palm oil In the second half of the year, facing the pressure of rebuilding the treasury of the main producing countries, it is expected to perform worse than other oils, which may be related to Rapeseed oil and Soybean oil The trend is gradually differentiated. The expected performance of palm oil price in the third quarter is weak. The arrival of the production reduction cycle from November to December may provide support for the price for a long time, and it will rise in oscillation under the boost of other peak oil consumption seasons.

Part I

Market review in the first half of 2017

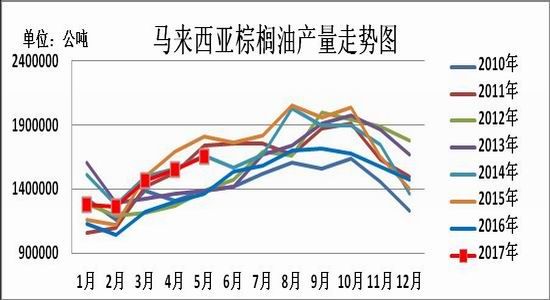

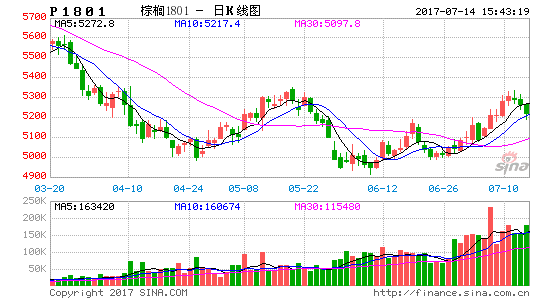

South America, due to the expected increase in palm oil production and weak export demand soybean The prospect of high yield is becoming clearer, domestic consumption demand is weak, and inventories are accumulating, which together suppress the decline of domestic and foreign palm oil pan from January to April. Malaysia's gross palm oil index fell from the highest point of RM3107/t to RM2449/t, a decline of 21.17%, and the domestic palm oil index fell from 6358/t to 5052/t, a decline of 20.5%. On May 26, Muslims entered Ramadan, and nearly a month before that, goods preparation activities were carried out. Malaysia's palm oil export demand was strong, boosting the price of palm oil, which rebounded to RM2646/ton at the highest level; The internal and external price difference is inverted, which suppresses the purchase enthusiasm of traders. The level of arrival at the port is low, the inventory has peaked and declined slightly, and the quotation is firm. The domestic palm oil futures price follows the fluctuation of the external market and rises by 9.5%. With the beginning of Ramadan and the end of goods stocking, the export demand has cooled down, and the futures price is lack of support, falling back again. The lowest futures price of Malaysia fell to RM2423/ton. The domestic palm oil index retested the previous low point of 5052 yuan/ton, and then the futures price fell into a narrow range of oscillation.

Figure 1: Daily K Line Chart of Malaysia Palm Oil Futures Index and Dalian Palm Oil Futures Index

Source: Wenhua Finance

Part II Analysis of influencing factors

(1) Global supply and demand pattern of vegetable oil

The second half of 2017 is the transition period from 2016/17 (September to October of the next year) to 2017/18. Therefore, to understand the macro environment of oil and fat, it is necessary to analyze the global supply and demand of vegetable oil in the two years. The USDA report shows that in 2016/17, the global output of vegetable oil was 186.17 million tons, the consumption was 183.9 million tons, and other losses were 3.91 million tons. The ending inventory decreased by 1.64 million tons to 18.54 million tons, and the inventory consumption reached the lowest 10.1% since 2010/11.

In 2017, palm oil production emerged from the shadow of El Nino. As the largest variety in the world, the recovery of its production directly promoted the prospect of vegetable oil production increase, and the supply and demand pattern was difficult to further tighten. USDA estimates a year-on-year increase of 4.51% to 194.45 million tons, a consumption increase of 2.95% to 189.33 million tons, and a carry over inventory of 1.99 million tons. The inventory consumption ratio is 10.5%, ending the trend of continuous decline in the previous three years.

(2) Supply and demand situation of main producing countries

The Malaysian Palm Oil Bureau reported that Malaysia's palm oil output in May was 1.65 million tons, up 6.5% month on month, and its export volume was 1.51 million tons, up 18% month on month. At the end of May, the palm oil inventory was 1.56 million tons, down 2.5% month on month, the second lowest level since 2009. After the completion of the goods stocking in Ramadan, Malaysia's export demand fell significantly in June. According to the data from the shipping survey agency SGS, Malaysia's palm oil export fell 16.7% to 710000 tons from June 1 to June 1, compared with the previous month, while the output is expected to continue the growth trend. According to the data released by the South Malaysia Palm Fruit Manufacturers Association (SPPOMA), in the first 25 days of June 2017, Malaysia's palm oil production increased by 1.5% compared with the same period in May, and it is expected that the stock of palm oil in June is more likely to recover. According to the previous production law, palm oil began to increase production after March, and reached the peak output from September to October, and then entered the production reduction cycle from November to December. Therefore, the key factor affecting the inventory change in Malaysia in the second half of the year shifted from demand to output.

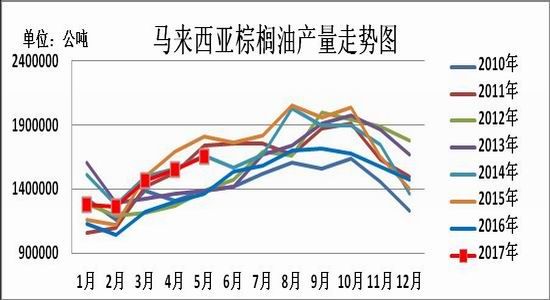

In terms of output, due to the delayed impact of El Nino in 2014-15, the palm oil output was cut in 2016. However, since February 2017, the unit yield of palm oil has rebounded. The productivity of Malaysian palm oleifera rose from 1.13 tons/ha in February to 1.46 tons/ha in May, significantly higher than 1.27 tons/ha in April last year, During this period, the output in March and April reached the third highest level in the same period of nine years, and the output in May was the fourth highest level in the same period of nine years. The month on month growth in this three months was close to the average growth in the same period of nine years. The above data reveal that the lag effect of El Nino climate phenomenon has subsided. Palm oil is still in the seasonal production increase cycle from June to October, and the output will further increase. The average growth rate of the past three to five months is close to that of the same period of nine years, so we can roughly estimate the output estimate of July October this year based on the average growth rate of July October in the past nine years. The average growth of Malaysian palm oil from July to October in the past nine years was 7.3%, 5.1%, 4.0% and 5.3% respectively. According to the above growth estimates, the output from July to October was 1.79 million tons, 1.88 million tons, 1.95 million tons and 2.06 million tons respectively. If the output is realized, the output in October will reach the highest level in the same period in history. It can be seen that compared with the low production at the beginning of the year, the production increase cycle from July to October will bring about a continuous increase in the supply side, and the pressure on inventory accumulation tends to increase. Until the production reduction cycle from November to December, the supply side once again provided the power to destock, preventing the further increase of inventory.

In terms of demand, generally speaking, summer is the peak season for the consumption of high melting point palm oil, and from the perspective of the FOB price difference between soybean oil and 24 degree palm oil, the price difference rebounded after hitting a low point in early April, and rebounded to $100.32/ton by the end of June, compared with $52.26/ton in the same period last year, which to some extent enhanced the substitutability of palm oil. However, after the end of the goods preparation activities in Ramadan, China, one of the major importing countries, is not very enthusiastic about buying ships in the near month, and the demand for palm oil exports has declined significantly. Moreover, the soybean harvest in South America has led to an increase in international oil supply, intensified market competition, and it is difficult for exports to maintain a good state. This situation is expected to continue until the arrival of the Double Festival in China from September to October. The festival stocking activities support the demand of the main producing countries. Then, with the end of stocking and the decline of temperature, the consumption end use of palm oil will also decline in general.

In general, the production increase cycle from July to October will bring about a continuous increase in the supply side, which tends to increase the pressure on inventory accumulation. After Ramadan, the end of Ramadan stocking from July to August and China's low enthusiasm for buying ships restrict the use of palm oil consumption terminals. The following September to October, major importing countries, China and India, have important festivals respectively, which may boost export demand, However, it is also the peak period of palm oil production at that time, and the inventory consumption pressure is high. With the arrival of the production reduction cycle from November to December, the supply side once again provided the impetus for de stocking to prevent further increase of inventory. In general, the second half of 2017 is the cycle of inventory reconstruction in major palm oil producing countries.

(3) Domestic grease supply

(1) Import and export

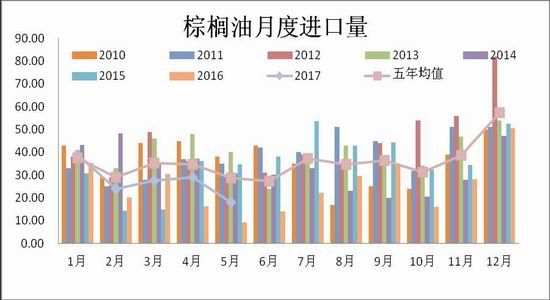

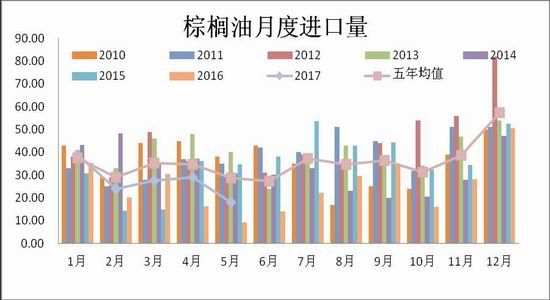

China is one of the main importing countries of vegetable oil. The range of imported varieties includes palm oil, soybean oil, rapeseed oil, peanut oil, olive oil, etc. The proportion of soybean oil and palm oil imports is usually more than 75%. Therefore, the import demand of soybean oil and palm oil is mainly analyzed. In the first half of this year, the profit of palm oil was poor, and the price difference between bean palm and vegetable palm was at a low level, which inhibited the enthusiasm of traders to purchase. The palm oil import volume in the first half of this year was in a downturn. From January to May 2017, the cumulative import of palm liquid oil was 1.3756 million tons, 24% higher than the 1.1138 million tons in the same period of last year, but lower than the average of 1.652 million tons in the same period of five years.

Looking into the future, Malaysian palm oil is still in the production increase cycle in the third quarter, while the consumer demand has cooled after Ramadan in June, and the inventory is expected to grow rapidly, putting pressure on the Malaysian palm market. Domestic palm oil inventory is slowly declining, and the basis price remains firm. The upside down of the difference between internal and external palm oil prices is expected to tend to narrow, and traders are more motivated to buy September shipping dates, At that time, the inventory may stop falling, but then it enters the peak oil consumption season, which restricts the speed of inventory recovery or maintains a stable state.

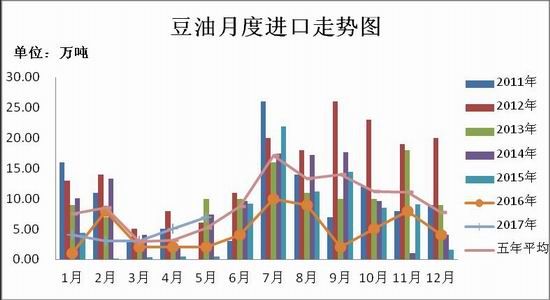

In terms of soybean oil import, China exported 46500 tons of soybean oil from January to May 2017, up 26.8% from 36700 tons in the same period last year. China's soybean oil is in a net import state. From January to May 2017, the cumulative import of soybean oil was 220000 tons, an increase of 90000 tons over the previous year, or 69%, but lower than the average of 272000 tons in the same period of five years. Generally speaking, after the centralized listing of South American soybeans, the export of oil dregs increased in the later period. Considering the shipping time, the arrival of China's soybean oil in Hong Kong increased from June to August. But this year, considering the high inventory of soybean oil and vegetable oil in the third quarter and the serious price difference between inside and outside, the import volume in the second half of the year may be lower than that of previous years.

(2) Other grease supply

In terms of soybean oil supply, due to the strict supervision on the flow of imported soybeans, some ports were unable to unload, and some shipping dates from May to June were delayed from June to July. The average monthly supply from June to August is expected to still exceed 8 million tons. According to Tianxia's granary data, 6.03 million tons are expected to arrive in Hong Kong in September. Before the new American soybean products are listed in Hong Kong, the import volume is expected to fall seasonally from September to October, and the import volume will further shrink in October. During this period, domestic soybean stocks are expected to be digested, and the soybean supply of oil plants may be tight. From November to December, American soybeans were listed in a centralized way, and China's soybean imports are expected to rise, and the supply of soybeans will be supplemented.

As of late June 2017, Soybean meal The unexecuted contract volume was 4.5245 million tons, higher than 4.31 million tons in the same period last year and 3.41 million tons in the previous year. From July to August, the soybean is expected to arrive at the port in large quantities, and the crushing volume is expected to peak in July, with a large supply of by-product oil meal. However, with the high supply in July, the number of oil plants expanding the oil depot is expected to increase again. In addition, the expected monthly decrease in the arrival volume from August to October, the crush volume is expected to follow the decline, especially in October, when the supply of raw materials may be tight, the speed of oil meal supply will slow down significantly. Until November December, American soybeans were shipped to the port, the raw material supply was supplemented, and the soybean crushing volume showed a growth trend again.

In terms of rapeseed oil, in 2016, China carried out two rounds of competitive auctions of rapeseed oil. The second round started on October 12, 2016 and ended on March 8, 2017. During this period, 21 auctions were conducted, with a planned reserve of 2.0793 million tons and an actual turnover of 2.0787 million tons, with a turnover rate of 99.97%. This round of auction made two-thirds of the temporarily stored vegetable oil flow into the social inventory. The output of temporarily stored vegetable oil in 2013 was about 360000 tons, and that in 2014 was 750000 tons. It is rumored that the remaining temporarily stored vegetable oil produced in 2013 will continue to be sold and stored in the second half of 2017, and the vegetable oil produced in 2014 will be transferred to the national reserve and will not be auctioned. If the rumor is true, it means that the potential inventory remaining in the market is less than 400000 tons. According to the data of the National Grain and Oil Information Center, as of the week of the last auction in 2017 (that is, the week of March 8, 2013), the cumulative stock out of temporary vegetable oil was about 1.35 million tons, and the actual terminal consumption was about 630000 tons. According to the requirement of stock out 60 days after the transaction of temporary vegetable oil, all temporary vegetable oil was delivered in the week of May 7, 2017. According to the previous average daily consumption, the estimated turnover from March 8 to May 7 is 248500 tons, so the channel inventory will be nearly 1.2 million tons in the week of May 7, and the social inventory will gradually reach the peak. The market will enter the time window of de stocking, and the negative marginal effect of supply will gradually reduce. In addition, the dish price of vegetable oil continued to decline, digesting the short-term and medium-term supply pressure, the 1709 contract of vegetable oil once approached the integer threshold of 6000 yuan/ton, which was far lower than the previous average transaction price of temporarily stored vegetable oil between 6271-7171 yuan/ton, and the cost support made the dish price of vegetable oil more resilient.

(4) Domestic demand for palm oil

According to the formula of month end inventory=month end inventory+output+import consumption export, the apparent consumption of soybean oil and palm oil is derived. According to the calculation results, the apparent consumption of soybean oil from January to May 2017 was 6.38 million tons, compared with 6.05 million tons in the same period last year, with a year-on-year growth of 5.6%. The average monthly consumption in the first five months was 1.28 million tons; From January to May 2017, the consumption of palm oil was 1.1 million tons, compared with 1.29 million tons in the same period of last year, a year-on-year decrease of 15%, with a monthly average of 219000 tons. In the first five months of 2017, the two consumed a total of 7.48 million tons, with a monthly average of 1.49 million tons, higher than the monthly average of 1.426 million tons in the same period of last year. Data shows that the end consumption level of this year is better than that of last year. In terms of varieties, soybean oil consumption is significantly better than palm oil. Palm oil consumption is just in demand, and soybean oil consumption is higher than that of the same period of last year.

The temperature in the third quarter was high, which was the season for the increase of palm oil substitutability. However, at the end of June, the spot price difference of bean palm was 220 yuan/ton, and the spot price difference of vegetable palm was 625 yuan/ton, which was lower than 685 yuan/ton and 763 yuan/ton respectively in the same period last year. The price difference of bean palm was far lower than the normal level of 700-800 yuan/ton, which restrained the demand for palm oil, and it was expected to remain just in demand in July August. At the end of the third quarter, the price of international palm oil fell due to the pressure on the production increase cycle, and the difference between other oil prices and palm oil prices widened, so the demand may recover. The fourth quarter is the peak oil consumption season, but the decline in temperature restricts the growth space of palm oil demand.

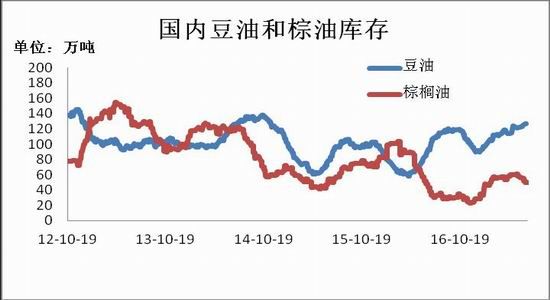

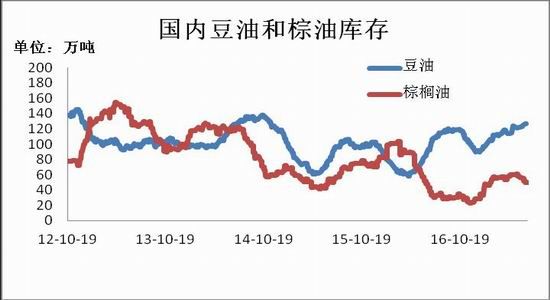

(5) Grease inventory

As of June 25, 2017, China's soybean oil inventory was 1.2928 million tons, palm oil inventory was 501000 tons, rapeseed oil inventory was 495400 tons, and the total inventory of the three varieties was 2.2892 million tons. The inventory of the three varieties in the same period last year was 929900 tons, 431000 tons, 259600 tons, and 1620500 tons in total. In terms of varieties, in the first half of the year, China's soybean arrival in Hong Kong was huge, and the consumption of soybean oil turned from boom to decline, driving the inventory to rise continuously; As consumer demand entered the slack season, palm oil accumulated inventory from January to the middle of May. From late May to June, the price difference between internal and external prices was seriously inverted. The recent purchase volume of shipping schedule was low, even insufficient to meet rigid demand, and the inventory fell slightly from a high level; From October 2016 to early March 2017, temporarily stored vegetable oil was sold at a high transaction rate and kept flowing into the market. The market was under supply pressure, while consumer demand was relatively light, and port inventory continued to increase.

The arbitrage of palm oil shipping date from June to August is still upside down, inhibiting traders' enthusiasm to buy ships. During this period, the inventory may continue to decline slowly. In September, the corresponding market profit of the shipping date is relatively improved, and the number of ships purchased increases. The inventory is expected to stop falling and stabilize. With the temperature dropping in the fourth quarter, the substitutability of palm oil weakens, and the inventory may rise slightly. Although the arrival of soybeans in Hong Kong is expected to decline in the third quarter, the soybean import in July August is still expected to be more than 8 million tons. Oil plants are actively starting up to honor contracts, but the peak demand season has not yet arrived. The soybean oil inventory may keep rising, but the speed will be slower than that in the second quarter. The import volume in October or the low point of soybean import in the second half of the year slowed down the supply speed of soybean oil. The oil in November ushered in the peak demand season, and the soybean oil inventory in the fourth quarter is expected to be digested. The temporary storage channel inventory and port inventory of rapeseed oil are under great pressure, and the rapeseed crushing profit is negative, which inhibits the demand for rapeseed imports. The rising speed of port inventory in the future market is expected to slow down, hoping that the arrival of the peak demand season in the fourth quarter will speed up the process of rapeseed oil de stocking. In the medium and long term, the supply pressure of oil and fat in China is large in 2017, and the future is in the stage of de stocking. It is hoped that the arrival of the peak demand season in the second half of the year will accelerate the consumption of inventory.

Summary and Prospect

The production increase cycle from July to October will bring about a continuous increase in the supply side, which tends to increase the pressure on inventory accumulation. After Ramadan, the end of the Ramadan stocking period from July to August, and China's low enthusiasm for buying ships, restrict the use of palm oil consumption terminals. From September to October, China and India, the major importing countries, have important festivals respectively, which may boost export demand, However, it is also the peak period of palm oil production at that time, and the inventory consumption pressure is high. With the arrival of the production reduction cycle from November to December, the supply side once again provided the impetus for de stocking to prevent further increase of inventory. In general, the second half of 2017 is the cycle of inventory reconstruction in major palm oil producing countries. In terms of domestic supply and demand, the arbitrage of palm oil shipment from June to August is still upside down, which curbs traders' enthusiasm to buy ships. During this period, inventory may continue to decline slowly. In September, the corresponding panel profit of shipment is relatively improved, and the number of ships purchased increases. Inventory is expected to stop falling and stabilize. In the fourth quarter, with the decline of gas temperature, palm oil substitutability is weakened, and inventory may rise slightly.

In general, palm oil is expected to perform less well than other oils in the second half of the year under the pressure of rebuilding the treasury of the main producing countries. It may gradually differentiate from rapeseed oil and soybean oil. The expected price of palm oil in the third quarter is weak. The arrival of the production reduction cycle from November to December may bring price support for a long time, and it will rise in oscillation driven by the growth of other oil consumption.

Part III Operation Strategy

1. Intraday and short-term operation

Compared with beans, palm oil not only has a strong market continuity during the day, but also has a considerable intraday fluctuation. On an intra day basis, transactions can be conducted according to the technical graphic analysis, and the K line chart can be adjusted to a shorter time span of 5 minutes or 10 minutes. In combination with MACD and other technical indicators, when the forward price is based on the system average, it can be much shorter. The stop loss is set as 0.3% lower than the position building price. When the current price deviates significantly from the system average, it can take profits in a timely manner. When the current price runs below the system average, it can be short. The stop loss is set as 0.3% higher than the position building price. Similarly, when the price deviates significantly from the average system, it leaves the market. When conducting intraday trading, I suggest to focus on short-term trend direction operation, and obtain more profits by high-frequency operation. For short-term palm oil trend, it is mainly homeopathic operation.

It is suggested that P1709 should be short at 5350 yuan/ton, with a stop loss of 5400 yuan/ton. For subsequent short-term operations, please follow the daily trading tips of Ruida Futures Research Institute.

2. Medium and long line operation

In terms of band operation, Malaysian palm oil increased seasonally from July to September, and export demand was lack of boosting factors, so the inventory may reach a turning point and tend to rise. Therefore, although the oil tends to oscillate at a low level, the price of palm oil is weaker than that of other oils. It is suggested to sell short P1709 in batches when the price rebounds to 5380, 5450 and 5530 yuan/ton, Stop loss 5600 yuan/ton, target 4950 yuan/ton.

(P1709 Trend chart of K-line on contract date, source: Wenhua Finance)

From the perspective of long-term operation, we can intervene in the long run in batches after the initial price decline in the fourth quarter has stabilized, waiting for the arrival of the seasonal upward trend in the peak oil consumption season. The support belt below the palm oil index is 4500-4700 yuan/ton.

3. Arbitrage operation

intercommodity spread

In May, the transaction of temporary storage of vegetable oil entered the market, and the inventory pressure reached the peak. The stock before Muslim Ramadan boosted the international demand for palm oil. However, in the long run, with the market consumption, the vegetable oil inventory is expected to fall from the high level, while after the Ramadan Festival, the export demand of palm oil slowed down, and the quantity of main production countries grew seasonally. It can be seen that the fundamentals of vegetable oil and palm oil will gradually change in the future, The price difference between the two is expected to expand. It is suggested to buy OI1801 and sell P1801 arbitrage portfolio within the price difference range of 1340-1420 yuan/ton. The position ratio is 1:1, the stop loss price difference is 1240 yuan/ton, the first target price difference is 1800 yuan/ton, and the second target price difference is 2000 yuan/ton.

Ruida Futures

Sina statement: The purpose of posting this article on Sina.com is to convey more information, which does not mean to agree with its views or confirm its description. The content of this article is for reference only and does not constitute investment advice. Investors operate accordingly at their own risk.