Stock speculation depends Jin Qilin analyst research report , authoritative, professional, timely and comprehensive, to help you tap potential theme opportunities!

Interface reporter | Feng Yuchen

Short term transactions of listed companies are common, and the number of cases has increased significantly in the past two months. The relatives of directors, supervisors and senior executives have frequently made "unintentional mistakes", and spouses, children and parents have "come". Why? How to contain?

According to the announcement statistics, up to 29 companies issued an apology announcement for short-term transactions in April this year, and there were 18 companies from May to May 22. Compared with the whole January, February and March, the number was 3, 8 and 17 respectively. According to various announcements, the subjects of short-term transactions are almost all relatives of senior executives or major shareholders, and the investment behavior is determined by relatives independently, without involving insider trading and other situations.

It was found that most of the penalties for such short-term transactions ended with a warning letter, and a small number of company executives received formal administrative punishment decisions and were fined.

Lawyers in the capital market told the interface reporter that in addition to facing administrative punishment, short-term trading will also turn in relevant profits, and short-term trading itself is unprofitable for executives and people acting in concert. The degree of punishment will consider the subjective malignancy of the parties, such as personal error or subjective intent, as well as the volume of transactions, the specific time point of transactions, including the degree of cooperation in the investigation.

On the issue of how to curb the short-term transactions of relatives, it is worth paying attention to the use of big data technology to limit transactions at the source, as well as to strengthen the design of digital supervision system, strengthen the management of insider information, and identify insider trading behaviors.

They are all called relatives' independent decision-making and investment behavior

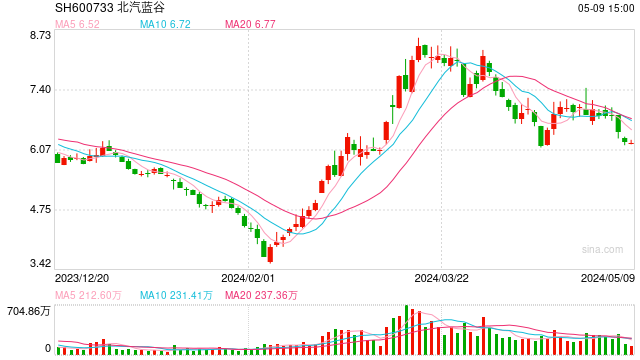

The spouses of Dong Jiangao become a group prone to "mistakes" in short-term trading. Announced short-term trading in recent two months BAIC Bluevale (600733.SH)、 Emerging equipment (003933.SZ)、 Time Publishing (600551.SH)、 Dawn of Zhongke (603019.SH)、 Giuseppe (002687.SZ)、 Plum Garden (605337.SH)、 Guodun Quantum (688027. SH) and other more than 30 companies were all the spouses of senior executives who "caught fire in the backyard".

In addition to spouses, there are many executives whose children and parents have short-term transactions, such as Microconductive Nanometer (688147. SH) General Manager's mother Sichuan Gold (001337. SZ) Director's son Chinese media (600373. SH) Daughter of the sole director, even Knopfein (002215. SZ) Secretary Dong's parents were "confused" together.

Uniformly, these listed companies involved in short-term transactions "proved their innocence" in the apology announcement, saying that it was the investment behavior of the senior executives' relatives, which had nothing to do with the senior executives themselves and the listed companies.

For example, BAIC Bluevale announced on May 22 that Li Zhichun, the spouse of Jiao Feng, the supervisor, constituted a short-term transaction. Jiao Feng did not know about the transaction in advance, and Li Zhichun did not consult with Jiao Feng and discuss the purchase and sale of shares. The above purchase and sale of company shares did not involve subjective and intentional violations, nor did they trade company shares and seek benefits because they learned insider information.

Although the wife of Chairman Shuguang, who is over 70 years old, threw hundreds of millions of yuan to speculate in the stock market, it is difficult to dispel the market doubt, but it also emphasizes the personal investment judgment of the chairman's wife.

On April 11, Zhongke Dawn announced that Zhang Tihua, the spouse of Li Guojie, the chairman of the company, had short-term transactions for one year, with a total transaction amount of 154 million yuan and a total profit of 589800 yuan. He said that Zhang Tihua failed to correctly understand the relevant laws and regulations on short-term trading, and there was no subjective and intentional violation. During the trading period, Li Guojie neither consulted Li Guojie nor informed him of the above trading behavior, which was an investment behavior independently made by an individual based on the information disclosed in the securities market and personal judgment, and Li Guojie did not know the trading situation of his securities account.

Yan Yiming, a lawyer from Shanghai Yan Yiming Law Firm, told InterfaceNews that the prohibition of short-term trading by senior executives is mainly to prevent senior executives from taking advantage of their special position and information advantages in listed companies to obtain illegal interests through frequent trading of the company's shares. "It is necessary to make a comprehensive judgment on whether their family members buy and sell stocks on their own from multiple aspects, such as the time relationship between the purchase and sale of stocks by relatives and the company's major information or major business activities, the relationship between the time of contact between senior executives and relatives and the time of purchase and sale of stocks by relatives, as well as the relationship between them."

A person from the Board Secretary's Office of a listed company mentioned in the exchange that in fact, the trading quality and risk awareness of senior executives' relatives are uneven, and there is no clear rule. On the other hand, the company is not very clear about their real-time trading behavior.

Most of the punishments are for executives to receive warning letters

According to lawyer Yan Yiming, the penalties for simple short-term transactions are generally confiscation of illegal income and a fine of 30000 yuan to 100000 yuan.

After sorting out the punishment announcements on short-term trading this year, the interface journalists found that most of the punishment results were the warning letters received by directors, supervisors and senior executives of listed companies, such as those recently announced Reliable smart power (300617.SZ)、 Lanwei Medicine (301060. SZ), Guodun Quantum, Gold Cupboard (603180. SH) Guangli Microenterprise (301095.SZ)、 Huace Film and Television (300133. SZ), etc. After the relatives "broke the rules", the senior executives themselves were subsequently warned by the CSRC.

A small number of directors, supervisors and senior executives of the company received the decision of administrative penalty and were given warnings and fines. For example, Li Guojie, Chairman of China Science Shuguang, received a decision on administrative punishment for his wife's short-term transactions, and Tianjin Regulatory Bureau decided to give Li Guojie a warning and impose a fine of 800000 yuan; LEO Shares (002131. SZ) Wang Xiangrong, Chairman of the Board, and Wang Zhuangli, Vice Chairman of the Board, received a written decision on administrative punishment for their mother's short-term transactions. Both were warned and fined 200000 yuan in total.

also Star technology (002132. SZ) Chairman Xie Xiaobo and General Manager Xie Xiaolong received the advance notice of administrative punishment for their parents' short-term transactions, and they were fined 800000 yuan in addition to being warned.

For different levels of administrative punishment, Wang Zhibin, a lawyer from Shanghai Minglun Law Firm, told InterfaceNews that the punishment will consider the subjective malignancy of the parties, such as whether it is personal error or subjective intent, as well as the transaction volume, the specific time point of the transaction, including the degree of cooperation in the investigation, etc, According to these factors, it is decided whether to impose a relatively light administrative penalty such as a warning letter or a more formal and heavier administrative penalty such as an administrative penalty letter.

The transaction amount involved in the above-mentioned fined Zhongke Shuguang, Leo Shares and Star Technology is relatively large. The short-term transaction turnover of Chairman's wife of Zhongke Shuguang is more than 100 million yuan, the parents of Star Technology executives are 85 million yuan in total, and the transaction volume of Chairman's mother of Leo Shares is more than one million yuan.

On the whole, the supervisor handled short-term transactions more quickly. For example, within a week of short-term transactions, the spouse of a director of Huace Film and Television received a warning letter; On the day when Lanwei Medical and Anzuo Smart released the apology announcement for short-term transactions, relevant directors, supervisors and senior executives were issued with warning letters.

However, the punishment decision cycle is also long. Medici (688202. SH) In July 2022, it was announced that Chen Minwu, the spouse of Cai Jinna, the director and deputy general manager, would carry out short-term transactions in January 2022, two years later. On May 14 this year, Cai Jinna was issued a warning letter by the Shanghai Securities Regulatory Bureau. Leo Shares announced in June 2023 that the mother of the chairman and vice chairman constituted a short-term transaction and apologized. Until May this year, the chairman and vice chairman were warned and fined after receiving the decision on administrative punishment.

Some earned nearly 600000 yuan and lost more than 30000 yuan

It is not difficult to find that Dong Jiangao and his relatives who are facing the risk of short-term trading are also "leeks", and some are chasing after the top of the mountain.

Since April and May, a total of 47 listed companies announced that directors, supervisors and senior executives or their relatives had short-term trading behavior. Among them, 18 directors, supervisors and senior executives and their relatives lost or did not generate gains in trading, and 29 had gains.

The biggest loser is Zhongchen Technology (603275. SH) The father of the sole director and the vice president of Lan Wei Medicine.

Jiang Kegui, the father of Jiang Haijun, the independent director of Zhongchen Technology, bought and sold 8900 shares of the company through centralized bidding from September 4, 2023 to April 16, 2024, with a total transaction amount of 364800 yuan and a total loss of 31200 yuan.

Mao Zhisen, vice president of Lanwei Medical, bought 16300 shares of the company on March 21 and sold 9000 shares of the company on March 26, losing 23600 yuan in five days. It is worth mentioning that on the trading day before Mao Zhisen bought the stock, the stock price of Lanwei Medical rose by 4.05% again on the buying day. Mao Zhisen was buying at a high level. In the following three trading days, Lanwei Medical fell by more than 15% in three consecutive trading days.

Most of the 29 "players" with profits ranged from thousands to tens of thousands of yuan, Hongyuan Pharmaceutical (301246. SZ) Director's spouse and Crystal photoelectric (002273. SZ) The chairman's spouse was the most "humble", earning 12 yuan and 17 yuan respectively, Daye Shares (300879. SZ) Deputy General Spouse Dengyun Shares (002715. SZ) The spouse of the chairman of the board of supervisors earned 123 yuan and 160 yuan in short-term transactions.

Zhongke Dawning, Xinxing Equipment (002933. SZ) Huiyu Pharmaceutical (688553.SH)、 Zoelli Pharmaceutical (300181.SZ)、 South Asia New Material (688519.SH)、 Sanhui Electric (002857. SZ), Chinese Media Hongbo Medicine (301230. SZ) and other companies' directors, supervisors and senior relatives all earned more than 100000 yuan, and the wife of Chairman Shuguang, who has the largest principal, also earned the best, up to 589800 yuan.

However, the profits under strong supervision will be temporary, and the profits obtained by the above parties will be handed over.

Lawyer Wang Zhibin said to the interface reporter that in addition to facing administrative punishment, short-term trading will also turn in relevant profits, which is unprofitable for executives and people acting in concert.

For suggestions on how to curb such short-term transactions, "the relevant system of short-term transactions is actually very perfect. If you want to further avoid such acts, you can limit them through big data, for example, from the source, you can limit the trading rights within a specific period of time. However, this has high technical requirements, and you need to repeatedly calculate the 6-month time point from the last transaction." Lawyer Wang Zhibin further said.

Some market professionals have also suggested that the short-term trading behavior of relatives should be curbed by strengthening the design of digital supervision system, strengthening the management of insider information, and identifying insider trading behavior.

When the stock market recovers, open an account first! Intelligent fixed investment, condition sheet, individual stock radar... for you>>

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: Yang Hongyan