The fourth quarter strategy report of Jingshun Great Wall: the economy continues to repair, and the index has limited downward space

You may also be interested in:

-

Jingshun Great Wall's fourth quarter strategy report: sustained economic recovery .. -

Shaanxi Guotou Trust made provision for double increase in net profit in the first three quarters .. -

The largest CSI 2000 index ETF in the whole market is heavy today .. -

Anning shares raised investment in the inquiry letter after a fixed increase of 4.98 billion yuan .. -

From January to August, the national catering revenue increased by 19.4% year on year .. -

Hunan Dazhonghe, a subsidiary of Dazhong Mining, plans to implement the first phase of the project .. -

Policy based export credit insurance supports the joint construction of "One Belt One..." -

How to grasp the investment opportunity of "Gold Nine Silver Ten"? Fuguoji ..

Today's Hot Spots

Recommended for you

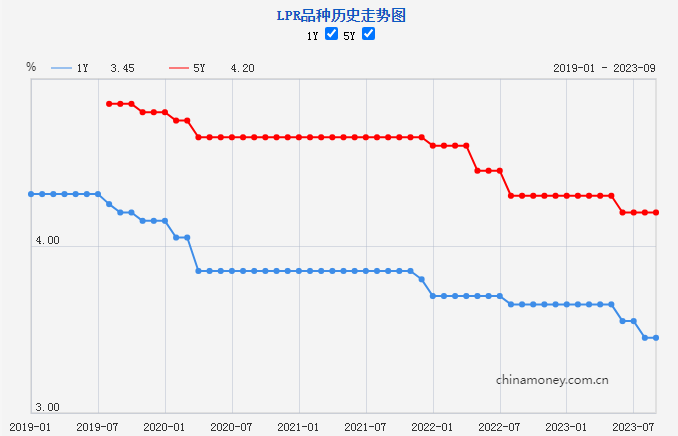

The market quoted interest rate of the new loan is not adjusted

more

-

Bazi Tunnel of Chongqing Qianjiang Section of Chongqing Hunan High speed Railway is connected -

Changjiang Xiangyang, director of Bosera Fund: Serve the high-quality development of central state-owned enterprises and build Chinese characteristics .. -

The housing market and stock market recovered, and the market foundation of basically stable RMB exchange rate was continuously consolidated -

In the first eight months, China's general public budget revenue increased by 10 percent in key areas such as people's livelihood .. -

A number of financial technology service providers published their "transcripts" in the first half of the year -

Stepping to a new level, China's total investment in research and experimental development will exceed 3 trillion yuan in 2022 -

Ma Fengwo predicted that the geothermal degree of long-term destinations at home and abroad will soar, and family parent-child customers will account for it .. -

Nanning, Guangxi: the down payment of provident fund available for purchase of pre-sale commercial housing from August 30 to the end of the year

more

-

The fourth quarter strategy report of Jingshun Great Wall: the economy continues to repair, and the index has limited downward space -

Shaan Guotou Trust's double increase in net profit in the first three quarters and provision for asset impairment of 271 million yuan -

The largest CSI 2000 index ETF in the whole market is heavily listed today -

The feasibility of the implementation of the raised investment project of Anning Stock's 4.98 billion fixed increase and re receipt inquiry letter attracted the attention of the Exchange -

From January to August, the national catering revenue increased by 19.4% year on year. The catering industry focused on new demand to improve adaptability -

Hunan Dazhonghe Mining Co., Ltd., a subsidiary of Dazhong Mining Co., Ltd., plans to implement the first phase project with an annual output of 20000 tons of lithium carbonate -

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

How to grasp the investment opportunity of "Gold Nine Silver Ten"? Wells Fargo Fund "Invest Together" Special Policy for September ..

Ranking

-

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

New policies will be implemented for housing provident fund withdrawn from rental housing in administrative areas of Chengdu -

Innovative policies support the gradual entry of a large number of rental houses into the market -

All business operations of housing provident fund are generally stable and the fund is generally safe -

[Globecast News] LinkedIn Financial (08163. HK) completed the issuance of HK $91 million convertible bonds -

Sinopec's market value evaporated by 68.1 billion yuan in two days, and the transaction losses of subsidiaries covered by clouds -

100 road transport enterprises in Henan were interviewed due to prominent potential accidents -

Yanling Jingcheng Building Materials Co., Ltd. does not implement heavy pollution weather control measures and produces illegally -

ICBC: Helping Hainan Free Trade Port trade and investment docking through "global matchmaking" -

The 19th batch of model kindergartens in Henan Province announced that 20 new batch of 16 kindergartens were delisted

Recent updates

-

The fourth quarter strategy report of Jingshun Great Wall: the economy continues to repair, and the index has limited downward space -

Shaan Guotou Trust's double increase in net profit in the first three quarters and provision for asset impairment of 271 million yuan -

The largest CSI 2000 index ETF in the whole market is heavily listed today -

The feasibility of the implementation of the raised investment project of Anning Stock's 4.98 billion fixed increase and re receipt inquiry letter attracted the attention of the Exchange -

From January to August, the national catering revenue increased by 19.4% year on year. The catering industry focused on new demand to improve adaptability -

Hunan Dazhonghe Mining Co., Ltd., a subsidiary of Dazhong Mining Co., Ltd., plans to implement the first phase project with an annual output of 20000 tons of lithium carbonate -

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

Jiawo Food was invited to attend the 8th "Chile Week" and China Chile Entrepreneurs Committee .. -

Jiawo Food participated in the 3rd "Belt and Road" Entrepreneurs Conference -

Manulife Fund Zhang Xiaolong: A-share valuation is gradually digested, focusing on electronics and innovative drugs -

Prince Happiness Plaza focuses on value, Phnom Penh CLD defines high-end -

Tang Yin, General Manager of Jiawo Food, accepted that the "gold lettered signboard" of Beijing enterprises shines on the Silk Road .. -

How to choose TV on Double 11? Hisense TV ULED X leads the high-end large screen market -

Yuekang Pharmaceutical's 1.1 class new drug compound ginkgo biloba leaves completed the phase III clinical trial -

The deep integration of online live broadcast and offline entities stimulates the new business of aloe skin care consumption -

Public Welfare Power Station · Dream Building Childhood | Goodway "Illuminates" the Dream of Mountain Children -

No! The identity of the New Sunflower Fairy as an electric car has been exposed -

The "conspicuous bag" of OIWAS appeared in the Half Sugar Music Festival, and the strength of Chaoqu clocking device came out -

Rongsu Technology announced to complete tens of millions of yuan of Pre-A round financing to accelerate industrial arc metal 3D printing -

Comprehensive and multi scene, Toyota Financial Services builds a diversified service matrix -

Dithering live broadcast: launched the "DOU Inheritance" program with China Coal Mine Arts and Crafts Group .. -

Spirulina in Ningxia is popular in the "Belt and Road" market -

(Economic observation) Can China's consumption warming continue in the fourth quarter? -

Chengde, Hebei, strives to build a "China Vanadium Valley", initially forming a vanadium titanium industrial system -

The 81st World Science Fiction Congress Science Fiction Design Summit was held -

The 10th International Lead and Zinc Conference was held in Changsha for the first time in China -

Bazi Tunnel of Chongqing Qianjiang Section of Chongqing Hunan High speed Railway is connected -

The first 20000 ton international navigation ship officially settled in Foshan, Guangdong -

Yuebao Branch of Bank of China helped the Egyptian government to issue 3.5 billion yuan of sustainable development sovereign panda bonds -

Three newly revised local oil and gas standards in Beijing will be implemented in April next year

this Daily news

-

The fourth quarter strategy report of Jingshun Great Wall: the economy continues to repair, and the index has limited downward space -

Shaan Guotou Trust's double increase in net profit in the first three quarters and provision for asset impairment of 271 million yuan -

The largest CSI 2000 index ETF in the whole market is heavily listed today -

The feasibility of the implementation of the raised investment project of Anning Stock's 4.98 billion fixed increase and re receipt inquiry letter attracted the attention of the Exchange -

From January to August, the national catering revenue increased by 19.4% year on year. The catering industry focused on new demand to improve adaptability -

Hunan Dazhonghe Mining Co., Ltd., a subsidiary of Dazhong Mining Co., Ltd., plans to implement the first phase project with an annual output of 20000 tons of lithium carbonate -

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

Jiawo Food participated in the 3rd "Belt and Road" Entrepreneurs Conference -

Jiawo Food was invited to attend the 8th "Chile Week" and the annual meeting of the China Chile Entrepreneurs Committee -

Prince Happiness Plaza focuses on value, Phnom Penh CLD defines high-end