Figure: In the first ten months of this year, China exported 74.73 million tons of steel, higher than the same period last year.

The National Bureau of Statistics of China recently released the economic data for October, and the data trend has obvious differentiation: industrial production and manufacturing investment maintain the recovery trend, but prices and exports continue to decline. Then, why would there be a deviation between the sluggish demand and the recovery of investment, and what would happen to China's economy in the fourth quarter?

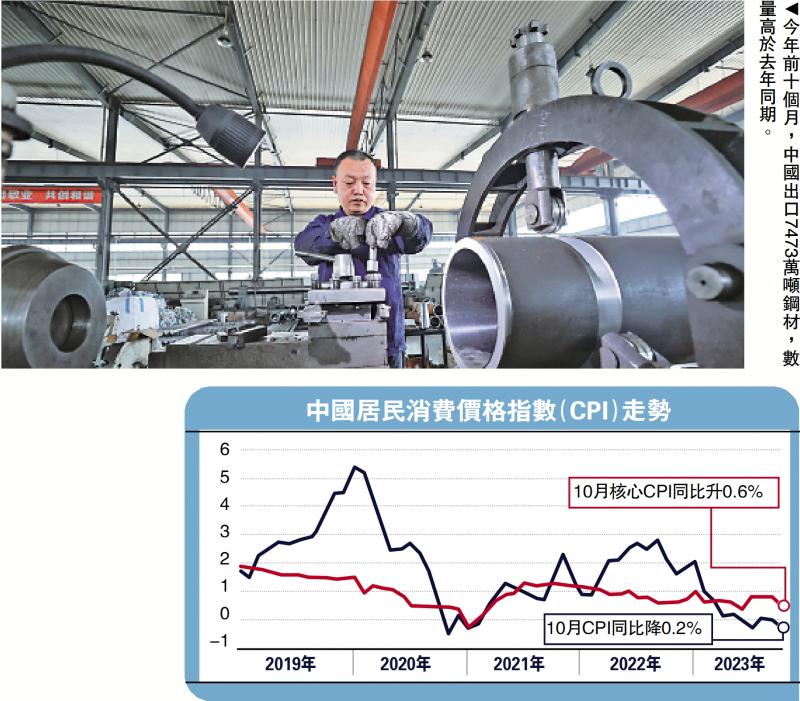

Data shows that in October, the national consumer price (CPI) fell 0.2% year on year, 0.2 percentage points lower than the previous value; The month on month decline was 0.1%, and it turned negative again; The producer price (PPI) of industrial producers across the country fell 2.6% year on year, 0.1 percentage point higher than the previous value; The month on month ratio was flat. The export data for October was lower than expected. In dollar terms, the export was 274.83 billion US dollars, down 6.4% year on year, and the absolute value was nearly 24.3 billion US dollars lower than the previous value, with a year-on-year decrease of 0.2 percentage points.

Industrial added value and manufacturing investment remained at a certain intensity. Data shows that in the first ten months, fixed asset investment increased by 2.9% year on year, real estate investment as a drag decreased by 9.3%, and manufacturing investment as a main driver increased by 6.2%; The added value of industries above designated size actually increased by 4.1% year on year. From August to October, the added value of industries above designated size was stable, and the year-on-year real growth remained at about 4.5%.

The above deviation may be a "price reduction effect", that is, the price decline stimulates the increase of demand, and the terminal sales have not increased significantly, but the upstream production and investment have kept growing.

Due to the decline of the RMB exchange rate this year (as of November 16, the offshore RMB rose 4.95%), the price effect of exports denominated in dollars is quite obvious. The prices of energy, minerals, raw materials and their processed products fell, and the amount of exports fell, but the decline in quantity was significantly lower than the price, and even increased.

In the first ten months of this year, the export amount of rare earth in dollar terms fell by 27.7% year on year, but the quantity increased by 7.7%; The amount of steel exports decreased by 7.8% year on year, but the quantity increased by 34.8%; The export amount of integrated circuits decreased by 14.1% year on year, while the number only decreased by 4.1%; The export amount of LCD panel display modules decreased by 4.1% year on year, but the number increased by 1.4%.

Some end consumer goods also show this feature: the export amount of bags and similar containers increased by 4.7% year on year, and the quantity increased by 13.2%; The export value of shoes and boots decreased by 12.3% year on year, while the quantity only decreased by 3%; The amount of mobile phone exports decreased by 8% year on year, while the number only decreased by 6.5%.

Although the export amount of raw materials, processed products and end consumer goods declined, the export volume did not decline significantly, or even rose. In the first ten months of this year, China exported 53.09 million tons of refined oil, 44600 tons of rare earth, 25.77 million tons of fertilizer, and 74.73 million tons of steel, higher than the same period last year.

Resilience of production and investment

From this point of view, the production end still maintains a certain degree of toughness. In the first ten months of this year, the raw materials, ethylene, chemical fiber, steel, ten kinds of non-ferrous metals, crude oil processing volume, and natural gas in terms of quantity, still maintained an increase of 5.7% to 11.2%; It still produced 23.66 million cars, 6.99 million new energy vehicles, 1.2477.2 billion mobile phones, and 276.5 billion integrated circuits, with a positive year-on-year growth in the number.

The investment in the corresponding fields has maintained a certain intensity. In the first ten months of this year, investment in power, heat, gas and water production and supply industries increased by 25.0%, infrastructure investment (excluding power, heat, gas and water production and supply industries) increased by 5.9% year on year, and manufacturing investment increased by 6.2% year on year. In terms of manufacturing, investment in special equipment increased by 10.7% year on year, that in electrical machinery and equipment manufacturing increased by 36.6% year on year, that in automobile manufacturing increased by 18.7% year on year, and that in chemical raw materials and chemical products manufacturing increased by 13.4% year on year.

From the perspective of economics, the price effect conforms to the demand principle, indicating that the price adjustment mechanism is playing a role. When the price decreases, the demand increases and the inventory decreases; When the demand increases to a certain extent, the price rises, stimulating the supply increase, and the economy continues to recover. This is the process of market clearing.

Of course, when prices fall and demand rises, enterprises will experience a difficult process of loss of profits. Enterprises sell at a reduced price, exchange price for volume, liquidate inventory and recover cash flow at the expense of profits, and the profit decline is greater than the operating revenue. According to the data, in the first nine months of this year, the operating income of industrial enterprises above designated size nationwide was flat on a year-on-year basis, but the total profit decreased by 9.0%. The mining industry, with the largest price decline, saw a year-on-year decline of 10.3% in operating revenue and 19.9% in total profits.

In addition, the total profit of the manufacturing industry decreased by 10.1% year on year. Among them, the profits of chemical raw materials and chemical products manufacturing industry declined by 46.5%, the textile industry by 10.2%, the furniture manufacturing industry by 14%, and the computer, communication and other electronic equipment manufacturing industry by 18.6%; The operating revenue of the automobile manufacturing industry increased by 10.4% year on year, and the profit growth was only 0.1%.

However, in the third quarter, industrial profits above designated size continued to repair, and the decline in the first nine months was 7.8 percentage points lower than that in the first half of the year. This shows that the current price is playing a role in stimulating the increase of demand, the decline of inventory, the repair of profits, and promoting the bottoming, stabilization and recovery of the economy.

Government financing continues to be strong

The economic recovery in the fourth quarter and next year can be observed from two perspectives:

The first is price adjustment, that is, the process of price from falling to rising. Observe how much the enterprise's inventory has fallen, whether the supply has increased, and when the profit becomes positive. In the downstream retail industry, service industry, export trade and other fields with high degree of marketization, price regulation is the core force of market recovery.

The second is the government policy, that is, how to effectively implement the fiscal policy and monetary policy, and whether the government can expand investment, boost total demand, or stimulate the recovery of investment and consumption confidence through the transfer of payment.

Government financing continued to be strong this year, but the investment effect was lower than expected. In the first ten months, the cumulative increase in the scale of social financing was 31.19 trillion yuan (RMB, the same below), 2.33 trillion yuan more than the same period last year. Government bond financing and medium - and long-term loans from state-owned enterprises are the main supporting items of social financing increment. Among them, the net financing of government bonds in October was 1.56 trillion yuan, 1.28 trillion yuan more than that of the previous year, accounting for 84% of the increase in social financing of the month.

Due to the large scale of local government debt, a large amount of debt financing is used for "borrowing new to repay old", and the actual investment ratio is low. Data shows that in the first ten months of this year, the local government issued bonds to raise funds of about 8 trillion yuan, of which the total amount of "borrowing new to repay old" reached 3.97 trillion yuan, accounting for 49.57%, which is far higher than 29.35% in 2020. In October, a new round of bonds was launched. The total amount of special refinancing bonds issued exceeded 1 trillion yuan, which was used to replace local bonds. Local government investment was further squeezed out. On the other hand, the State Council has decided to issue 1 trillion yuan of special national debt for investment in infrastructure such as flood control and waterproofing. This investment will become the basic platform for government investment at the end of this year and the first half of next year.

The author predicts that in the next few years, local government debt repayment and central government debt investment will become the basic mode of government debt financing and arrangement.

In addition, due to the lack of confidence in private investment, the multiplier effect of government expenditure declined, and the effect of public investment was less than expected. In the first ten months of this year, state-owned investment in fixed assets increased by 6.7% year on year, while private investment decreased by 0.5% year on year. Real estate is the main component and drag item of private investment. Excluding real estate development investment, private investment increased by 9.1% year on year.

Real estate support has come in succession

It should be noted that the real estate industry is the pillar industry of the national economy, which has not yet stopped falling to stabilize. The two main drivers of economic recovery - price adjustment and government policies seem to have limited effect on the repair of the real estate market. The price decline did not boost sales, and the policy adjustment did not improve the plight of developers. Data shows that in October this year, real estate failed to continue the recovery in September, and sales, investment and financing declined significantly on the basis of a low base. Among them, open investment decreased by 16.69% year on year, sales area decreased by 20.34% year on year, and development investment sources decreased by 17.03% year on year. At the end of October, the area of commercial housing for sale was 6483.5 million square meters, up 18.1% year on year. It is expected that the real estate inventory at the end of the year will be close to or exceed the peak level of 2015.

At present, the real estate policy is in the transition cycle. The government is promoting the "new housing reform". On the one hand, it will relax the demand side control, encourage just needed and improved housing, and stimulate the recovery of the real estate market; On the other hand, we will promote the transformation of villages in cities and build rental affordable housing. However, without the introduction of additional policies, especially the policy of liquidity support for developers, it is difficult for developers to recover slowly by sales. Some large private real estate enterprises will fall into debt crisis, and the repair cycle of the real estate market will be prolonged, which will also drag down the macroeconomic recovery.

In fact, the decision-makers have begun to consider increasing liquidity assistance to developers to avoid debt risk spillover. It is rumored that the government is drawing up a "white list" of real estate enterprises to encourage financial institutions to increase relevant financing support; The People's Bank of China is also considering using tools such as mortgage supplementary loans (PSL) and special bonds to increase investment in three major projects - affordable housing, urban village renovation and "emergency and peaceful" infrastructure.