Special topic: dividend market is expected to last for a long time, but we need to be alert to short-term correction

Stock speculation depends Jin Qilin analyst research report , authoritative, professional, timely and comprehensive, to help you tap potential theme opportunities!

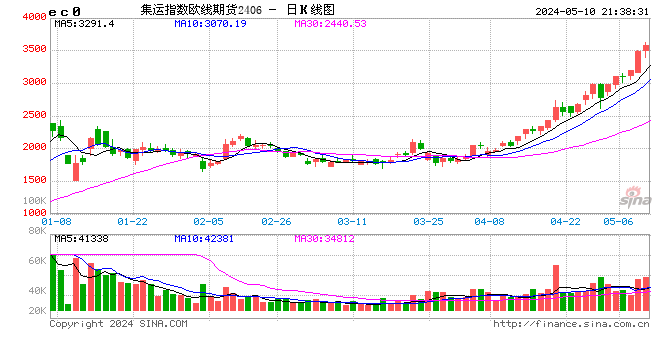

Recently, sea freight prices have jumped continuously, and some futures related to tracking freight prices have even doubled by five times in half a year, causing widespread concern.

The background of the recent sharp rise in freight rates is that many trunk lines in the maritime industry have been fully loaded. For the reason of the rise in freight rates, industry insiders and institutions generally believe that it is affected by a variety of factors, one of which is the rise in the cost of some routes.

In the context of the strong rebound of freight rates from the bottom, the performance of shipping industry chain companies has rebounded significantly since this year. As for the subsequent trend of freight rates, some insiders believe that there are still many uncertainties and it is impossible to make accurate qualitative predictions.

Sea freight prices continue to rise

Recently, Wanhai Airlines, an international shipping company, issued a W22 freight adjustment notice, saying that recently, due to the rising operating costs of the company, the freight rate will be increased for the cargo exported from China to Asia (offshore leg). This notice of freight adjustment was signed on May 13. Not long ago, Wanhai Airlines just released the W21 freight adjustment notice, which was signed on May 8. In April of this year, Wanhai Shipping has issued two freight adjustment notices, both of which are freight increases.

The continuous increase of freight rate of Wanhai Shipping is just a microcosm of the overall continuous rise of the industry's shipping price recently.

The continuous rise of sea freight prices is also reflected in the futures that track freight prices, and the recent rise of related futures is particularly fierce.

According to market data, Shanghai International Energy Trading Center Consolidation index The main futures contract (European line) once exceeded 4300 points in the middle of the day on May 16. In contrast, the quotation of the main futures contract was less than 800 points in the middle of November last year, which means that the quotation of the container transport index (European line) futures has increased about five times in half a year.

However, it is worth noting that after the acceleration of the rise, the price fluctuation of the above container futures also increased significantly. On May 14 and May 15, the daily amplitude of multiple term contracts reached about 10%.

On the previous May 13, Shanghai International Energy Exchange Center issued a notice on doing a good job in market risk control to give risk warnings. The notice said that the price of the container transport index (European line) futures has fluctuated greatly in the near future. All relevant units are requested to do a good job in risk prevention, make rational investment and jointly maintain the smooth operation of the market.

Relevant trunk lines are in full load condition

The background of the recent rise in sea freight prices is that the current supply and demand relationship of sea freight is favorable to suppliers.

negotiable securities Times reporter called as an investor on May 14 COSCO Marine Control On the other hand, the person in charge who answered the phone said that the company's production and operation are normal at present, and the export trunk lines in Europe and the United States are in full load recently.

Some details of life related to shipping also seem to support the recent prosperity of the shipping industry. For example, an employee of a leading shipping enterprise familiar to the reporter has been busy recently, and the overtime work has increased significantly, and the overtime work is late. In addition, some residents in Shenzhen close to the port told reporters that the number of container trucks running on the road near their residences has increased significantly for a period of time, and the noise of container trucks has also increased. However, according to their observation, the above situation is still some distance from the boom period of the maritime industry during the epidemic.

As for the reasons for the recent increase in the freight collection price, COSCO Marine Control The above person in charge believes that it is caused by multiple factors, and the rising cost is one of the reasons.

The spillover effect of the Red Sea crisis is also affecting freight rates. Dongguan negotiable securities According to the recent research report, the Red Sea crisis has led to more ships having to avoid the Red Sea route and bypass the Cape of Good Hope in Africa, resulting in a global congestion of container transport, which has led to a record delivery of new transport capacity and a tightening of supply and demand in the container transport industry.

Marine Industry Chain Company

The performance has rebounded significantly during the year

In the past 2023, affected by the decline of industry prosperity from a high level, the performance of shipping industry chain companies has generally declined.

However, by the first quarter of 2024, the performance of shipping industry chain companies has picked up significantly, which can be clearly seen from the financial report data of related companies.

For example, Maersk, an international shipping giant, said in its recently released financial report for the first quarter of 2024 that the company's performance was in line with expectations due to the good performance of the terminal business, the dual impact of increased demand and the ongoing Red Sea crisis. Compared with the fourth quarter of 2023, the revenue recovered strongly.

Vincent Clerc, CEO of Maersk, said: "This year started well, and the performance of the first quarter was as expected. The demand trend tended to the upper limit of market growth in the previous financial expectations, and the problems in the Red Sea region still existed, so the performance of the first quarter recovered compared with the previous quarter. We expect that these market conditions will continue to exist for most of this year, so the prospects for the next few quarters will also be clearer. However, due to the large number of new ships delivered this year and next, we expect that this will offset the positive impact of the above factors and put the marine market under pressure again. Therefore, we will continue to carry out cost control to reduce the additional costs caused by the blocked maritime transport business and improve the profits of logistics and service business. Based on the company's strong value proposition, cost control is essential to support customers to cope with continuous market fluctuations and build more resilient businesses. "

Among A-share listed shipping companies, COSCO Marine Control The first quarter of 2024 saw a year-on-year growth of 1.94% in revenue, COSCO Marine Control Revenue dropped 55.14% year on year.

Among A-share shipping industry chain companies, Milkway The recently disclosed first quarter report also shows that in the first quarter of 2024, the company's revenue increased by 23.26% year on year, and the net profit attributable to the parent company increased by 40.62% year on year. In 2023, Milkway The revenue decreased by 15.75% year on year, and the net profit attributable to the parent company decreased by 28.72% year on year; Mecca core color Recently, the reply on the Shanghai Stock Exchange e-interaction platform said that the European freight collection index rose significantly, which has a positive effect on the company's container coating business.

However, most companies in the industry and relevant people believe that there is a lot of uncertainty about the subsequent changes in ocean freight prices.

Maersk said that it is expected that the situation in the Red Sea/Gulf of Aden will last until the second half of this year. Overcapacity is still a challenge and will eventually come, but the impact will be delayed.

COSCO Marine Control The above person in charge believes that there are many uncertain factors in the future freight rate, and it is impossible to make accurate qualitative prediction.

(Source: Securities Times)

Safe, fast and guaranteed futures account opening on Sina cooperation platform

Massive information, accurate interpretation, all in Sina Finance APP