This website provides Linux server operation and maintenance, automated script writing and other services. If you need, please contact the blogger on WeChat: xiaozme

Recently, Overseas Chinese Bank of Singapore (OCBC) allowed foreign customers in China, Hong Kong, Malaysia and Indonesia to open full digital bank accounts locally. If you need a bank account and debit card in Singapore, you can apply. Because Xiaoz stepped on some holes in the process of opening an account, I wrote this article. Please note that this document is for reference only and does not bear the corresponding risk. If you cannot bear the corresponding risk, please stop reading immediately. 。

What's the use of applying for OCBC account?

- More than 2 Singapore bank accounts can be obtained

- It is more convenient for cross-border collection and payment

- Hong Kong shares and US shares can be purchased (refer to: Changqiao Securities 、 Yingli Securities )

- You can apply for a debit card for online consumption and global consumption

- Debit card supports Apple Pay/Google Pay mobile payment

- OCBC to WSIE The deposit is received in seconds

If you do not have the above requirements or do not understand the purpose of this account, I suggest you not to apply. If you have the above needs or understand the purpose of this account, please continue reading.

About Overseas Chinese Bank of Singapore

OCBC Bank is one of the three major local banks in Singapore. Headquartered in Singapore, it was founded in 1932 and is one of the oldest banks in Singapore. The website and APP support Chinese and have Chinese customer service.

Apply for OCBC account

First, you need to prepare the following materials/documents:

- Android or Apple phones, and support NFC function

- passport

- ID

- Mobile phone number in mainland China

- Prepare 1000 SGD deposit verification

Go to Apple or Google Store to search "OCBC Digital" for installation, or directly visit the following address:

Open "OCBC Digital" and fill in the information truthfully according to the requirements of the interface. Fill in the invitation code: UZ48FDOS If you deposit 1000 SGD within one month after using the invitation code, you can get an additional 15 SGD bonus. If the APP turns on flash back or black screen, please try to turn it off completely and then turn it on again. In addition, the domestic network may load slowly. Since xiaoz has completed the account opening, forget the screenshot. The general steps are as follows:

- Phone number is required (domestic phone number is enough)

- You will be asked to use the NFC function of your mobile phone to sense your passport

- Passport required

- ID card photo

- Require video verification

The information must be filled in truthfully, otherwise the account opening may be affected. The entire application process is completed in a few minutes. The lucky user may open the account in seconds, and the unlucky user may trigger manual review. The review cycle is within 7 working days. In the process of opening an account, please keep in mind the following information:

- You will be asked to set a user name, which is used to log in to the web version. Please remember

- You will be asked to set a 6-digit PIN (required for login to the web version). Please remember

- The mobile phone will be required to bind OneToken (which can be understood as a secure secondary authentication tool)

Note: Please do not log out of the current user status of "OCBC Digital" during the core process, or you may not be able to log in after passing the audit, and fall into an endless loop.

After approval, two Singapore bank accounts are opened for you by default, namely:

- Statement Savings Account(STS)

- Global Savings Account(GSA)

These two accounts can be used for collection or external transfer.

Deposit activated OCBC

After the account is opened successfully, the OCBC needs to be activated by the deposit of the same name account. As of 2023-10, according to netizens' feedback, OCBC has strengthened the verification, and does not support WISE first deposit activation, and all deposits will be rejected if the account is not activated. The available activation methods collected so far are as follows:

Bank of China

- Download the "BOC cross-border GO", and new users will get cross-border remittance coupons

- Operating RMB to purchase new currency through APP

- Cross border remittance to OCBC

STS Account , coupon can deduct service charge and telegram fee, but 30 SGD Intermediate transfer bank expenses

Reminder: If OCBC uses an invitation code( UZ48FDOS )Register and pay 1000 SGD to OCBC within 30 days to get 15 SGD rewards (generally after successful remittance 24H Therefore, when remitting by BOC, the intermediary transfer fee is included, and it is recommended to remit 1050 SGD

Industrial and Commercial Bank of China

When ICBC makes cross-border remittance to OCBC, it will automatically add a space in the middle of the name, which leads to the disapproval of OCBC, Therefore, ICBC is only applicable to users whose names are two Chinese characters. It is not recommended to try if the names are more than three Chinese characters 。

Please refer to: Real experience sharing of cross-border remittance from ICBC to OCBC

Other instructions

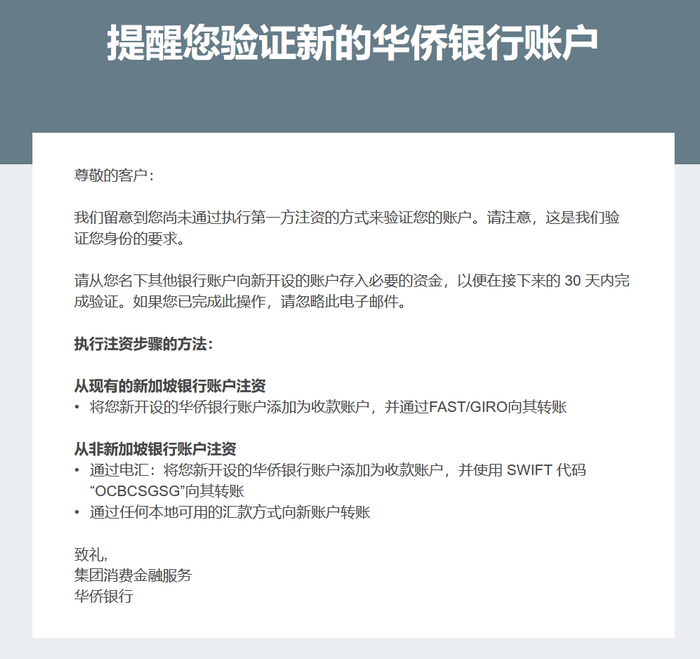

If the account with the same name is not used for transfer activation for more than one month, you may receive an email reminder from OCBC to be activated, and the account may be closed if it is not activated for a long time.

Deposit to OCBC account

If you have activated the account with the same name in the previous step, the subsequent deposit to OCBC will not be mandatory, but can be made to OCBC in the following ways.

Panda Express

Xiaoz Remittance by Panda Quick Remittance to OCBC STS Account( Note: Panda quick remittance is not an account with the same name ), operate on weekdays, and arrive at the account in a few minutes.

Panda Express registration and certification process:

- You are required to fill in your mobile phone number, which is recommended to be consistent with your domestic bank card mobile phone number

- Require ID card and video authentication

- Need to bind a domestic bank card for cross-border remittance

The next step is to use Panda Express to deposit money into OCBC STS account, and the following information of the collection account needs to be filled in:

- First name: the pinyin of your name. For example, if your name is Zhang San, you should fill in the name: SAN (note that it is your name used when you opened an account in the Overseas Chinese Bank)

- Last name: For example, if your name is Zhang San, then your last name is ZHANG (please note that your last name is used when you open an account in Overseas Chinese Bank)

- Nationality: China

- Beneficiary bank: OVERSEA-CHINESE BANKING CORPORATION LIMITED

- Bank account number: the number you see on the STS account of "OCBC Digital" (note: - symbol is not required)

- Street and number: 63 Chulia Street # 10-00, OCBC Centre East, Singapore 049514

- Purpose of remittance: Others

The information of the payee must be consistent with that provided by OCBC Bank, and must be checked again and again. Then enter the remittance amount (SGD), and use the domestic bank card to complete the payment according to the prompt. If you remit money on weekdays, it will basically arrive at OCBC in seconds. My fee information is as follows (for reference only):

- Remittance amount: 5292.73 CNY

- Service charge for remittance: 80.00 CNY

- Total payment: 5572.73 CNY

- OCBC actual receipt: 1020 SGD

Panda Express collected a one-time service charge of 80 CNY, which was acceptable, but it also suffered from some exchange rate differences.

If you successfully deposit more than 1000 SGD into the OCBC account (the account with the same name is required), the 15 SGD bonus will be sent to your account after a few hours (the bonus is not received in real time)

WISE deposit OCBC

When the OCBC account has been activated, you can transfer SGD to the OCBC account using WISE, or you can use Paynow payment method. The service charge is 0, and it is basically received in seconds.

Modify your OCBC mailing address (can be skipped)

The residence address has been filled in when applying for OCBC account, APP will automatically translate the Chinese address to English. If the address is inaccurate, it can be modified by the following method. If the address is correct or you do not need to apply for a debit card, you can skip this step.

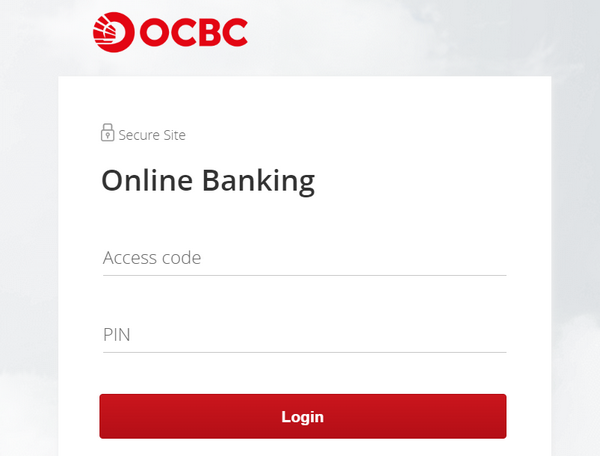

OCBC web version login address: https://internet.ocbc.com/internet-banking/

Login to the web page will ask you to fill in:

- Access Code: the name you set when you opened your account

- PIN: 6-digit PIN code set when you open an account

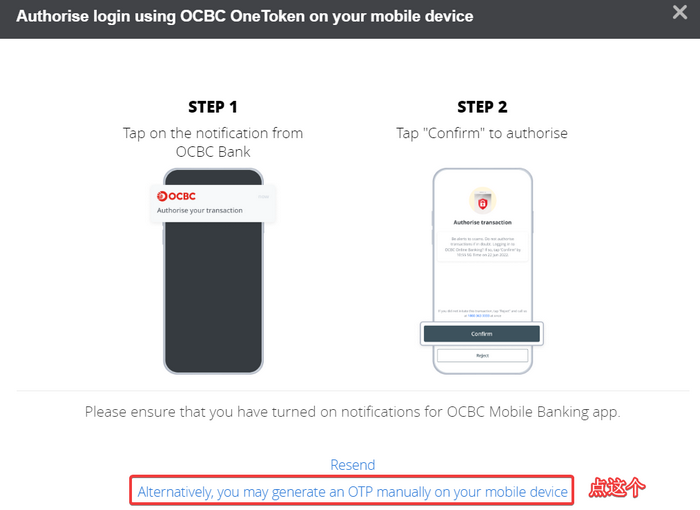

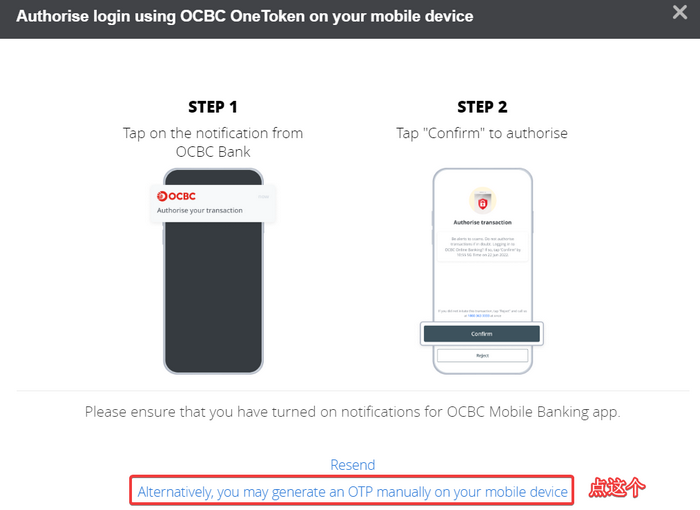

At this time, the second authentication of "OneToken" will pop up, and probably the domestic network cannot receive this reminder. You can click "Alternatively, you may generate an OTP manually on your mobile device”

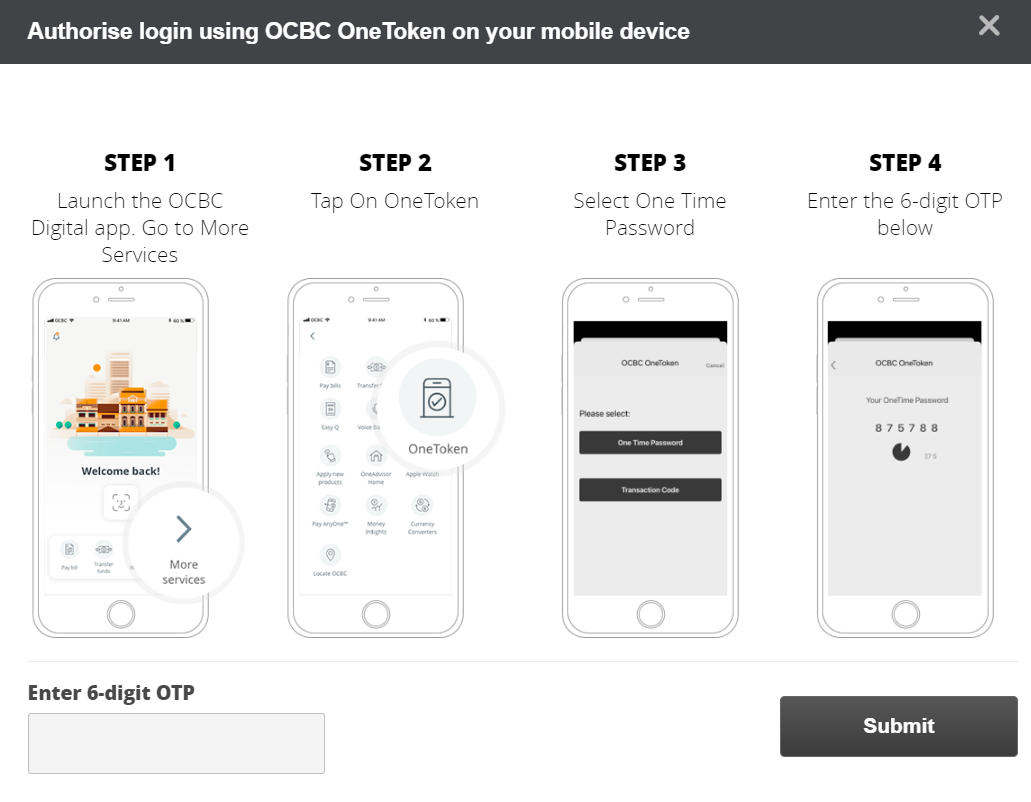

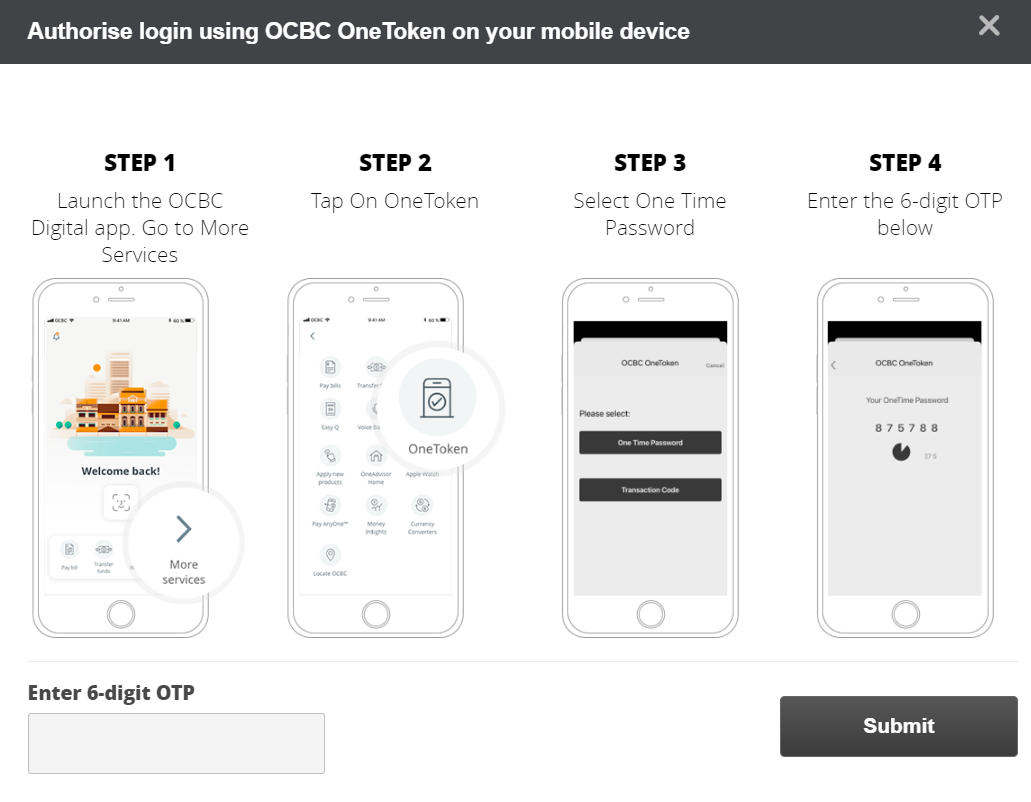

Then open the APP of "OCBC Digital", do not immediately verify your fingerprint to enter the APP, click "More" at the bottom right, find "OneToken", obtain the 6-digit authentication code, and fill in the webpage to log in.

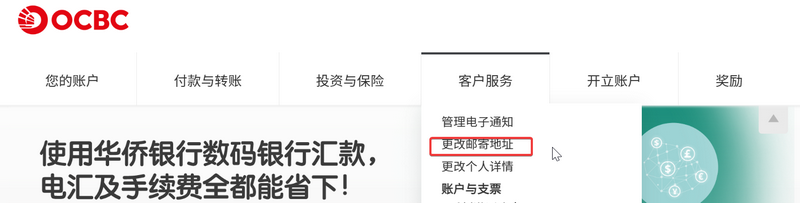

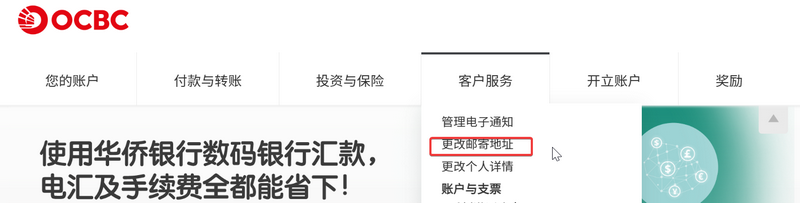

I changed the OCBC webpage version to Chinese, and click "Customer Service - Change Mailing Address" on the navigation bar

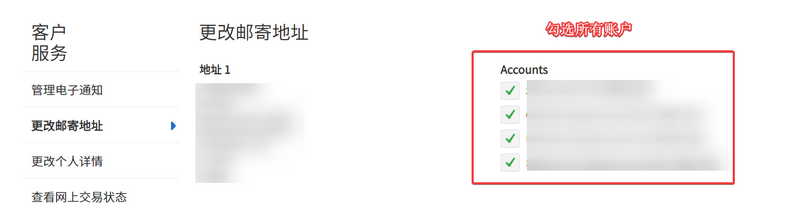

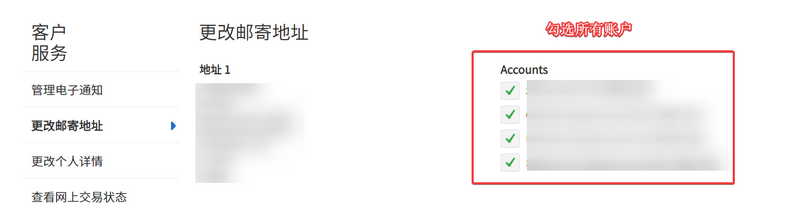

Check all your accounts directly, and then go to the next page.

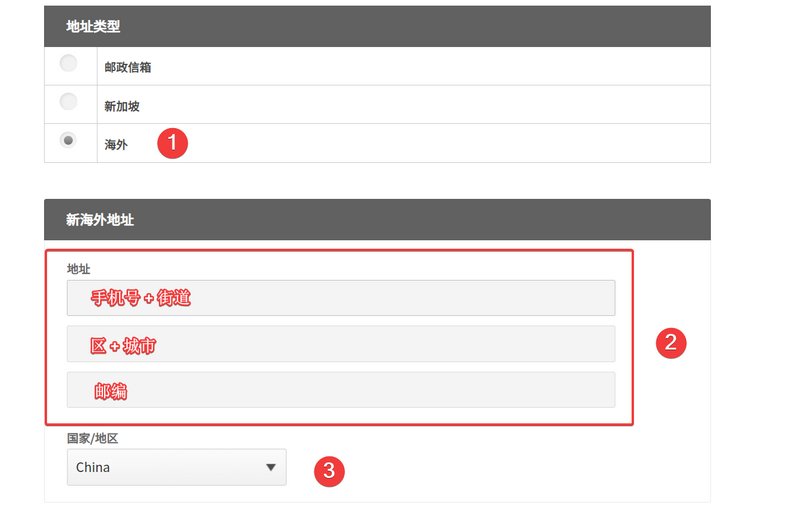

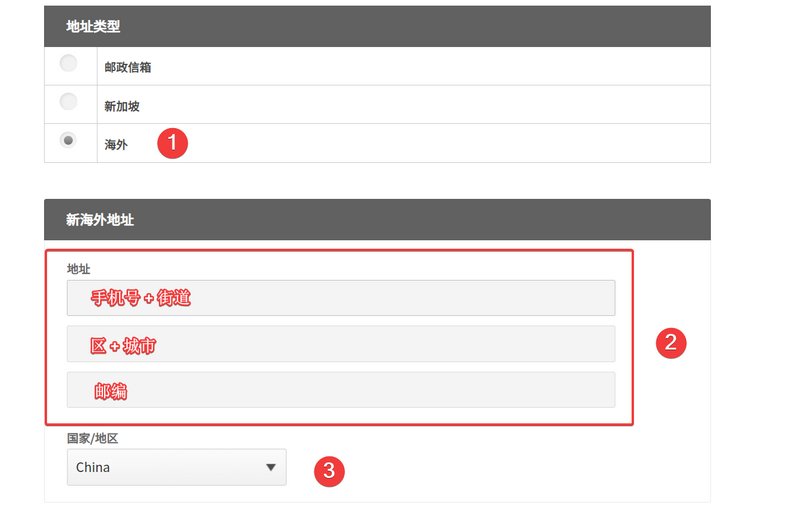

Then fill in the new address information:

- Address type: overseas

- Address column 1: fill in your mobile phone number and street address (translate with ChatGPT)

- Address bar 2: fill in your district and city (you can use pinyin)

- Address bar 3: Zip code of your address

- Country/region: China

On the next page, save the confirmation address. The purpose of filling in your mobile phone number in the address column 1 is that OCBC may not print your mobile phone number on the logistics information, so that the courier may not be able to contact you normally.

Apply for OCBC 360 Account

Applying for OCBC 360 Account can open an additional account and allocate a VISA debit card by default, which can be used for overseas consumption (such as paying ChatGPT Plus), ATM withdrawal, etc. If you do not need a debit card, skip this step.

Return to the "OCBC Digital" APP, click "Application - Account - 360 Account" on the left navigation bar, and fill in according to the step prompts.

be careful:

- Self employment is not recommended for applying for 360 Account (manual review may be triggered)

- It is recommended to keep the name default (otherwise, manual review may be triggered)

If manual review is triggered, there may be no card for some users. At this time, another method should be referred to: https://blog.xiaoz.org/archives/20041

By default, the debit card is sent by registered mail. You can ask for the logistics tracking number in "Navigation on the left side of the APP - Safe mailbox - Send English mail", and then inquire through the EMS number.

Domestic consumption

- If there are users who apply for 360 debit card, they can swipe the card or use ATM in China (there is a service charge, which is not recommended)

- After updating "OCBC Digital" to the latest, you can scan the merchant UnionPay code for consumption, or scan Alipay collection code for consumption

The blogger scanned the Alipay collection code for consumption in person. There is no service charge, but there is 2% exchange loss, which is suitable for temporary emergency use and not suitable for large consumption.

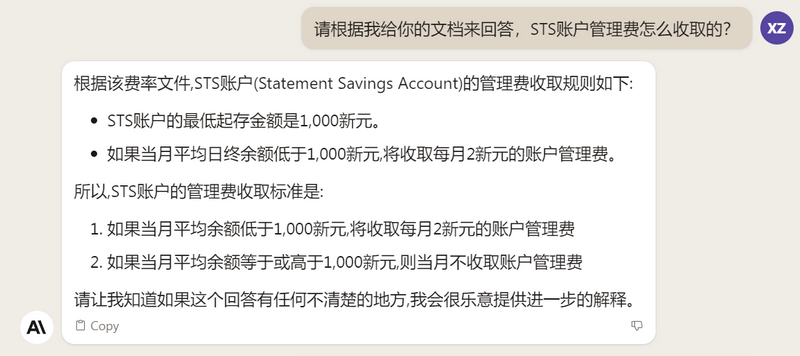

About management fees

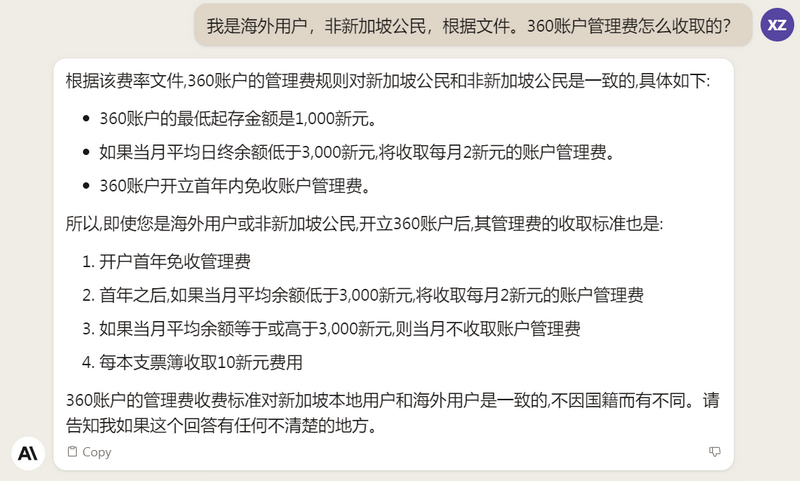

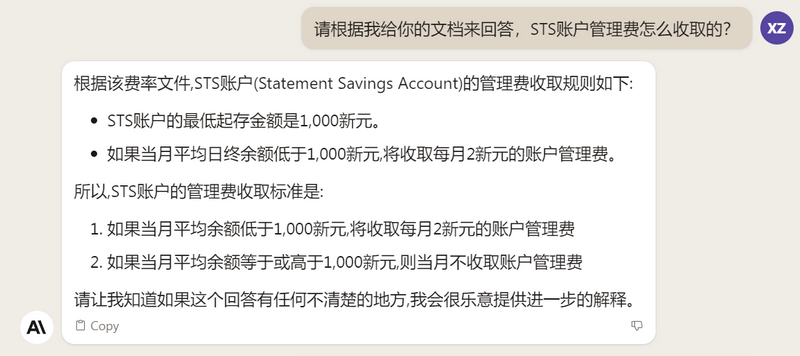

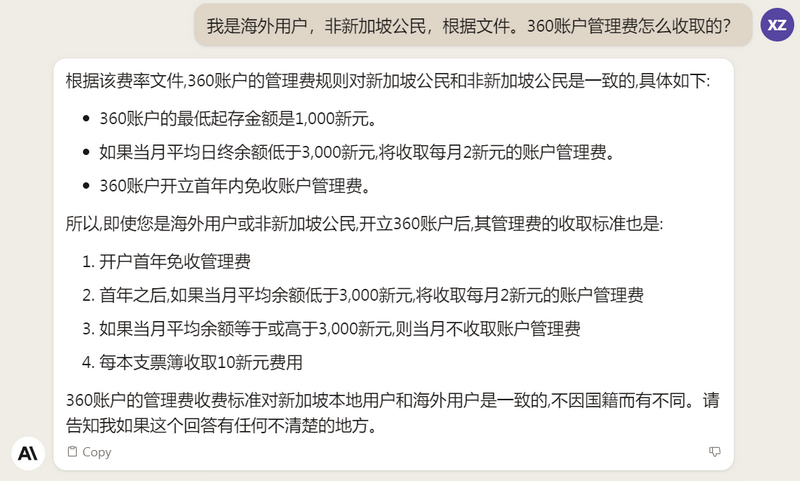

I downloaded a PDF file of the fee description from the OCBC official website, and then let Claude Help me interpret and get the following reply:

Note that the above fee indicates that Xiaoz did not verify it, and cannot ensure that it is correct.

summary

- Mainland Chinese users can use "OCBC Digital" to apply for Singapore OCBC bank accounts, using the invitation code:

UZ48FDOS 15 SGD bonus can be obtained (a single remittance of more than 1000 SGD within 30 days is required) - The account with the same name must be activated for the first time. It is recommended to use Bank of China or ICBC (only applicable to users whose names are 2 Chinese characters)

- After the OCBC account is activated, Panda Express can be used to deposit money into the OCBC STS account. Panda Express Invitation Code:

ten million nine hundred and forty-seven thousand one hundred and thirty-eight - If you need to apply for an OCBC debit card, you need to go to the webpage version to change your address first, and then apply for 360 Account. When applying for 360 Account, you should not choose to be self-employed

- The accounts of OCBC are basically free of management fees in the previous year, and management fees will be charged if they fail to meet the minimum deposit requirements one year later

If you have other questions, please leave a message to discuss and take shelter together.

TG card playing communication group, welcome to add group communication: https://t.me/usecardone