There are many problems in the domestic ferroalloy industry. It is very necessary for spot enterprises to use futures to avoid risks and improve their competitiveness

Classification and application of ferroalloys

Ferroalloy refers to the intermediate alloy composed of iron and one or several elements, which is mainly used as deoxidizer and element additive in steelmaking to make steel have certain properties.

Ferroalloys as deoxidizers are generally used to remove oxygen from molten steel during steelmaking; Ferroalloys, as alloy additives, are generally used to add certain alloying elements to steel to improve its properties. In addition, ferroalloys as inoculants are added into molten iron before casting to improve the crystal structure of castings.

There are many ways to classify ferroalloys, such as the main elements in alloys, carbon content, or production methods. Ferrosilicon alloy and silicon manganese alloy belong to the alloy varieties classified according to the main elements in the alloy, and these two varieties belong to the main varieties of ferroalloys. In addition, there are ferromanganese, ferrochrome, ferrotungsten, ferronickel, ferrovanadium, ferromolybdenum and other ferroalloys. According to the scale of production and consumption, ferroalloys can also be divided into two categories: bulk ferroalloys and special ferroalloys. The output and consumption of bulk ferroalloys account for more than 90% of ferroalloys, including ferromanganese, silicon manganese, ferrosilicon and ferrochrome, which are mainly used for ordinary steel; Special ferroalloys are mainly used in special steel fields, including ferronickel, ferromolybdenum, ferrotungsten, etc.

Production

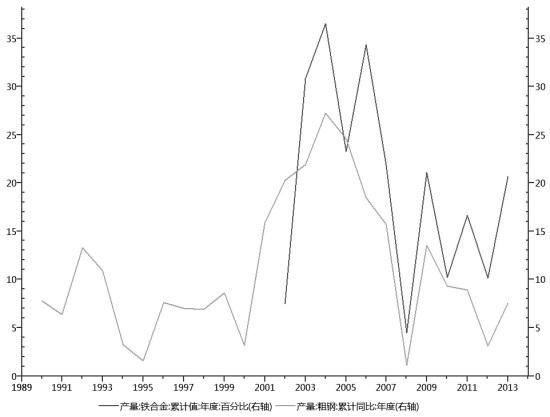

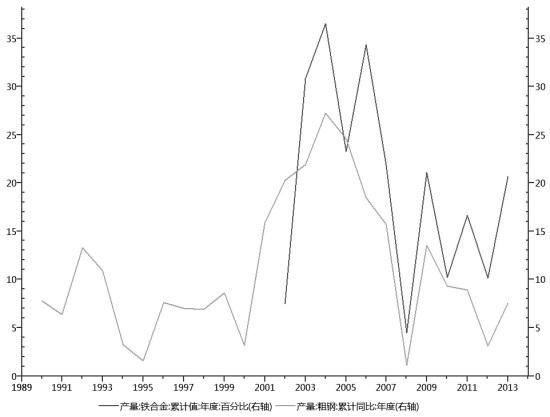

According to the data of the National Bureau of Statistics, the production of ferroalloys in China has increased year by year and maintained a relatively high growth rate. In 2001, the output of ferroalloy in China was only 4.5083 million tons, but by 2005, it had exceeded 10 million tons to 10.6702 million tons, in 2009, it had exceeded 20 million tons, and in 2012, it had exceeded 30 million tons. By 2013, China's ferroalloy production had reached 37.7587 million tons, an increase of nearly 740% compared with 2001, with an average compound annual growth rate of more than 18%. Between 2001 and 2013, the lowest actual growth rate of annual output was in 2008. Affected by the financial crisis, the output growth rate was only 3.9%. Most other annual output maintained double-digit growth rates. From 2011 to now, although the growth rate of ferroalloy production has gradually declined, it still maintains a double-digit growth rate, of which the output in 2013 increased by 14.67% compared with that in 2012. From January to April 2014, China's ferroalloy output was 12.2386 million tons, with a year-on-year growth rate of 9.19%. The continuous and rapid growth of China's ferroalloy production has made China the world's largest ferroalloy producer and consumer. China's ferroalloy output accounts for about 40% of the world's output.

Among the ferroalloy output, China's ferrosilicon output reached 5.97 million tons in 2013, an increase of 17.63% year on year; The output of silicon and manganese was 11.03 million tons, an increase of 5.8% over 2012. The total output of ferrosilicon and silicon manganese accounts for 45% of the total output of ferroalloys.

In the regional production structure of ferroalloys, Guangxi, Inner Mongolia, Hunan, Guizhou and Ningxia are the top five major production areas. Among them, the ferroalloy output of Guangxi in 2013 was 6.644 million tons, up 27.8% year on year, accounting for 18% of the national output; The output of Inner Mongolia in 2013 was 4.301 million tons, up 18.9% year on year, accounting for 11% of the total output; Hunan's output in 2013 was 3.402 million tons, up 10.5% year on year. In 2013, the fastest growth rate of output in all regions was in Henan, with a growth rate of 46.1%, followed by Shandong, with a growth rate of 39.9%, and Xinjiang ranked third, with a growth rate of 31.5%. Guizhou is a region with high output but low growth rate, and its output growth rate was only 5.1% in 2013. From the distribution of production areas, the industrial concentration of ferroalloys is not very high.

Among the regional distribution of ferrosilicon output, Qinghai occupies the first place. In 2013, the output of ferrosilicon in this region reached 1.312 million tons, followed by Ningxia with 1.1215 million tons, Inner Mongolia with 90856 tons, and Hunan with 60497 tons. The output of the top two provinces accounted for 41% in total, and the output of the top five provinces accounted for 76% in total. Therefore, the industrial concentration of ferrosilicon is better than that of ferroalloy. However, it is worth noting that the proportion of ferrosilicon production in Guangxi and Guizhou, the two main ferroalloy production areas, is quite small, and these two areas are mainly based on other alloy products.

The industrial concentration of silicon manganese is close to that of ferrosilicon. Its output is mainly distributed in the southwest of China, including Guangxi, Guizhou, Yunnan, Hunan and other places. In 2013, the output of the top five major production areas also accounted for 76%, and the output of the top two reached 45%, slightly higher than that of ferrosilicon. According to the data of the National Bureau of Statistics, Guangxi, Hunan, Guizhou, Inner Mongolia and Ningxia ranked the top five provinces in terms of silicon manganese alloy output in 2013, with the output of 3.1297 million tons, 1.8758 million tons, 1.5444 million tons, 950 thousand tons and 845600 tons respectively.

The regional distribution characteristics of ferrosilicon and silicon manganese alloys are mainly related to the geographical distribution of the raw materials silicon and manganese of these two alloys. Qinghai, Inner Mongolia and other places are the main production areas of quartz sand, while Guangxi and Hunan are the main production areas of manganese ore.

Import and export pattern

Before 2008, China was a net exporter of ferroalloy products. At that time, the annual export volume exceeded 3 million tons, while the import volume was 1.315 million tons in 2008. During the period from 2005 to 2007, China's ferroalloy import experienced a leap forward development. In 2006, the import increased by 66.85% to 617000 tons, and in 2007, the growth rate reached 150.9%, and the import volume jumped to 1.55 million tons. In 2008, domestic imports declined slightly due to the financial crisis. However, China's ferroalloy import and export pattern began to reverse in 2009.

Due to the heavy impact of the financial crisis on the foreign market, the consumption demand for ferroalloys has declined significantly. In addition, China's steel production capacity has expanded significantly, and the consumption demand for ferroalloys has increased. As a result, China's export of ferroalloys has decreased significantly while its import has increased significantly. In recent years, with the adjustment of the industrial structure of China's steel industry and the slow recovery of the peripheral market, China's ferroalloy import and export volume has gradually declined, but still maintains the pattern of net imports. In 2013, China imported 1.93 million tons of ferroalloys and exported 1.099 million tons. From January to April 2014, China's ferroalloy imports reached 952000 tons, up 28.2% year on year; The export volume was 374000 tons, down 13.6% year on year. It can be predicted that China's net imports of ferroalloys will further increase in 2014.

In recent years, China has imposed an export tariff of up to 20% on the export of silicon and manganese, coupled with the continued downturn in the price of silicon and manganese, the high cost of domestic products and intensified international trade friction, China's silicon and manganese alloy exports have continued to decline in recent years, while imports have remained low. By 2013, the proportion of silicon manganese products in the import and export of ferroalloy varieties had dropped to only about 1%. In 2013, China exported 17170 tons of silicon and manganese, up 372.4% year on year; 13302 tons of silicon and manganese were imported, a year-on-year decrease of 56.67%. In 2014, the import and export of silicon and manganese in China further decreased. From January to April, the export was only 594.9 tons, and the import was only 516.75 tons, compared with 11491.15 tons and 7258.31 tons in the same period last year.

In contrast, the export of ferrosilicon accounts for a large proportion, but the export volume has also continued to decline in recent years. The import volume is small but shows a moderate growth trend. In 2013, China exported 319228.6 tons of ferrosilicon, a year-on-year decline of 29.73%, accounting for 29% of the year's exports; In 2013, China imported 27255.91 tons of ferrosilicon, a year-on-year increase of 12.5%, accounting for 1.4% of imports. In the first four months of 2014, the export volume of ferrosilicon in China fell to 101800 tons from 117300 tons in the same period last year; Imports increased moderately to 8624.75 tons from 8461 tons in the same period last year.

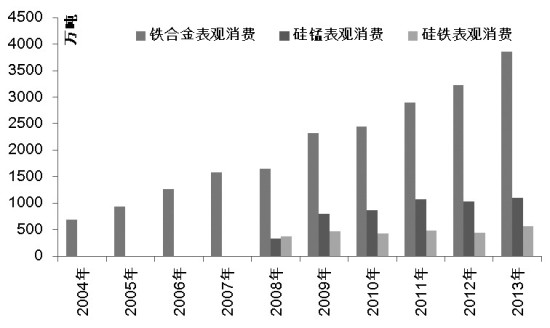

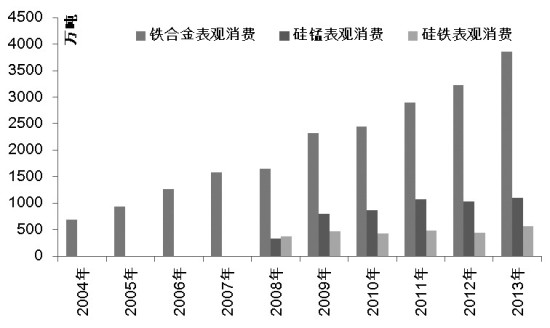

Consumption

In combination with the above mentioned production, import and export conditions, China's apparent consumption of ferroalloys has maintained a steady and rapid growth trend. In 2013, the apparent consumption of ferroalloy reached 38.59 million tons, up 19.7% year on year. However, ferrosilicon and silicomanganese can fully meet their own consumption demand due to the abundant domestic production, and some surplus is exported. In 2013, China's apparent consumption of silicon and manganese was 11.026 million tons, up 7.4% year on year, and that of ferrosilicon was 5.68 million tons, up 30.5% year on year.

However, apparent consumption is not equal to actual consumption. Since more than 90% of ferroalloys are directly used for steelmaking, and less than 10% are used for iron casting, non-ferrous metal smelting and other fields, we can actually roughly estimate the actual demand for ferroalloys based on some empirical data. According to the market situation in 2012, the demand intensity of ferroalloy is about 41 kg/ton of crude steel, of which about 4 kg of ferrosilicon is consumed per ton of steel, and about 14 kg of silicon manganese is consumed. In addition, ferrosilicon is also consumed in the production process of metallic magnesium, and about 1.2 tons of 75 # ferrosilicon is consumed per ton of magnesium. According to this data, in 2013, China's crude steel output was 779 million tons, and the consumption of ferroalloy was about 31.94 million tons. If 90% of the ferroalloy consumption in the steel industry is calculated, China's total consumption of ferroalloy is about 35.5 million tons, with an excess of about 3 million tons. It can also be estimated that the consumption of silicon manganese in 2013 was about 10.9 million tons, and the consumption of ferrosilicon was about 4.04 million tons. It can be seen that the supply of silicon manganese in China was slightly surplus, while the supply of silicon iron was much surplus.

There is another way to investigate the surplus situation in the ferroalloy market. According to the empirical data, the consumption intensity of alloy was about 20 kg/t crude steel in 2004, and increased to about 41 kg/t by 2012. Here we assume that the consumption intensity of alloy changes linearly, so we can get an actual consumption intensity line. According to the change ratio of alloy and crude steel output, we can also get an apparent consumption intensity increment line. It can be found that the apparent increment line is far more than the actual strength line, which means that the increase of alloy output exceeds the amount of alloy required for the increase of crude steel output, thus the pattern of alloy oversupply appears.

From the above analysis, we can learn that ferroalloy is essentially a self-sufficient variety. The degree of international trade is not high, and its supply and demand are mainly affected by the domestic environment. Therefore, ferroalloy futures listed in the future will be like other varieties steel products As for futures varieties, they will be relatively less affected by the international market, and the price is expected to be dominated by the domestic market.

Price operation characteristics

The price of domestic ferroalloys fluctuated violently, especially during the period from 2008 to 2009, the price of ferrosilicon and silicon manganese in some major domestic production areas fell by more than 50%. After 2009, the price fluctuation has slowed down relatively, but the gap between high and low prices can also reach two or three thousand yuan, and the price fluctuation direction of ferrosilicon and silicon manganese is relatively consistent, so the hedging demand of spot enterprises is relatively strong.

From the comparison of alloy price and rebar price fluctuation, we will find an interesting phenomenon. The rebar price and the alloy price have the same high point time, and even the alloy price will lead to the high point, but the rebar price will lead the alloy price to the low point, and the lead time is about one month. Although our data is limited and the observed time period is not very long, we believe that this price feature should also exist in a longer price history, and this feature is determined by the industrial pattern and the voice in the industrial chain. For a long time, among all links of the ferrous metal industry chain, steel mills are in a strong position, while ferroalloy enterprises should be in a relatively weak position, because their industry concentration is not high, as can be seen from the data. In 2013, the output of ferroalloy in China was 37.75 million tons, with 1550 enterprises, and the average output was only 243.55 million tons. There were very few enterprises with a single capacity of more than 200000 tons. Therefore, the industrial position determines that the alloy price will peak first in the process of price rise and bottom later in the process of price decline.

Since the fluctuation of alloy price is relatively consistent with that of steel price, and the operation of steel price has strong seasonal characteristics from the historical perspective, it can be predicted that the operation of ferroalloy price will also have certain seasonal characteristics. However, due to our limited historical price data, it is difficult to make a more clear judgment on the seasonal characteristics.

In addition, the price of ferroalloy should also be affected by the price of silicon, manganese ore and other raw materials, as well as macro policies, such as environmental protection, energy conservation and emission reduction.

In general, the domestic ferroalloy industry is still facing many problems, such as difficult to meet the mineral supply, vulnerable to external market extrusion, low concentration of enterprises in the industry, weak comprehensive competitiveness, serious overcapacity, slow growth of consumer demand and so on. Therefore, it is very necessary for spot enterprises to use futures tools to avoid risks and improve their competitiveness. (Author's unit: Nanhua Futures)