The registered capital of foreign-invested enterprises can be expressed not only in foreign currencies such as US dollars, but also in Renminbi, which is clearly stipulated in Article 8 of the 2006 Implementation Opinions on Several Issues Concerning the Application of Laws Governing the Approval and Registration of Foreign invested Companies. However, it has also caused many foreign businessmen to be confused, that is, does the registered capital expressed in RMB mean that the capital contribution must be remitted into RMB from abroad?

In fact, which currency is used to represent the registered capital and which currency is used as the capital contribution are two different concepts. As mentioned above, according to the provisions of the Implementation Opinions on Several Issues Concerning the Application of the Law on the Administration of the Examination, Approval and Registration of Foreign invested Companies, "the registered capital of foreign-invested companies can be expressed in Renminbi or other freely convertible foreign currencies." The expression here actually refers to the business license and other licenses of foreign-invested enterprises, The question of whether to use RMB or foreign currency; That is to say, although the foreign exchange inflow from abroad is US dollars, it does not affect the domestic enterprises established by them to express their registered capital in RMB. For example, a foreign-funded enterprise may express its registered capital as 10 million yuan when applying for establishment, but intends to remit in US dollars, At that time, only the dollar limit is calculated according to the middle rate of the exchange rate published by the People's Bank of China on the day of payment.

On the contrary, if a foreign-funded enterprise expresses its registered capital in US dollars when applying for establishment, but intends to use overseas RMB as its capital contribution, can it? The answer is yes. With the development of the pilot business of cross-border trade RMB settlement, in 2011, the State Administration of Foreign Exchange stipulated in the Notice on Issues Related to Regulating the Operation of Cross border RMB Capital Account Business (Hui Zong Fa [2011] No. 38): "Foreign investors are in the form of cross-border RMB (including overseas RMB funds and non resident domestic RMB account funds, the same below) In case of fulfilling the obligation of capital contribution or paying the consideration for equity transfer to domestic residents, the target enterprise shall go through the corresponding registration or change registration of foreign-invested enterprises at the local foreign exchange bureau with the approval documents of the competent commercial department indicating that the capital contribution is in RMB or the consideration for equity transfer is paid. ”In fact, this is the recognition of foreign investors' investment in RMB.

Then the question arises: how should foreign investors choose the currency when setting up enterprises when the trend of the RMB exchange rate is unknown? Now, according to several aspects that may be involved in the operation of foreign-invested enterprises, the analysis is as follows:

1、 If the industry has restrictions on the minimum registered capital

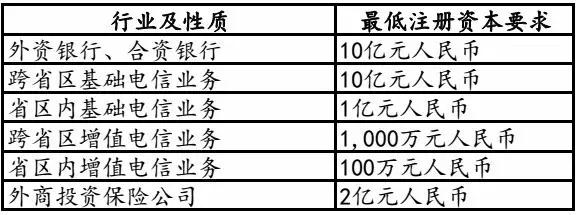

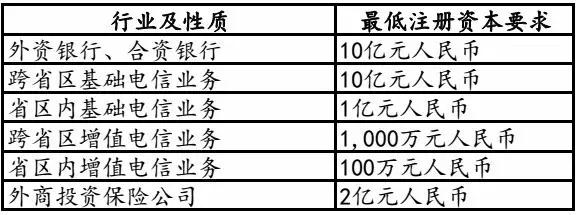

Following the 2014 Notice on Improving the Administration of Foreign Investment Review, the Ministry of Commerce issued the Decision on Amending Some Rules and Normative Documents on October 28, 2015, abolishing the restrictions on the investment period of foreign-invested enterprises and the minimum registered capital of general foreign-invested enterprises. However, for some special industries, other national regulations should also be observed, The main industry restrictions are as follows:

In addition, there are also some industrial regulations that also require the minimum registered capital of enterprises in response to the needs of qualification level identification (such as construction enterprises). In order to avoid the risk of exchange rate changes when foreign-invested enterprises are engaged in the above industries, it is suggested that they can directly use RMB as the currency of their business licenses.

2、 Currency calculation of equity transfer transaction

From the perspective of the tax law, the equity transferor is the taxpayer, and the calculation of equity transfer income tax is based on the difference between the transfer price and the original investment cost (regardless of the unfair transfer price verified by the tax). At the same time, according to the provisions of Article 4 of the Notice on Strengthening the Management of Enterprise Income Tax on the Equity Transfer of Non resident Enterprises (Guo Shui Han [2009] No. 698), "When calculating the income from equity transfer, the equity transfer price and equity cost price shall be calculated in the currency in which the non resident enterprise invests in the Chinese resident enterprise whose equity is transferred or purchases the equity from the original investor. If the same non resident enterprise has multiple investments, the equity transfer price and equity cost price shall be calculated in the currency when the capital is first invested, and the equity cost price shall be calculated by the weighted average method; If the currency is inconsistent when making multiple investments, it shall be converted into the currency of the first investment according to the exchange rate on the date of each capital investment. "

Since foreign investors usually invest in foreign currencies when establishing companies, how to determine the transaction currency when calculating the income from equity transfer may involve different tax payments. For example:

If the paid in capital of a foreign-funded enterprise is US $1 million (one-time contribution), the book paid in capital is RMB 8 million, and the middle rate of the exchange rate between US $and RMB on the date of equity transfer is 7.

There are two cases:

1. If the price is US $1 million, the equity income is 0, and there is no need to pay corporate income tax. At this time, because the exchange rate is 7, the actual convertible RMB is 7 million, but if there is no need to convert into RMB, there is no actual loss for the equity transferor;

2. If the price is 8 million yuan, then on the transfer date, if it is converted to US $1.1429 million (800/7), which is higher than the equity cost price by 1 million dollars, the equity income is 142900 dollars, and then converted to about 1 million yuan, the equity transferor shall pay corporate income tax with 1 million yuan as the equity transfer income.

It can be seen that in the case of RMB appreciation, the transfer is also at parity, but if the price is set in RMB, tax will be paid. The income here actually refers to the income generated by the appreciation of RMB after the US dollar was remitted into China that year.

Similarly, for the above example, if the foreign-funded enterprise invested 8 million yuan in the same year (in fact, the same amount is 1 million dollars), and now trades at 8 million yuan, the income from equity transfer is 0, and no corporate income tax is required, However, since the exchange rate between the US dollar and the RMB has changed to 78 million yuan, which can be converted into 1142900 dollars before being remitted overseas (the collection of RMB for equity transactions by overseas institutions can be settled through the NRA account), investors have enjoyed the benefits of RMB appreciation.

It can be concluded from the above that when the RMB is expected to appreciate in the future, when it is invested in RMB and used as the registered currency, it can enjoy the benefits brought by the appreciation of RMB in the future, and it is not necessary to pay income tax (individual income tax or enterprise income tax); When a currency is expected to appreciate against RMB in the future (that is, RMB depreciates), it can be invested in that currency and used as the registered currency. In the future, it will be priced in equivalent RMB without paying income tax, but it can enjoy the benefits of the currency appreciation.

3、 When borrowing foreign debt in the mode of poor bets

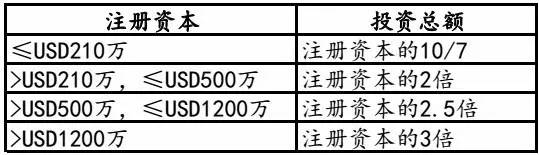

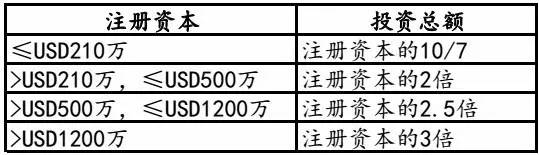

As for the relationship between total investment and registered capital, according to the Interim Provisions on the Proportion of Registered Capital to Total Investment of Sino foreign Joint Ventures issued by the State Administration for Industry and Commerce in February 1987, see the following table:

The key to the size of the total investment is to affect the foreign debt quota of enterprises, that is, foreign-invested enterprises can borrow foreign debt at the difference between the total investment and the registered capital (referred to as the "bet difference"). Of course, there was also a preferential policy for foreign-invested enterprises to import equipment within the foreign debt quota, but now it has been canceled.

The amount of foreign debt in the mode of bet difference is converted based on the actual paid in registered capital of foreign-invested enterprises. For example, if the original bet difference, i.e., the amount of foreign debt, is $5 million, and the actual paid in capital only accounts for 10% of the registered capital, then the amount of foreign debt that can be borrowed at this stage is only 10%, i.e., $500000.

Is there any difference in currency selection? For example, in the case of the expected devaluation of RMB, a foreign-funded enterprise obtained the approval from the Ministry of Commerce on January 6, with a registered capital of RMB 30 million yuan (assuming that the central parity rate of the RMB against the U.S. dollar on January 6 is 6). When converted into U.S. dollars of 5 million dollars, the total investment is 10 million dollars, that is, the enterprise has a foreign debt quota of 5 million dollars, However, the foreign-funded enterprise has never actually contributed. Assuming that the central parity rate of the RMB against the US dollar is 7 one year later, the foreign shareholders of the enterprise only need to contribute US $4.2858 million one year later to meet the requirement of fully paying the registered capital, that is, the enterprise uses US $4.2858 million to obtain the original foreign debt of US $5 million. It can be seen that in the case of expected devaluation of RMB, selecting RMB as the currency can alleviate the pressure on funds to a certain extent; It is not suitable to use RMB as the registered currency when the RMB is expected to appreciate, otherwise it will increase the capital pressure on overseas shareholders' investment.

Of course, if the enterprise uses US dollars as its registered currency, no matter how the RMB exchange rate changes, the capital of US $5 million will not be affected.

To sum up, there is no unified answer on whether to use foreign currency or RMB when registering a foreign-invested enterprise. It depends on the analysis of the nature of the enterprise's operation, industry, group planning, expected trend of the RMB exchange rate and other factors. Of course, the currency planning in equity transfer is based on the most tax efficient standard. At present, according to the regulations of the industry and commerce department, only when a foreign-funded enterprise changes from a sole proprietorship to a Sino foreign joint venture, the joint-stock system reform, or capital increase in RMB, can it convert its original foreign currency registered capital into RMB. The industry and commerce department that only changes the currency of its registered capital generally does not accept the registration. Therefore, foreign investors should plan in advance and choose the appropriate currency of its registered capital.