GF Futures Yu Peiyun Z00195196

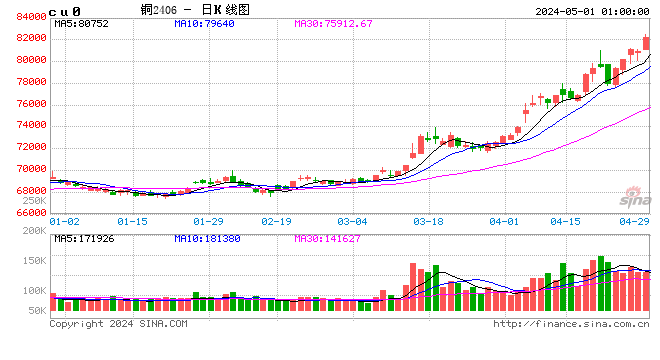

Market Guide: Copper rose more than 5% in the middle of today's session.

Drive 1: The expectation of overseas interest rate cut is rekindled, and good news about domestic real estate spreads frequently, and the macro atmosphere is warmer

Overseas, the US CPI and core CPI in April increased by 3.4% and 3.6% respectively year on year, the lowest growth rate in three years. The US retail sales in April and the NAHB real estate index in May weakened. The swap contract pricing showed that there were two 25bp interest rate cuts in the year. The expectation of interest rate cuts revived, the US dollar index weakened, and the precious metals and nonferrous metals sectors rose. In particular, in the election year, the US economy has a strong expectation of soft landing, and the expectation of preventive interest rate reduction is dominant. The narrative of "soft landing+interest rate reduction" is conducive to the rise of copper prices. On the domestic side, the National Regular Meeting deliberated and adopted the Action Plan for Digital Transformation of Manufacturing Industry; The Ministry of Finance announced the arrangement for the issuance of ultra long term special treasury bonds; The real estate policy in many regions was relaxed, the down payment ratio was reduced to the lowest 15%, and the personal housing provident fund loan interest rate was lowered by 0.25 percentage points. Domestic policies have been introduced frequently, and the market is expected to repair domestic demand. The internal and external information is frequent, and the macro atmosphere is generally warm.

Drive 2: copper mine capital expenditure is low, unexpected interference leads to early contraction of the mine end, and supply constraints exist in 24-26 years

Generally speaking, copper price rise will stimulate copper mine capital expenditure, and the capital investment into copper mine production lags about 5 years. Therefore, copper price is ahead of capital expenditure, and capital expenditure is ahead of copper mine production. In the rising cycle from 2020 to 2022, due to factors such as the outbreak of COVID-19 epidemic, high overseas inflation, decline in ore grade and community disturbance, the global copper mine capital grew slowly, which led to a significant decline in new copper mine capacity in 2025. Since the end of 2023, the mining contract of Cobre panama copper mine has been judged unconstitutional, and the power problem in Africa has become prominent... unexpected interference continues, resource democracy rises, and copper supply shrinks ahead of schedule. In addition, since May, the ban on the export of Indonesian copper concentrates has been postponed, and Cobre has actively negotiated with the new Panamanian government, which can only alleviate concerns for a short time and will not materially improve the current situation of tight mines. There are constraints on copper supply in 2024-2026, and the early shrinkage of the ore end restricts the volume of crude copper, which is an important factor for the fund to be optimistic about copper prices.

The copper concentrate processing fee (TC) is the embodiment and game of the supply and demand relationship between the mine and the smelter. At present, the TC is at a very low level in history, which mainly reflects the contradiction at the mine end. The smelter profits are squeezed, and the mine end tightening restricts the smelting output.

Drive 3: The overseas inventory continues to decrease, and COMEX copper warehouse squeeze event ferments

On May 14, the copper price difference between LME and COMEX hit a historical peak of more than 1000 dollars/ton. The copper warehouse squeeze event in the United States quickly fermented, further intensifying the bullish sentiment of funds. The position squeeze is the result of the combined effect of low inventory and high position. The market price difference is an important incentive, and the European and American sanctions against Russian metals are a boost.

Since this year, COMEX copper price is higher than SHFE copper price, attracting a batch of funds to buy SHFE copper and COMEX copper in reverse, in order to expect the return of price difference; In addition, compared with the price difference between COMEX and LME, some industries choose COMEX for short hedging. However, up to now, COMEX07 contract still has up to 161200 positions, which corresponds to about 1.8 million tons of refined copper according to 25000 pounds/hand conversion of COMEX contract, while the current stock of COMEX copper is only 20.1 million short tons, and the warehouse receipt is significantly lacking. COMEX's requirement for the delivery period is described as "delivery can be carried out on any business day from the first business day of the delivery month or any business day later, but not later than the last business day of the delivery month", that is, 07 contract can be delivered on July 1. According to the analysis of the market research institute, considering the operable inventory of American local goods, LME and China, and considering the uncertainties caused by the current shortage of shipping, the inventory that can be diverted to COMEX is limited. If the Exchange and the main participants do not have a good way to cope, the position squeeze may continue until the position level drops significantly.

Future prospects:

In a word, the pricing power of copper is biased overseas and at the mine end. At present, the macro view is mainly focused on the recovery of the global manufacturing industry, re inflation, and geopolitical pattern. Domestic real estate favorable policies are constantly introduced, and the overall atmosphere is warm. The tight mining end of the industry has always provided strong support, overseas stocks have continued to decline, and domestic demand is expected to repair. COMEX copper 07 contract position is still high, and the risk of position squeeze still exists. Operationally, maintain the idea of bargain hunting and long trading.

Disclaimer:

The information in this WeChat push content is derived from the publicly available information that Guangfa Futures Co., Ltd. believes to be reliable, but Guangfa Futures does not guarantee the accuracy and completeness of these information.

The content of this WeChat push reflects different views, opinions and analysis methods of researchers, and does not represent the position of GF Futures or its affiliates. The information, opinions and speculations contained in the report only reflect the judgment of the researchers on the date of issuing the report, and can be changed at any time without notice.

In any case, Content pushed by this WeChat For reference only, Push content Or the opinions expressed do not constitute an offer or inquiry for the purchase and sale of the said varieties, and investors shall invest accordingly at their own risk.

The content of this WeChat push is intended to be sent to specific customers and other professionals of GF Futures, and the copyright belongs to GF Futures. Without the written authorization of GF Futures, no one is allowed to publish or copy this report in any form. If it is quoted or published, it shall be noted that the source is "GF Futures", and this report shall not be abridged or modified contrary to the original intention.

Safe, fast and guaranteed futures account opening on Sina cooperation platform

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: Li Tiemin