Both Gann theory and wave theory are familiar to investors. The end result of many technology learners is whether the two theories can be used together?

1. Introduction to wave theory

Wave theory is a kind of price trend analysis tool invented by Eliot, which mainly analyzes and forecasts the trend of futures prices according to the cyclical fluctuation law. It involves three aspects: content form, proportion and time.

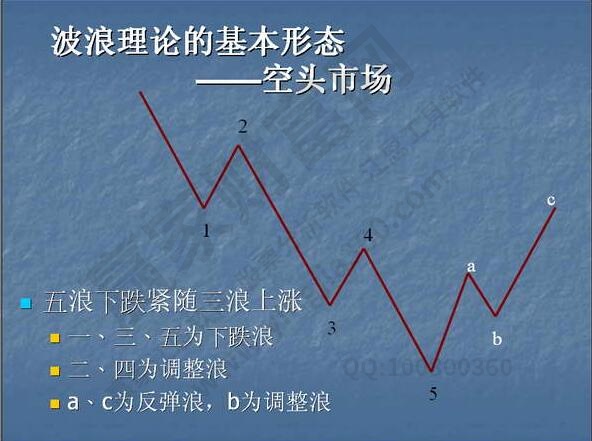

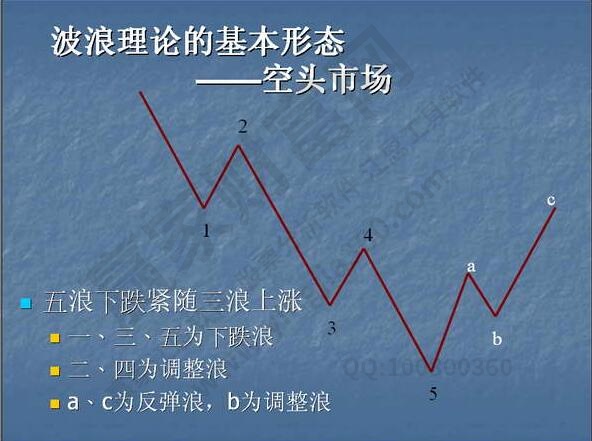

Its basic form is that after five waves of price rise, there will be three waves of price decline. Such fluctuations constitute a cycle of price changes. Among the five rising waves, wave 1, wave 3 and wave 5 are the main rising waves, while wave 2 and wave 4 are the callback waves; Among the three falling waves, A and C are the main rising waves, and B is the rebound waves. Among rising waves, the third wave is the main rising wave with the largest amplitude; The fourth wave is a callback wave, and its bottom should not be lower than the top of the first wave.

Schematic diagram of wave theory

Wave theory not only considers the form of price trend, but also studies the position ratio of each high point and low point in the trend chart. For example, by measuring the relationship between each wave, determine the rollback point and price target. Among them, and Fibonacci numbers (the common golden split numbers 0.382, 0.5, 0.618 and 1.618 are related to Fibonacci numbers) are widely used.

Wave theory also studies the time required to complete a shape. The usual way is to use Fibonacci numbers 1, 2, 3, 5, 8, 13, 21, 34, 55, 89 to find the time window for market turning. For example, on the daily chart, from an important turning point, count down to a certain trading day in Fibonacci, and it is expected that the top or bottom of the future will appear on these "Fibonacci days". This method is also applicable to weekly, monthly and even annual line charts.

Wave theory is a set of subjective analysis tools. In practical application, the difficulty is not small.

Looking at the single wave structure, it seems very clear. But the question is on what scale you stand. For example, when you look at a small room, each wave is actually composed of smaller waves. For example, according to the wave theory, each homeopathic wave is composed of 5 smaller waves, and each contrarian wave is composed of 3 smaller waves. In this way, the original 8 waves can be decomposed into 34 smaller waves. When you look at the big picture, these 8 waves become an ascending wave and a descending wave again, becoming part of a larger wave. The scale of Eliot's trend can be divided into nine levels, from a super long cycle of 200 years to a small scale that lasts only a few hours.

In fact, this is not the most difficult. What is more difficult is that the actual trend cannot be so satisfactory. In case of abnormality, the wave theory will use extended wave or X wave to explain. For example, when the market moves out of the seventh wave or even the ninth wave, this is the expansion wave. However, during the adjustment period, some waves could not be explained clearly, so they were named as X waves.

Therefore, it is not difficult to think that when traders apply the wave theory, it is not easy to determine which level the current trend belongs to and which wave it belongs to. The deformation of the main wave and the adjustment wave will produce complex and changeable forms. The level of the wave will produce big waves and small waves. There will be waves of multi-level forms in the waves, leading to the deviation of the wave count. In fact, facing the same form, different wave experts will have different mathematical methods because of different levels and starting points to determine the waves, and no one can convince anyone. Finally, I fell into the mode of guessing.

2、 Introduction to Gann Theory

Gann's theory, like the wave theory, is also a theory with rich content and its own system. There are not many books dedicated to these two theories on the market.

Gann theory is named after William Gann, an American investor, and it has also been translated into Gan theory. The main analysis methods are the En Calendar, Gann Matrix, Gann Corner Line and Gann Wheel, which are used to predict the top and bottom of the price and the possible arrival time. Advocates usually cite many examples to illustrate its magical effect. If you master one of them, you can predict the market and achieve the purpose of analysis. In addition to prediction, Gann has a practical system. For example, Gan En Twelve http://www.yingjia360.com/jemmsefz This is reflected in a series of books of Gann. At present, more practical researches on Gann's theory are displayed on Wingaid Fortune, and there are complete Gann tools.

There are still many difficulties in practical application. It will take a long time to master some theoretical knowledge and apply it.

In fact, some people ask whether these two theories can be combined. The combination is actually a problem of cohesion. We can understand the situation in this regard, better deal with some issues of Gann, solve some inflection points in the waves, and see the market trading sentiment, which changes over time. In the whole market, the ring comparison confirms the overall change of the market, and even goes beyond the specific balance. However, the research on time cycle proportion in wave theory is relatively weak, which can better make up for each other's shortcomings.

No matter what kind of theory we adopt, we must have in-depth discussion in the process of cognition, and try to understand some internal things, so that we can make a better judgment. These will play an important role for us to some extent, so I hope you can actively consider them in the process of doing so. There will be some changes in different markets and specific situations. Only if you can have a better understanding, can we really make more judgments in the process of doing, so that our understanding of many things is somewhat different.