Jiang Weinan, financial analyst of China Foreign Exchange Investment Research Institute

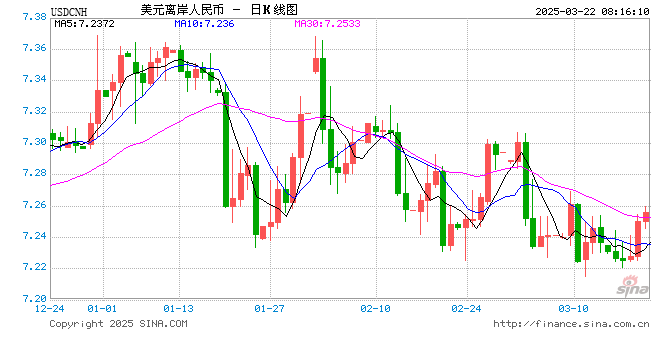

The People's Bank of China has cut the foreign exchange reserve ratio of financial institutions by 2 percentage points to 4%, RMB The appreciation correction driven by the offshore market is prominent, with the quotation of 7.24 yuan. As the continuous devaluation of RMB has increased the pressure on trade import costs, which is also the beginning of the traditional cycle of "nine golden years and ten silver years", China's frequent policies to stimulate economic recovery are clearly beneficial to the market, and the future economy will still follow a steady and positive recovery expectation, and the stability of the RMB exchange rate is worth paying attention to.

Since the third quarter, the world has faced more complex growth contradictions, which are the differentiation points. The situation in Russia and Ukraine continues, the European economy is poor, the monetary policy in Europe and the United States is high, and the commodity prices are soaring. The capital price and asset price in the financial market showed obvious structural adjustment. The US dominated stock market entered the period of adjustment and correction. The continuous rise of US bond yield and the key period for the US bond issuance to respond to the financial year's final accounts had a profound impact on the structural manipulation of global market prices. What is more prominent is the rise of commodity prices led by oil, and the rise of capital prices indicates the focus of global capital anchor speculation, which is the capital concentration port for short-term capital selection. The rise of commodities does not come from demand. After all, the global economy is in a period of weak growth. The contrast between Germany falling into a technical recession and the United States taking the initiative to destocking strengthens the importance of the United States economy. The United States wants to ensure a high interest rate level. The financing environment of enterprises dominated by the stock market and the support of oil inflation for interest rate increases are essential. In addition, the continuous rise in the yield of U.S. bonds has enhanced the attractiveness of U.S. bond issuance. Of course, the short-term strength of the U.S. dollar exchange rate price is also a short-term performance at an important node in the U.S. fiscal year. The long-term depreciation trend of the U.S. dollar is still the fundamental goal. In particular, the expectation that European and American stock markets will return to market attraction and concentration still exists.

Under the anxious situation of rising overseas prices and trade barriers, China's import costs continued to rise in the weakening cycle of the RMB exchange rate. The short-term effect of the decline in trade data from June to July was obvious, but the first seven months of the year were still in a stable growth state, which is a part of the normal adjustment of the global market cycle, In addition, the commodity price this year is far lower than that of the same period last year, which is also the basis for the contraction of trade volume. In fact, from the perspective of volume, the import volume of iron ore, copper and other commodities in the major categories has remained stable. Therefore, the factor of rising commodity prices is the focus of transmission from overseas to domestic. Compare the import pressure against the devalued area of RMB 7.2-7.3. China's central bank has successively issued policies to reduce MLF, stamp duty, real estate and foreign exchange reserve of financial institutions, mainly to ensure the further stable recovery of the domestic economy and stimulate consumption and corporate financing environment. The logic of reducing the reserve requirement ratio for foreign exchange deposits to adjust the RMB not to depreciate excessively is to release the domestic stock of dollars, which has a history of operation in the past depreciation cycles of RMB, and effectively curbs the excessive unilateral trend of RMB. At the same time, the three sides of the stock market, real estate and exchange rate are conducive to the structural appreciation correction of the RMB exchange rate. As the interest rate spread effect at home and abroad is weakening, the favorable policies of the stock market may be conducive to attracting liquidity in combination with other policies, thus protecting the stability of the RMB exchange rate.

To sum up, under the complex internal and external environment, the driving force of the offshore market is still speculation, which is also a risk point that needs to be prevented. The excessive devaluation of RMB is not conducive to China's import costs and market stability. The continuous policies of the Central Bank will stimulate China's economic stability and restore more powerful support. The short-term effect of international commodity concentrated funds speculation will be expected to remain unchanged in the future with the transfer of funds to equity, debt and other asset prices. After the central bank adjusted the reserve requirement ratio for foreign exchange deposits, the RMB may depreciate in moderation. Stabilizing foreign trade and promoting consumption are still the driving forces of economic growth. However, from the perspective of the RMB exchange rate priced in US dollars, the higher level of 104 is still the price range that the RMB needs to adapt to and explore. Therefore, the central bank's policy is an important support for the bilateral stability of the RMB and strengthening the bilateral stability of the RMB. The synergistic effect of the exchange rate and the stock market may be the focus of attention in the future.

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: Guo Jian