Analysis of PVC production capacity in China

From 2006 to 2007, the investment in China's PVC industry grew rapidly. Foreign investors swarmed into the PVC industry, which led to rapid growth of PVC production capacity. There are several reasons why the industry can attract such a high level of investment. First, the international crude oil price continues to rise, causing the rise of the price of the oil and gas route PVC method, while the domestic carbide route price is relatively low, with great market competitive advantages, and the profit is higher than the industry average; Second, with the rapid development of the domestic construction industry in recent years, the demand for synthetic resin materials, especially PVC, has grown rapidly, resulting in an increase in demand in the downstream market; Third, the demand of the five general resin markets in the domestic market continues to surge, but the price of oil and gas routes is high, and PVC as a substitute becomes an ideal choice; Fourth, some coal chemical enterprises see the prospect of higher return on investment in the downstream market, extend the product industry chain, and obtain better investment benefits.

The average annual consumption growth rate of PVC from 1990 to 2003 reached 18.7%, and the average annual production capacity growth rate of PVC from 1998 to 2003 reached 20.4%

1、 General situation of domestic synthetic resin

(1) Continuous, rapid and stable growth of output

In 2007, the production of China's synthetic resin industry continued to grow rapidly. The annual output reached 30.736 million tons, with a year-on-year growth of 18.5%. The growth rate was slightly higher than that of the previous year (see the table below). China is the second largest synthetic resin producer after the United States in the world. The output of PVC reached 9.717 million tons, up 19.8% year on year; With the production of CNOOC Shell and Huizhou ethylene projects, and the formal operation after the reconstruction and expansion of Jihua and Daqing ethylene projects, the polyethylene output reached 6.925 million tons, up 16.1% year on year; With the expansion of production units such as Hainan Refinery, Maoming Petrochemical and Dalian Petrochemical, the polypropylene output reached 7.127 million tons, up 21.7% year on year; The output of polystyrene reached 3.003 million tons, up 9.8% year on year; ABS output was 1.35 million tons, up 16.4% year on year.

From 2000 to 2007, the average annual growth rate of synthetic resin in China reached 15.6%. It is predicted that by 2010, the output of synthetic resin in China will continue to grow rapidly at an annual growth rate of about 15%.

(2) The production capacity is mainly concentrated in the eastern coastal areas

At present, among the 31 provinces, cities and autonomous regions in China, only Tibet has no synthetic resin production. The production capacity of synthetic resin is mainly concentrated in the four major regions of East China, Central South China, North China and Northeast China, of which 7 provinces and cities in East China account for more than 43% of the total production capacity of the country, followed by Central South China and North China, accounting for 18.2% and 14.8% respectively, and Northeast China accounts for 11.1%. The four regions together account for 87.1% of the country's total production capacity, which means that more than 80% of the country's synthetic resin production capacity is concentrated in the eastern coastal areas.

(3) The scale of enterprises has been expanding, and the industrial concentration has been improved

Statistics show that there were 600 synthetic resin manufacturers in China in 2007, with a total output of 30.736 million tons. Among them, the output of Sinopec and PetroChina is 15.056 million tons, accounting for about 50% of the total national output, accounting for half of the country.

From the perspective of enterprise development, in 2004, there were 4 enterprises with an annual output of more than 500000 tons and 1 enterprise with an annual output of more than 1 million tons; In 2005, the number of enterprises with output of more than 500000 tons rose to 5, and the number of enterprises with output of more than 1 million tons rose to 2; In 2006, the number of enterprises with an annual output of more than 1 million tons jumped to 9, up 80% year on year.

Although there are more and more large-scale synthetic resin enterprises in China, and the output is also growing, the proportion of synthetic resin in the country has not increased, and has a slight downward trend. According to statistics, the total output of the top 10 enterprises accounted for 33.3% of the total national output in 2004, 32.2% in 2005 and 31.7% in 2006. This situation shows that while large enterprises are developing, the majority of small and medium-sized enterprises are also seizing the opportunity to strengthen themselves, and it also indicates that market competition will further intensify in the future, enterprise restructuring and M&A will become more active, and some small and medium-sized enterprises will be eliminated.

2、 PVC production capacity analysis

China's chlor alkali industry has maintained a good momentum of development since 2004. Although the sequelae of production expansion and capacity expansion have appeared since the beginning of this year, the production capacity has still increased significantly. According to the preliminary statistics of China Chlor Alkali Network, by the end of 2006, China's total production capacity of PVC had reached 11.58 million tons, of which the proportion of calcium carbide method was close to 70%.

In 2005, the national PVC output was 6.492 million tons, an increase of 27.6% over 2004. Among them, the output of ethylene method raw material route is about 1.2 million tons, accounting for 18.5% of the total output, a small increase from 890000 tons in 2004; The output of imported monomer and EDC raw material route is about 1.19 million tons, accounting for 18.3% of the total output, slightly increasing from 1.15 million tons in 2004; The output of the raw material route using calcium carbide acetylene method is about 4102000 tons, accounting for 63.2% of the total output, which is significantly higher than the 2.99 million tons in 2004. Calcium carbide method still dominates. Since 2003, the international oil price has risen sharply, which has increased the cost of ethylene PVC, while calcium carbide production has been less affected. This has led to a new upsurge in the construction of domestic calcium carbide PVC production plants, which has dramatically expanded the production capacity of calcium carbide PVC, posing a great challenge to the production of ethylene PVC. Many ethylene enterprises are on the verge of loss.

In 2007, the PVC production capacity in China reached 12.08 million tons/year, with a year-on-year growth of 24.5%, and the output reached 8.238 million tons, with a year-on-year growth of 23.3%. The self-sufficiency rate was about 90%. Among the general resins in China, the self-sufficiency rate was the highest. From 2000 to 2006, the average annual growth rate of PVC production capacity in China reached 19.8%, and the average annual growth rate of output reached 23%. It is the fastest growing variety among the five synthetic resins, second only to ABS.

3、 Analysis of PVC production

(1) Output of main PVC manufacturers in 2006

In 2006, the total output of PVC in China was 8.24 million tons, of which the output of ethylene method was 2.3 million tons, the output of carbide method was 5.94 million tons, and the output of carbide method has exceeded 70%.

As of 2006, there are more than 130 PVC manufacturers in China, 27 of which have output of more than 100000 tons and 10 of which have output of more than 200000 tons (see the table below). The total output of the top 27 companies is 5.606 million tons, accounting for 68% of the total output. In general, the average scale of PVC in China is still small, and the number of enterprises is the main factor to win.

In recent years, although the scale of PVC plants in China has been continuously improved, it is still lower than the international average level. At present, the average scale of PVC production plants in China is less than 100000 tons/year, while the average scale of PVC plants in the world is 150000~200000 tons/year, and the largest scale of plants exceeds 1 million tons/year. In developed countries such as the United States, the average plant size is 300000 tons/year, which is a larger gap. In Japan, the average plant size of PVC is 150000 tons/year.

The ranking of the top ten PVC producers in China in 2006 has not changed much, only Cangzhou Chemical Due to the fact that ethylene production plants are basically shut down throughout the year, they fall out of the top ten and are replaced by Xinjiang Tianye (600075 shares). Relying on its cost and energy advantages, enterprises in Xinjiang are developing rapidly, and will be a force that cannot be ignored in China's carbide PVC industry in the future. Tianjin Dagu has completed the expansion of production this year, with a production capacity of 700000 tons. This year, the output of the enterprise has also jumped over Qilu Petrochemical (600002, Guba) became the largest manufacturer in China.

(2) Analysis of PVC regional output in 2007

In 2007, the overall macro situation of China was better. The PVC industry in China maintained a good momentum of development, and the output of various production enterprises increased significantly. According to PetroChina (601857, Guba) and the Chemical Industry Association released statistics that China's total PVC output was 9.717 million tons, up 19.8% year on year from 8.111 million tons in the same period last year.

Compared with the same period last year, the output of all regions in the country has increased significantly, especially in the northwest, southwest, central China and north China. This is mainly because the rapid expansion of carbide production in the above regions and the rapid increase of output. East China and North China are still the main producing areas of PVC in China. The total output of the two regions above reaches about 60% of that of the country. Although the number of enterprises in the northwest region is small, there is a great trend of catching up with the advantages of developing chlor alkali industry.

(3) Analysis on the output of PVC provinces in 2007

In 2007, the output of the top 10 provinces in terms of PVC output has increased significantly. Shandong and Tianjin are the provinces and cities with the largest PVC output in China. Shanghai has only one chlor alkali production enterprise, and with the high price of crude oil this year, ethylene production enterprises are facing great difficulties. This year's output has decreased, It has dropped from the sixth place in the output ranking in 2005 to outside the top ten.

4、 PVC production expansion in China from 2007 to 2008

Although the expansion of PVC production in China slowed down from 2007 to 2008, the production capacity still increased in a relatively large amount, but the expansion of production in 2008 has significantly decreased compared with 2006 and 2007. According to preliminary statistics, the number of new buildings since 2008 is small. With the increase of demand, the entire PVC market is expected to gradually restore the balance between supply and demand.

Demand of PVC for China's economic development

Since this year, new progress has been made in reform, opening up and modernization. The national economy has maintained a good momentum of sustained, rapid and healthy development. The overall situation is better than expected and better than last year. According to the preliminary calculation, the GDP in the first three quarters was 7168.2 billion yuan, an increase of 7.9% over the same period of the previous year at comparable prices, 0.3 percentage points faster than the same period of the previous year, of which the added value of the primary industry was 895.9 billion yuan, an increase of 3.0%; The secondary industry was 3816.8 billion yuan, up 10.0%; The tertiary industry was 2455.5 billion yuan, up 6.6%. The main characteristics of economic development are:

1. Economic growth picked up slightly quarter by quarter. Under the dual role of the national policy of expanding domestic demand and market driving, and driven by domestic and international factors, the stability of China's economic growth has increased since this year. Compared with the same period last year, the economy grew by 7.6% in the first quarter, 8% in the second quarter, and 8.1% in the third quarter. Industrial production, market sales, and import and export trade also showed a trend of accelerating growth quarter by quarter. This shows that the foundation of China's economic growth has been further consolidated.

2. Agricultural production grew steadily in the course of structural adjustment. Grain planting area continued to be reduced, with high quality agriculture products (000061, Guba) increased its proportion and further optimized its regional layout. Although the yield of summer grain and early rice was reduced, the harvest of autumn grain was good, and the annual grain output showed a recovery growth, expected to reach 457.5 million tons, an increase of 1.1% over the previous year. Among the main cash crops, the output of cotton (information, market) and oil crops will decrease, but the production of sugar, vegetables and fruits will continue to increase, and the production of animal husbandry and fishery will continue to develop steadily.

3. Industrial production is growing rapidly in accelerating structural adjustment. In the first three quarters, the added value of industries above designated size nationwide reached 2248.7 billion yuan, up 12.2% year on year. Industries of all kinds of ownership grew in an all-round way. Among them, state-owned and state-controlled enterprises increased by 10.8%, collective enterprises by 8.8%, joint-stock enterprises by 13.5%, and "three capital" enterprises by 12.7%. The production of heavy industry grew slightly faster than that of light industry. In the first three quarters, heavy industry grew by 12.3% and light industry grew by 12.0%. The adjustment of product structure continued to accelerate, and the production of investment products, high-tech products and new consumer goods adapted to the upgrading of consumption structure maintained rapid growth, becoming the main force driving the rapid growth of industrial production. In the first three quarters, six major industries, including electronic communication equipment manufacturing, transportation equipment manufacturing, chemical industry, electrical machinery equipment manufacturing, metallurgy and textile, contributed 53.2% to the growth of industries above designated size. Industrial enterprises achieved an export delivery value of 1391 billion yuan, up 21% year on year, contributing nearly one fifth to industrial growth.

4. Investment in fixed assets grew rapidly. In the first three quarters, the investment in fixed assets of the whole society was 2583.8 billion yuan, up 21.8% year on year. Among them, the investment in fixed assets of state-owned and other economic types increased by 24.3%, and the investment of collective and individual increased by 18.0%, showing a good trend of accelerated growth. Among state-owned and other types of fixed asset investment, investment in capital construction increased by 24.6%, investment in renovation and transformation increased by 16.3%, and investment in real estate development increased by 29.4%. From a regional perspective, investment in the East, Central and West has basically achieved synchronous growth. Among them, the investment in the east and the middle increased by 22.9% and 25.3% respectively, and the investment in the west increased by 25.2%. Investment in agricultural water conservancy, infrastructure, industry and various new service industries maintained steady growth.

5. The domestic market is running smoothly. In the first three quarters, the total retail sales of consumer goods reached 2911.1 billion yuan, up 8.7% year on year. Excluding the price factor, the actual growth was 10.2%. Among them, the total retail sales of urban consumer goods reached 1848.8 billion yuan, up 9.8%; Retail sales of consumer goods in rural areas totaled 1062.3 billion yuan, up 6.8%. Consumer hotspots such as automobiles, housing and communications have maintained rapid growth. In the first three quarters of the total retail sales of wholesale and retail trade goods above the designated size, the sales of communication equipment and automobiles increased by 62.4% and 58.0% respectively. In addition, the sales of commercial housing increased by 31.9%, of which the sales to individuals increased by 33.5%, accounting for 91% of the total sales of commercial housing. Residents' tourism and cultural consumption also grew rapidly.

6. Market prices continue to operate at a low level. In the first three quarters, the prices of consumer goods fell 0.8% year on year. Among them, urban areas declined by 1.0% and rural areas by 0.4%. By commodity category, the price of service items rose by 2.0% year on year, while the price of consumer goods fell by 1.6%. In the first three quarters, the retail price of goods fell 1.4% year on year. The ex factory price of industrial products dropped 2.9% year on year. Among them, the price of means of production decreased by 3.1% year on year, and the ex factory price of means of livelihood decreased by 2.2% year on year. The purchase price of raw materials, fuels and power decreased by 3.2%. From the dynamic point of view, the decline of market prices in the third quarter has tended to narrow, and the year-on-year decline of all kinds of prices is lower than that in the previous two quarters. The month on month indicators have stopped falling and become stable, and some are still slightly rising.

7. Foreign economy and trade grew rapidly. In the first three quarters, the total import and export volume was 445.1 billion US dollars, an increase of 18.3% over the same period of the previous year. Among them, the export reached US $232.6 billion, up 19.4%; Imports reached US $212.6 billion, up 17.2%. The balance between imports and exports has accumulated a trade surplus of US $20 billion, an increase of US $6.6 billion year on year. In total exports, exports to the United States increased by 24.5%, to the European Union by 13.8%, and to ASEAN by 27.4%,; It grew 25.2% for Hong Kong, 19.9% for South Korea and 4.9% for Japan. The utilization of foreign capital increased significantly. From January to September, the amount of foreign direct investment agreements reached US $68.4 billion, up 38.4% year on year; The actually utilized foreign direct investment was 39.6 billion US dollars, up 22.6%.

8. Economic benefits have gradually improved. From January to August, the industrial enterprises realized a total profit of 324.6 billion yuan, up 10% year on year. Among them, the profit of state-owned and state-controlled enterprises was 152.6 billion yuan, down 4.1% year on year, which was significantly smaller than that in the first half of the year. From January to August, the loss of loss making enterprises was 83.6 billion yuan, up 1.9% year on year. Among them, the loss of state-owned and state-controlled enterprises was 50.3 billion yuan, which was reduced by 1.1% from the original increase in loss. In the first three quarters, the industrial production and marketing rate was 97.6%, 0.41 percentage points higher than the same period of the previous year. With the sustained economic growth and the implementation of measures to increase revenue and reduce expenditure, fiscal revenue has gradually reversed the situation of low growth.

9. The growth of money supply accelerated. In the first three quarters, the loans of financial institutions increased by 1353.3 billion yuan over the beginning of the year, an increase of 415.1 billion yuan over the same period last year. All deposits increased by 2253.5 billion yuan, an increase of 689.8 billion yuan year-on-year. By the end of September, the balance of broad money (M2) was 17698.2 billion yuan, an increase of 16.5% over the same period of the previous year; The balance of narrow money (M1) was 6679.7 billion yuan, up 15.9%; The balance of cash in circulation (M0) was 1623.4 billion yuan, up 7.8%.

10. Residents' income maintained a rapid growth. In the first three quarters, with the acceleration of economic growth, policies such as increasing residents' income, strengthening social security and reducing farmers' burden have produced positive effects, and residents' income has maintained a rapid growth. The per capita disposable income of urban residents was 5793 yuan, an increase of 17.2% in real terms excluding price factors; The per capita cash income of rural residents was 1721 yuan, up 5.3% in real terms. By the end of September, the balance of savings deposits of urban and rural residents had reached 8413.9 billion yuan, an increase of 1046.1 billion yuan over the beginning of the year, or 351.3 billion yuan more than the same period last year.

At present, the main problems existing in the economic operation are: the employment pressure is still large, the effective demand is insufficient, the situation of market price decline has not been completely changed, the rural market sales growth is slow, the economic structure is unreasonable, and so on, which need attention.

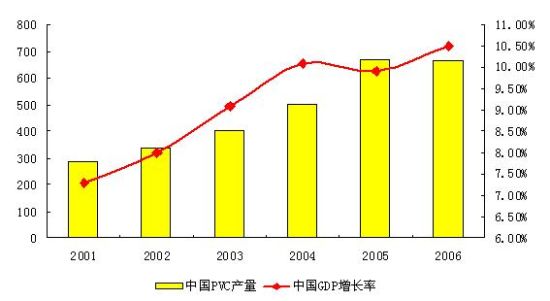

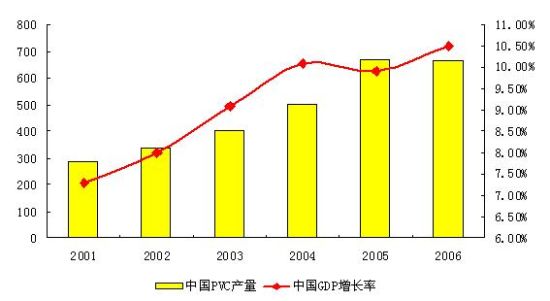

Figure 2: Comparison between China's PVC output and GDP growth rate

Figure 2: Comparison between China's PVC output and GDP growth rate

Figure 2: Comparison between China's PVC output and GDP growth rate