At present, the outward remittance of funds is limited. Some foreign investors have proposed whether they can directly collect share funds in the name of the ultimate overseas natural person shareholder or the domestic natural person/institution designated by the overseas shareholder when they transfer their Chinese enterprise equity to the domestic acquirer?

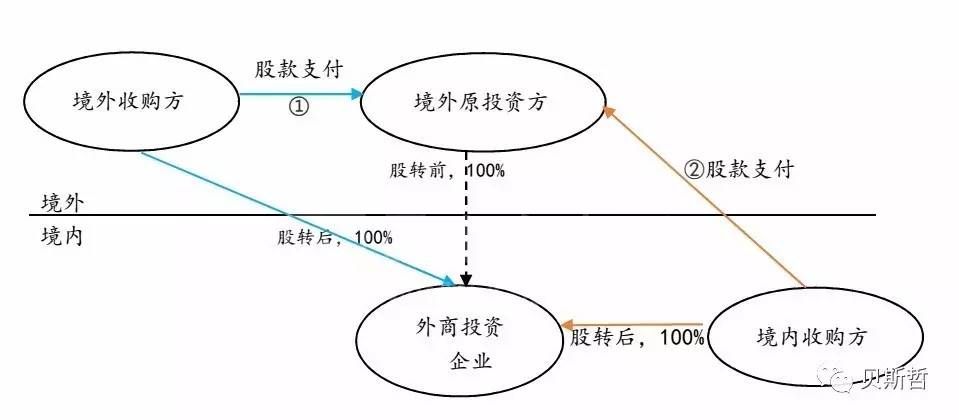

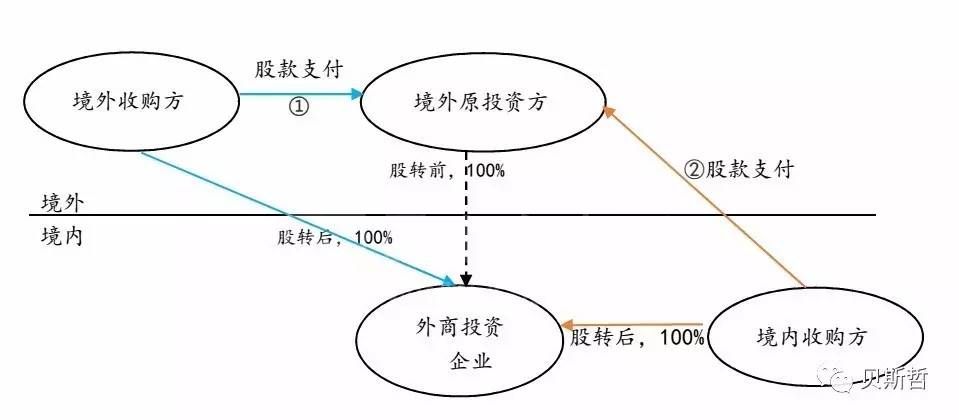

When a foreign investor transfers the equity of a Chinese enterprise, there are two kinds of acquirers: overseas acquirers and domestic acquirers. Let's take a look at the stock trading process in two cases:

As shown in the above figure, the equity transfer in case ① is a transaction between two overseas entities, which is also commonly known as "external transmission". The payment of share funds is also made entirely overseas without the need to submit relevant vouchers for share funds payment to the external management department; In case ②, the equity transfer, which is commonly known as "transfer from outside to inside", should comply with the relevant provisions of China on foreign exchange control, since it involves two different cross-border entities and the share payment needs to be paid by the domestic acquirer to the overseas investor.

Due to different national exchange control policies in different periods, and based on China's encouragement for RMB to become an international currency, whether foreign investors can collect share funds in China by transferring their shares to domestic acquirers is analyzed from the following two aspects:

1、 If the overseas investor has an NRA account in China, it can directly collect RMB in the name of the NRA account in China

On July 13, 2009, the State Administration of Foreign Exchange issued the Notice on Issues Related to the Management of Domestic Foreign Exchange Accounts of Overseas Institutions, allowing overseas institutions to open domestic foreign exchange accounts, that is, NRA accounts; Since October 1, 2010, the People's Bank of China has promulgated and implemented the Measures for the Administration of RMB Bank Settlement Accounts of Overseas Institutions, which distinguishes the management of local and foreign currencies under the NRA accounts of overseas institutions, and requires banks to uniformly prefix "NRA" when preparing RMB bank settlement account accounts of overseas institutions. Therefore, the NRA account here usually refers to the RMB account of overseas institutions in China. Accounts opened by overseas individuals in China are not NRA accounts.

However, transactions under the NRA account will not be exempt from foreign exchange control because they are paid in RMB. According to Article 5 of the Notice on Issues Related to the Administration of Domestic Foreign Exchange Accounts of Overseas Institutions, "V. Foreign exchange receipts and payments between domestic institutions and domestic individuals and domestic foreign exchange accounts of overseas institutions shall be managed in accordance with cross-border transactions. Domestic banks shall review the effective commercial documents and vouchers of domestic institutions and domestic individuals in accordance with the provisions on the administration of foreign exchange for cross-border transactions." Therefore, if an overseas investor opens an NRA account in China and collects equity transfer funds, the domestic acquirer should still submit relevant audit materials in accordance with the requirements of the Administration of Foreign Exchange even if it makes payment in RMB.

Here is a small episode to mention. On September 20, 2002, the State Administration of Foreign Exchange (SAFE) issued the Reply on Domestic Residents' Purchase of Foreign Exchange to Pay for Foreign Equity Transfer (HF [2002] No. 231) to the Zhejiang Branch, It was clearly stated that "the transfer of equity by Chinese shareholders to foreign parties, the transfer of equity by foreign shareholders to Chinese parties, and the transfer of equity by foreign shareholders to another foreign party belong to transactions between residents and non residents, and the transfer of equity by foreign shareholders to another foreign party belongs to transactions between non residents and non residents, should be priced and settled in foreign currencies." This provision that cross-border share payments can only be calculated in foreign currencies, With the encouragement of the state to make RMB an international currency, it has become history. As early as October 2011, the People's Bank of China issued Article 13 of the Measures for the Administration of Foreign Direct Investment in RMB Settlement Business, which stipulates that foreign investors remit RMB funds from capital reduction, share transfer, liquidation, and early recovery of investment out of China, The bank shall go through the procedures for outward remittance of RMB funds after reviewing the approval or filing documents and tax payment certificates of the relevant national departments; In the following year, November 2012, the State Administration of Foreign Exchange issued HF [2012] No. 59 document, canceling the approval of foreign exchange purchase and external payment for domestic institutions or individuals to purchase foreign equity of foreign-funded enterprises to pay the price of equity transfer, and the bank handles foreign exchange purchase and external payment procedures for domestic institutions or individuals according to the registration information in the relevant business system of the SAFE; By May 2013, the State Administration of Foreign Exchange had issued Hui Fa [2013] No. 21 document, abolishing Hui Fu [2002] No. 231 document, that is, the provision that foreign investors must be priced and settled in foreign currencies when transferring their equity to China.

2、 If the payee of the foreign investor in China is not the NRA account but the domestic personal account of an overseas natural person, or directly uses the designated domestic person as the payee, the following risks may be caused:

In case ② of the figure, the "transfer from outside to inside" refers not only to the transfer of the foreign party's equity to the Chinese shareholder, but also to the change of the nature of the foreign-funded enterprise, that is, the change from the original foreign-funded enterprise to a domestic funded enterprise (unless the foreign party transfers part of its equity to become a Sino foreign joint venture/enterprise).

1. May be punished for failure to go through cancellation procedures of foreign exchange registration

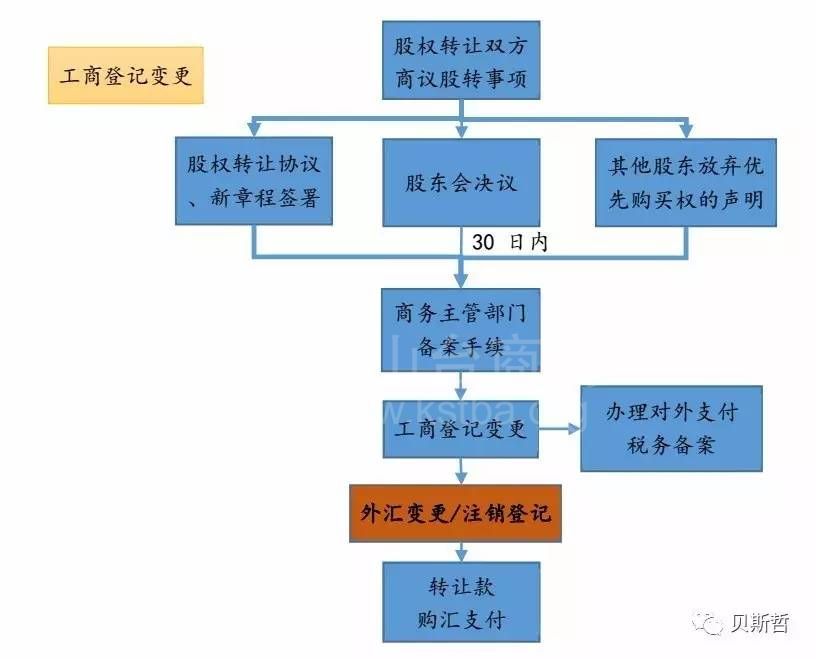

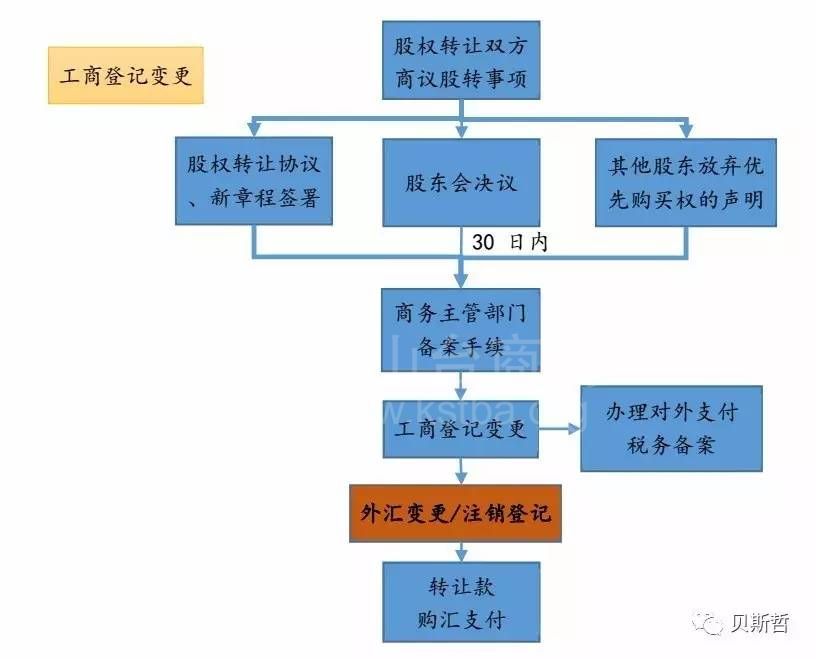

The following is the approval and capital payment process for equity transfer of foreign-invested enterprises:

It can be seen from the above process that the foreign exchange registration and cancellation process is at the end of the approval process after the business, industry and commerce, tax and other processes. After a foreign-funded enterprise is changed into a domestic funded enterprise, it should go through the procedures for cancellation of foreign exchange registration. For example, the domestic acquirer directly pays the share funds to the domestic non NRA account designated by the foreign investor in China. Since it has not been reviewed by the SAFE (or the bank), it cannot go through the procedures for cancellation of foreign exchange registration, which violates the Regulations on Foreign Exchange Administration The provisions of Article 48 may result in penalties: "In any of the following circumstances, the foreign exchange administration agencies shall order correction, give a warning, impose a fine of less than 300000 yuan on the institutions, and impose a fine of less than 50000 yuan on individuals:...... (5) Violation of foreign exchange registration regulations;......".

2. Penalties may be imposed for failing to provide tax filing certificates or failing to pay taxes.

The income from equity transfer obtained by the foreign party from China shall be subject to income tax, which is usually withheld and remitted by the domestic acquirer from the transfer price. According to the Announcement on Issues Related to Tax Filing of External Payments for Trade in Services and Other Projects issued by the State Administration of Taxation and the State Administration of Foreign Exchange on July 9, 2013, it is stipulated that "I. Domestic institutions and individuals shall make a single payment of more than US $50000 (excluding the equivalent of US $50000, the same below) The following foreign exchange funds, except for the circumstances specified in Article 3 of this Proclamation, shall be filed with the local competent national tax authority for tax record. If the competent tax authority is only the local tax authority, it shall be filed with the local national tax authority at the same level:...... (III) Financial leasing rent, real estate transfer income Income from equity transfer and other lawful income of foreign investors. " In addition to submitting the equity transfer agreement and other materials, the Company shall also fill in and submit the Tax Filing Form for External Payment of Service Trade and Other Items, which has also become one of the necessary documents required by the bank when reviewing the outward remittance of share funds.

If the equity transfer funds are not remitted or paid through other abnormal ways, the domestic acquirer may be punished by the tax authority for failing to perform the withholding and remitting obligations because it is unable to provide the Tax Filing Form for External Payment of Service Trade and other Items, and has not handled the remittance business.

3. Risk that the capital source cannot be explained due to the retention of stock funds in China under CRS

As we all know, China will implement CRS from 2017, which will strengthen the information supervision of high asset persons. When a foreign investor transfers its equity interests in a Chinese enterprise, it should collect the share funds directly in the name of the foreign investor, but now it is collected by other accounts in China. On the one hand, such persons may be regarded as high-value transactions by the bank (according to the provisions of the People's Bank of China Order (2016) No. 3 "Administrative Measures for Reporting Large Value Transactions and Suspicious Transactions by Financial Institutions", For large transactions between natural persons and non natural persons, the domestic and cross-border reporting standards are more than 50000 yuan, and the foreign currency equivalent is more than 10000 dollars; For large amount transfer transactions between natural persons, the domestic reporting standard is more than 500000 yuan and more than 100000 dollars for foreign currency positions) and suspicious transactions. On the other hand, the implementation of CRS will be regarded as a qualified non resident financial account and the tax related information will be automatically exchanged, resulting in a sharp increase in risk.