Layout of fund companies

MSCI funds (separate statistics for feeder funds)

At the end of the first quarter of 2018, 497 index funds (excluding feeder funds) in the whole market totaled 482.414 billion yuan, up 1.59% from the end of the previous quarter.

China Fund News reporter Li Husheng

According to Shenwan Hongyuan's research report, at the end of the first quarter of 2018, 497 index funds (excluding feeder funds) in the whole market totaled 482.414 billion yuan, up 1.59% from the end of the previous quarter. In the view of fund companies, after the introduction of various new regulations, index funds have a great opportunity for development. This is not only a market where large companies can participate, but also a market where small and medium-sized fund companies can break through.

Index funds become the focus

Since 2018, the equity market shocks have to some extent dragged down the performance of fund performance. From the performance of A-share market mainstream index, as of May 31, the GEM index with the best performance also fell 0.51%.

Nevertheless, the scale of index funds still increased. According to Shenwan Hongyuan's research report, at the end of the first quarter of 2018, the scale of 497 index funds (excluding feeder funds) in the whole market totaled 482.414 billion yuan, up 1.59% from the end of the previous quarter.

The product director of a large fund company in Shanghai said that this year, thanks to the implementation of a number of policies, index funds can find good opportunities for development regardless of the constraints or promotion of the market. In its view, the most fundamental positive is that MSCI's inclusion of A-shares into the underlying market has triggered a series of related index fund reporting boom.

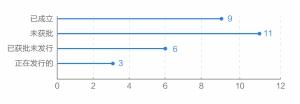

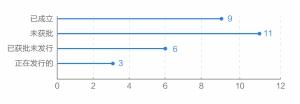

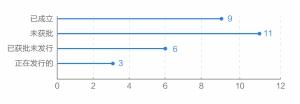

According to Wande data, 9 MSCI related index funds have been established this year, with a cumulative issuance scale of nearly 14 billion yuan. In the administrative approval process of the CSRC, there are 11 related funds waiting for approval, and many other funds have been approved for issuance.

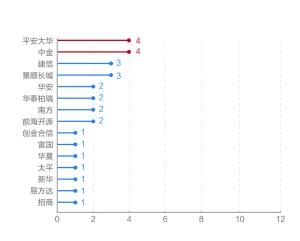

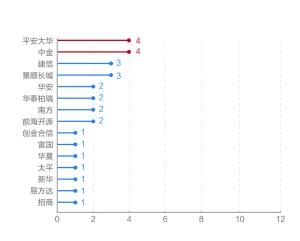

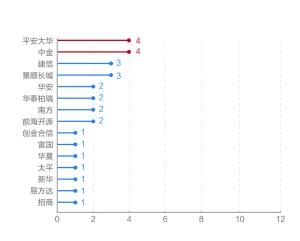

It is not difficult to find from the list that in this feast of MSCI funds, not only large fund companies including E Fund, Nanfang, CCB, etc. actively participated, but also some small and medium-sized fund companies appeared, such as Taiping, CICC, etc., and CICC even applied for four MSCI and related feeder funds at one time.

In the view of the market department of a small fund company, index funds will become the focus of the company's next development. In the opinion of this person, applying for index fund products is one of the better ways for small and medium-sized fund companies to break out of the encirclement at present. "Whether companies previously focused on special account business or fund companies relying on outsourcing, under the background of major policy changes this year, the original way of breaking out has narrowed."

At the same time, he also pointed out that index funds can play the role of a tool to fill the gaps in the allocation of some large fund companies. In addition, lower fees can also reduce transaction costs and attract more investors. "The most important thing is that with the pace of internationalization, the development of index funds is inevitable."

It is difficult for small companies to break through through the index

However, there are still difficulties for small and medium-sized fund companies to break through. Public information shows that index funds have been approved successively, especially the competition of the same subject is particularly fierce. At present, most mainstream index targets have been distributed, and small and medium-sized fund companies have to develop differently as far as possible.

Such differentiation is mainly reflected in the fact that the more core target index is selected from the existing targets in the market for tracking. Maybe the weight and trend are not as good as the mainstream index, but they still have their own positioning.

As stated by the above product director, with reference to the development of tiered funds, investors have certain needs for instrumentalized products in the subdivided fields, which may also be due to the use of tiered fund leverage. However, after the implementation of the new asset management regulations, tiered funds will not survive, and the index layout of the subdivided fields may become a new breakthrough point for fund companies.

In addition, small and medium-sized fund companies are still difficult to solve the problem of low initial offering scale. Wande data shows that a fund company in North China has issued 10 fund products this year, half of which are index funds, and most of them are initiating products, with the establishment scale of about 10 million yuan. Similarly, in the issuance of MSCI related funds, the company's product initial offering scale is only 68.3658 million yuan, It is far from the scale of more than 1 billion or even billions of large fund companies.