abstract

In the second half of the year, the number of production lines that are expected to be ignited and resumed production is within 10. In combination with the situation of some cold repair production lines that are about to expire, we expect that the overall net increase in supply and demand in the second half of the year will be small.

The effect of real estate regulation policy will become more and more obvious in the second half of the year, which will also make the growth rate of real estate investment continue to fall.

For the second half of the year Glass We maintain a neutral judgment on the price trend.

Chapter 1 Supply of Glass

1.1. Small space for new supply

In the first half of 2017, there were 9 production lines for cold repair of glass, reducing the annual production capacity by 30.18 million boxes; Three new production lines were put into operation, and the annual production capacity was increased by 13.2 million boxes; 5 cold repair and production recovery production lines, with an annual capacity of 16.2 million heavy boxes restored. The profit and loss balance, with a cumulative net reduction of 780000 boxes since this year.

Table 1.1.1: Cold repair production line in 2017

Source: China Glass Information Network

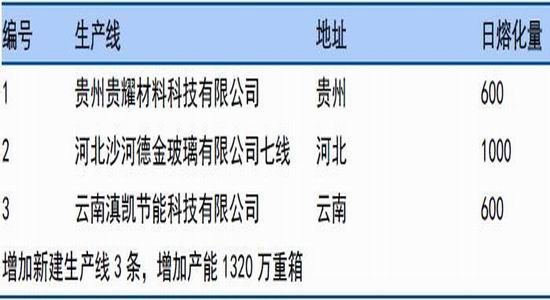

Table 1.1.2: New production lines in 2017

Source: China Glass Information Network

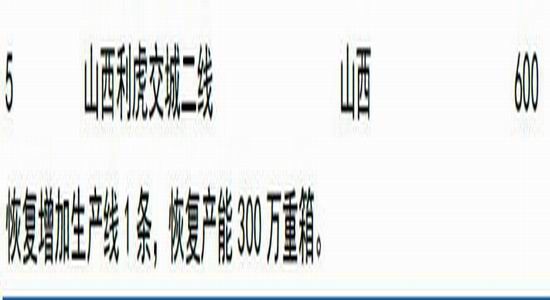

Table 1.1.3: 2017 Cold Repair and Resumption Production Line

Source: China Glass Information Network

Due to the increasingly strict supervision of environmental protection policies, coupled with the supply side reform of the glass industry (strict control over new capacity requirements, more stringent than the previous policies), this will play a restrictive role in cold repair and resumption of production or the commissioning of new production lines. From what we have learned, we can see that the number of production lines that are expected to ignite and resume production in the second half of the year is within 10. In combination with the situation of some cold repair production lines that are about to expire, we expect that the overall net increase in supply and demand in the second half of the year will be small.

Chapter 2 Demand for Glass

2.1. Real estate regulation is increasing

In the first half of the year, the regulation of the property market has been continuously strengthened. At present, the regulation of the property market has entered the "five limit era" of purchase, loan, price, sales and business restrictions.

With the central bank [Weibo] With the gradual tightening of liquidity and deleveraging of the financial market, the interest rate of housing mortgage loans is gradually rising. In first tier cities such as Beijing and Shanghai, the interest rate of the first housing mortgage loan has risen to 1.1 times of the benchmark interest rate, and the interest rate of the second housing mortgage loan has risen to 1.2 times of the benchmark interest rate. The overall rise in the housing mortgage loan interest rate in the first tier cities has also begun to spread in the second and third tier cities.

The rise of the housing mortgage loan interest rate, coupled with the "five restrictions" policy, will greatly reduce the willingness of housing investors to enter the real estate market. In this case, the housing market in many places gradually "subsides", and the real estate market is expected to return to stability.

Figure 2.1.1: Housing price data

Source: Wind Nanhua Research

2.2. Slowing growth of real estate investment

From January to May, the national investment in real estate development was 3759.5 billion yuan, up 8.8% year on year. The growth rate dropped 0.5 percentage points from January to April, and was 1.8 percentage points faster than the same period of last year, including a 10.0% increase in residential investment. From January to May, the sales area of commercial housing was 548.2 million square meters, up 14.3% year on year, 1.4 percentage points lower than that from January to April. From January to May, the sales area of commercial housing was 548.2 million square meters, up 14.3% year on year, 1.4 percentage points lower than that from January to April. Among them, the residential sales area increased by 11.9%. The sales volume of commercial housing was 4363.2 billion yuan, up 18.6%, and the growth rate dropped by 1.5 percentage points. Among them, residential sales increased by 15.3%.

Although the growth rate of real estate investment has slowed down, it still remains at a high level, which is also caused by various reasons and backgrounds. Due to the extremely hot sales of commercial housing nationwide last year, real estate enterprises have increased their investment. Many projects under construction are still in progress, and investment projects are cyclical. Once they are started, they need to continue for a while. The current growth of real estate investment can be said to be the continuation of this cyclical. In addition, in the context of classified regulation, first-line cities have also increased the supply of land and housing in order to curb the rapid rise of housing prices.

Although the trend of overheated investment in the first and second tier cities has been "held down", the market is multi-level and multi demand. From the current situation, the investment in the third and fourth tier cities is still hot. There are two main reasons for the current round of third and fourth tier cities: first, a wave of investment demand squeezed out to the surrounding third and fourth tier cities after the first and second tier regulation; Second, the de stocking policy in some places has actually played a role. However, in the case of economic stability, it is possible that the real estate regulation will continue to increase in the later period. With the further tightening of credit, the hot market in the third and fourth tier cities may slow down significantly in the second half of the year. On the whole, the effect of the real estate regulation policy will become more and more obvious in the second half of the year, which will also make the growth rate of real estate investment continue to fall back.

Figure 2.2.1: Real estate investment growth

Source: Wind Nanhua Research

Figure 2.2.2: Real estate sales data

Source: National Bureau of Statistics

Chapter 3 Cost of Glass

3.1. The price of soda ash gradually stabilized

After the Spring Festival this year, with the weakening of environmental protection factors in soda ash enterprises, the operating rate rose significantly, resulting in a sharp increase in the overall inventory level. After the Spring Festival, the price of soda ash declined at a faster rate and more than people had expected. Taking Shahe as an example, the price dropped from the highest 2350 yuan to the lowest 1500 yuan, which is basically close to the normal price that glass manufacturers can accept.

Since the second quarter, the price of soda ash has stopped falling and stabilized. On the one hand, the whole industry has been on the verge of profit and loss, and some soda enterprises have started to lose money. It is difficult to reproduce the situation that soda ash manufacturers increased shipments by sharply reducing prices in the early stage; On the other hand, the downstream demand side of heavy soda ash always has strong support. Previously, some soda ash manufacturers, due to their high inventory, have made operations such as production reduction and maintenance, and the demand side has recovered. A large amount of heavy soda ash goods accumulated in the early market has been gradually consumed. It can be seen that the operating rate of domestic soda ash plants is higher than that in the same period of previous years. Therefore, we judge that it is unlikely that the price of heavy soda ash will fall sharply again in the short term.

Figure 3.1.1 Price of soda ash Unit: yuan/ton

Source: Wind Nanhua Research

Figure 3.1.2: Output of soda ash Unit: 10000 tons

Source: Wind Nanhua Research

3.2. Fuel: It is difficult for coal price to rise or fall

In the first half of 2017, there was a rational return in the coal market price, but the price remained relatively high. From the coal supply side, we believe that with the relaxation of the 276 policy and the release of advanced production capacity, the coal output will continue to grow steadily in the second half of the year. On the demand side, with the recovery of the real economy, the demand for electricity in the whole society rebounded. In addition, the water inflow of major hydropower stations this year is slightly lower than that in the same period of previous years, and the hydropower generation capacity has declined, freeing up some space for thermal power generation. We expect that the national electricity demand will maintain a growth rate of 5% this year, and the thermal power generation capacity will continue to maintain a positive growth. In terms of policy, the coal industry has now entered the era of full link regulation, and the fluctuation range of coal price will also tend to ease. There is no basis for the sharp rise and fall of coal prices. First of all, the tone of national capacity reduction has not changed, which determines that the coal price will not plunge significantly. Secondly, if the coal price remains high, it will affect the power supply. Therefore, we believe that the coal price in the second half of 2017 will show a wide range of fluctuations.

Chapter 4 Glass Strategy

4.1. Long and short game, up and down dilemma

At present, the overall inventory in Shahe area is in a reasonable state, and the profitability is good. In the second half of the year, there is little room for the supply side to increase. However, in terms of demand, due to the increasingly stringent policies of the state on real estate, the impact on glass consumption demand will gradually emerge. On the whole, we maintain a neutral judgment on the price trend of glass in the second half of the year.

Nanhua Futures

Sina statement: The purpose of posting this article on Sina.com is to convey more information, which does not mean to agree with its views or confirm its description. The content of this article is for reference only and does not constitute investment advice. Investors operate accordingly at their own risk.