The cross-border "golden nine and silver ten" is just a short cut, but the tension in Q4 peak season has changed one after another.

While the market value of Amazon in North America has evaporated, the continuous changes in logistics have not made it easier for sellers:

The market freight is at a high level, and the transport standard rate continues to fluctuate. The lack of unilateral transport capacity of sea, land and air makes cross-border export more difficult.

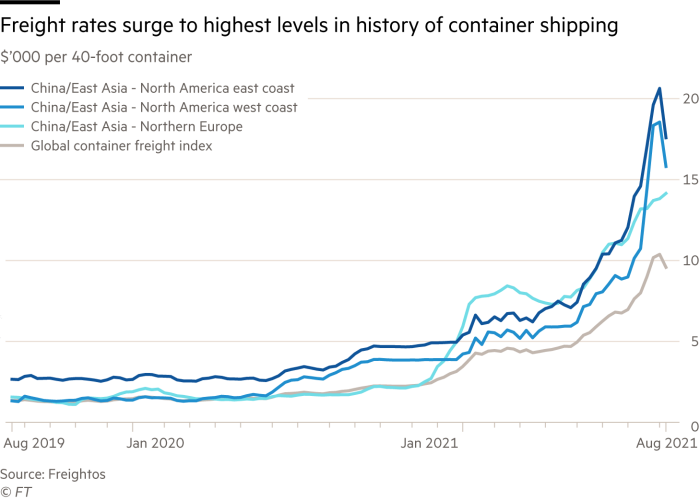

This was almost unimaginable two years ago. A seller in Shenzhen said frankly: "This year, cross-border logistics freight has reached a record level. It is very common for freight to double. Container transportation costs have exceeded the threshold of 20000 dollars, more than 10 times more than 2019. Compared with the overall cross-border logistics freight in July and August, the increase has also been close to 50%."

The rise of cross-border logistics and the decline of operational efficiency in the epidemic have made cross-border sellers feel the tension in the industry. From a longer perspective, I'm afraid that only the market can give an answer to whether cross-border sellers can stand up in the Q4 peak season.

Bulk carriers act as "temporary workers" for shipping, and the high freight rate conflicts with the scheduled rate

Since the outbreak of the epidemic, the logistics costs of related shipping routes have soared more than 10 times. "According to the current shipping price, the captain may be able to earn the purchase cost of the ship as long as he goes there", which is shocking, but it is also true.

According to Freightos, the cost of transporting a 40 foot container from China to the west coast of the United States has soared to about 15800 dollars - the price is pre epidemic 10X , even if it is the same as last month, the cost is half too expensive.

(Chart data source: Freightos )

Under the high price shipping, the continuous good foreign trade export still accelerates the tight demand of shipping—— According to the data released by the General Administration of Customs on August 7, China's exports in the first seven months were 11.66 trillion yuan, up 24.5% year on year. The demand is far greater than the supply of transport capacity, and the demand for container space has reached an unprecedented peak. There has also been a temporary "requisition" of bulk carriers in the market.

In normal operation, the seller's bulk cargo will be transported by professional container ships after being collected. However, at present, due to the insanity of the difficulty of obtaining one hold, not only are containers stacked on the deck of small and medium-sized bulk carriers, but even containers are stuffed in the belly of the cargo hold.

It is found that the International Maritime Organization (IMO)'s Safe Operation Rules for Cargo Stowage and Securing stipulates that bulk carriers are allowed to place containers on the deck, with a maximum height of two units (two layers). However, in fact, according to the type and cargo suitability of the ship, the cargo hold of bulk cargo ships is usually not competent for safe stacking and stacking of containers due to its shape and difficulty in proper stowage and fastening. Although there is no law prohibiting bulk carriers from loading containers, the relevant personage of the P&I Association said that there are many risks in shippers' practice of shipping containers by bulk carriers instead of bulk carriers. This practice may lead to the failure of the marine insurance of the seller's goods and rejection of claims, and at the same time, they may face punishment from relevant regulatory authorities. Under the turbulence, sellers and freight forwarders are often willing to take risks.

Strictly speaking, the expedient of "temporary workers" did slightly ease the pressure on the demand for containers. However, the repeated outbreaks in overseas countries still conflicted the high freight rate with the standard rate.

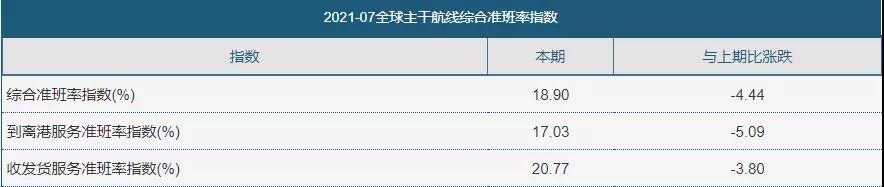

(Source: Shanghai Shipping Exchange - July 2021 Global trunk route comprehensive standard rate index )

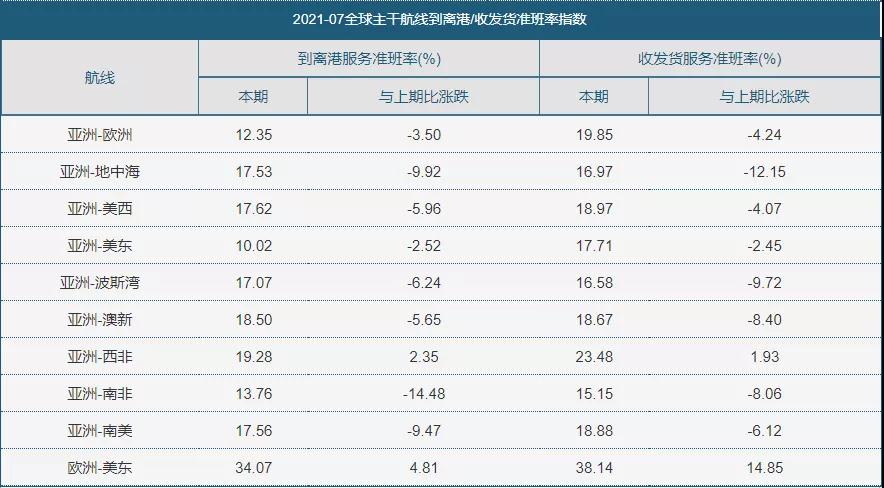

(Source: Shanghai Shipping Exchange - Index of Arrival/Departure/Receipt/Shipment Standard Rate of Global Trunk Routes in July 2021)

basis According to the comprehensive standard rate index of global trunk routes in July 2021 and the standard rate index of arrival and departure/receipt and shipment of global trunk routes published by Shanghai Shipping Exchange on August 19, the unrealistically high freight level does not match the transportation timeliness. Compared with the previous period (June), the comprehensive standard rate, the standard rate of arrival services and the standard rate of receiving and dispatching services have dropped significantly.

"The timeliness of logistics is far lower than the timeliness standard of our perception of high price freight. The cost of freight has doubled, but the timeliness has slowed down", the seller pointed out.

Spillover effect from sea transportation to air transportation

Sea transportation - air transportation - land transportation, which is the sort of transportation mode that most cross-border sellers will choose in consideration of cost and timeliness. Today, the excessive load of the shipping market has rewritten this order, and the high demand for shipping has obviously spilled over to the air transport market.

It should be noted that although the air freight price also fluctuates greatly, it deserves the word "stable" compared with the sea freight. Air freight has become a viable alternative to many container shipping.

The main reasons are as follows:

First, with the shortage of containers and shipping spaces, the delay of global shipping plans has increased significantly, and the loss of available ship power is serious;

Second, soaring shipping costs have persuaded some freight forwarders and sellers to choose air freight instead;

Third, in the face of the tight delivery time limit of the platform, air transportation is an effective means to turn the stock crisis and logistics customer complaints;

Fourth, the epidemic has led to the suspension of a large number of international passenger flights, with a significant trend of passenger cargo change. Willie Walsh, president of IATA, once publicly said, "About 45% of the world's air cargo is traditionally transported by the belly of passenger aircraft, and 55% of the cargo is transported by full cargo aircraft."

Driven by market supply and demand, The cargo loading in the belly cabin of passenger aircraft and the investment of more full cargo aircraft also provide more choices for sellers. The large-scale outbreak of new business forms of cross-border e-commerce has led airlines and third-party logistics enterprises to invest more cargo aircraft echelon capacity and international flights, and even led to the entry of new cargo airlines and freight enterprises.

On June 16, SF Group announced that, along with The 66th full cargo aircraft—— With the B-220R aircraft listed, the number of all cargo aircrafts put into use by SF Airlines in 2021 has reached 5, more than the total number in 2020, and the efficiency of fleet construction has been significantly improved.

Focusing on Shenzhen, the hinterland of China's cross-border e-commerce sellers, This year, Shenzhen Airport has successively opened and encrypted 12 international freight Waypoint. Since July, including UPS, Shunfeng and Zhongzhou Airlines, Shenzhen has opened different international cargo routes to Japan and Southeast Asia. In addition, According to the data of Civil Aviation Resources Network, "In the first half of this year, Shenzhen Airport achieved a cargo throughput of 7700000 tons, a year-on-year increase of 25.2%, ranking first among the national cargo and mail million ton airports. Among them, the international cargo and mail throughput increased by more than 50%, and the cargo business continued to maintain a good momentum of development."

CHINA RAILWAY TRAIN CHANGES THE PATTERN OF INTERNATIONAL LOGISTICS CHANNEL

Compared with the seaborne market, the "throat" fortress of China Europe regular train is relatively unblocked, and the freight costs rise and fall much more than that of air transport, which has become a breakthrough point for sellers to choose cost-effective cross-border logistics.

China Railway Group recently announced that in July, the operation quality of China Europe regular trains continued to improve. 1352 trains were opened and 131000 TEUs of goods were delivered, up 8% and 15% year on year respectively. It is worth noting that the advantages of international railway intermodal transport played by China Europe Express have played a significant role in alleviating cross-border shipment difficulties.

According to statistics, China EU trains have run more than 1000 trains in a single month for 15 consecutive months since May 2020, and more than 1300 trains in a single month for three consecutive months since May this year, which has effectively guaranteed the stability and smoothness of the international industrial chain supply chain.

With the addition of more and more new owners and sources of non-traditional land transportation, such as the sellers of AliExpress and Amazon Europe, the increase in the volume of high passenger price products and epidemic prevention materials transported, the trade model of China Europe regular trains serving cross-border e-commerce has become more convenient.

In addition, the railway department reported that since this year, the railway department has further improved the capacity of port channels, made full use of the increased capacity after the expansion and reconstruction of port stations such as Khorgos and Erlian, accelerated the expansion and reconstruction projects of port stations such as Manzhouli and Alashankou, and actively cooperated with the port supervision department to raise high pass To achieve the steady growth of China Europe regular trains, we must pay attention to capacity and operational efficiency. Among them, from January to July, the traffic volume of the western, central and eastern channels increased by 44%, 18% and 35% respectively year on year.

The particularity of Q4 peak season

Under the changing sea, land and air logistics, if they choose to ignore cross-border industry changes, the sellers may become victims of the Q4 peak season.

Industry insiders pointed out: "In March and February, the cross-border craze under the influence of Amazon's number blocking wave has seen new ripples, and a single internal fluctuation is leading to large-scale 'collective' behavior."

Behind this, the local distribution of the severity of the global epidemic is the first reason; The second reason is that Amazon has spread from big sales to small, medium and multi category sellers; Even the investment direction of the investors and the "olive branch" thrown out by the third-party platform have created the particularity of this Q4 peak season due to multiple factors.

Some sellers described that "cross-border 'besieged city' is more appropriate: the original sellers want to leave the site, while the peripheral sellers want to enter. The big sellers have all moved to the surrounding platforms and independent stations, the upstream supply chain has separated from the platform supply and marketing system, and the decentralized capacity has turned to small and medium-sized sellers to supply goods, creating the middle and middle Amazon sellers to quickly fill the gap."

There are many similar sayings, "When a whale falls, everything grows". Industry insiders explained that it is not only about the rational layout of sellers' multi-channel and multi platform operation risk dispersion, but also the secondary ecological reconstruction of the original Amazon seller circle's transfer to other e-commerce platforms and independent stations.

epilogue

Identifying this structural change is of great significance for sellers to control logistics, business flow and even information flow and capital flow. Faced with the upcoming Q4 peak season, in addition to flexibly integrating shipping plans, air transport plans and land transport plans as needed, and selecting new channels such as passenger to cargo and cargo charter flights to integrate idle transport capacity, sellers have put forward greater demands for efficient and stable cross-border logistics under the new situation of branding, boutique and multi-channel, especially branding forces the efficiency of cross-border logistics, The overseas warehouse has a stabilizing effect on the brand to improve the buyer experience and reduce customer complaints.

Looking back at many actions of cross-border brands this year, overseas warehouse is undoubtedly the top priority of brand layout. From the policy support of overseas warehouse issued by the state to the additional flow tilt and operation empowerment of the platform, the effect of the brand benefiting from the overseas warehouse model is really good.

According to relevant data from the Ministry of Commerce, so far, the number of overseas warehouses in China has exceeded 1900, with a total area of more than 13.5 million square meters, mainly in mainstream countries and markets in Europe and the United States. More specifically, apart from the impact of the tight cross-border first journey and the lengthening of the original logistics cycle, the splendor of the overseas warehouse can not be separated from the application of the seller's logistics platform system and ERP software tools, to get through the integration of logistics, business flow and information flow, and finally realize the transformation from more efficient logistics circulation to lower cost operation. Based on this, the transit cooperation from sea, land and air lines to overseas warehouses seems to leave much more scheduling space for cross-border sellers in Q4 peak season logistics, while how to reasonably schedule logistics to enable peak season under different operations is different.

More insights on logistics trends in peak season, welcome to leave a message at the end of the article~

(By Hugo cross-border Zhong Yunlian)

(Source: Yura ABCD)

The author of this article has complete and legal copyright and other relevant rights and interests in this work. Without permission, no individual or organization may copy, reprint, or otherwise use the content of this website. Please contact the observer of this article for reprinting, and illegal reprinting will be prosecuted!