Huitong Finance APP—— The rebound of metal prices has recently occupied the headlines of major media, but with the development of gold silver As copper hit a new high, traders may need to weigh the potential for further price increases and reassess the impact of these trends on the global economy.

Taylor Krystkowiak, vice president and investment strategist of Theme setf, said that the rise of precious metals and industrial metals was supported by the overall development of the global macroeconomic environment and the increase of special demand for individual metals. Investors flocked to precious metals as inflation remained relatively stubborn and the prospect of interest rate cut was further pushed down. In addition, the demand of global central banks for gold, silver as the industrial raw material for solar panel production, and copper for renewable energy power generation and electric vehicles still increased significantly.

Krystkowiak said: "On the one hand, bulls who see the economic outlook improving may regard copper as the traditional means of the overall rebound of emerging markets and the global economy. On the other hand, bears believe that the economic outlook is deteriorating, and the central bank may make mistakes, and may regard gold as a means of hedging the potential stagflation environment." Stagflation refers to slow economic growth High unemployment and rising prices. "

He said that the rise in the prices of these three metals may not be interpreted as good news or bad news for the global economy.

Krystkowiak said: "Metals provide investors with a way to bet on both sides, depending on their respective prospects. Therefore, for the global economy, the rise of these three metals may not be interpreted as good news or bad news."

Peter Spina, founder and president of GoldSeek and SilverSeek, believes that the rebound of silver on Friday, May 17 marks a historic moment for silver prices and the market.

He said that silver entered the next stage on Monday. The invisible cattle came out of their hiding place - there is no denying that the price fluctuation is not only real, but also accelerating.

Spina also said: "The technical trend of silver confirms the extremely bullish fundamentals. The structural supply gap in the silver market continues to expand, and interest in silver is about to explode."

He said: "Record prices have aroused the interest of silver investment in the West which has been sluggish for many years. If we see a wave of silver buying interest in the West now, you will accelerate the tight physical inventory."

Spina added that there will soon be a real price squeeze and prices may soar. This potential itself has aroused the interest of speculators.

Taylor Krystkowiak, vice president and investment strategist of Themes etf, said that from a more macro perspective, given the strong potential demand for gold, silver and copper, in the foreseeable future, the driving force behind the broad rise may eventually prove to be sustainable.

However, he said that the sharp rise of these metals, as well as the rise relative to the long-term average price, may also limit further price increases.

Krystkowiak said that investors may "benefit from the allocation of gold, silver and copper enterprises, rather than gold. He pointed out that the continuous rise in metal prices has significantly improved the profitability of mining companies, and mining stocks may have greater upside potential.

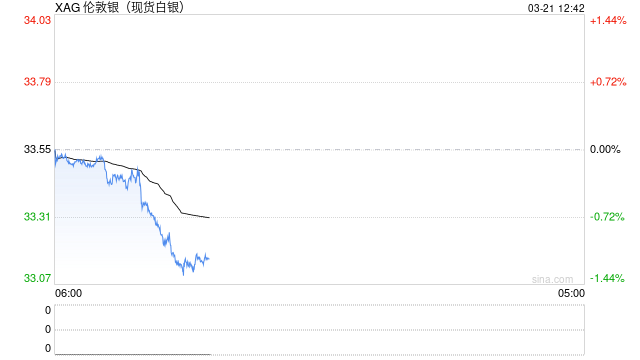

Spot Silver Daily chart At 14:11 on May 22, Beijing time, Spot Silver Reported at $31.81 /Ounces

Safe, fast and guaranteed futures account opening on Sina cooperation platform

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: Zhang Jingdi