Report: RMB cross-border receipts and payments from January to September this year amounted to 39 trillion yuan

You may also be interested in:

-

Report: From January to September this year, the cross-border collection and payment scale of RMB was 3 -

Is the efficacy of generic drugs selected from centralized purchase inferior to that of original drugs -

The central bank's net daily investment in the open market is 733 billion yuan MLF -

The second phase of Qingshan Public Welfare and Ecological Environment Volunteer Service Project starts -

Silk Road Youth Talks (III) | I am "Threading the needle" for China Europe Train -

Zhongxin online review: postdoctoral work as a traffic policeman is a great talent -

Double warning! Shanxi Releases Blue Warning for Strong Wind and Frost -

Guangdong starts Level IV emergency response for windbreak

Today's Hot Spots

Recommended for you

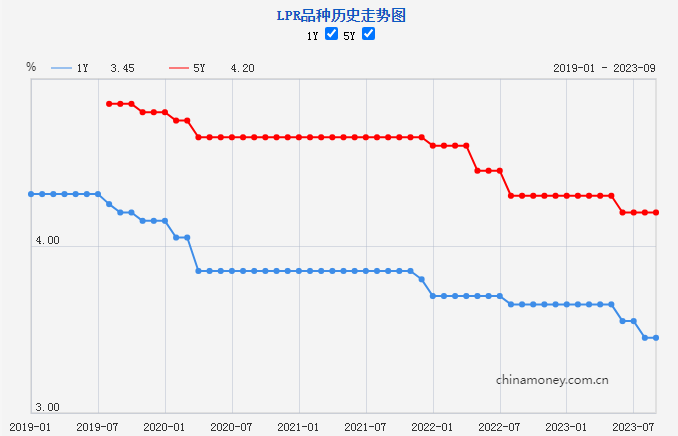

The market quoted interest rate of the new loan is not adjusted

more

-

Bazi Tunnel of Chongqing Qianjiang Section of Chongqing Hunan High speed Railway is connected -

Changjiang Xiangyang, director of Bosera Fund: Serve the high-quality development of central state-owned enterprises and build Chinese characteristics -

The housing market and stock market recovered, and the market foundation of basically stable RMB exchange rate was continuously consolidated -

In the first eight months, the national general public budget revenue increased by 10% in key areas such as people's livelihood spending -

A number of financial technology service providers published their "transcripts" in the first half of the year -

Stepping to a new level, China's total investment in research and experimental development will exceed 3 trillion yuan in 2022 -

Ma Fengwo predicted that the geothermal degree of long-term destinations at home and abroad will soar, and family parent-child customers will account for -

Nanning, Guangxi: the down payment of provident fund available for purchase of pre-sale commercial housing from August 30 to the end of the year

more

-

Yili: Taking the lead to promote high-quality economic development in Inner Mongolia -

Shuidi Company: Focusing on users to stimulate the momentum of scientific and technological innovation -

Shuidi Company: Focusing on users to stimulate the momentum of scientific and technological innovation -

The fourth quarter strategy report of Jingshun Great Wall: the economy continues to repair, and the index has limited downward space -

Shaan Guotou Trust's double increase in net profit in the first three quarters and provision for asset impairment of 271 million yuan -

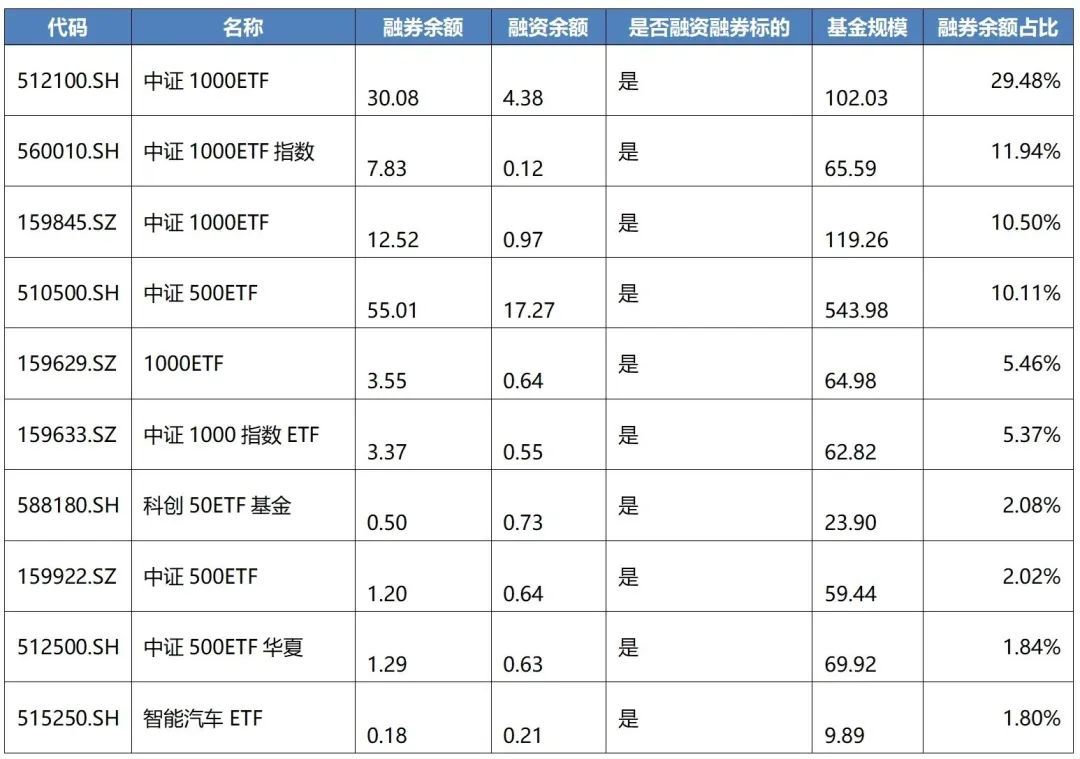

The largest CSI 2000 index ETF in the whole market is heavily listed today -

The feasibility of the implementation of the raised investment project of Anning Stock's 4.98 billion fixed increase and re receipt inquiry letter attracted the attention of the Exchange -

From January to August, the national catering revenue increased by 19.4% year on year. The catering industry focused on new demand to improve adaptability

Ranking

-

Ecological control of the Yellow River in Shanxi: the big river flows into the sea -

Shenzhen requires construction sites to implement "six in place" construction projects to implement enclosed management -

By the end of March, all 29 pilot financial technology application projects in Shenzhen had been put into operation -

The total output value of high-performance membrane material project invested and constructed by Xiamen enterprises will reach 6 billion yuan in the future -

The key projects in Chongqing Banan in the second quarter were signed in a centralized manner, with a contract investment of 21.5 billion yuan -

National well-known private enterprises entered Wanzhou District of Chongqing and signed 21 key cooperation projects -

Qinghai Haixi 4000MW Scenery Hydrogen Storage Integration Project was signed with a total investment of 21.4 billion yuan -

Shenzhen Bao'an District launched 23 new projects with an annual investment plan of 4.21 billion yuan -

In the first quarter, Shenyang signed 480 new projects worth more than 100 million yuan, up 22.1% year on year -

Fuzhou Jin'an Investment Promotion Conference signed 45 projects with a total investment of 20.843 billion yuan

Recent updates

-

Report: RMB cross-border receipts and payments from January to September this year amounted to 39 trillion yuan -

With the help of sports events, villages and towns develop tourism. Sports are burning up. Rural tourism -

Is the efficacy of generic drugs selected from centralized purchase inferior to that of original drugs -

Pan Gongsheng: Continue to implement sound monetary policy, comprehensively strengthen and improve financial supervision -

Zhang Xiaoyan: China's economy has great development toughness and potential -

Under the road sign, start a new journey! The 13th China Management · Global Forum was successfully held -

The fourth Yongding River Culture and New Guomen Culture Forum, "One River Yongding, One City Daxing", was held in the -

Bank of Tianjin strives to be the track leader of "finance+sports" -

Innovation and transformation of the dairy industry to meet the era, and digital intelligence empowerment will help China's dairy industry enter the "new world" -

Beijing Daxing Airport Area: Mini Marathon Starts -

The foreign exchange market showed strong resilience in the third quarter, and the foundation for balanced cross-border capital flow will be more stable -

How to treat young people's "old style consumption" by eating the canteen for the elderly and attending the university for the elderly -

LuLugao cooperates with the transformation of mother and baby industries to expand the customer market and open a new business model -

The price of popular categories has risen 80% a year, and pearls have become the "favorite" of young people -

Traditional pediatrics expands children's height management, and Lulugao shows his own experience -

"Double 11" promotions have been launched, and platforms have been clustered to play the "low price" card -

Enhancing the soundness of the financial system Measures for assessing systemically important insurance companies -

Most of the first house loans in stock have been adjusted in place -

The recommendation and underwriting business of Vanward Securities was suspended for three months -

There is room for the PBOC to lower the MLF interest rate of 733 billion yuan per day in the open market -

After 34 years of unremitting pursuit of murders, Shanghai police solved the old murder case again -

Comment: The "confession wall" of university governance should be both conscientious and "moderate" -

Catch up, dare to compete in cutting-edge fields: interview with academician Wu Peiheng, leader of superconducting electronics in China -

Should we charge 900 yuan for transporting purple potato by truck to the expressway? Expert interpretation -

Is the distance between E-sports and the Olympic Games getting closer or farther? -

Qingshan Public Ecological Environment Volunteer Service Project Phase II was launched to help build ecological civilization -

Silk Road Youth Talks (III) | I am "Threading the needle" for China Europe Train -

21 players from Heilongjiang Province "formed a team" to participate in the 2nd National Postdoctoral Innovation and Entrepreneurship Competition -

How to deal with dogs that hurt people? Emergency notice in many places! -

Zhongxin online review: postdoctoral work as a traffic policeman is a great talent

this Daily news

-

LuLugao cooperates with the transformation of mother and baby industries to expand the customer market and open a new business model -

Traditional pediatrics expands children's height management, and Lulugao shows his own experience -

Lvyuan Group, an investment enterprise of Seaview Group, was officially listed on the main board of Hong Kong Stock Exchange -

Run, Jiangling! -

Yishang Hotel has been listed in the top five brands of Midrange Hotels in Maidian for 9 consecutive months -

Skin care guide: Mystery of Tussauds Multi repair mask enables skin to pass through autumn sensitive time smoothly -

Full chain assistance, innovative dairy development mode, and cooperation to dairy highlands -

Meet Rongcheng! Longyangxia Salmon invites you to witness the first Western Cuisine Skills Finals -

Dialogue with Zheng Suyong: Why did enterprise management consulting choose "Zhetu"? -

Tracing the Origin of Lianhua Qingke Tablet from the "Lung Collateral Syndrome Treatment" of TCM Collateral Disease Theory