The Federal Reserve releases "hawks" again.

On Wednesday, May 22 local time, the three major stock indexes of the US stock market closed lower. By the end of the day, the Dow had fallen 0.51%, the Nasdaq had fallen 0.18%, and the S&P 500 had fallen 0.27%.

According to the minutes of the Federal Reserve meeting, "many" officials are uncertain about the restrictive degree of monetary policy; "Multi party" participants are willing to further tighten policies when necessary.

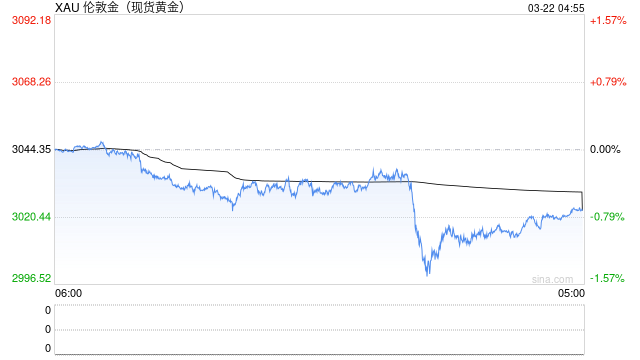

Gold silver Wind data shows that as of the end of the day, COMEX gold fell 1.80% to 2382.3 dollars/ounce, while London gold now fell 1.78% to 2378.506 dollars/ounce. COMEX silver fell 3.39% to US $30.990/ounce, while London silver now stood at US $30.775/ounce, down 3.71%.

The minutes of the Federal Reserve meeting are "eagle"

On Wednesday, May 22 local time, the three major stock indexes of the US stock market closed lower. By the end of the day, the Dow had dropped 201.95 points, or 0.51%, to 39671.04; The Nasdaq Composite Index fell 31.08 points, or 0.18%, to 16801.54; The S&P 500 index fell 14.40 points, or 0.27%, to 5307.01. The yield of two-year US government bonds climbed four basis points to 4.87%. The minutes of the Federal Reserve meeting released on the same day showed that officials were still not eager to cut interest rates.

The minutes of the FOMC meeting from April 30 to May 1 released on Wednesday showed that "many" officials were uncertain about the restrictive degree of monetary policy; "Multi party" participants are willing to further tighten policies when necessary; Many decision makers at the meeting mentioned that they are willing to take action if the risks faced by the economic outlook become reality and further tightening policies become appropriate; The decision makers at the meeting said that the future policy path will depend on the data to be released, the changing prospects and the risk balance; Several decision makers at the meeting said that it would be useful to start discussing the appropriate long-term composition of the Federal Reserve's portfolio.

On May 1, the Federal Reserve said that it would reduce the ceiling of the national debt that is allowed to expire but not reinvest every month from $60 billion to $25 billion from June. The ceiling on mortgage-backed securities remained at $35 billion. The market had expected that the monthly limit of government bonds would be reduced to $30 billion.

Several officials, including Jerome Powell, chairman of the Federal Reserve, said that slowing down the pace of balance sheet reduction would help reduce the possibility of pressure in the money market. At present, the short-term financing market remains stable, which provides flexibility for officials on the path of quantitative tightening. However, market participants have been speculating how much more officials can reduce the US $7.3 trillion portfolio of the Federal Reserve.

David Solomon, CEO of Goldman Sachs, said that he currently expected the Federal Reserve not to cut interest rates this year because government spending proved that the economy was more resilient.

Amazon announced that Europe's largest investment Meta set up an AI advisory committee

In terms of sectors, three of the 11 major sectors of the S&P 500 index rose and eight fell. Among them, medical and health stocks led the gains, while energy stocks led the losses.

Popular technology stocks mostly fell. Texas Instruments, TSMC, Cisco and Qualcomm rose by more than 1%, Meta and Microsoft rose slightly, Amazon, Eli Lilly, Asma, Invida, Broadcom, Apple, Google A and Micron Technology fell slightly, Intel and Netflix fell by more than 1%, Ultramicro fell by more than 2%, and Tesla fell by more than 3%.

Amazon fell 0.01%. Amazon Web Services (AWS) said in a statement on Wednesday that it would invest $17 billion in Spain to expand its cloud business in Europe, the largest investment Amazon has announced in Europe so far. This plan will last until 2033, which is an expansion and upgrade of Amazon's commitment to invest 2.5 billion euros in Spain in 2021.

Amazon has vigorously expanded its cloud computing service AWS worldwide. This year, it has announced similar long-term projects in Germany, Mexico, the United States, Saudi Arabia and Singapore. As the world's largest provider of cloud computing services and data storage, AWS is facing increasing competitive pressure from Microsoft and other competitors.

In addition, Amazon also announced that it would invest 7.8 billion euros in the German data center by 2040. The office of French President Makron also said that Amazon earlier this month promised to invest 1.2 billion euros in infrastructure and computing.

The Meta rose 0.68%. Mark Zuckerberg, CEO of Meta, has set up a new product advisory committee to guide the company in AI and technological progress. The team, called Meta Advisory Group, consists of four members: Patrick Collison, CEO and co-founder of Stripe, Nate Friedman, former GitHub CEO, Toby Lutek, CEO of Shopify, and Charlie Sanhurst, investor and former Microsoft executive. According to the company spokesman, these members will not be paid.

Zuckerberg said in his internal memo to employees that he highly respected the achievements of this group of people and thanked them for their willingness to share their views during the critical period of Meta. Unlike Meta's Board of Directors, the members of this advisory group are not elected by shareholders, nor are they entrusted to the company.

It is understood that the task of this advisory group is to provide insights and suggestions on technological progress, innovation and strategic growth opportunities. This group is established because Meta hopes to regain momentum in AI products, including hardware devices such as Quest virtual reality helmet and Ray Ban smart glasses, and software products such as Meta's AI assistant.

Nvidia closed 0.54% lower, but was up more than 7% after the session. After Wednesday's trading, Nvidia announced a better than expected performance. Nvidia's first quarter financial report showed that the company's revenue in the first quarter was 26 billion dollars; Net profit was 14.88 billion US dollars, up 628% year on year; It is estimated that the revenue of the second fiscal quarter will be about 2% of 28 billion US dollars; The adjusted gross profit rate in the first fiscal quarter was 78.9%; Both exceeded analysts' expectations. Nvidia announced that it would increase its quarterly cash dividend from 4 cents per share to 10 cents per share; At the same time, it will also split shares one by one, and take effect on June 7, 2024. Huang Renxun, the founder and CEO of Nvidia, said that the company "will usher in the next round of growth".

Ryan Detrick of Carson Group said: "Even in the face of huge expectations, Nvidia has come forward again and delivered results. Data center revenue is strong, and future revenue is impressive." Solita Marcelli of UBS Global Wealth Management said: "We are optimistic about the trend of AI and maintain our preference for large technology companies in view of its favorable market position. We expect that the profits of the global technology industry will increase by 20% and 16% respectively this year and next year, among which we see investment opportunities in the semiconductor industry."

Citigroup's "own dragon finger" fined more than 500 million Goldman Sachs warned of the debt crisis

Large bank stocks generally ended lower. Goldman Sachs, Citigroup and UBS fell more than 1%, Wells Fargo, Morgan Stanley, BlackRock and JPMorgan Chase fell slightly, and Bank of America rose slightly.

Citigroup fell 1.42%. On Wednesday local time, Citigroup was fined a total of 61.6 million pounds (about 568 million yuan) by British regulators due to the temporary collapse of the European stock market in 2022 due to the misoperation of a London employee. The Financial Conduct Authority (FCA) found that Citi's transaction monitoring system was poorly designed, real-time monitoring was "invalid" and failed to prevent the execution of this wrong transaction. The trader intended to sell a stock basket worth $58 million, but input errors led to the creation of a stock basket worth $444 billion.

Although Citi's control system prevented the execution of some transactions, about $1.4 billion of shares were still sold on major European exchanges until traders cancelled their orders. This mistake triggered a five minute sell-off in the OMX 30 index in Stockholm, Sweden, and caused chaos in several stock exchanges from Paris to Warsaw, once leading to a market value loss of up to 300 billion euros.

The Prudential Regulation Authority (PRA) and FCA of the United Kingdom fined Citigroup £ 33.88 million and £ 27.77 million respectively. Citi said that it had resolved the matter. This incident occurred more than two years ago and was an individual error. It was identified and corrected within a few minutes.

Goldman Sachs fell 1.71%. Goldman Sachs updated its forecast in the latest long-term US fiscal outlook, pointing out that the ratio of debt to GDP, the US debt sustainability indicator, will climb to an historical extreme level. Economists Manuel Abecassis and David Merrick said in their reports to customers that, in particular, the expected high interest rate in the future has significantly worsened the trend of debt to GDP ratio and the proportion of actual interest expenditure in GDP.

Janet Yellen, the US Treasury Secretary, has mentioned many times that the net inflation adjusted interest payment in terms of GDP is her main indicator for measuring debt sustainability. Goldman Sachs' latest forecast shows that this ratio will rise steadily to 2.3% in 2034, compared with 1.5% predicted five years ago. In a paper in 2020, Harvard University economist Furman and former Treasury Secretary Summers argued that policymakers should strive to control the ratio of actual net interest expenditure to GDP below 2%.

The Goldman Sachs team also predicted that by 2034, the ratio of US debt to GDP will rise from the current 98% to 130%. The current primary fiscal deficit, excluding interest costs, is more than 5% of the US GDP, far higher than the typical level in the period of full employment. The report points out that the current fiscal trajectory may eventually push the debt to GDP ratio to the level required for a few sustainable fiscal surpluses. Although the United States has the conditions for fiscal consolidation, the political motivation for deficit reduction is small.

Energy stocks closed lower across the board. ExxonMobil fell by more than 2%, ConocoPhillips, American Energy, Murphy Oil, Chevron, BP, Shell, Western Petroleum fell by more than 1%, and Petrobras fell slightly.

Most popular Chinese stocks ended lower. The Nasdaq China Golden Dragon Index fell 1.16%. Alibaba fell by more than 4%, Baidu and Weibo by more than 2%, Jingdong and Tencent Music by more than 1%, Idealcar, Netease, Xiaopeng Auto, Futu Holding, Weilai and Manbang fell slightly, iQiyi, Bilibili rose slightly, and Pinduoduo rose by more than 1%.

Safe, fast and guaranteed futures account opening on Sina cooperation platform

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: Xu Ailun