Stock speculation depends Jin Qilin analyst research report , authoritative, professional, timely and comprehensive, to help you tap potential theme opportunities!

Interface journalists| Longli

Top hot money Hujialou sold PV stocks!

The dragon and tiger list data disclosed after the market on May 22 shows that the commonly used seats in Hujialou CSC Securities Beijing Guangqumen Inner Street appeared in the top five buyers of five photovoltaic stocks, with a total net purchase amount of 321 million yuan.

Table: The net purchase of individual shares on the Dragon Tiger List of CSC Beijing Guangqumen Inner Street on May 22

Table: The net purchase of individual shares on the Dragon Tiger List of CSC Beijing Guangqumen Inner Street on May 22 Data source: Eastmoney Web and interface news sorting

Hujialou is an old hot money with strength. It has the courage to actively guide individual stocks, and its style is open and close.

Specifically, the largest amount of Hujialou bought on that day is TCL Middle Ring (002129. SZ), CSC Beijing Guangqumen Inner Street ranked the third among the buyers of the stock, with a purchase amount of 101 million yuan.

In addition to Hujialou, TCL Central also obtained other active luxury purchases from multiple hot money on that day. Among them, the seats commonly used by famous hot money Foshan Guotai Jun'an Sanya Yingbin Road of Securities ranked second among the buyers, with a purchase amount of 157 million yuan; Famous hot money seats citic securities (Shandong) Zibo Branch ranked fifth among the buyers, with a purchase amount of 45.545 million yuan.

TCL Zhonghuan's main products include new energy photovoltaic silicon wafers, photovoltaic cells and modules, other silicon materials, and the development and operation of high-efficiency photovoltaic power station projects. Its application fields include integrated circuits, consumer electronics, grid transmission, wind power generation, rail transit, new energy vehicles, 5G, artificial intelligence, photovoltaic power generation, industrial control and other industries.

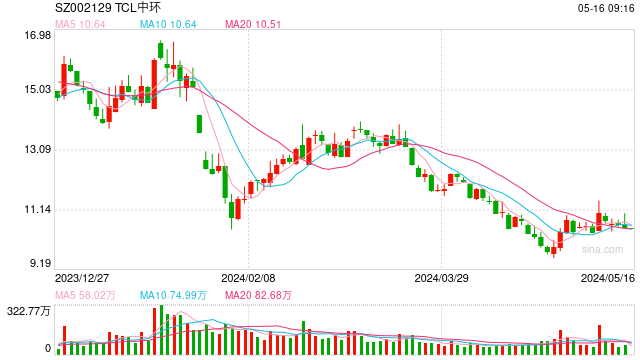

Since the record high of 49.69 yuan/share was set on July 1, 2022, the share price of TCL Central has fluctuated and fallen all the way. Until April 25, this year, the share price fell to 9.57 yuan/share in the middle of the session, and then began to rebound. Even after the strong limit rise on May 22, the latest closing price of the share was only 11.37 yuan/share.

The second largest stock of Hujialou on that day was Jing'ao Technology (002459. SZ), the purchase amount of CSC Beijing Guangqumen Inner Street was 90.5114 million yuan, ranking the third among the buyers of the shares.

Jingao Technology is based on solar energy The vertical integration model of the photovoltaic industry chain has long been committed to providing global customers with photovoltaic power generation system solutions. Its main business is the R&D, production and sales of solar photovoltaic silicon wafers, batteries and modules, the development, construction and operation of solar photovoltaic power stations, and the R&D, production and sales of photovoltaic materials and equipment.

In recent years, the stock price of Jing'ao Technology is also not optimistic. As of May 22 this year, its latest closing price was 15.09 yuan/share. Compared with the record high of 59.47 yuan/share set by the stock on June 29, 2022, the range decline was as high as 74.63%.

On May 22, in addition to Hujialou, the well-known hot money seats China International Finance Shanghai Branch and Donghai Securities Nanjing Branch also appeared in the top five buyers of Jingao Technology, with the purchase amount of 32.5761 million yuan and 31.4615 million yuan respectively.

In addition, CSC Beijing Guangqumen Inner Street also appeared in the Junda Shares (002865.SZ)、 Diamond photovoltaic (300093. SZ) and Oriental sunrise (300118.SZ) Among the top five buyers of three individual shares, the purchase amount was 55.6909 million yuan, 46.5484 million yuan and 28.3225 million yuan respectively.

Among them, Jingang PV also won the well-known hot money seat Guotai Jun'an Securities, Songjiang Zhongshan East Road, Shanghai, to buy 23.3267 million yuan, and CITIC Securities, Xi'an Zhuque Street, Fang Xinxia's common seat, to buy 23.0737 million yuan.

Junda is mainly engaged in the R&D, production and sales of photovoltaic cells. At present, Junda focuses on the new generation of N-type TOPCon solar cells. The company's product performance has reached the international advanced level and has strong market competitiveness. Jingang Photovoltaic focuses on the main business of heterojunction cells and modules, providing high-quality and efficient heterojunction cells and modules to the market. The main business of Dongfang Risheng is the R&D, production and sales of solar cell modules. Its business also covers the fields of photovoltaic power station EPC, photovoltaic power station operation and energy storage. It is mainly located in the middle of the photovoltaic industry chain, and has set foot in the upstream and downstream of the photovoltaic industry chain.

Similar to TCL Zhonghuan and Jing'ao Technology, in addition to the main business involving the photovoltaic field, the shares of Junda, Jingang PV and Dongfang Risheng have also experienced a round of deep correction before, and are currently at a relatively low level in recent years.

At the same time, on May 22, the above five individual shares also attracted the active participation of institutional funds and Beishang funds. According to the Dragon Tiger List data, the special seats for Shenzhen Stock Connect bought the above individual shares of 149 million yuan, 201 million yuan, 119 million yuan, 1158900 yuan and 66.8946 million yuan in turn on the same day, and the special seats for institutions bought the above individual shares of 74.6194 million yuan, 71.5049 million yuan 47887900 yuan, 30163600 yuan and 63341500 yuan.

However, it should be noted that the performance of the five "new favorites" selected by Hujialou in the first quarter of this year was not optimistic, TCL Zhonghuan, Jing'ao Technology and Dongfang Risheng suffered losses of 880 million yuan, 483 million yuan and 280 million yuan respectively in the first quarter, and Jingang PV suffered losses of 84.12 million yuan in the first quarter. The net profit of Junda, the only profitable company, in the first quarter was only 19.5 million yuan, down 94.42% year on year.

When the stock market recovers, open an account first! Intelligent fixed investment, condition sheet, individual stock radar... for you>>

Massive information, accurate interpretation, all in Sina Finance APP

Editor in charge: He Songlin