The largest CSI 2000 index ETF in the whole market is heavily listed today

You may also be interested in:

-

The largest CSI 2000 index ETF in the whole market is heavy today -

Anning shares 4.98 billion fixed increase re receipt inquiry letter raised investment -

From January to August, the national catering revenue increased by 19.4% year on year -

Hunan Dazhonghe Mining Co., Ltd., a subsidiary of Dazhong Mining Co., Ltd., plans to implement the first phase -

Policy based export credit insurance supports the joint construction of "One Belt One..." -

How to grasp the investment opportunity of "Gold Nine Silver Ten"? Fuguoji -

The debt base reappears and large redemption "serial robbery" is difficult to repeat -

Second quarter national marriage registration data: marriage and divorce on a year-on-year basis

Today's Hot Spots

Recommended for you

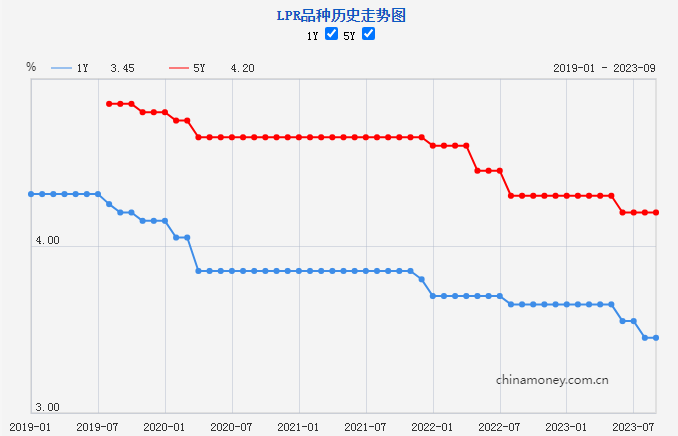

The market quoted interest rate of the new loan is not adjusted

more

-

Bazi Tunnel of Chongqing Qianjiang Section of Chongqing Hunan High speed Railway is connected -

Changjiang Xiangyang, director of Bosera Fund: Serve the high-quality development of central state-owned enterprises and build Chinese characteristics -

The housing market and stock market recovered, and the market foundation of basically stable RMB exchange rate was continuously consolidated -

In the first eight months, the national general public budget revenue increased by 10% in key areas such as people's livelihood spending -

A number of financial technology service providers published their "transcripts" in the first half of the year -

Stepping to a new level, China's total investment in research and experimental development will exceed 3 trillion yuan in 2022 -

Ma Fengwo predicted that the geothermal degree of long-term destinations at home and abroad will soar, and family parent-child customers will account for -

Nanning, Guangxi: the down payment of provident fund available for purchase of pre-sale commercial housing from August 30 to the end of the year

more

-

The largest CSI 2000 index ETF in the whole market is heavily listed today -

The feasibility of the implementation of the raised investment project of Anning Stock's 4.98 billion fixed increase and re receipt inquiry letter attracted the attention of the Exchange -

From January to August, the national catering revenue increased by 19.4% year on year. The catering industry focused on new demand to improve adaptability -

Hunan Dazhonghe Mining Co., Ltd., a subsidiary of Dazhong Mining Co., Ltd., plans to implement the first phase project with an annual output of 20000 tons of lithium carbonate -

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

How to grasp the investment opportunity of "Gold Nine Silver Ten"? Wells Fargo Fund "Invest Together" Special Policy for September -

The debt base reappears and large redemption "serial robbery" is difficult to repeat -

Data of nationwide marriage registration in the second quarter: 156000 and 178000 couples of marriage and divorce respectively increased year on year

Ranking

-

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

New policies will be implemented for housing provident fund withdrawn from rental housing in administrative areas of Chengdu -

Innovative policies support the gradual entry of a large number of rental houses into the market -

All business operations of housing provident fund are generally stable and the fund is generally safe -

[Globecast News] LinkedIn Financial (08163. HK) completed the issuance of HK $91 million convertible bonds -

Sinopec's market value evaporated by 68.1 billion yuan in two days, and the transaction losses of subsidiaries covered by clouds -

100 road transport enterprises in Henan were interviewed due to prominent potential accidents -

Yanling Jingcheng Building Materials Co., Ltd. does not implement heavy pollution weather control measures and produces illegally -

ICBC: Helping Hainan Free Trade Port trade and investment docking through "global matchmaking" -

The 19th batch of model kindergartens in Henan Province announced that 20 new batch of 16 kindergartens were delisted

Recent updates

-

The largest CSI 2000 index ETF in the whole market is heavily listed today -

The feasibility of the implementation of the raised investment project of Anning Stock's 4.98 billion fixed increase and re receipt inquiry letter attracted the attention of the Exchange -

From January to August, the national catering revenue increased by 19.4% year on year. The catering industry focused on new demand to improve adaptability -

Hunan Dazhonghe Mining Co., Ltd., a subsidiary of Dazhong Mining Co., Ltd., plans to implement the first phase project with an annual output of 20000 tons of lithium carbonate -

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

Jiawo Food was invited to attend the 8th "Chile Week" and the China Chile Entrepreneurs Committee -

Jiawo Food participated in the 3rd "Belt and Road" Entrepreneurs Conference -

Manulife Fund Zhang Xiaolong: A-share valuation is gradually digested, focusing on electronics and innovative drugs -

Prince Happiness Plaza focuses on value, Phnom Penh CLD defines high-end -

Tang Yin, General Manager of Jiawo Food, accepted that the "gold lettered signboard" of Beijing enterprises shines on the Silk Road -

How to choose TV on Double 11? Hisense TV ULED X leads the high-end large screen market -

Yuekang Pharmaceutical's 1.1 class new drug compound ginkgo biloba leaves completed the phase III clinical trial -

The deep integration of online live broadcast and offline entities stimulates the new business of aloe skin care consumption -

Public Welfare Power Station · Dream Building Childhood | Goodway "Illuminates" the Dream of Mountain Children -

No! The identity of the New Sunflower Fairy as an electric car has been exposed -

The "conspicuous bag" of OIWAS appeared in the Half Sugar Music Festival, and the strength of Chaoqu clocking device came out -

Rongsu Technology announced to complete tens of millions of yuan of Pre-A round financing to accelerate industrial arc metal 3D printing -

Comprehensive and multi scene, Toyota Financial Services builds a diversified service matrix -

Dithering live broadcast: with the China Coal Mine Arts and Crafts Group, we launched the "DOU Inheritance" program, which is a hundred art -

Spirulina in Ningxia is popular in the "Belt and Road" market -

(Economic observation) Can China's consumption warming continue in the fourth quarter? -

Chengde, Hebei, strives to build a "China Vanadium Valley", initially forming a vanadium titanium industrial system -

The 81st World Science Fiction Congress Science Fiction Design Summit was held -

The 10th International Lead and Zinc Conference was held in Changsha for the first time in China -

Bazi Tunnel of Chongqing Qianjiang Section of Chongqing Hunan High speed Railway is connected -

The first 20000 ton international navigation ship officially settled in Foshan, Guangdong -

Yuebao Branch of Bank of China helped the Egyptian government to issue 3.5 billion yuan of sustainable development sovereign panda bonds -

Three newly revised local oil and gas standards in Beijing will be implemented in April next year -

Qi Xiangdong: Four Ways to Realize "Zero Accident" of Industrial Internet Security -

2023 China (International) Flax Textile Conference Opens in Yinchuan

this Daily news

-

The largest CSI 2000 index ETF in the whole market is heavily listed today -

The feasibility of the implementation of the raised investment project of Anning Stock's 4.98 billion fixed increase and re receipt inquiry letter attracted the attention of the Exchange -

From January to August, the national catering revenue increased by 19.4% year on year. The catering industry focused on new demand to improve adaptability -

Hunan Dazhonghe Mining Co., Ltd., a subsidiary of Dazhong Mining Co., Ltd., plans to implement the first phase project with an annual output of 20000 tons of lithium carbonate -

Policy based export credit insurance supports the joint construction of the "Belt and Road" with fruitful results -

Jiawo Food participated in the 3rd "Belt and Road" Entrepreneurs Conference -

Jiawo Food was invited to attend the 8th "Chile Week" and the annual meeting of the China Chile Entrepreneurs Committee -

Prince Happiness Plaza focuses on value, Phnom Penh CLD defines high-end -

"Gold lettered signboard" of Beijing enterprises shines on the Silk Road -- Tang Yin, General Manager of Jiawo Food, was interviewed by Beijing Daily -

How to choose TV on Double 11? Hisense TV ULED X leads the high-end large screen market