Introduction: March to April is the traditional construction peak season, and the downstream demand continues to recover. Although the overall demand this year is less than that in previous years, it is significantly better than that in February. Many places in the south have successfully removed the inventory, and the production and sales are balanced at present; There is too much stock in the northern heating season. In the short term, the supply of raw ash still exceeds the demand, and only Grade I and Grade II ash goes to the warehouse quickly. After the contradiction between supply and demand in the fly ash market is eased, the price may continue to rise.

I three Review of the National Fly Ash Market in July

1.1、 three Monthly price of fly ash Continuous recovery

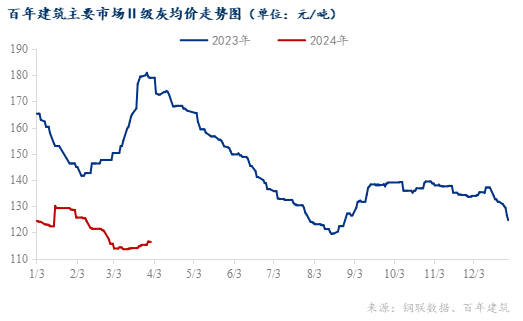

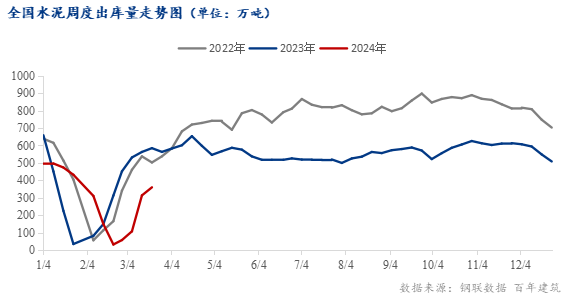

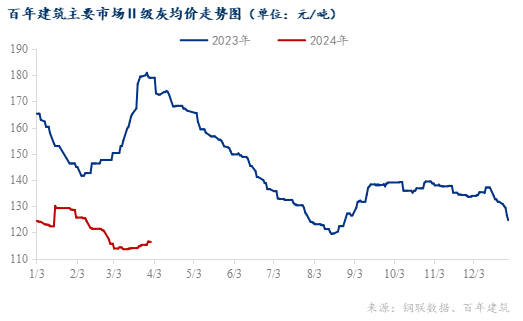

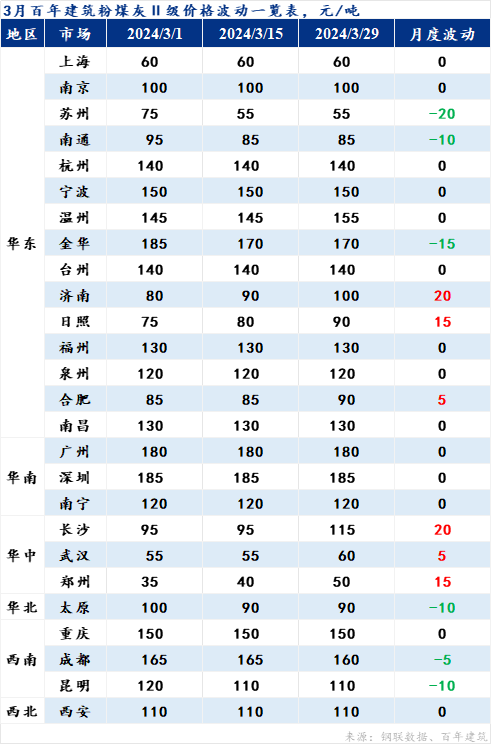

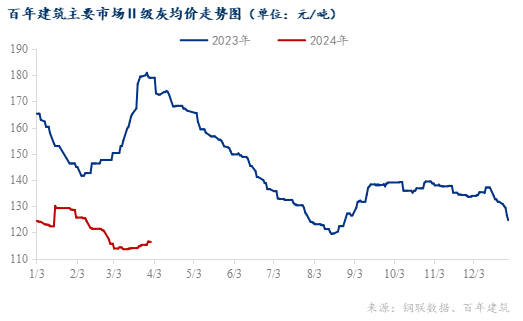

As of March 29, the average price of Class II fly ash in major cities of China with a history of 100 years was 116.53 yuan/ton, up month on month 2.44% , down year-on-year 34.92% The monthly price continued to rise, but the annual decline was large. At present, the price of fly ash is far lower than that in previous years, mainly because the price base is low at the beginning of 2023, and due to the slow recovery of downstream demand, the price difference between two years continues to expand.

1.2、 Regional up and down exchange

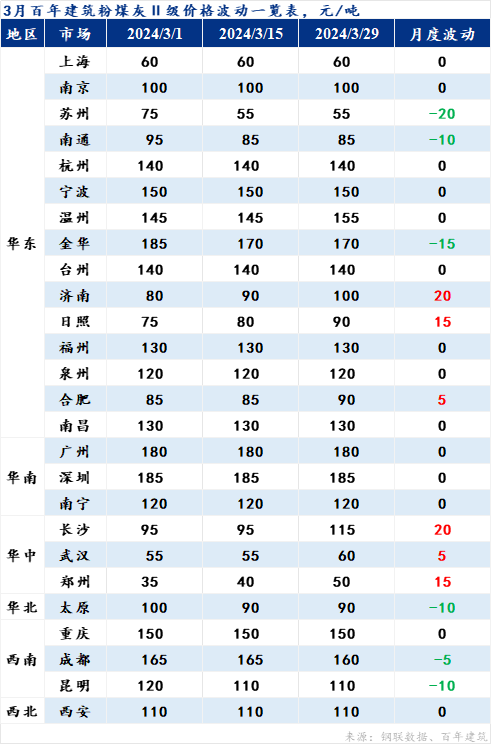

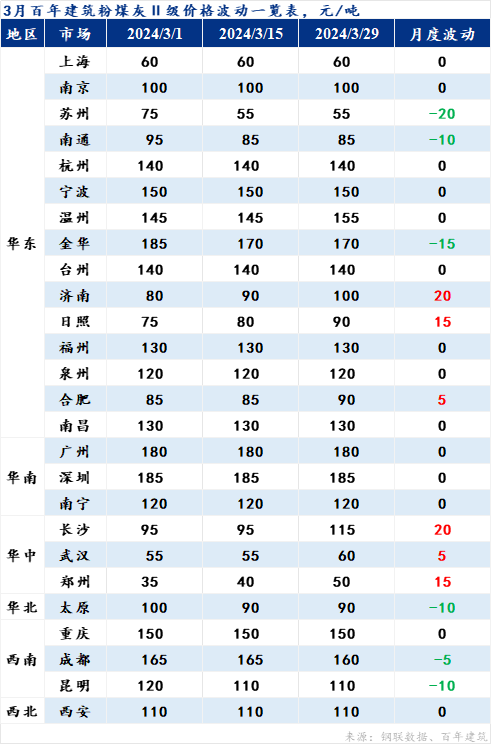

From the fluctuation of the six regions, prices in the northern and local markets with high prices showed a downward trend in March; After the supply in central and eastern China narrowed, the price recovered.

With the increase of rainfall in the middle and late March, the downstream demand continues to be weak. The overall demand recovery is not as good as that in previous years. Although the consumption of powder materials has increased, the early stage is still dominated by destocking to ease the contradiction between supply and demand. The price has not changed much, and even there are some price reduction promotions.

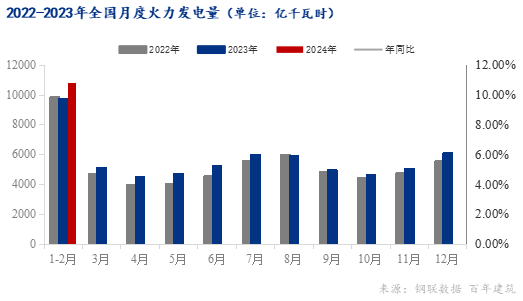

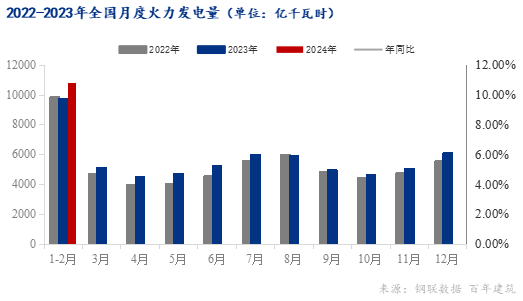

1.3 、 After the increase of rainwater, hydropower generation increases and the supply of fly ash narrows

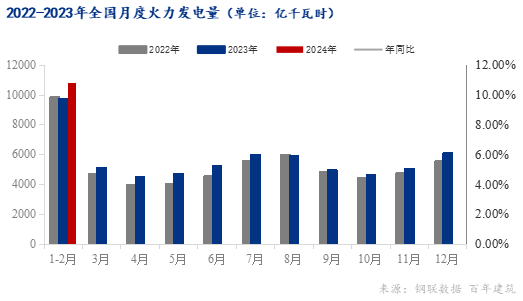

According to the seasonal analysis of previous years, the hydropower generation in China will achieve positive year-on-year growth in March. According to the data of the National Bureau of Statistics, in January and February 2024, the absolute thermal power generation in China will be 1080.19 billion kWh, an increase of 10.71% year on year, 0.63 percentage points higher than that in the previous month, and 20.34% higher than that in the previous month. After the increase of hydropower generation, the growth of thermal power generation has narrowed, and the supply of fly ash has narrowed.

1.4 、 The "boom" season is not boom, and the recovery rate of downstream demand for fly ash is slower than that in previous years

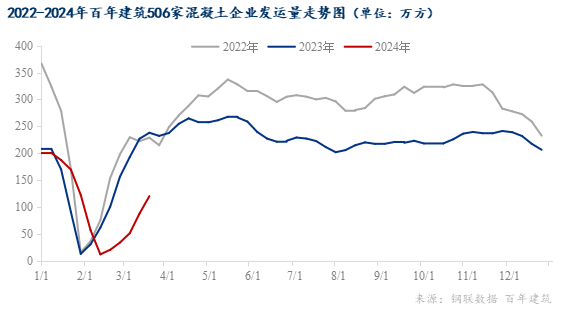

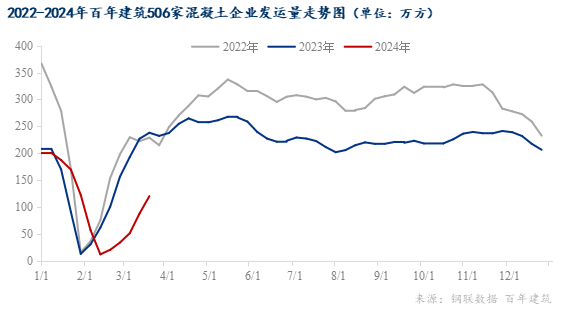

1.4.1 、 concrete Low enthusiasm for purchasing fly ash

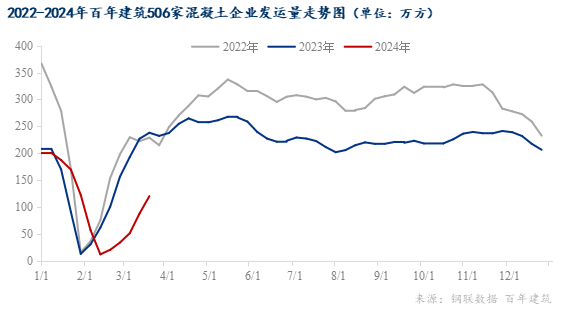

According to the shipment situation of 506 domestic concrete enterprises surveyed by Centennial Construction, the utilization rate of national concrete production capacity continued to decline in March. At the end of March, the utilization rate of national concrete production capacity was 6%, down 5.6 percentage points year on year and down 3.63 percentage points year on year compared with the same period in the lunar calendar last year. After the festival, most of the real estate projects had a lower rate of commencement and resumption than last year due to the poor rate of funds in place. Secondly, some municipal projects were temporarily suspended due to funding problems, so the volume of concrete shipment dropped significantly year on year.

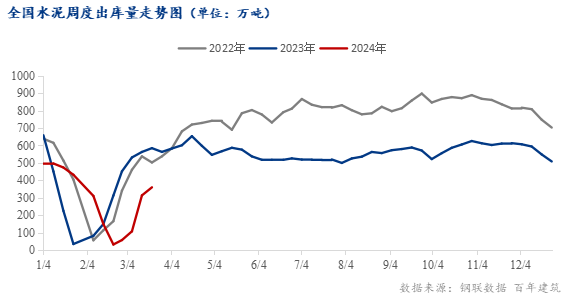

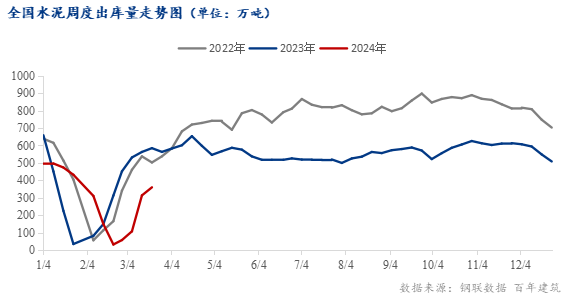

1.4.2、 cement Plant to plant ash procurement slightly rebounded

According to the data of 250 cement production enterprises surveyed by Centennial Architecture, the delivery volume in March was 9.986 million tons, an increase of 83.12% month on month and a decrease of 44.7% year on year in the lunar calendar. In March, the actual procurement was limited due to the slow start and resumption of the construction site after the festival and the preparation work in the early stage of new construction. In the middle and last ten days of March, the rain weather in some areas continued to affect, and the recovery rate of demand slowed down. The cement delivery volume nationwide fell by nearly 50% year on year in the lunar calendar.

Summary: In March, the supply of fly ash market narrowed, the demand continued to recover, and the price fluctuated.

II four Prospects for the National Fly Ash Market in September

2.1 Fly ash production Volume growth narrowed

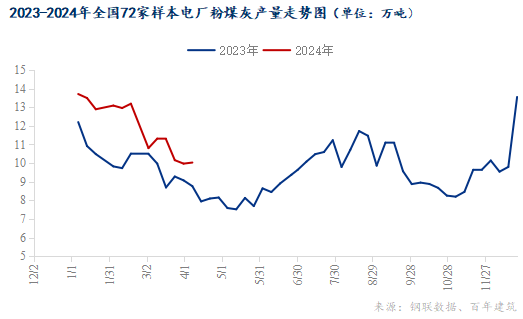

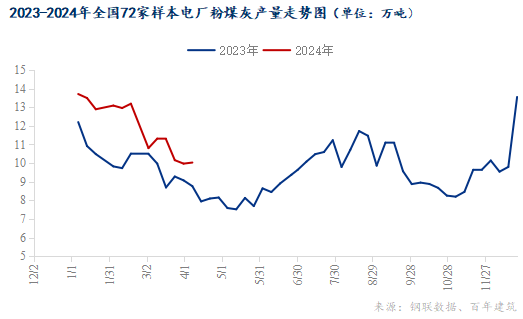

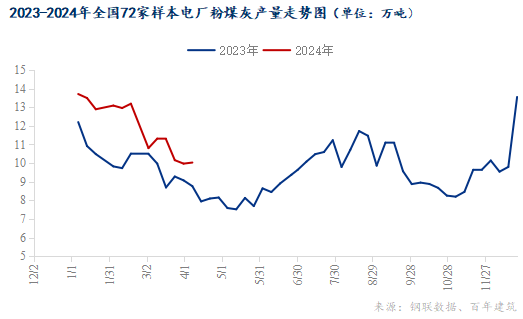

According to the survey of Centennial Construction Network, as of March 29, Mysteel The average daily output of fly ash in the sample areas of 72 domestic appliance plants in China is about 100300 tons, up 14.44% year on year, an increase from the previous period. As thermal power generation is still the main power generation mode in China, the increase of social electricity consumption and the output of fly ash have narrowed after the temperature rise.

2.2、 The project has been resumed in succession, and the demand has rebounded

As of March 12 (the third day of the second month of the lunar calendar), the 100 year construction survey of 10094 construction sites nationwide had a 75.4% resumption rate, with a year-on-year decrease of 10.7 percentage points in the lunar calendar; The labor employment rate was 72.4%, with a year-on-year decrease of 11.5 percentage points in the lunar calendar; The fund delivery rate was 47.7%, an increase of 3 percentage points on a month on month basis; Among them, the fund availability rate of the construction unit was 47.7%, up 3 percentage points month on month, and the overall tightness was an important reason for the construction site resumption not as good as in previous years. As of March 26, the site fund availability rate was 56.46%, an increase of 3.05 percentage points month on month. The site fund situation has continued to improve. It is expected that large areas of the site will start to purchase raw materials normally in April, and the labor service availability rate will continue to increase. After the personnel are successively in place, the project will purchase normally, and the demand for fly ash will gradually return to the normal level.

two three 、 Infrastructure projects continue to support domestic demand

It is reported that in 2024, a cumulative budget investment of 219.6 billion yuan has been arranged to strengthen infrastructure construction, strengthen infrastructure construction in education, health care, employment, cultural tourism, social services, fitness for all, "one old and one young" and other fields, and strive to make up for weaknesses in the social field. Infrastructure construction in various regions frequently welcomes the policy increase, and various regions have also successively announced the list of the second round of key projects. With the commencement of the project, the demand for high-quality primary and secondary ash will be supported to a certain extent.

two four Price of fly ash Possible recovery

In terms of supply: thermal power generation continued to grow, but the increase has narrowed, and the supply of fly ash has also narrowed.

Demand: In April, the downstream construction started to purchase raw materials normally, and some new projects also had zero supply in the early stage, so the demand for fly ash continued to rise.

In terms of price after April: at present, the price of fly ash has basically reached the bottom. With the easing of the contradiction between supply and demand in the market, the price of fly ash may rise again.

Information editor: He Luyan 021-26096794 Information supervision: Tang Zhongming 021-26093670 Information complaint: Chen Jie 021-26093100

Disclaimer: The original and reprinted content released by Mysteel is only for customers' reference, not for decision-making suggestions. The copyright of the original content belongs to Mysteel, and the reproduction requires Mysteel's written authorization, and Mysteel reserves the right to investigate any infringement and quotation contrary to the original intention of the original content. The reprinted content comes from the network and is intended to convey more information and facilitate learning and exchange, which does not mean that Mysteel agrees with its views and is responsible for its authenticity and integrity. To apply for authorization and complaints, please contact Mysteel (021-26093397) for handling.