Source: China's money market

Summary

along with RMB The internationalization and marketization reform of the exchange rate is deepening, and the prospect of the RMB foreign exchange options market is broad. Based on the trend of RMB exchange rate and the current development of foreign exchange option market in China, this paper discusses the applicable strategies of RMB foreign exchange option instruments in the environment of two-way fluctuation of RMB exchange rate.

1、 Review of RMB foreign exchange options market in recent years

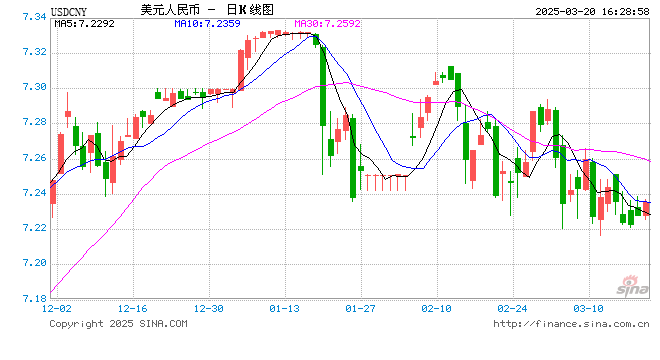

The rise and fall of the volatility of foreign exchange options has been driven by the enhanced two-way volatility of the RMB exchange rate. The rapid appreciation of the RMB in 2017 led to the first decline and then rise of volatility. The sharp depreciation of the RMB in 2018 led to the rapid rise of volatility. In 2019, the sharp bilateral volatility led to the first rise and then decline of volatility, and the overall level of volatility rose. In 2019 USD to RMB For example, the implied volatility of 1-year ATM options (1Y USD/CNY ATM VOL). At the beginning of the year, with the easing of Sino US trade situation and the stabilization and recovery of the RMB exchange rate, market risk sentiment was gradually released, and the implied volatility of options gradually fell from above 5.0% to around 4.3%. After that, the exchange rate of the US dollar against the RMB continued to hover at a low level, and the implied volatility of options continued to decline to the low point of 3.6% within the year. In May, the Sino US trade negotiations deteriorated, and the RMB depreciated rapidly. Stimulated by the news, the implied volatility of options rebounded rapidly and rose above 4.5%. After August, the RMB exchange rate fell below the "7.0" position, and the implied volatility of options rose sharply above 5.5%, hitting a new high in the year. Since then, although the exchange rate of the US dollar against the RMB has continued to rise, the implied volatility of options did not rise further because the rapid rise of the volatility had included the expectation of further depreciation of the RMB. Then, as the RMB moved in the direction of appreciation, the implied volatility of options gradually fell back to the year low of 3.8%.

In the volatile market, foreign exchange options will have greater performance space, and will also attract more financial institutions, non bank institutions and corporate customers to participate in, jointly promoting the development of the foreign exchange options market. The essence of option trading is volatility trading. The value of options will fluctuate with the market when the volatility fluctuates back and forth, and its time value can be effectively highlighted. In a two-sided volatile market, participants can not only sell options to earn option premium, but also obtain future potential income through call options, making full use of the highly leveraged nature of options. At the same time, the flexible combination of various options, the flexible allocation of various periods, and the mutual hedging between options and the subject matter meet the diversified trading and hedging needs, making the choice of market participants more diversified.

2、 Strategies and risks of inter-bank RMB foreign exchange options trading in the current market environment

Foreign exchange option is an effective tool for market participants to hedge and exchange rate risk. At present, there are many foreign exchange option products that banks can choose, including single call and put options and more complex combinations of various options. At present, there are five standard quotation methods in the inter-bank foreign exchange options market, namely, ATM options, 25D butterfly options, 10D butterfly options, 25D risk reversal options and 10D risk reversal options. Each of these five options has quotations of different periods, which together form the volatility surface of the inter-bank foreign exchange options market. These five options can be divided into three categories: ATM options, butterfly options and risk reversal options. ATM option price determines the high and low position of the volatility surface, butterfly option determines the convexity of the volatility surface, and risk reversal option determines the skewness of the volatility surface.

Taking 2019 as an example, the bilateral fluctuation trend of exchange rate in the whole year has strengthened, and the fluctuation of exchange rate has reached 4950 points. In such a volatile market, it is a more rational choice to buy ATM options to hold volatility bulls. ATM options are composed of a call option and a put option. The two options have the same trading direction, the same strike price, and the same forward price of exchange rate for the same period. Regardless of whether the market exchange rate changes in the direction of appreciation or depreciation, this strategy can bring rich profits to bank participants. When the exchange rate changes in the direction of appreciation, the put option will be exercised; When the exchange rate changes in the direction of depreciation, the call option will be exercised. The risk of this strategy is that if the market volatility is small, ATM option bulls will bear Theta losses, especially when the maturity date is approaching, Theta losses are relatively large. Therefore, this strategy is effective only in the market with more violent fluctuations.

If the bank's judgment on the direction of market operation is more accurate, it can also choose the risk reversal option with greater risk return. The risk reversal option consists of a call option and a put option. The two options have opposite buying and selling directions and different strike prices, and their strike prices correspond to their respective Delta prices. Suppose that the bank buys the risk reversal option when the exchange rate is low at the beginning of the year. When the market rises sharply, the call dummy option will quickly become the call real option, and the value of the option will increase significantly. At the same time, the rapidly rising exchange rate can bring more volatility positions to banks and further improve the overall profitability. The risk of this strategy is that if the direction of the exchange rate is misjudged, the value of the entire option portfolio will decline rapidly and it is difficult to hedge.

If the bank judges that the market will fluctuate within the range, it can choose to trade butterfly options. Butterfly options are composed of four options. The butterfly option portfolio is composed of selling a group of ATM options and simultaneously buying a group of straddle options. The nominal principal of the straddle option is higher than that of the ATM option, and the delta and vega of the entire portfolio are 0. On the contrary, selling butterfly options consists of buying a group of ATM options and simultaneously selling a group of straddle options. Assuming that the bank sells butterfly options at the beginning of the year, the bank can gain a larger return as the exchange rate moves towards the two ends of the straddle options. If the exchange rate fluctuates further in one direction, the profit will decrease. However, due to the existence of ATM options, the speed of profit reduction will be relatively slow, and banks can still earn trading profits. The risk of this strategy is that if the market volatility is small, the butterfly option short will bear the loss of Theta; If the market volatility is greater than the exercise price of straddle options, profits will also be greatly affected.

3、 Choice of RMB foreign exchange options for customers in the current market environment

For customers, the option structure given by the bank will guide customers to choose options. At present, the mainstream options portfolio in the market mainly includes the following:

1. "Interval forward" combination. The option portfolio consists of two single options. If it is an interval forward portfolio in the direction of foreign exchange purchase, the portfolio consists of a call option and a put option. The strike price of the two options is equal to the current limit forward price in the same period. On the maturity date, no matter where the market moves, two options will have one option to exercise. The enterprise can completely lock the exchange rate of foreign exchange purchase at maturity, and this combination can help the enterprise effectively hedge exchange rate risk.

2. Combination of "enhanced/profit increasing interval forward". The option portfolio consists of an "interval forward" portfolio plus a common option to sell. From the perspective of product performance, this product has higher risk than the common "interval forward" portfolio. Accordingly, due to the existence of the third option, it can obtain better foreign exchange purchase/settlement prices, so it is more suitable for enterprises with moderate risk appetite.

3. "Time difference foreign exchange purchase/settlement" combination. The option portfolio is composed of two single options with different expiration dates. The enterprise can obtain a certain option premium through this combination to optimize the near end foreign exchange settlement price, and the risk is retained at the far end expiration time point.

4. "Double interval forward" combination. The option portfolio consists of two single options, and the nominal principal of the put option is twice that of the call option. From the perspective of market performance, the product has high risk and high income, which is more suitable for enterprises with high risk appetite.

The above four foreign exchange option portfolios are hedging instruments that corporate customers currently choose more. The structure of each product is very flexible, which can meet various risk preference options. Judging from the current market exchange rate trend, two-way market fluctuation has become the main theme of operation. When designing the option structure for customers, banks should comprehensively consider the market risks borne by customers and the bank itself, and guide customers to make reasonable choices.

4、 Problems in the current RMB foreign exchange options market

(1) The market product structure is relatively single

At present, the main foreign exchange option products in the inter-bank market are Vanilla options, and Vanilla options are the simplest option products, which can only meet the most basic hedging needs and cannot meet the more diversified needs of market participants. Similar exotic options and cross asset class index options have not yet appeared. In more mature foreign trading markets, exotic options, interval interest bearing options, basket options and other complex derivatives have been widely accepted and traded in large quantities. At present, the RMB foreign exchange options market still has much room for expansion in terms of product structure, and enriching product lines should be a development direction in the future.

(2) Market volatility curve pricing is not perfect

As there are relatively few institutions participating in RMB and foreign exchange options trading, and affected by customer preference, at present, the volatility curve quotation of RMB and foreign exchange options market is basically within 1Y and mainly ATM to 25D quotations. Over 1Y long term foreign exchange options and deep dummy options are not actively quoted, and the option surface pricing at the tail end is still dominated by interpolation pricing, which has caused certain obstacles to transaction management and is not conducive to the development of independent pricing of RMB foreign exchange options.

(3) Option pricing model is relatively simple

At present, the foreign exchange option products in the inter-bank market are basically priced using the Black Scholes model, which can meet the pricing and risk management of Vanilla options. However, because the Black Scholes model is based on the assumption of constant exchange rate volatility, constant interest rate and other assumptions, it has great limitations in dealing with exotic options, basket options, cross currency options and other complex derivatives. The current mature foreign exchange options market has derived a variety of pricing models based on Black Scholes, such as Stochastic Model, Vanna Volga Model, etc. Different models are applicable to different options products, which can help traders and investors better manage risks and achieve more accurate pricing.

5、 Suggestions on the development of RMB foreign exchange options market

(1) Further enrich the product structure of RMB foreign exchange options market

At present, the tradable RMB foreign exchange option products in the inter-bank market are basically ordinary European options and their related combinations, and more complex exotic options have not been included in the tradable category. Compared with ordinary options, exotic options have more complex elements and more flexible trading methods, which can meet more diversified trading needs of traders.

At present, exotic options are gradually favored by corporate customers in bank to customer transactions. Banks can start with customer transactions, constantly accumulate experience in managing exotic options, and improve the trading ability of exotic options, including model pricing, risk identification, curve valuation, system development, etc. At the same time, the inter-bank market can also learn from the trading mode and development experience of mature markets, gradually promote the research and development work including demand design, trading rules, clearing mechanism, etc., and gradually expand relevant exotic option products after the opening of the foreign exchange market and the market participants' risk management ability have the corresponding conditions.

(2) Further improve the volatility curve of RMB foreign exchange options market

The inter-bank foreign exchange options market can consider setting up a foreign exchange options market maker system to improve the enthusiasm of trading institutions for quotation, and on this basis, further expand the foreign exchange options market to allow more types of financial institutions to participate in transactions in the foreign exchange options market and improve the comprehensiveness of pricing. At the same time, on the basis of the existing USD/CNY foreign exchange options, the tradable quotations of cross currency pairs, such as EUR/CNY, JPY/CNY, are added to improve the pricing of RMB against various foreign currencies.

(3) Further enrich RMB foreign exchange option pricing model

It is suggested to add new option pricing models on the basis of the existing Black Scholes model to make up for the inherent defects of the Black Scholes model, such as stochastic volatility model, Vanna Volga model, etc. Taking the Vanna Volga model as an example, the Vanna Volga model uses ATM quotation, RR quotation, Butterfly quotation and the Greek letters of Vega, Vanna and Volga under the Black Scholes model to price options. Since the Greek letters used in the Vanna Volga model are all associated with the option volatility, risk management using the Vanna Volga model can effectively cope with the impact of the volatility smile curve and have better pricing performance in a market with non normal volatility curves.

At the same time, Vanna Volga model has better applicability in the pricing of exotic options. Taking barrier options as an example, compared with the Black Scholes model, when the exchange rate is close to the barrier price of barrier options, the Vanna Volga model can provide more accurate pricing, and provide traders with more continuous Greek letters such as Delta and Vega when the price changes, so that traders can manage risk positions more carefully.

Author: Gao Lufeng, Financial Market Department of Shanghai Pudong Development Bank

Disclaimer: All the content provided by We Media is from We Media, and the copyright belongs to the original author. Please contact the original author and obtain permission for reprinting. The opinion of the article only represents the author, not Sina's position. If the content involves investment advice, it is only for reference, not as an investment basis. The investment is risky, so you should be cautious when entering the market.

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: Guo Jian