Original title: Business Insight | Kaiyun Lifeng's Acquisition Action: From Left to Right, How will the luxury market change?

Reprinted from: WWD International Fashion News

Faced with domestic worries and foreign aggression, the giants could not sit still.

Luxury giants are slightly embarrassed by the performance data. In the increasingly saturated rich economy, the luxury giants' vision has gradually shifted from short-term dividends to long-term solutions.

A few days ago, by the end of July 27, the market value of Kaiyun Group was 65.722 billion euros, and the market value of Richemont Group was 79.999 billion Swiss francs (about 83.751 billion euros), which was far from the 421.864 billion euros of LVMH Group, and even more than Hermes, whose unlisted value exceeded 200 billion euros. Investment and acquisition and other capital actions have become a particularly fast and effective means of "giant hegemony".

Last Thursday, the parent company of Gucci, Kaiyun Group, said that it had purchased 30% of Valentino's shares for 1.7 billion euros. The two companies said in a joint statement that Kaiyun Group could choose to acquire 100% of Valentino's equity before 2028, and Mayhoola might become a shareholder of Kaiyun Group. The preliminary transaction of the French luxury group to acquire 30% shares of Valentino is expected to be completed by the end of 2023. Fran ç ois Henri Pinault, chairman and CEO of Kaiyun Group, said that Valentino would benefit from the synergy of the group's operation, while Valentino's high-end positioning filled a gap in Kaiyun's portfolio, and said that Jacobo Venturini, the current CEO of Valentino, would continue to serve.

The parent company of Gucci, Kaiyun Group, said that it had purchased 30% shares of Valentino for 1.7 billion euros

A few days ago, Richemont Group also announced the acquisition of Gianvito Rossi, an Italian high-end shoe brand, which further revealed the group's capital distribution strategy for fashion and leather products. At present, the financial terms of the acquisition have not been disclosed, Gianvito Rossi, founder, CEO and creative director of Rossi, retained the shares of the company. He said: "I am looking for a partner who can help the brand establish a high-level retail network worldwide and provide quality services to customers." Philippe Fortunato, CEO of Richemont Group's fashion and accessories business, exclusively disclosed to WWD, The acquisition is a partnership.

Richemont Group announced the acquisition of Gianvito Rossi, an Italian high-end shoe brand

The oligopoly effect of giants is being eroded, which constantly confirms the fact that "eggs cannot be put in the same basket". Just like the first half of 2023 financial report of Kaiyun Group.

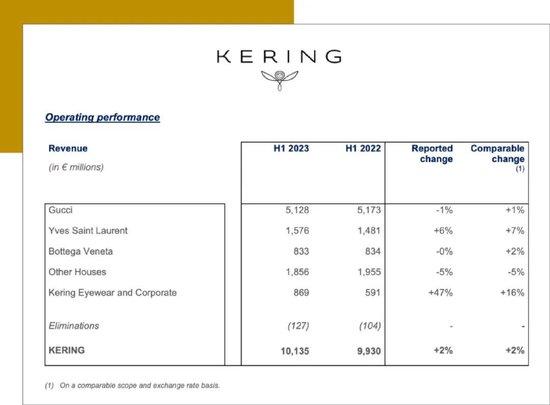

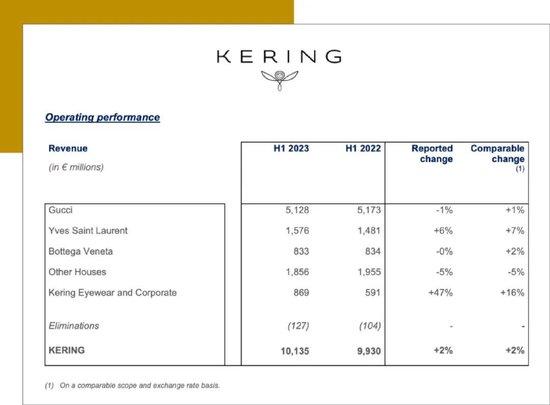

On July 28, the French Kaiyun Group released its performance report for the first half of 2023. In the six months ended June 30, the sales revenue of Kaiyun Group increased by 2% compared with 2022 to € 10135 million (about RMB 79.8 billion), lower than the 6% increase expected by analysts, while the operating profit and net profit decreased by 3% and 9.5% respectively to € 2739 million and € 1785 million. The financial report of the first half of 2023 recently disclosed by the competitor LVMH Group shows that the sales revenue will increase by 15% to 42.24 billion euros compared with 2022, and the net profit will increase by 30% to 8.481 billion euros. The sales revenue of the fashion and leather goods department and the jewelry and watch department increased by 17% and 11% to € 21162 million and € 5427 million respectively.

Open data of Kaiyun Group's financial report in the first half of 2023

The weak performance of Gucci, the main brand, is regarded as the main problem of the poor performance of Kaiyun Group. More than 65% of the group's operating profit came from Gucci, but its sales fell by 1% in the first half of the year, and its operating profit fell by 4%. Gucci did not achieve post epidemic consumer recovery and growth. Saint Lauren and Bottega Veneta recorded sales of 1.567 billion euros and 833 million euros respectively in the first half of the year, the former increased by 6% compared with 2022, while the latter did not.

Gucci's performance was weak, with sales falling 1% and operating profit falling 4% in the first half of the year

The performance of Kaiyun Group has been quite difficult in recent years. Different from LVMH Group, Kaiyun Group's brands usually reshuffle the previous style when new designers take office. This model can only bring short-term freshness and growth, and cannot obtain long-term stable income.

According to the "28 Law", Kayun Group has always regarded Gucci as the main performance engine of 20% and used it to leverage 80% of the benefits. At present, Kaiyun Group needs to re find the key factors, plan the input-output ratio, and strive to achieve the best performance while reducing resource loss.

From the establishment of the beauty department, the acquisition of the perfume brand Creed, to the high-level reshuffle, and then to the acquisition of Valentino, Kaiyun Group is stepping up the pace of change, trying to spread eggs into multiple baskets under the shadow of the beautiful first half financial report.

Previously, Fran, CEO of Kaiyun Group ç Ois Henri Pinault has repeatedly said that he does not reject new acquisitions. According to analysts, in recent years, Kaiyun Group has been facing the pressure of transformation and investment portfolio. The acquisition of Valentino's equity will make it more competitive with competitors and reduce its dependence on Gucci. As Fran ç ois Henri Pinault, Chairman and CEO of Kaiyun Group, said, Valentino's high-end positioning fills a gap in Kaiyun's portfolio.

On May 10, the parent company of Moschino brand, the Italian luxury group Aeffe, announced the main financial data of the first quarter of fiscal year 2023: the comprehensive income decreased by 6% year-on-year to 96.89 million euros, of which the sales income decreased by 8.2% year-on-year to 93.2 million euros, 8.4% at a fixed exchange rate.

The parent company of Moschino brand and Italian luxury group Aeffe's comprehensive income in the first quarter of fiscal year 2023 decreased by 6% year on year to 96.89 million euros, of which the sales income decreased by 8.2% year on year to 93.2 million euros

It can be seen that both Gucci and Moschino's outstanding but single brand aesthetics are too symbolic. Due to the rapid changes in the market, the brand style and the aesthetic resonance of consumers have declined significantly. Therefore, Reducing the excessive dependence on the "leading lady" is the top priority for luxury groups, while acquiring new brands has become an important means to disperse pressure and improve the possibility of growth.

Not long ago, Richemont Group released the performance data for the first quarter of fiscal year 2024 as of June 30, 2023. The sales increased by 19% at the fixed exchange rate (14% at the real exchange rate) to 5.322 billion euros, with a strong recovery in the Asia Pacific region. The jewelry sector and the professional tabulation sector achieved an increase of 24% and 10% respectively. The growth rate of "other departments" is 6%, which includes fashion and accessories brands such as Chlo é, Ala ï a, AZ Factory, Dunhill, etc.

In the future, Gianvito Rossi will be included in the "other departments" of Richemont Group when reporting performance.

Richemont Group has always had an "absolute" advantage in the field of hard luxury. In recent years, a series of actions have also seen its ambition to expand its territory. Two years ago, Richemont Group acquired Delvaux, a top Belgian handbag manufacturer, which to some extent coincided with the positioning of Quiet Luxury and enriched its "other business" field mainly composed of fashion and accessories brands. Philippe Fortunato, CEO of Fashion and Accessories of Richemont Group, further hinted in this acquisition that Richemont Group would expand its product range, and handbags and leather goods would be the first categories to be involved.

Two years ago, Richemont Group acquired Delvaux, a top Belgian handbag manufacturer

In fact, shoes have always been a cyclical business. Although trend sneakers dominated the market for a long time in the past, now the footwear industry has returned to diversification again, and the trend of high-heeled shoes will sweep again. Philippe Fortunato, CEO of fashion and accessories business of Richemont Group, said: "Although sneakers have been the focus of many large luxury brands in recent years, the high-end footwear market will become a very important frontier for the development of luxury goods." In addition, he further said that this acquisition is based on the optimistic trend of "Quiet Luxury" that currently sweeps the market, And the development and expansion potential from professional shoe manufacturers.

The footwear industry returns to diversification again, and the trend of high-heeled shoes will sweep again

Furthermore, in a more calm and long-term aesthetic perspective, Quiet Luxury has gradually moved from a niche market to the mainstream, and has had an impact on and reshaped the mainstream aesthetic.

Today, the luxury ecology is surging forward. The new consumer and the luxury industry pattern is not a trade-off, but a symbiotic relationship. Fashion trends also swing back and forth between the trend and high-end. Fixed brand style is doomed to be unsafe. The giant's embrace of the Quiet Luxury trend is not only a bet on the greater possibility of niche areas, but also to explore the certainty and premium of return on investment in the already popular luxury industry.

Previously, after the first episode of The Heirs was broadcast, the Google search volume of "low-key luxury", "secret wealth" and "old money style" soared 684%, 990% and 874% respectively. Karolina Zmarlak, creative director of KZ_K Studio, believes that "Quiet Luxury" refers to a woman who has formed a personal style she believes in and comes from her own self-confidence. She doesn't pursue fashion, which means that the clothes she wants can't be worn for only one season or thrown away after several times. She wants timeless, high-quality, handmade investment pieces. Although the accumulation of commercial assets is often achieved by the continuous "desire and impulse" of consumers, brands are also looking for long-term sustainable return models when the aesthetic environment changes. This is true for consumers; For luxury brands or groups themselves, it is also a more long-term, more balanced, and more deterministic luxury value judgment under the condition of faster aesthetic iteration of consumption and more frequent market fluctuations in the future.

And classic brands with a long history, such as Gianvito Rossi, may just meet their long-term foothold of constantly seeking balance and constantly examining the value of luxury.

"Gambling" does not seem to be the magic weapon of the giant.

The acquisition is an obvious release of pressure. However, the conventional acquisition action may not be able to move forward steadily in the new consumption environment, bet on various possibilities and reserve for the unknown, so as not to be in a hurry and lose the whole game when the ecology changes. It is the necessary way out to rebuild a balanced ecology to make bold strides and reform the old and reform the new. WWD

Writing Longjing

Edit yalta

Picture Source network