Image source: Tu Chong's creativity

The development of cross-border e-commerce is hot, and the perfection of infrastructure construction represented by logistics and payment is often a constraint to rapid development. From the perspective of payment field, the popular payment methods in different countries/regions around the world may have something in common, but there are more or less differences.

For example, in the early years of Southeast Asia, cash payment was the main payment, accounting for more than 50%. COD (payment on delivery) was widely used in the field of e-commerce. In recent years, various electronic payments began to emerge; For another example, credit card payment has always been popular in Europe, America and other countries, and PayPal, Apple Pay, Google Pay and other electronic wallets are also popular.

No matter in Southeast Asia or Europe and the United States, an interesting and innovative payment method - BNPL has sprung up in recent years. BNPL refers to Buy Now Pay Later, which allows consumers to place orders first and pay after the arrival of goods. This is a short-term loan product with little or no interest. It is not only becoming popular in Europe and the United States, but also growing rapidly in Southeast Asia with the advantages of low threshold, convenience and so on, and has greatly promoted the expansion of global multinational electronic payment penetration.

If global e-commerce is a hot land with great development potential, Then the BNPL payment method represented by AfterPay is like an accelerator, adding to its rapid growth.

Recently, AsiaBill has reached strategic cooperation with AfterPay, a world-famous platform that pays after buying, to jointly bring merchants a new payment experience and help them double the number of orders.

About AfterPay

Photo source: Screenshot of AfterPay official website

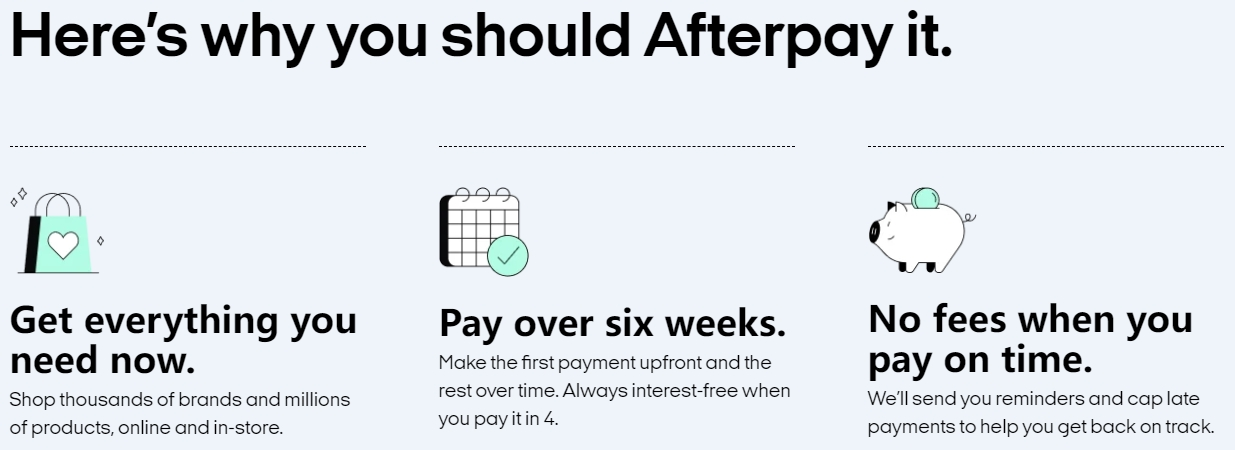

Photo source: Screenshot of AfterPay official website

AfterPay was established in Australia in 2014. It is essentially a consumer credit product, providing customers with a more flexible payment method, which is often referred to as buy before pay (BNPL).

Consumers who use AfterPay do not need to pay the full amount of the goods they buy. Instead, they can choose to pay four installments or monthly installments within a maximum period of 56 days. During this period, no interest and handling fees will be charged. The global recovery rate in advance or on time is 95%. Transparent spending restrictions and late fee ceilings are designed to increase the turnover of merchants, It also prevents consumers from overspending.

By the end of 2023, AfterPay has about 20 million users and about 144000 active merchants. In the PYMNTS research report on "Buy first and pay later" application program ”AfterPay ranks second among suppliers of. AfterPay is not only a leading buy before pay service provider in Australia, but also very popular in North America.

AfterPay's market share in the United States is about 25.9%. 29% of the surveyed consumers said they had used AfterPay payment service, and AfterPay has a network of more than 240000 merchants. 98% of the purchase fees did not charge late fees.

As a leader in the field of buy before pay, AfterPay has won the favor of millions of consumers around the world. Consumers choose to buy before pay when shopping, which will spread the payment pressure to the next few weeks. This flexible payment method has greatly improved consumers' willingness to shop, and is very suitable for cross-border e-commerce independent stations to increase the order volume and average order value.

AfterPay payment logic

Photo source: Screenshot of AfterPay official website

Photo source: Screenshot of AfterPay official website

BNPL's payment mode has become commonplace in the domestic market and is very popular with e-commerce, but it is in a booming period in the cross-border field and will be very large in the future.

To briefly understand the different modes of BNPL, take a $120 commodity as an example. BNPL has roughly two payment modes.

1、 The first installment is $30, and the payment will be $30 in two weeks, and so on until the payment reaches $120. It is similar to our Huabei interest free installment service.

2、 The first payment is $0, until the last day of the cycle is $120, and the consumption amount is repaid in a lump sum, which is similar to the service of buy before pay provided by Tmall and JD.

As an installment payment method, AfterPay's payment logic is more similar to the former. It provides interest free installments so that consumers can obtain goods without paying the full amount. Consumers with good reputation can not only be divided into 4 periods, but also have the qualification of 6 or 12 interest free periods.

The business model of AfterPay is also very clear and simple: while providing interest free installment payment for consumers, AfterPay will charge a commission from cooperative merchants at a certain rate based on the transaction volume. When a consumer purchases a commodity, AfterPay will first pay the full amount to the merchant, and then the consumer will repay AfterPay in four installments according to the unit price of the commodity. The repayment frequency is Fortnightly. Users who repay on time do not need to pay any interest and service charges during the repayment period.

AsiaBill & AfterPay

Image source: AsiaBill

Image source: AsiaBill

Now merchants can quickly integrate the BNPL payment method of AfterPay into your online store through AsiaBill. After integration, the use of AfterPay is also very simple.

When a consumer places an order at a merchant's online store to check out, he/she selects AfterPay as the payment method and fills in the payment information. After the payment is displayed, the consumer will be redirected to the merchant's website. After completing the purchase, the customer will receive an overview of AfterPay's payment via email.

New users who use it for the first time need to register on the AfterPay application and provide payment details, while old users can purchase by clicking. For users who consume large amounts of money, AfterPay can avoid tedious paperwork applications, and does not need to provide proof of income funds, which can greatly shorten the application time. For users with small consumption, it can also save the time required by the applicant for shopping.

Not only does the AfterPay platform itself have a huge user base, but this flexible payment method also greatly improves the purchasing power of users to a certain extent - according to statistics The number of unit goods sold by merchants offering AfterPay to consumers tripled, the average order value increased by 58%, and the return rate decreased by 18%. In addition, nearly 50% of consumers who bought first and paid later chose to continue using AfterPay after spending.

AfterPay's flexible installment payment method and convenient shopping experience have not only won consumers' favor, but also stimulated the significant growth of merchants' orders. It is a high-quality choice for merchants to expand payment methods. Now contact AsiaBill to access AfterPay to attract new consumer groups.

Contact AsiaBill Customer Service A to ask how to access AfterPay

Contact AsiaBill Customer Service A to ask how to access AfterPay

epilogue

In the wave of digitalization and sea going, cross-border e-commerce is experiencing unprecedented growth. In order to meet the growing shopping demand of global consumers, payment methods are also constantly innovating and evolving, especially in the current purchase decisions of global consumers, BNPL installment payment scheme plays an increasingly important role.

From the perspective of merchants, BNPL payment method reduces the pressure of one-time expenditure of customers, indirectly changes the budget of single consumption, making consumers more likely to purchase additional goods; Its convenience can also reduce the payment friction, so that the number of orders will increase; In addition, installment payment reduced the repayment pressure of consumers, which eventually led to an increase in stickiness and repurchase rate.

What is more worth mentioning is that at present, the global economy is declining, and the overall purchasing power of consumers is declining. BNPL has solved the problem of short term capital shortage of consumers by means of "no immediate payment" and "zero interest worry installment", which can better stimulate consumption, accelerate purchase decisions, and become an important force to drive the sustainable growth of e-commerce.

This time, AsiaBill's payment solution integrates the buy before pay function of AfterPay, which not only provides more payment options for brands and businesses, but also will attract more consumers, especially young consumers of Generation Z, and ultimately help businesses double the number of orders.

(Editor: Jiang Tong)

(Source: AsiaBill)

The above content only represents the author's own opinion, not Hugo's cross-border position! If you have any questions about the content, copyright or other issues of the work, please contact Hugo cross-border within 30 days after the publication of the work.