1、 Delivery standard of late indica rice futures

(1) Delivery unit and delivery price

Delivery unit: 20 tons.

The delivery benchmark price is the tax inclusive price of the benchmark deliverable of the futures contract delivered in bulk grain (excluding packaging) at the benchmark warehouse.

The delivery settlement price is the arithmetic average of the transaction settlement price of the 10 trading days (including the matching day) prior to the futures delivery matching day.

(2) Benchmark Deliverables and Alternatives

Benchmark deliverable: late indica rice that meets the quality indicators of Grade III and above in the National Standard of the People's Republic of China for Rice (GB1350-2009, hereinafter referred to as the National Standard for Rice), with chalkiness grain rate ≤ 30% and grain type (length width ratio) ≥ 2.8.

Substitutes and premium: If the difference between the quality indicators of late indica rice and the benchmark deliverable meets the following requirements, the delivery can be replaced by premium.

1. When the late indica rice is put into storage: if the moisture content is ≤ 13.5%, it shall be put into storage in sufficient quantity; If the moisture content is more than 13.5%, take 13.5% as the benchmark. 0.2% will be deducted for every 0.1% excess moisture content. The moisture content of late indica rice warehoused from October 1 (inclusive, the same below) to March 31 of the next year shall not exceed 15.0%, and that of late indica rice warehoused at other times shall not exceed 14.5%. When the late indica rice leaves the warehouse, if the moisture content is ≤ 13.5%, it will leave the warehouse in sufficient quantity; If the water content is more than 13.5%, 13.5% shall be taken as the benchmark. If the water content exceeds 0.1%, 0.2% shall be added, which shall be borne by the warehouse. (This clause is only applicable to Jiangxi, Hunan, Hubei, Anhui and other major production areas)

2.1.0% < impurity ≤ 1.5%, 0.5% of inbound deduction (outbound supplement); If 1.5% < impurity ≤ 2.0%, the stock in deduction (stock out supplement) is 1.0%.

3.30% < chalkiness grain rate ≤ 40% and grain type (length width ratio) ≥ 2.8, the discount is 150 yuan/ton.

4. The fatty acid value of late indica rice warehoused from October 1 to March 31 of the next year shall not be higher than 19mg/100g (dry basis), and that of yellow rice shall not be higher than 0.3%; The fatty acid value of late indica rice stored at other times shall not be higher than 22mg/100g (dry basis), and that of yellow rice shall not be higher than 0.5%.

The fatty acid value of late indica rice delivered from October 1 to March 31 of the next year shall not be higher than 22mg/100g (dry basis), and that of yellow rice shall not be higher than 0.5%; The fatty acid value of late indica rice released at other times shall not be higher than 25mg/100g (dry basis), and that of yellow rice shall not be higher than 0.7%.

When the warehouse receipt is issued from the factory, the yellow rice and fatty acid value indicators shall be subject to the warehousing standard of the corresponding period.

5. The chalkiness rate and grain type (length width ratio) shall be inspected in accordance with the National Standard of the People's Republic of China for High Quality Rice (GB/T17891 - 1999). The fatty acid value shall be inspected in accordance with the Rules for Determining the Storage Quality of Paddy (GB/T20569 - 2006).

6. Health quarantine shall be carried out according to relevant national standards and regulations, and the inspection cost shall be borne by the owner.

(3) National standard for late indica rice

Table 1: GB1350-2009 Quality Indexes of Late Indica Rice

| Grade |

Roughness ratio/% |

Head milled rice rate/% |

Impurity content/% |

Moisture content/% |

Yellow grain rice content/% |

Content of brown rice outside grain/% |

Mutual mixing rate/% |

Color and smell |

| one |

≥79.0 |

≥50.0 |

≤1.0 |

≤13.5 |

≤1.0 |

≤2.0 |

≤5.0 |

normal |

| two |

≥77.0 |

≥47.0 |

| three |

≥75.0 |

≥44.0 |

| four |

≥73.0 |

≥41.0 |

| five |

≥71.0 |

≥38.0 |

| Out of equality |

<71.0 |

— |

| Note: "-" means not required. |

Table 2: National Standard for Oily Rice

| category |

Grade |

Roughness yield% ≥ |

Head milled rice rate% ≥ |

Chalky grain rate% ≤ |

Chalkiness% ≤ |

Grain type (length width ratio) ≥ |

Imperfect particles ≤ |

Yellow rice ≤ |

Impurities ≤ |

Moisture ≤ |

Color, smell, indica rice |

| Indica rice |

one |

seventy-nine |

fifty-six |

ten |

one |

two point eight |

two |

zero point five |

one |

thirteen point five |

normal |

| two |

seventy-seven |

fifty-four |

twenty |

three |

two point eight |

three |

zero point five |

one |

thirteen point five |

| three |

seventy-five |

fifty-two |

thirty |

five |

two point eight |

five |

zero point five |

one |

thirteen point five |

2、 Late indica rice futures delivery system

(1) Delivery method

According to the characteristics of spot circulation of late indica rice, late indica rice futures adopt the delivery method of warehouse standard warehouse receipt delivery and factory warehouse standard warehouse receipt delivery.

There are many late indica rice storage and processing enterprises with complete facilities and good storage and circulation capacity. Storage enterprises such as central and local grain storage depots and third-party commercial grain depots can store late indica rice all year round, while processing enterprises mostly adopt the mode of purchasing, processing and selling to the whole country at the same time. Therefore, the storage and circulation of late indica rice are relatively good, which is very suitable for warehouse receipt delivery and factory warehouse receipt delivery.

(2) Delivery layout

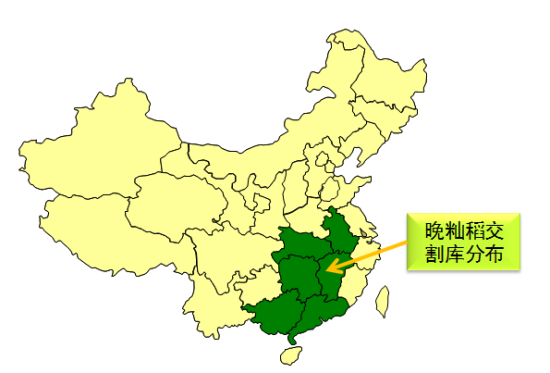

Late indica rice is mainly distributed in Hunan, Hubei, Sichuan, Jiangxi and Anhui. Among them, Jiangxi, Hubei, Hunan and Anhui are regions with large transfer volume of late indica rice and the largest processing capacity of late indica rice. The designated delivery warehouse of late indica rice is selected in the above main production and marketing areas, which is conducive to the normal flow of late indica rice in the futures and spot markets.

Figure 1: Regional distribution of late indica rice futures delivery

(3) Others

1. Delivery unit: 20 tons

The delivery unit of late indica rice futures is set at 20 tons, with moderate value, which is conducive to improving market liquidity and promoting functions. If the delivery unit is too large, it will raise the participation threshold of spot enterprises, keep the delivery unit consistent with the trading unit, which is conducive to relieving investors' concerns about position consolidation before entering the delivery month. From the perspective of transportation, the spot market is mainly automobile transportation, accounting for about 80% of the transportation volume. The single transportation volume of automobile transportation is 20-40 tons. The delivery unit can flexibly match the bulk trade in the spot market.

2. Warehouse Receipt General

There are few projects of late indica rice, only including chalky grain rate. In order to facilitate the buyer to select and pick up goods and improve the storage efficiency and safety of the warehouse (factory warehouse), the general standard warehouse receipt is used for late indica rice.

3. Valid period of warehouse receipt

The validity period of the warehouse receipts for late indica rice futures is one year. The standard warehouse receipts registered from October 1 of each year shall be cancelled before the last working day of September of the next year.

3、 Risk control management system of late indica rice futures

(1) Margin system

| Variety |

Normal month |

One month before the delivery month |

Delivery month |

| Early ten days |

Mid day |

Late ten days |

| Late indica rice |

5% |

5% |

10% |

15% |

20% |

For contracts that simultaneously meet the provisions of these Measures on the adjustment of trading margin, the trading margin shall be charged at the larger value of the specified trading margin ratio.

(2) Limited warehouse system

1. Members of futures companies are not limited to positions

2. The position limits for members and customers of non futures companies are as follows:

| Limited warehouse unit Trading period

|

Maximum unilateral position of non futures company members and customers (hand) |

| Normal month |

twenty thousand |

| One month before the delivery month |

Early ten days |

Mid day |

Late ten days |

| twenty thousand |

eight thousand |

three thousand |

| Delivery month |

500 (0 for natural person customers) |

(3) Price limit system

The daily fluctuation limit of late indica rice futures contract is ± 4% of the settlement price of the previous trading day.

(4) Key account reporting system

When the number of a futures contract held by a member or client of a non futures company reaches more than 80% (including this number) of the position limit specified by the Exchange or the Exchange requires to report, it shall report to the Exchange the funds, positions and other information during the period. According to the market risk status, the Exchange can adjust the position reporting level.

(5) Compulsory position closing system

Compulsory position closing refers to the compulsory measures taken by the Exchange to close the positions of relevant futures contracts held by members and customers in violation of the relevant business regulations of the Exchange.

In case of any of the following circumstances, the Exchange has the right to forcibly close positions:

1. The balance of the settlement reserve is less than zero and cannot be replenished within the specified time;

2. The position exceeds the position limit;

3. Natural person positions entering the delivery month;

4. Being punished by the Exchange for compulsory position closing due to violation of regulations;

5. The position should be closed compulsorily according to the emergency measures of the Exchange;

6. Other positions that should be closed by force.

(6) Risk warning system

In case of abnormal transactions, positions and funds of members or clients, suspected violations and defaults of members or clients, complaints and other situations, the Exchange may talk to designated members' executives or clients to remind them of risks, issue risk reminder letters or require members or clients to report to warn and resolve risks.