On September 7, the digital market research and consulting organization Ai Analytics officially released the 2022 Chinese Small and Micro Enterprises SaaS White Paper (hereinafter referred to as the "White Paper"), which depicts small and micro enterprises and outlines their problems The market situation was introduced and analyzed, and the financial and tax integration market of small and micro enterprises was investigated in depth. The market status, business value and representative products were analyzed, and typical implementation cases of financial and tax integration of Baoshu Bank and Huineng Silicone were presented. Finally, the White Paper made a systematic judgment on SaaS and the trend of financial and tax integration.

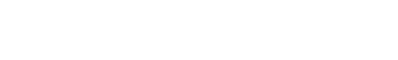

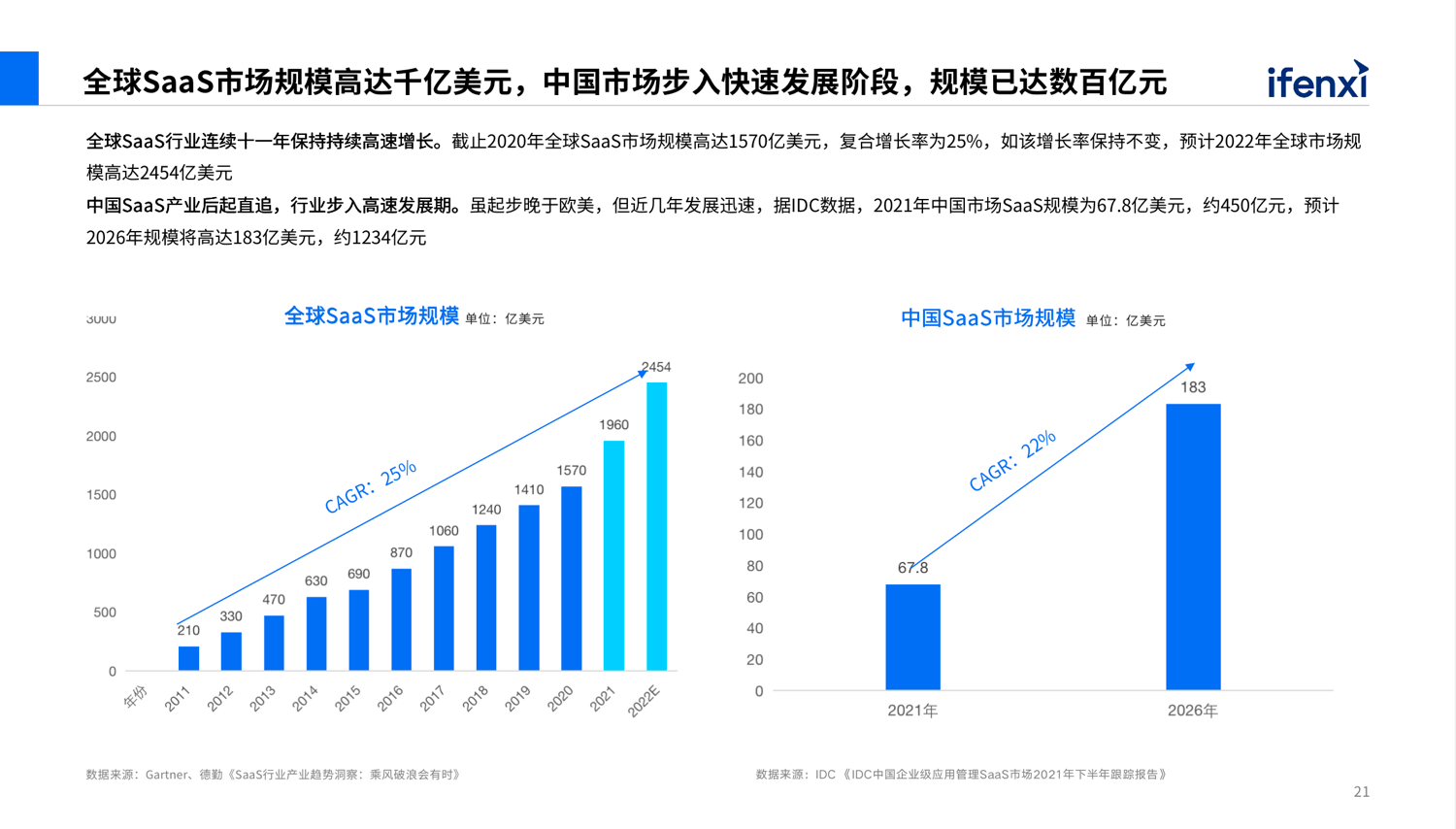

The White Paper proposed that at present, there are more than 10 general scenarios and multiple vertical scenarios in the domestic enterprise level SaaS industry, with an overall scale of tens of billions of yuan. The SaaS market size of small and micro enterprises has exceeded the 10 billion mark. With the popularity of SaaS penetration and industry finance and tax integration, the future SaaS market capacity of small and micro enterprises is expected to approach the scale of 100 billion yuan.

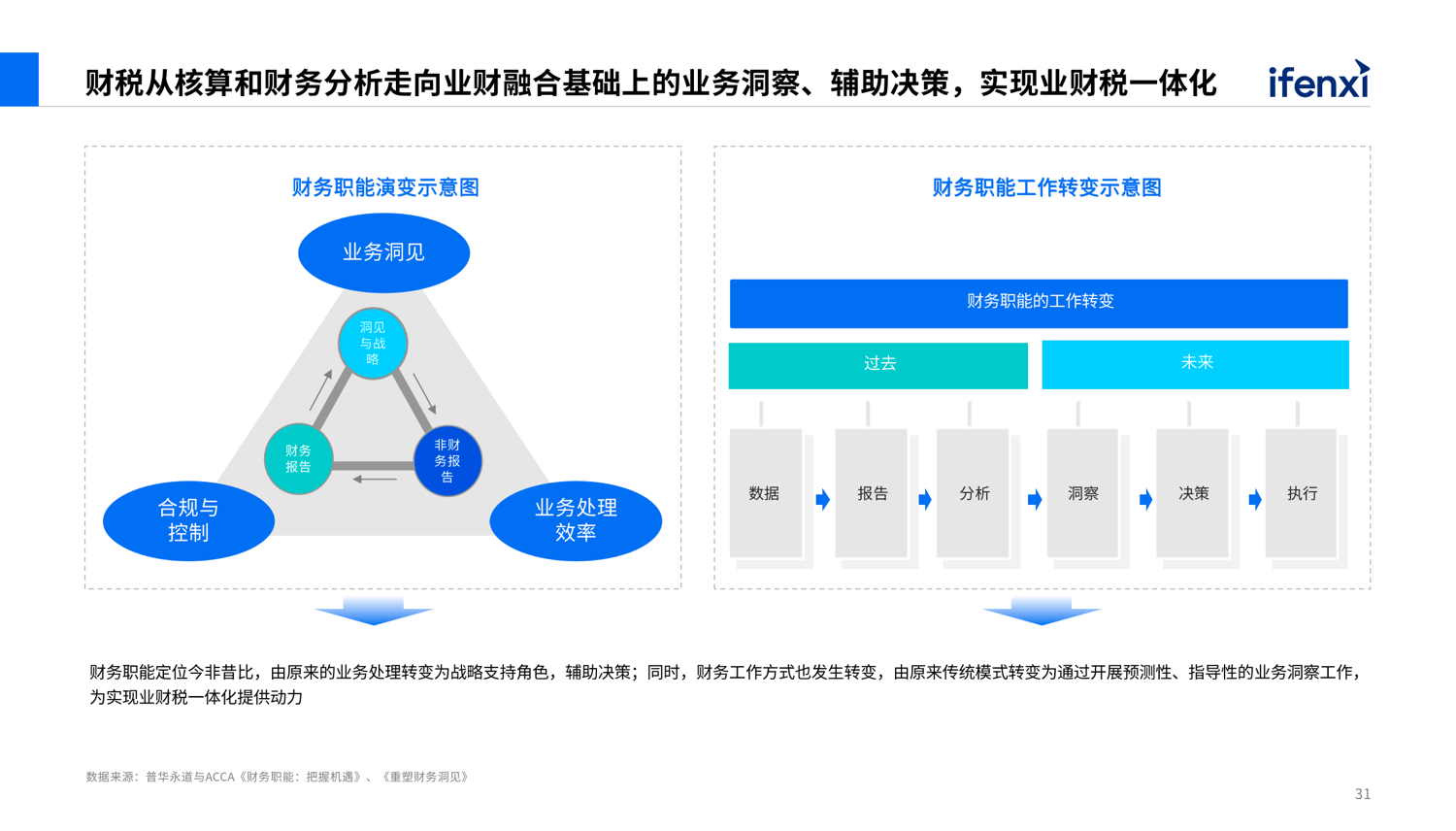

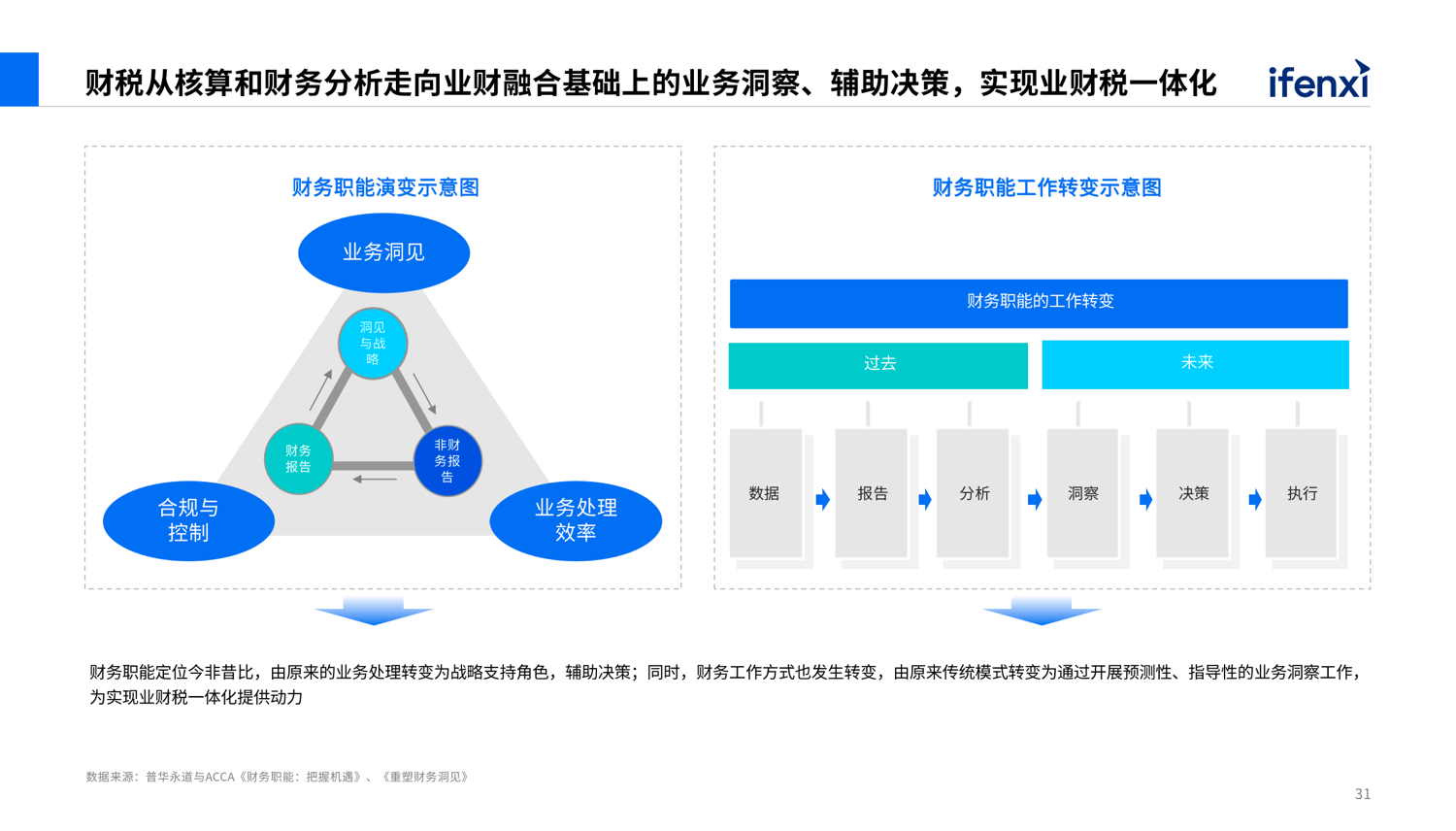

Although the domestic SaaS industry started around the turn of the century, later than that in Europe and the United States, after more than 20 years of development, it is in a period of rapid development as a whole. Among them, the business management category has basically been in a mature period, and the finance and taxation category is expected to take over the cooperative office, CRM and ERP, becoming an important field of the next wave of development. In enterprise practice, the financial function positioning has changed from the original business record and accounting role to the strategic support role, and the focus will shift to the auxiliary decision-making; At the same time, the way of financial work has also changed from the original traditional mode to the predictive and guiding business insight, which provides the original impetus for the realization of the integration of industry, finance and taxation.

According to the analysis and research of Ai, among the small and micro enterprises using SaaS, the penetration rate of industry finance and tax integration is close to 30%. The integration of industry, finance and taxation has achieved data connection, which can significantly improve the cooperation efficiency of various departments and the overall operation and management level of enterprises. Therefore, as the value is gradually recognized by the majority of small and micro enterprises, the penetration rate of industry, finance and taxation integration of small and micro enterprises in the Chinese market is expected to further increase.

In the whole SaaS software application, enterprises with a complete application chain account for 27.6% of the total business, financial and tax data, approaching 30%. If 15% of the SaaS market penetration rate is considered, it means that about 5% of small and micro enterprises have achieved the integration of industry, finance and tax, and there is huge space in the future. With the acceleration of SaaS penetration and integration of industry, finance and taxation, the number of small and micro enterprises that achieve integration of industry, finance and taxation will continue to increase rapidly.

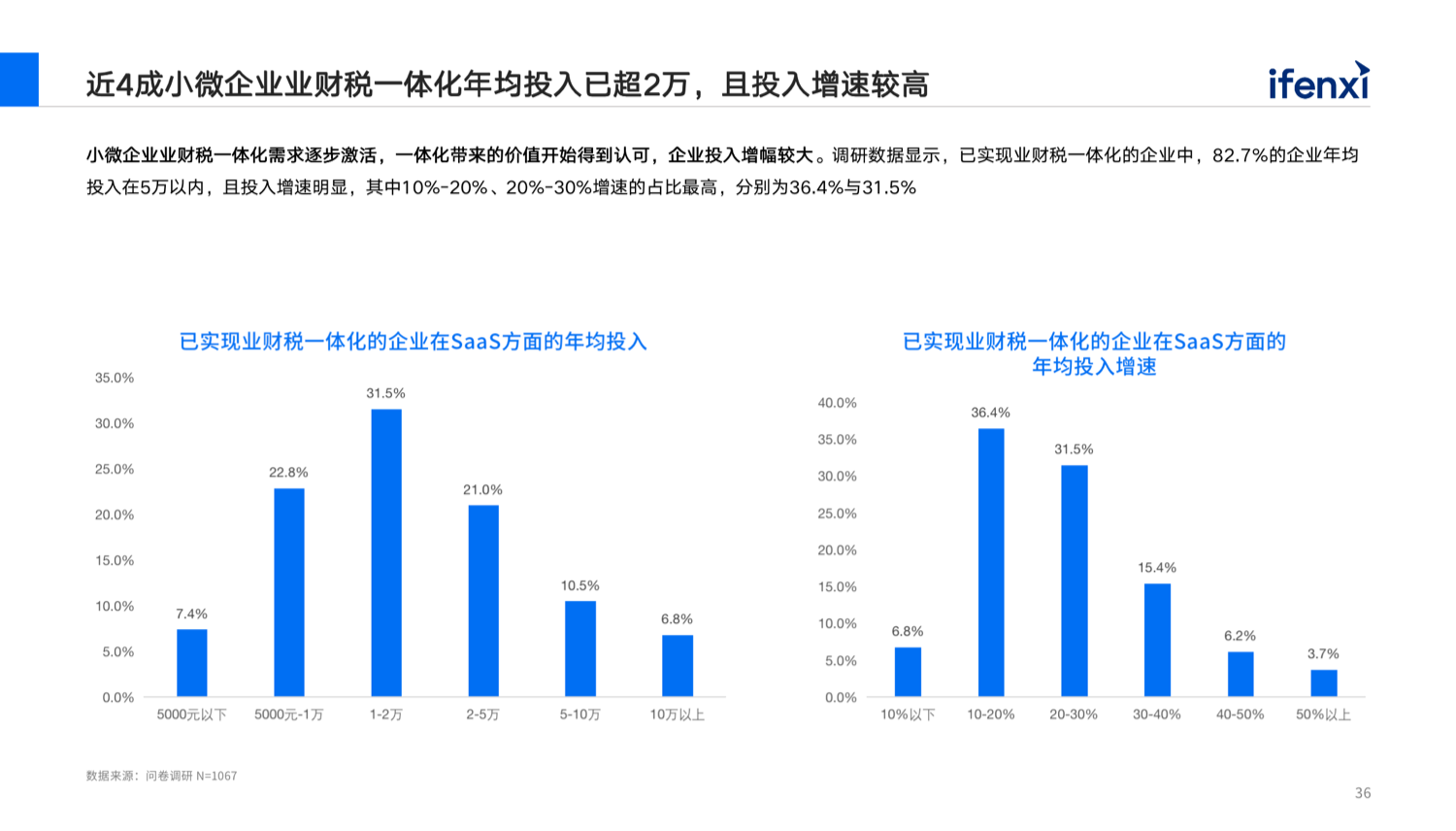

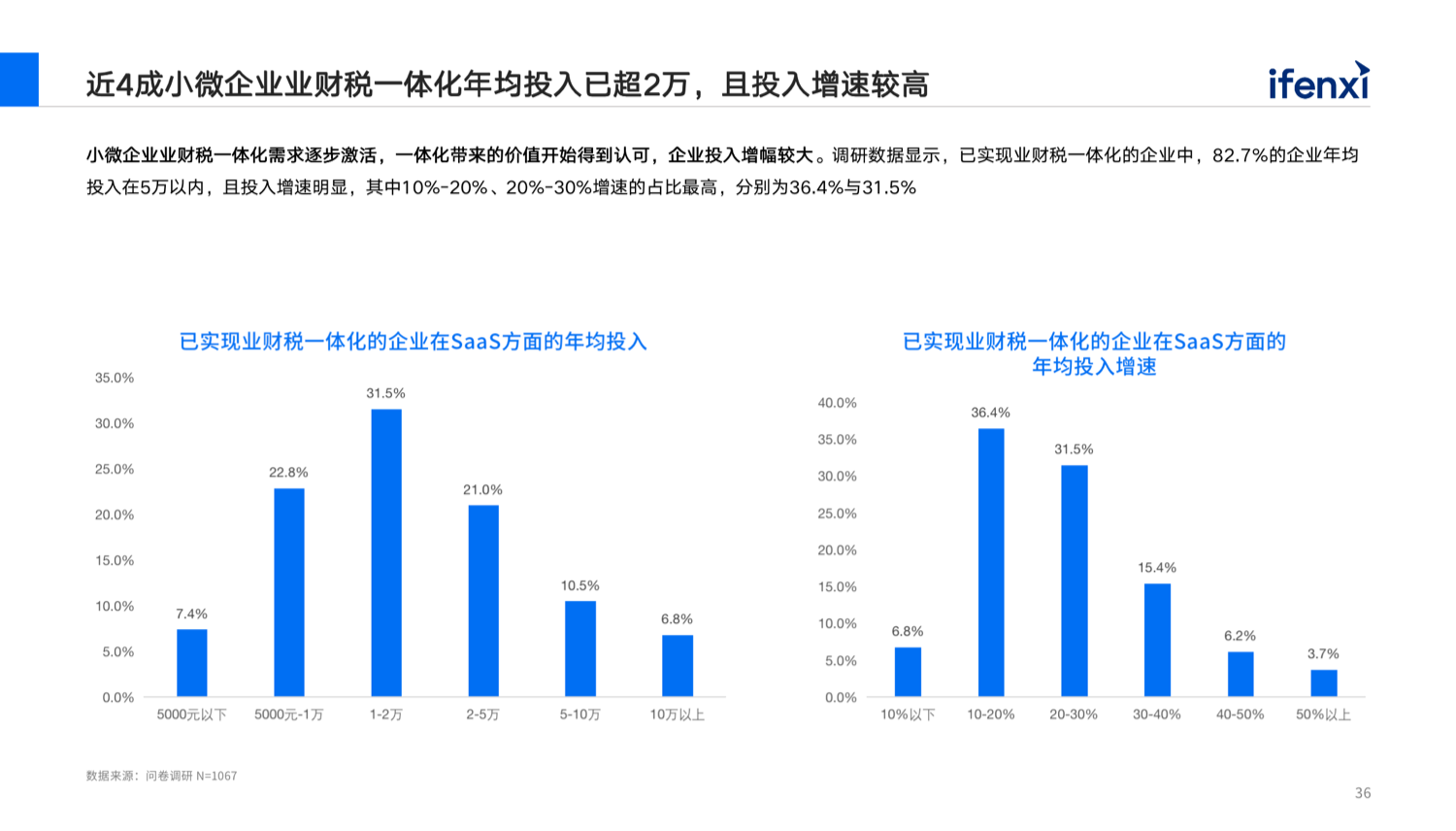

The demand for financial and tax integration of small and micro enterprises is gradually activated, the value brought by the integration is recognized, and the investment growth of enterprises is large. According to the survey data, 82.7% of the enterprises that have achieved the integration of industry, finance and taxation have an average annual investment of less than 50000, and the investment growth rate is obvious. Among them, the growth rates of 10% - 20% and 20% - 30% are the highest, accounting for 36.4% and 31.5% respectively. Nearly 40% of small and micro enterprises have an average annual investment of more than 20000 in the integration of industry, finance and taxation, and the investment growth rate is high.

According to the analysis and research of Ai, among the small and micro enterprises using SaaS, the penetration rate of industry finance and tax integration is close to 30%. The integration of industry, finance and taxation has achieved data connection, which can significantly improve the cooperation efficiency of various departments and the overall operation and management level of enterprises. Therefore, as the value is gradually recognized by the majority of small and micro enterprises, the penetration rate of industry, finance and taxation integration of small and micro enterprises in the Chinese market is expected to further increase.