transaction

1. The position limitation system refers to the maximum amount of a certain contractual speculative position that members or clients can hold according to the regulations of the Exchange and calculated unilaterally.

The specific proportion and amount of the copper futures contracts of brokerage members, non brokerage members and clients in different periods are as follows:

Table 1: Specific proportion and amount of copper futures contracts with limited positions in different periods (unit: hand)

Note: The position of a futures contract in the table is calculated in two directions, and the position limit of brokerage members, non brokerage members and customers is calculated in one direction; The position limit amount of the brokerage members is the base number.

Note: The position of a futures contract in the table is calculated in two directions, and the position limit of brokerage members, non brokerage members and customers is calculated in one direction; The position limit amount of the brokerage members is the base number. 2. Hedging transactions

To apply for hedging transactions, you must fill in the hedging application (approval) form of Shanghai Futures Exchange uniformly formulated by the Exchange, and submit relevant supporting materials consistent with the type, trading position, trading volume and hedging time of the hedging transaction applied for.

The hedging application must be submitted before the 20th day of the month before the delivery month of the hedging contract, and the overdue exchange will no longer accept the hedging application of the contract in the delivery month. The Exchange shall review the hedging application within 5 trading days after receiving it.

Traders who have been approved for hedging transactions must build positions according to the approved trading positions and limits within the position building period approved by the Exchange (no later than the last trading day of the month before the month of hedging contract delivery). It shall not be reused from the first trading day of the month before the delivery month.

The Exchange shall calculate the position and delivery volume of hedging transactions separately and shall not be subject to the position limit under normal circumstances.

settlement

It refers to the business activities of calculating and allocating the members' trading deposits, profits and losses, service charges, payment for delivery of goods and other relevant funds according to the trading results and the relevant provisions of the Exchange.

1. Daily settlement

The Exchange shall open a special settlement account in each settlement bank for depositing members' deposits and related funds; Members must open a special capital account in the settlement bank to deposit deposits and related funds; The Exchange shall implement separate account management for the deposits of members in the special capital account of the Exchange. The Exchange implements a daily debt free settlement system, that is, after the end of daily trading, the Exchange settles the profit and loss of all contracts, trading deposits, service fees, taxes and other fees at the settlement price of the day, and transfers the net amount of accounts receivable and payable at one time, increasing or reducing the settlement reserves of members accordingly.

Additional margin: at the end of each day's closing, if the settlement reserve after settlement is less than the minimum balance, the member must make up the funds to the minimum balance of the settlement reserve before the opening of the next trading day. If it fails to make up in time, if the balance of the settlement reserve is greater than zero but lower than the minimum balance of the settlement reserve, it is prohibited to open new positions; If the balance of the settlement reserve is less than zero, the Exchange will implement "forced closing" in accordance with the relevant risk control management regulations.

2. Transaction margin:

It refers to the funds deposited by members in the special settlement account of the Exchange to ensure the performance of the contract, which is the margin occupied by the contract.

The Exchange formulates different standards for the collection of trading margins according to the different stages of the listing operation of a futures contract and the different number of positions. The specific provisions on the collection of standard contract deposits for cathode copper are as follows:

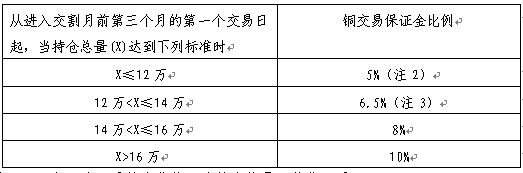

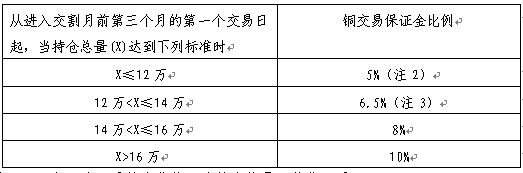

Trading margin collection standard when the position of copper futures contract changes

Note: 1. X represents the total bilateral positions of contracts in a certain month, unit: hand.

Note: 1. X represents the total bilateral positions of contracts in a certain month, unit: hand. 2. At present, the copper trading margin is temporarily charged at 7%.

3. If the current standard is higher than 6.5%, the current standard shall prevail.

During the trading process, when the position of a certain futures contract reaches the total position of a certain level, the Exchange will not adjust the collection standard of trading margin temporarily; At the settlement of the day, if the position of a certain futures contract reaches the total position of a certain level, the exchange will charge the trading margin corresponding to the total position of all positions of the contract. If the margin is insufficient, it shall be added in place before the opening of the next trading day.

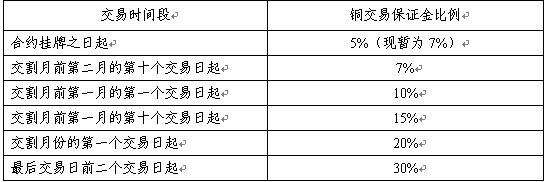

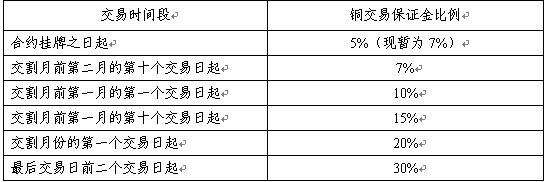

The Exchange shall adjust the collection standard of trading deposits according to the different stages of the listing operation of futures contracts (near the delivery period).

Trading margin collection standards of copper futures contracts at different stages of listing operation

The collection standards of trading margins at different stages of the listing operation of futures contracts

The collection standards of trading margins at different stages of the listing operation of futures contracts When a certain copper futures contract reaches the standard that the trading margin should be adjusted, the Exchange shall settle all historical positions of the contract according to the new trading margin standard at the time of settlement on the trading day before the implementation of the new standard. If the margin is insufficient, it shall make up before the opening of the next trading day. After entering the delivery month, the seller can use the standard warehouse receipt as the performance guarantee for the futures contract position in the delivery month with the same quantity as that shown, and the trading margin corresponding to its position will not be collected.

When the price of a copper futures contract rises or falls by a limit at the close of the day, the contract margin shall also be increased accordingly at the settlement of the day. The specific provisions are as follows: when the closing is on the first trading day when there is no continuous quotation on the unilateral side of the limit, the trading margin will be increased to 7% of the contract value, and those higher than 7% will be charged according to the original proportion; When there is no continuous unilateral quotation on the second trading day in the same direction as the last trading day, the trading margin will be increased to 9% of the contract value at the settlement of the second trading day, and those higher than 9% will be charged at the original proportion...... (see the Shanghai Futures Exchange Risk Control Management Measures for details).

The trading margin charged by brokerage members to customers shall not be lower than the trading margin charged by the Exchange to members.

3. Certificate of entitlement as security deposit:

It means that after a member applies for and is approved by the Exchange or the investor implements the authorization to the member and the member submits the authorization to the Exchange, the holder of the right certificate will submit the electronic form of the standard warehouse receipt to the Exchange through the standard warehouse receipt management system of the Exchange to handle the deposit formalities. If the standard warehouse receipt is used as the margin, it shall be used as the guarantee for the performance of the transaction margin debt. Pledge of documents of title is only limited to the transaction margin, but losses, expenses, taxes and other funds must be settled in monetary capital.

(1) Certificate of rights that can be used as security deposit

The standard warehouse receipt registered by the Exchange and other certificates of title determined by the Exchange.

(2) Calculation of voucher of title as security deposit

If the standard warehouse receipt is used as the margin, its market value shall be calculated based on the settlement price of the futures contract of the latest delivery month of the variety as the benchmark price, and the amount used as the margin shall not be more than 80% of the market value of the standard warehouse receipt.

The amount that can be used as margin after the market value of the voucher of title is discounted is called the discounted amount. The Exchange shall determine the maximum matching amount of a member's warrant as the margin according to 4 times of the actual monetary capital of the member in the special settlement account of the Exchange (matching multiplier). The lower amount of the discounted amount and the maximum matching amount shall be used as the right certificate as the actual available amount of the deposit.

The benchmark price of other certificates of title as deposits shall be determined by the Exchange.

As the security deposit, the voucher of title is calculated dynamically according to the change of daily settlement price.

(See Chapter VI "Certificate of Rights" of the Settlement Rules of Shanghai Futures Exchange for details)

delivery

1. Settlement price: settlement price on the last trading day

2. Delivery unit: 25 tons, the weight of cathode copper listed in each standard warehouse receipt is 25 tons, the excess and shortage shall not exceed+2%, and the pound difference shall not exceed+0.2%.

3. Packaging of delivered goods

Packaging of domestic commodities: cathode copper of each delivery unit must be composed of commodities produced by the same manufacturer, with the same registered trademark, the same quality grade, the same block shape and similar bundle weight. The registered manufacturer shall choose the weight of the registered products by itself, but it shall be convenient for hand assembly. Each package shall be bound with 30-32 * 0.9-1.0mm steel belt with rust proof surface in a zigzag manner. The binding shall be firm and marked with eye-catching and non falling commodity marks and the weight. The weight of each bundle shall not exceed 2.5 tons.

Packaging of imported goods: generally, the delivery shall be based on the original imported packaging (fastened and intact), and the maximum bundle weight is 4 tons.

In case of broken or severely rusted packaged steel strips or loose pieces of goods in the warehouse, they must be reassembled and fastened with specified steel strips before delivery. The packing cost shall be borne by the consignor.

4. Necessary documents for delivery of commodities

● Domestic products: The Product Quality Certificate issued by the registered manufacturer must be provided.

● Imported commodities: Product Quality Certificate, Certificate of Origin, Commodity Inspection Certificate, and Payment Certificate of Value Added Tax Collected by the Customs on behalf must be provided, which are valid after being approved by the Exchange.

5. Settlement process

Shanghai Futures Exchange currently implements the five-day delivery system. The closing procedure is as follows:

(1) First delivery date

● The Buyer declares its intention. The buyer submits the letter of intent for the required commodities to the exchange, including the variety, brand, quantity, and the name of the designated delivery warehouse.

● The Seller shall submit the standard warehouse receipt. The Seller shall deliver the valid standard warehouse receipt of the paid storage expenses to the Exchange.

(2) Second delivery date

The exchange allocates standard warehouse receipts. The Exchange shall distribute standard warehouse receipts to the buyer according to the existing resources and the principle of "time priority, quantity rounding, nearest matching and overall arrangement".

(3) Third delivery date

● The Buyer makes payment and withdraws documents. The buyer must pay the purchase price and obtain the standard warehouse receipt at the exchange before 14:00 on the third delivery day.

● Collection by the Seller. The Exchange shall pay the payment to the seller before 16:00 on the third delivery day.

(4) Fourth and fifth delivery date

The Seller shall submit VAT special invoice.

6. Circulation procedure of standard warehouse receipt for physical delivery at the exchange

(1) The seller investor authorizes the standard warehouse receipt to the seller's brokerage member to handle the physical delivery business;

(2) The seller member submits the standard warehouse receipt to the Exchange;

(3) The Exchange shall distribute the standard warehouse receipt to the buyer members;

(4) The buyer brokerage member distributes the standard warehouse receipt to the buyer investor;

7. Futures to cash

It refers to the members (clients) holding contracts in the same month with opposite directions who reach consensus and apply to Shanghai Futures Exchange (hereinafter referred to as the Exchange). After obtaining the approval of the Exchange, they will respectively close their positions on behalf of the Exchange at the price specified by the Exchange, and at the price agreed by both parties, the number and variety of futures contracts are the same as those of futures contracts Exchange behavior of warehouse receipts with the same direction.

The warehouse receipts here include standard warehouse receipts and non-standard warehouse receipts. The non-standard warehouse receipt refers to the warehouse receipt issued by the relevant warehouse under the following circumstances: non registered trademark goods are stored in the designated delivery warehouse; Registered trademark goods are stored in non designated delivery warehouses; Non registered trademark goods are stored in non designated delivery warehouses.

Term of periodic cash transfer: from the first trading day after the last trading day of the contract in the previous month of the delivery month in which the periodic cash transfer contract is to be carried out to the two trading days (including that day) before the last trading day of the delivery month.

Handling of futures positions for cash transfer in the application period: the futures positions of the corresponding delivery month originally held by the buyer and seller for cash transfer in the application period shall be closed by the Exchange before 15:00 on the application date at the settlement price of the contract for the delivery month on the trading day before the application date.

Trading margin (delivery margin) for short-term cash transfer: calculated according to the settlement price of futures contracts in the delivery month on the trading day before the application date.

(For details, see Chapter VII "Futures to Cash" of the Shanghai Futures Exchange Delivery Rules)

8. Warehouse receipt market

● The warehouse receipt market is an information platform established on the home page of the exchange, which aims to provide an opportunity for information exchange between the trading parties who have the intention to buy and sell warehouse receipts and exchange warehouse receipts, so as to strengthen the organic link between the futures market and the spot market. The specific transaction matters shall be negotiated by the trading parties themselves, and the Exchange shall not bear any legal liability arising therefrom.

● You can directly enter the warehouse receipt market by clicking the "warehouse receipt market" module in the home page of the exchange (www.shfe. com. cn).

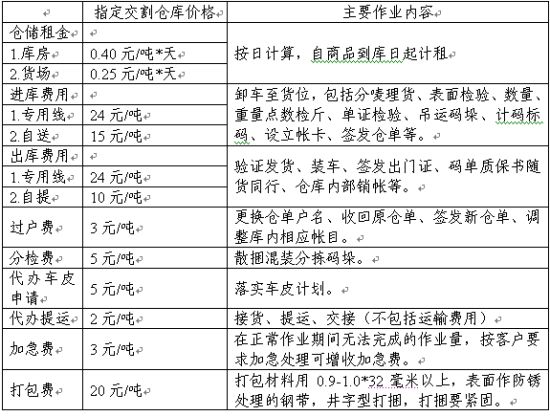

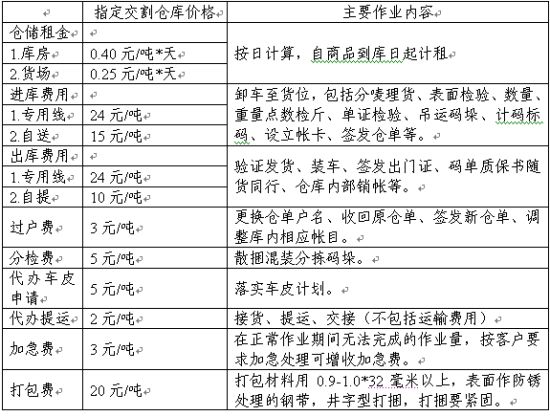

Charging standard of delivery warehouse

Charging standard of delivery warehouse