract design

Electricity is a very special commodity. As mentioned above, it is similar to other futures commodities, but at the same time it has some unique characteristics in some aspects. This is what we must focus on when designing electricity futures contracts. In general, power futures contracts should have the following four main characteristics:

1. Peak and valley prices are different.

Considering the technical and economic needs of power system peak shaving, safe and stable operation and other aspects, the price of electricity in the daily load peak period (daytime) and load valley period (late night) in the power market is completely different. The price of electricity in the peak period is higher, and the price of electricity in the valley period is lower. The difference between the two can be very large (one time or more). Therefore, when designing power futures contracts, it is necessary to design corresponding contracts for peak load periods and low load periods respectively.

2. High volatility of electricity price.

As power consumption is close to rigid demand, the change of power demand will cause huge price fluctuations in the power market. Sometimes in a day, the electricity price reaches the upper limit of the market price at the peak load, while the electricity price is zero or even negative at the low load. It makes electricity futures trading more risky than other futures commodity trading. Therefore, from the perspective of risk control, the proportion of trading margin should be appropriately increased.

3. Difficulties in physical delivery of power due to the non storability of power.

Another notable feature of electricity is its non storability, that is, the electricity generated by the power plant at every moment every day must be balanced with the actual consumption in real time. Because it cannot be stored (except for pumped storage power plants), it is more difficult to deliver electricity in kind than other futures commodities. It is impossible to deliver a large amount of electricity futures at one time on the delivery date (which may not be used up at that time). Usually, the method that can be considered is to deliver power in small batches every day in the delivery month until all power is delivered.

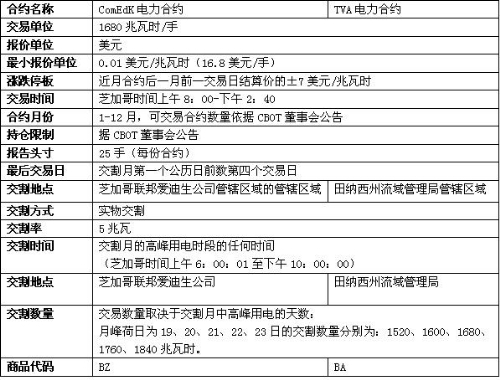

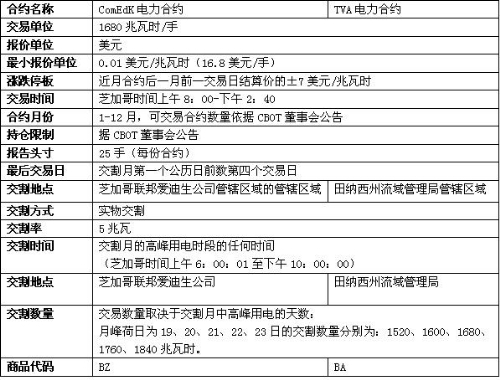

4. Different peak load days

We know that the total number of days from Monday to Friday in any month will not exceed 23, so the maximum delivery peak power is 736 (2Mw per hour, 6A. M.~10P. M., 16 hours per day, Monday to Friday). Therefore, the number of units for electricity futures contract trading is 736Mwh. If the peak load day of a month is less than 23 days, the contract electricity quantity of 736Mwh will be different from the delivery electricity quantity. Table 1 shows the differences between them.

Necessity and Feasibility of Opening Electric Power Futures

(I) Necessity of opening electricity futures trading

1. It is conducive to avoiding price risk in the power market

Under the traditional power industry management system, the state strictly controls electricity prices, the government uniformly manages electricity prices, and strictly audits electricity prices. Under such hard control, the fluctuation of electricity price is very small, and there are almost no independent power generation, transmission and distribution enterprises, so they will not face the risk caused by the fluctuation of electricity price. However, with the market-oriented reform of the power system, the wholesale price and retail price in the power market will be gradually liberalized. The price of electricity is determined through market bidding, which will inevitably lead to the fluctuation of market price. For example, the real-time price of a day when the load is at the peak and the real-time price of a day when the load is at the bottom can be several times different, and sometimes even the price of a day when the load is at the bottom can be zero or negative, while the price of electricity in different days and months is more different. In this way, the drastic fluctuation of electricity price will make the participants in the electricity market face huge price risks. Facts have proved that once there is a big price risk in the power market, its severity is no less than some very famous financial risk events in the international financial industry.

2. It is conducive to the healthy and stable development of the power market

Price is the most important means of resource allocation. Under the planned economy, the price signal is distorted, and it is impossible to realize the optimal allocation of resources; After entering the market economy, a single spot market cannot be realized; Only by combining the futures market with the spot market can the optimal allocation of resources be fully realized. In the absence of the expected price of the futures market, the government can only carry out macro-control according to the spot price, and the power development lacks the scientific planning ability. As a result, there will be surplus during the Ninth Five Year Plan period, power shortage during the Tenth Five Year Plan period, and surplus during the Eleventh Five Year Plan period. China's power will inevitably wander in the vicious circle of 'power shortage, project expansion, surplus, investment reduction, and power shortage', Cause huge waste of social resources. The prices generated in the futures market are authentic, advanced and authoritative. The government can determine and adjust macroeconomic policies according to them, guide enterprises to adjust the scale and direction of production and operation, and make them meet the needs of national macroeconomic development.

(2) The feasibility of carrying out electricity futures trading - that is, the futures nature of electricity commodities

Electricity commodity itself has most of the characteristics of futures commodity:

(1) Division of power commodity types: according to the different use of power and the difference in the quality of power itself, the power and electricity prices are scientifically differentiated, which provides a prerequisite for the futures trading of power commodities.

(2) Easy transfer: With the development of large power grid and trans regional dispatching mechanism, the transfer and delivery of power goods will become more and more convenient.

(3) Frequent price fluctuations: with the development of the nation, the further prosperity of the trading participants and the power market, the range and frequency of the price changes of power commodities will further intensify.

(4) The transaction scale is large and there are many traders. The function of the futures market is based on the premise that both the supply and demand sides of commodities widely participate in transactions. Only commodities with large spot supply and demand can fully compete in a large range and form authoritative prices.

Therefore, electricity commodities have a solid foundation for futures trading.

At the same time, we should also see that electricity commodities have two different characteristics from most other futures trading commodities: first, electricity commodities are not suitable for storage; The second is that the production of futures commodities needs a cycle. They are fully consumed at the same time during the production cycle. Production and delivery or consumption are carried out simultaneously. Therefore, these differences should be taken into account when designing futures contracts.

The development of electricity futures in america

In the United States, since the 1980s, there has been an electricity broker, which matches trade between buyers and sellers and distributes profits; The New York Mercantile Exchange began to operate power forward contracts in March 1996 with a term ranging from one month to 18 months. At the same time, the idea of option trading has also been fully valued in the power market. From the experience of the successful operation of the three power markets in the eastern United States (PJM, New England and New York State power markets), the combination of spot transactions and forward contract transactions has become an important means of stabilizing power price fluctuations. The PJM model, which combines the power exchange (PX) and the independent operating system operating agency (ISO), has also become a model for the operation of the U.S. electricity market at this stage.

China's listing of electric power futures is the general trend

In China, after the split and reorganization of the State Power Corporation, another major reform of the power system - the regional power market reform oriented at "breaking the barriers between provinces and introducing the competition mechanism", was first launched in the Northeast in the second half of 2003. In the Opinions on the Establishment of the Northeast Regional Power Market issued by the State Electricity Regulatory Commission, the long-term goal of the Northeast regional power market was outlined: introducing a competition mechanism at the power sale end, achieving comprehensive competition involving all market participants, and establishing power futures, options and other power financial markets. The relevant person in charge of the Electricity Regulatory Commission pointed out that the success of the construction of the futures and options markets of the Northeast regional power market, as a pilot of the power reform, will to a considerable extent affect the construction progress of the national power financial market in the future. This is the first guiding opinion for China to promote the regional power market, which means that the northeast power market integration has been started, and it is also the preliminary idea of the marketization structure of China's power system under the future competition mechanism. It can be predicted that with the maturity of the electricity market, the introduction of electricity futures has become an inevitable trend.

Risk control measures for electric power futures

1. Improve the spot power market system

The futures market is developed on the basis of the spot market. Without a developed spot market and an effective and authoritative spot market price, a fair and authoritative futures market price cannot be formed, and the functions of the futures market cannot be realized. Therefore, improving the price formation mechanism of the spot market for power commodities is the primary prerequisite for the development of the power futures market. First of all, we should steadily promote the bilateral open power market, and allow all parties such as power generation, power supply and large users to participate in the transaction, so as to form a mature bilateral power market. Secondly, we should speed up the development of regional power market based on the provincial power market, and finally move towards the national power market.

2. Membership approval system

The members who apply for the qualification of power futures trading shall be subject to the strict qualification approval of the Exchange. Due to the characteristics of electricity commodity, the operation and supervision of electricity futures market should be more strict than other commodity futures. Strict market access is adopted for participants of electric power futures. After cultivating power generation companies, power distribution companies, and large users into institutional investors, a group of institutions with strong financial strength, good reputation, and familiarity with the power industry can be developed to act as brokers of power futures and increase the market share of institutional investors.

3. Establish perfect technical limiting measures

The basic idea of technical restriction measures is to reduce the huge fluctuation of the market through certain technical design. For example, margin, daily debt free settlement, price limit, position limit system, customer position reporting system, compulsory position closing system, full disclosure of trading information and introduction of advanced real-time risk analysis system. The Nymex East Market electricity futures position limit stipulates that the maximum total number of contracts in all months is 5000, but the number of transactions in the last three days of the spot month cannot exceed 350, and the number of contracts in any month cannot exceed 3500. These can give us a good reference, so as to prevent risks in the future.

4. Establish settlement risk fund

The settlement risk fund is the last barrier to protect the financial integrity of the entire futures market. When applying for power futures trading, members must pay a specified amount of reserve fund, which together with the subsequent transaction fees constitutes a settlement risk fund to deal with the credit risk brought about by unexpected market price changes. When a member breaches the contract, the long and short positions of its clients will offset each other, and the relevant losses will be covered by its margin. If the loss exceeds its margin deposit, the balance will first be withdrawn from the proportion of its existing settlement risk fund.