In recent years, people's requirements for the kitchen environment have greatly increased, especially in the modern kitchen represented by the open kitchen. The traditional range hood has been unable to meet the demand in terms of smoke extraction, space matching, etc. With the new generation of young people gradually becoming the main force in the consumption of kitchen appliances, traditional cooking stoves are far from meeting the needs of the new generation of young people, and integrated products have been increasingly recognized by consumers. For the future, both traditional brands and later newcomers are striving to develop. After the test of the epidemic, how about the performance of the boss, Meida and Martians? Let's see.

1、 Focus on logic

As the leader of the kitchen appliance industry, Electric Appliance has always been the representative of good students in our eyes. In the past ten years of industry rotation development, the boss of electrical appliances has made timely changes and seized the opportunity. The company can be very prescient at different stages, grasp market changes, take the lead in vigorously developing e-commerce channels when e-commerce development accelerates, and gradually layout engineering channels before the outbreak of fine decoration.

In the 2020 annual report of Boss Electric Appliances, we can see that the company has undergone significant changes in product revenue categories in the past 20 years and 19 years: the proportion of traditional steamers and ovens in the second category group has further declined, and instead, the proportion of the revenue of the steam baking machine has quadrupled; Dishwashers in the third category are also growing very fast. Although the revenue growth rate of integrated stoves has also reached 22.25%, the volume is still relatively small, and the revenue of integrated stoves only accounts for 3.19% of the overall revenue in 2020. More than 70% of the operating income is still on traditional stoves.

However, we can see that the growth of traditional stoves is weak only by relying on the incremental market. From the rapid growth of the steam baking machine, it can be seen that the future integrated, integrated, intelligent and healthy products will become a new growth point.

Compared with the sluggish growth of traditional stoves, the annual compound growth rate of integrated stoves sales from 2021-2025 is expected to be 15%, far exceeding the average growth rate of the traditional kitchen appliance industry. Especially in recent years, the development of traditional kitchen appliances has been flat due to the continuous regulation of real estate. From the perspective of market penetration, the proportion of integrated cooker products in the tobacco cooker market has increased year by year, but the penetration rate is still at a low level: 2017-2019, the sales of integrated cookers in the domestic kitchen appliance market accounted for 5%, 9% and 11% of the total sales of tobacco cooker products, respectively. Considering the core competitiveness of products and product popularity, the penetration of integrated cookers in the kitchen appliance industry will further expand in the future.

Compared with traditional stoves, integrated stoves have incomparable advantages in terms of smoke extraction, noise reduction, space saving, integrated design, etc., which can better meet consumers' requirements for high-quality kitchen life. Integrated stoves are a direct replacement for traditional stoves. Small and medium-sized families will consider more functional needs such as space utilization and sound interference. Integrated stoves integrate the functions of cigarette machines and stoves with disinfection, steaming and baking, significantly saving kitchen space, providing opportunities for adding other small appliances and increasing storage space, meeting the living needs of small and medium-sized families.

From the point of view of end consumers' concerns, the focus of attention on the functions of integrated stoves is now on higher level products such as steamers, dishwashers, and steaming and baking. Compared with the basic functions of disinfection cabinet and storage cabinet, the unit price and gross profit rate of steam box functional products are higher, and the product structure of integrated stoves is also significantly upgraded.

The continuous increase of revenue and market share of Zhejiang Meida and Martians in recent years can reflect the continuous improvement of the substitution effect of integrated stoves on kitchen appliances.

Revenue classification of Zhejiang Meida

Martian revenue classification

Judging from the classification of the revenue products of Zhejiang Meida, the leading enterprise of the two integrated stoves, and Martians, the growth rate of Martians' integrated stoves is very fast.

The transcripts of 2020 have been released. This time, we will compare the traditional good student boss electric appliance with the new top students Zhejiang Meida and Martian on the financial data to see who can be elected as the "three good students" of this year.

2、 Comparison of basic financial data

1. Company performance

In 2020, Boss Electric will achieve an operating revenue of 8.129 billion yuan, up 4.74% year on year; Deduct 1.585 billion yuan of non net profit, up 4.46% year on year. The operating revenue in the first quarter was 1.908 billion yuan, up 50.77% and 14.94% year on year compared with the first quarter of 2020 and 2019, respectively; Non net profit deducted was 322 million yuan, up 70.01% and 17.09% year on year respectively from 2020 and the first quarter of 2019.

In 2020, Zhejiang Meida realized an operating revenue of 1.771 billion yuan, up 5.13% year on year; Deduct non net profit of 542 million yuan, up 19.01% year on year. The operating revenue in the first quarter was 369 million yuan, up 229.25% and 27.2% year on year respectively compared with the first quarter of 2020 and 2019; Deduct non net profit of 100 million yuan, with year-on-year growth of 405.15% and 38.6% compared with 2020 and 2019, respectively.

Martians will achieve an operating income of 1.614 billion yuan in 2020, with a year-on-year increase of 41.71%; Non net profit deducted was 258 million yuan, up 16.89% year on year. The operating revenue in the first quarter was 349 million yuan, an increase of 179.79% over the first quarter of 2020; Deduct non net profit of 37 million yuan, a year-on-year increase of 415.38% over the first quarter of 2020.

From the perspective of the total amount of revenue and non net profit deducted, the boss of kitchen appliances is the top one, far more than other boys. But looking at the growth rate, the younger brother of the integrated cooker is growing faster. However, if the boss looked at the integrated cooker business alone, the operating income of the integrated cooker in 2020 was 259 million yuan, with a growth rate of 22.25% compared with 2019.

2. Profitability

From the perspective of gross profit rate, the boss's electrical appliances are still rising steadily year by year. The epidemic situation was catalyzed, and the online channel of the boss's electric appliance showed outstanding performance, and the profitability of single products was improved. As the company's multi-channel market share is the first, it can flexibly transfer some products to the online market. The online direct marketing mode has pushed up the gross profit margin, and the retail sales of online kitchen appliances increased by 9.1% compared with the same period last year; At the same time, the company positioned itself as a high-end brand, and the profitability of single products continued to improve. In 2020, the gross profit margin of range hoods and gas stoves, the main sources of revenue, increased by 1.12% and 3.13% compared with 2019. The gross profit rate of the company has steadily increased.

The gross profit rate of Zhejiang Meida and Martians was significantly affected by the epidemic, and there was a significant decline in 2020 and the first quarter of 2021.

Raw materials have continued to rise since the second half of 2020. For the kitchen appliance industry, raw materials account for more than 80% of the operating costs. Therefore, the price fluctuation of raw materials will directly affect the company's product costs, thus affecting the company's profitability. In the fourth quarter of 2020, the prices of main raw materials have risen sharply, which will exert certain pressure on the operating performance of each company.

From the perspective of net interest rate, Zhejiang Meida's net interest rate is the highest, reaching 30%. It is far higher than Martians in the integrated stove industry. The net interest rate of BOSS Appliances is relatively stable, which remains around 20% all the year round. However, with the continuous rise in the price of raw materials, more expenses for discount and promotion, and the company's demand for channel expansion, the company's net interest rate may suffer from considerable pressure.

3. Debt repayment

The asset liability ratio of Martians declined relatively quickly, the asset liability ratio of Zhejiang Meida was the lowest, and the asset liability ratio of Boss Electric was stable at about 30% all the year round.

4. Interest free debt ratio

The interest free debt ratio of Zhejiang Meida is increasing year by year. At present, the interest free debt ratio of Zhejiang Meida and Boss Electric is about 60%, which indicates that the two companies have strong voice and control over upstream and downstream enterprises, while Martians are weaker.

5. Operational capability

From the perspective of total asset turnover rate, Martians have the highest total asset turnover rate, Boss Electric has the lowest total asset turnover rate, and it has declined significantly year by year, while Zhejiang Meida's total asset turnover rate is rising year by year.

26.96% of the boss's electrical revenue is from agency companies and 22.58% is from engineering channels, so the turnover days of accounts receivable are relatively long. The turnover days of accounts receivable of Zhejiang Meida is the smallest.

The number of days of inventory turnover is also the highest for Boss Electric and the lowest for Zhejiang Meida.

6. Three fees

The sales expense rate of Boss Electric Appliances is the highest, reaching 32.23% in the first quarter of 2021. Zhejiang Meida has the lowest sales expense rate.

The management expense rate of Boss Electric is relatively stable, always between 6% and 7%. In the first quarter of 2021, the management expense rate of Martians is the highest and that of Boss Electric is the lowest.

The financial expense ratio of the three companies is relatively good, and the financial expense ratio is negative. At present, the boss has the lowest rate of electrical appliances, and Martians have the fastest rate of decline.

7. Aging structure of accounts receivable

From the perspective of the aging structure of accounts receivable, Martians have the best aging structure. More than 99.9% of the accounts are aged within one year, and the risk of bad debts is relatively small. Boss Electric has different accounting periods due to its diversified channels, but more than 90% of the accounts are aged within one year. Zhejiang Meida has a higher proportion of accounts aged 2-3 years and above.

8. R&D investment

In 2020, the total R&D investment of Boss Electric Appliances is the highest, but the R&D expense rate is declining year by year. The R&D expense rate of Zhejiang Meida and Martians rose rapidly, and the R&D expense rate of Martians in the first quarter of 2021 was the highest.

9. Cash flow trend

The cash flow of the three companies is good, and Zhejiang Meida is more stable. The operating cash flow of Martians in the first quarter of 2021 is negative.

10. Dividend yield

The annual report distribution plan of Boss Electric in 2020 is 5 yuan for 10 shares;

Zhejiang Meida's 2020 annual report distribution plan is 6 yuan for 10 shares;

The distribution plan for Martians' 2020 annual report is 6 yuan for 10 shares.

In contrast, Zhejiang Meida has a higher dividend yield.

11. Purchase and sale of important shareholders

In recent years, there has been no senior shareholder trading of Boss Electric.

The senior executives of Zhejiang Meida reduced their holdings frequently.

Martians just came into the market last year, and it is not time to lift the ban.

12. DuPont analysis

The decline of return on equity of BOSS Appliances in 2020 is mainly due to the decline of asset turnover rate and the small decline of net sales interest rate.

The slight increase of asset turnover and equity multiplier in the first quarter of 2021 led to the increase of return on equity.

The increase of return on equity of Zhejiang Meida in 2020 is mainly due to the increase of net sales interest rate.

In the first quarter of 2021, the sharp rise in the return on net assets is also due to the sharp increase in the net sales interest rate.

In 2020, the return on purified assets of Martians declined significantly, mainly because the asset turnover and equity multiplier declined significantly.

In the first quarter of 2021, the YoY rise in the return on net assets is mainly due to the significant increase in the net sales interest rate.

Compared with the return on equity of the three companies, the downward trend of Martian and Boss Electric is obvious, showing a downward trend year by year. The return on equity of Zhejiang Meida is rising year by year, and the return on equity of Zhejiang Meida is the highest in the first quarter of 2021.

13. Valuation

The valuation of Boss Electric is currently above the low order line.

The valuation of Zhejiang Meida is also above the low order line.

Martian estimates are currently below the low water mark.

14. Summary:

Comparing the three companies, we can conclude as follows:

(1) From the perspective of total operating income and net profit, Boss Electric is the appropriate leader in the subdivided industry. However, from the perspective of the growth rate of revenue and net profit, the boss appliance is obviously weak, and the rising star of integrated cooker has a stronger growth momentum.

(2) The gross profit rate of Boss Electric is the highest, the net profit rate of Zhejiang Meida is the highest, and Martians have the lowest gross profit rate and net profit rate.

(3) The asset liability ratio of Zhejiang Meida is the lowest, but the interest free debt ratio is relatively high. Martians have the highest asset liability ratio, but the rate of decline is relatively fast. Martians have the lowest interest free debt ratio.

(4) The turnover rate of total assets of Martians and boss appliances are showing a downward trend year by year. The turnover rate of total assets of Zhejiang Meida is gradually rising.

(5) Accounts receivable and inventory turnover days of BOS Electric are much higher than those of the other two companies. In addition, the accounts receivable and inventory turnover days of the boss and Martians have increased significantly year by year, compared with that of Zhejiang Meida.

(6) In terms of sales expense rate, Zhejiang Meida is also far lower than the boss Electric Appliances and Martians. The sales expense rate of Boss Electric in 2020 and the first quarter of 2021 increased significantly.

(7) The management expense rate of Boss Electric is relatively stable, the Martian management expense rate fluctuates greatly, and the management expense rate of Zhejiang Meida is gradually declining every year.

(8) The financial expense rate of Boss Electric is the lowest, and Martians' financial expense rate drops faster.

(9) In terms of aging structure, 99.9% of the accounts receivable of Martians are within one year, and the accounts receivable of Zhejiang Meida over two years account for a higher proportion.

(10) The total R&D amount and R&D expense rate of Boss Electric are both the highest, and the R&D expense rate of Zhejiang Meida and Martians is rising rapidly year by year.

(11) The cash flow of the three companies is good, and Zhejiang Meida is more stable.

(12) In terms of dividend yield, Zhejiang Meida has the highest dividend yield.

(13) In terms of return on equity, Zhejiang Meida performs better, with an obvious upward trend year by year, while the return on equity of Boss Electric is declining year by year.

(14) The current valuations of the three companies are not high. The valuations of Boss Appliances and Zhejiang Meida are above the low line, and the valuations of Martians are below the low line.

3、 Summary

After the above financial analysis, I wonder who will be the new "three good students" in the kitchen appliance industry. Is it the former good student boss Electric Appliance, or the new rising star Zhejiang Meida, or the Martian who just came last year?

Next, let's continue to look at the future development trend of the kitchen appliance industry.

With the construction of a new development pattern with domestic circulation as the main body and domestic and international double circulation promoting each other, China's super large domestic demand market will continue to promote the consumption growth of the middle class and young people.

According to the statistics of the Bureau of Statistics, the first and second tier cities in China are dominated by small and medium-sized houses (generally speaking, houses with a floor area of less than 90 m2 are small, 90-144 m2 are medium, and those with a floor area of more than 144 m2 are large). Top domestic real estate enterprises, such as Poly Real Estate, focus on rigid and improving needs, and adhere to the product strategy of focusing on small and medium-sized ordinary houses. According to Vanke's sales data, in 2019, the proportion of small and medium-sized houses with a floor area of less than 144 square meters dominated by self occupancy accounted for 91.2%, which has remained above 90% in recent years.

Small and medium-sized families will consider more functional needs such as space utilization, environmental protection, noise and smell interference. The available kitchen space of small and medium-sized residential buildings is generally small (according to the research of Zhongyikang, 44.9% of the users with a kitchen area of less than 8 square meters in China, and small kitchen space is the main problem). The traditional range appliances occupy large space, and the top cabinet space is squeezed, while the integrated range appliances are the same as the disinfection cabinet, oven The integration of multiple functions, such as steam box, significantly saves kitchen space, provides opportunities for adding other small appliances and increasing storage space, and meets the living needs of small and medium-sized households.

It is obvious that integration is definitely the trend of kitchen appliances in the future. In the past, due to its small size, the integrated cooker was less affected by the prosperity of the real estate market, and has always maintained a growth above the industry average. With the continuous expansion of the market scale of integrated stoves and the improvement of product popularity, the relevance with real estate will gradually increase.

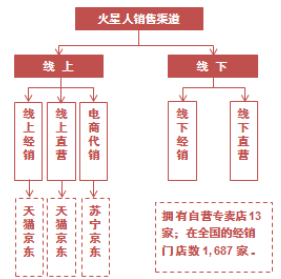

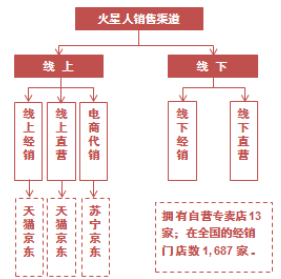

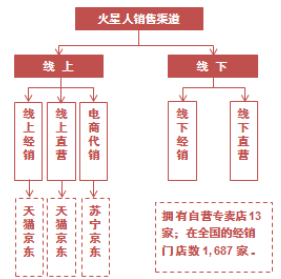

Meida, Martian and other manufacturers mainly engaged in integrated stoves have a single sales channel. The sales model is dominated by the distribution model (including online and offline), with the distribution revenue accounting for about 80% - 90%. Other models such as direct sales, KA, and engineering channels account for a small proportion.

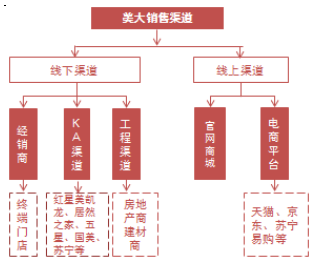

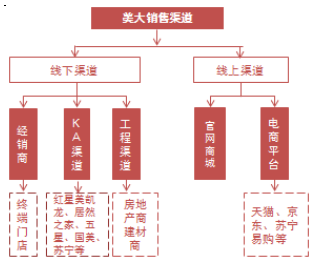

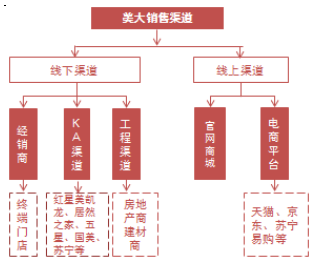

The sales channels of Boss Appliances are mainly divided into three channels: offline retail (KA, franchised stores), e-commerce (Tmall, JD, Suning, etc.), and engineering fine decoration (national and regional developers).

In recent years, new brands of integrated cooking stoves have emerged constantly, and even the leading brands have limited control over channels.

We can see from the 2020 annual report of Boss Electric Appliances that the proportion of integrated products of Boss Electric Appliances is also gradually increasing. The entry of traditional kitchen appliances and integrated household appliances brands will use their perfect channel layout and mature marketing methods to promote the popularity of integrated cooker products, improve consumers' awareness of integrated cooker products, and make integrated cookers gradually grow from niche products to mass consumer products, which is a catalyst for the expansion of the industry scale.

In July 2018, Boss Electric officially signed a contract with Jindi Integrated Cooker, holding 51% of the shares of Jindi. The two sides worked together to create the integrated cooker market. Several key executives of Boss Electric filled into Jindi, and Boss Electric entered the first high-end brand in the integrated kitchen electric industry. In May 2019, the grand slam integrated cooker of steaming and baking was released. Since then, we have built our own complete product line of integrated cooker of steaming box, launched the product series of "steaming box family", and pushed the industry into the era of steaming.

In June 2019, an investment of 1 billion yuan was made to build an intelligent integrated kitchen ecological industry, and an intelligent integrated kitchen research and development center, a national standard laboratory, an intelligent factory, a brand operation center, and a customer experience hall were established. The project is expected to be completed in 2021.

Zhejiang Meida has significant competitive advantages in products and channels. On the product side, Zhejiang Meida's sales scale is far higher than that of other competitors, which has brought obvious scale effect to the company, and its cost control ability is stronger. The company's high-end positioning and high-quality product quality give the company a higher brand premium, and its profitability is higher than other competitors; On the channel side, Midea has a dense network of outlets, and the strength and operation ability of dealers are stronger than those of competitors. In terms of categories, the company has continuously upgraded its products and laid out new products in new fields, and has continuously launched a series of new kitchen appliances such as integrated sinks, steamers, ovens, dishwashers, cabinets, etc. Therefore, in the new cake of integrated kitchen appliances, whether it is integrated kitchen appliance enterprises that seize the share of traditional kitchen appliances or traditional kitchen appliances that use channel advantages to quickly occupy the integrated market, R&D is very important, and speed is also very important. Whether Boss Electric can continue to be elected as the "Three Good Students" depends on whether he can make rapid efforts in the direction of integration and intelligence.

4、 Industry research summary

1. The epidemic has accelerated the evolution and innovation of kitchen appliances. Health, intelligence, integration and scene have become the key words of product development, which are mainly reflected in three aspects: first, the iteration of single products is accelerated, and the product forms are diversified and the functions are stronger; Second, the integrated kitchen solution represented by the suite and integrated kitchen began to heat up. The third is the hot sale of health products represented by dishwashers, disinfection cabinets and embedded steaming and baking machines.

Integrated stoves, embedded all-in-one machines, and sink dishwashers, including integrated dishwashers, have an average annual growth rate of 30% from 2016 to 2020, or a compound annual growth rate of 34%.

2. The key problem to be solved by kitchen electricity integration technology products is the contradiction between people's demand for functional expansion of kitchen appliances and kitchen space.

3. There is an inevitable substitution relationship between integrated stoves and split smoke stoves. If we regard split smoke stoves as 100%, integrated stoves will only account for 1.8% of them in 15 years, 6% in 20 years, and 6.6% in 21 years.

4. Capital is constantly pouring into the integrated cooker industry, but the position of the leading enterprises is not stable.

There are about 130 brands in 2016 and about 260 brands by 2020. The whole market fluctuates greatly. In addition to the relatively stable Martians, the top 10 e-commerce brands change their status every year from the second to the tenth.

By channel:

In the offline channel, Meida has a relatively stable advantage in this channel, which accounts for more than 20% annually. There are two offline brands growing very fast this year, namely Martian and Midea.

In addition, the building materials channel is also quite leading at present, with a share of nearly 20%. In addition, we can see that Martians only have a market share of more than 10% with Meida. Fangtai's integrated cooking center has grown significantly in building materials channels in the past 20 years, and its current share is about 8%.

By brand:

Meida's first mover takes advantage of offline customer base. The influence of the Midea brand is obvious in the industry. It has a strong user group, which is the middle-aged and old user group. Everyone has a strong sense of trust in this brand. In addition, it has a very large offline.

Martians overtook in three ways. A starts with e-commerce and uses the opportunity of e-commerce Internet development to let consumers know about integrated cooking range categories. In terms of product function, it has grasped a current consumer trend. In the past, the combination of storage cabinets or disinfection cabinets was more traditional, but now we can see more steam boxes or steam baking products. This is to meet the needs of people's choice of product functions, including appearance, which is aesthetically prominent. C The design of Martian appearance is very suitable for young people today. The whole play method is also suitable for young people. His team is very young, so the younger the team, the better able to grasp young people.

The most prominent comprehensive brand is Midea. Midea now has a very prominent competitive advantage, especially online. Last year, it was online, and this year, both online and offline.

I don't know whether the boss's current situation is ink or loneliness. I only know that the boss has been sharpening his knife, but I can't see him.

5. Due to the limitation of building standards, the permeability of integrated stoves in the first and second line is not high, and they occupy a small proportion in engineering channels. It is mainly due to the limited installation environment. At present, the public flue of commercial housing in the first and second tier cities is usually opened at the upper opening, but the integrated cooker needs to smoke down, so its installation is limited. We can see that at present, Zhejiang Province requires lower smoke exhaust settings for residential standards, but there is no such requirement nationwide. Due to the restrictions of the construction standards in the first and second tier cities, the penetration rate of integrated stoves in the first and second tier cities is not particularly high at the early stage, so it is more suitable for bungalows. The key breakthrough point of the integrated cooker market in the future depends on the update of the smoke exhaust standard under the residential standard.

6. The integrated cooker project accounts for a very low proportion of the whole market, and the price is also a part of the reason. Because of the split products, individual enterprises do projects for 1000 or 2000 yuan, and the brand is relatively large. However, if the integrated cooker is made by a leading enterprise, the ex factory price will cost about 4000 yuan on average.

reflection: In the future, the logic of the real estate supporting kitchen appliance front loading market is still in fine decoration. The boss's advantage lies in the engineering channel, and the engineering channel is stuck in the standard. If the future standard is broken through, and depending on the strength of the brand and the reserves in the steam oven and the cleaning integrated stove, will the boss's appliances in turn crush the new stars like Midea and Mars? (Source: Buffett Reading Club)