Event playback: A few years ago, we handled the "Dinghuotong" business of Ping An Bank and deposited 150000 yuan in succession. It is estimated that there are tens of thousands of yuan of interest, but only 1500 yuan was received when we withdrew. The bank's reason is that the central bank has introduced a new policy, and the deposit receipt withdrawn by the customer has changed from file based interest calculation to current interest rate calculation. If the customer withdraws two months in advance, it will not be affected by the new regulations. Southeast Network invited financial experts and lawyers to make specific analysis. Relevant reports were reprinted by Fujian Channel, Guangzhou Daily Client, Jilin Daily Client, Daily Economic News, Surge News, China Youth Network, Dayang Network, Sina Finance, etc. Many netizens published comments questioning the bank's practices. Under the pressure of public opinion, Ping An Bank handled the complaint properly. Netizens sent brocade banners and thank-you letters to Southeast Net to praise the promotion of rights protection and the elimination of problems and difficulties for the masses.

Detailed report:

On March 12, 2021, Southeast Net (our reporter Feng Xu) handled the "Dinghuotong" business of Ping An Bank a few years ago and deposited 150000 yuan in succession, but found that the interest was only 1500 yuan, far from the personal estimate of 12000 yuan. The staff of Ping An Bank informed that according to the new policy issued by the Central Bank, the deposit receipt withdrawn by the customer has changed from file based interest calculation to current interest rate calculation, and if withdrawn two months in advance, it will not be affected by the new regulations. Recently, Mr. Wu from Fuzhou reported this matter to Southeast China Netcom Direct to Pingshan, and questioned that Ping An Bank had not informed of the change of interest accrual rules. 【 Message details 】

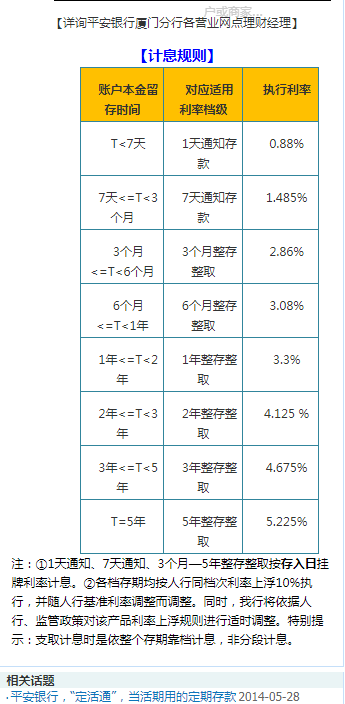

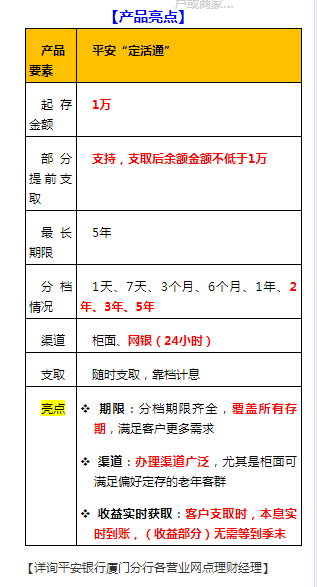

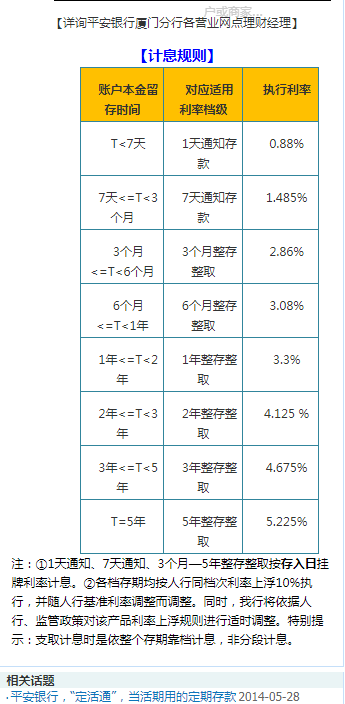

Ping An Bank's "Dinghuotong" product introduction (screenshot of official website) Policy change: 150000 yuan was saved for two months, and the income was 10000 yuan less Mr. Wu told the reporter that since 2014, Ping An Bank has promoted the "Dinghuotong" business throughout the country, and the customer service personnel of Ping An Bank also recommended this product to him, saying that the agreed deposit period of this product is five years, but it can be withdrawn in advance, and the deposit interest rate is calculated flexibly according to the actual deposit period. Take the deposit of 100000 yuan as an example. If the deposit is withdrawn before the minimum term of time deposit expires, the interest will be calculated at the current deposit interest rate; If the deposit is withdrawn after 13 months, the interest will be calculated according to the fixed term of one year and the current term of one month... Then, Mr. Wu signed an agreement on the ATM by checking in accordance with the guidance of the customer service personnel and handled this business. Over the years, he has transferred 150000 yuan. In February this year, Mr. Wu withdrew his deposit through Ping An Bank's APP. However, it is quite different from his estimated interest of about 12000 yuan, and the actual interest is only 1578.83 yuan. In doubt, Mr. Wu called the customer service number 95511 of Ping An Bank. The customer service staff informed that according to the new policy issued by the Central Bank, the interest calculation method for individual large deposit receipts, fixed deposits and other products withdrawn in advance was changed from file based interest calculation to current deposit listing interest rate; If Mr. Wu withdraws the deposit before January 1 this year, the interest will not be affected by the new policy. "Why didn't you call or send a text message to inform users of such a big impact?" Mr. Wu believes that Ping An Bank has the responsibility to notify users in advance. The customer service staff told him that they had made announcements on the mobile APP before. Mr. Wu proposed that he checked the historical push news of Ping An Bank's mobile app, but did not find the relevant announcement. "Users cannot open this app every day, let alone the elderly who do not have this app installed or even a smartphone at all?" Mr. Wu mentioned that he was not the only user whose interests were damaged due to policy changes, and fixed deposit users across the country were affected. The customer service staff of Ping An Bank also disclosed that some users complained about the matter on the twitter, but they could not deal with it, so they had to register on behalf of them.

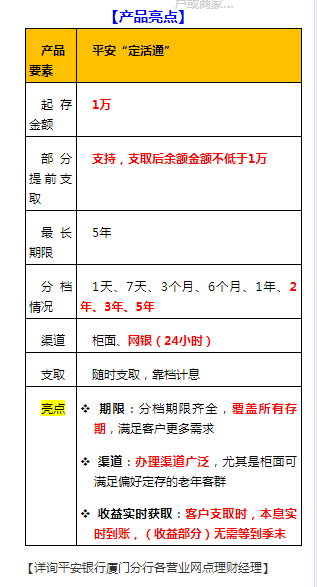

Ping An Bank's "Dinghuotong" product promotion (screenshot) From "withdraw at any time and calculate interest on file" to "withdraw in advance and calculate interest on demand" The reporter found from the official website of Ping An Bank that there is still "Dinghuotong" business in its investment and wealth management projects. The relevant introduction said: "Dinghuotong" refers to the "Dinghuotong" product service agreement signed between individual customers and our bank, with the minimum deposit amount of 10000 yuan/10000 yuan US dollars/50000 yuan Hong Kong dollars, the agreed deposit period (5 years in RMB, 2 years in foreign currency), which can be withdrawn in advance, It is also a time deposit product with both profitability and liquidity, with intelligent interest calculation based on the fixed interest rate corresponding to the actual deposit period of the principal. Although the specific rules of intelligent interest calculation have not been found on the official website, the promotion and publicity of that year still have traces to follow. For example, in 2014, articles such as China. com, Xiamen Evening News, Xiamen Xiaoyu. com, etc. published "Ping An Bank launched" Dinghuotong "as a fixed deposit for current use" and so on. Some articles list the highlights of Ping An Bank's "Dinghuotong", such as withdrawal at any time and interest calculation on file. The classification includes 1 day, 7 days, 3 months, 6 months, 1 year, 2 years, 3 years, and 5 years. The longest term is 5 years, and partial withdrawal in advance is supported. The reporter wanted to interview Ping An Bank on this matter, but the bank only called back to confirm its identity to the reporter, and there was no news for many days after that, and the reporter did not answer the question again. Mr. Wu provided the contact number of Fuzhou Gutian Branch of Ping An Bank, which handled the matter. The reporter called many times, but no one answered the phone all the time. Miss Xu, a member of the Central Bank's 12363 Fujian Financial Consumer Consultation and Complaint Hotline No. 8002, told the reporter that the Central Bank had indeed abolished the rule of interest calculation by file. According to this rule, if part of the time deposit is withdrawn in advance, the interest of the part withdrawn in advance will be calculated and paid according to the current deposit interest rate announced on the day of withdrawal, The rest will pay interest at the time of maturity according to the fixed deposit interest rate announced on the opening date of the deposit certificate; If all the undue time deposits are withdrawn, the interest shall be calculated and paid according to the current savings deposit interest rate announced on the withdrawal date. "In fact, the rule of canceling the file based interest calculation for regular products has existed before, but some banks did not follow the rule, so the Central Bank issued a notice of rectification last year." Miss Xu said that financial institutions conducting business, as the first responsible person, should explain and communicate with relevant departments and customers, "If the customer doesn't agree with the reply, you can call 12363 to report that we will help transfer it." The reporter asked how to solve the loss of profits caused by the new rules to the original customer. Miss Xu said she had no right to explain, but could only transfer it.

Ping An Bank's "Dinghuotong" product promotion (screenshot) The law does not retroactive to previous practices of Ping An Bank or it is a breach of contract Xie Changhua, a lawyer from the Fujian Provincial Committee of Consumer Affairs and Fujian Zhisheng Law Firm, believes that the contract agreement between the bank and the consumer is reached voluntarily by both parties, is a commercial act rather than a criminal act, and is effective when the law does not explicitly prohibit it; And the law does not go back to the past. The central bank has introduced new rules to regulate market behavior. The society should cooperate, but it cannot deny the previous contract agreement. Xie Changhua suggested that Mr. Wu fix the evidence in time and protect his rights and interests through the CC or legal channels. Pan Changfeng, professor of the Department of Finance, School of Economics and Management, Minjiang University, believes that consumers have already signed an agreement with the bank when they purchase products, and should also sign a new agreement when they need to change the agreement; And the policy release is only to inform the whole people, while the bank has not signed an agreement with the whole people. Under the conditions of modern technology, the bank should fulfill the obligation of point-to-point disclosure. "From a legal point of view, Ping An Bank should be on the side of losing money." Pan Changfeng believes that a person's loss of 10000 yuan may involve tens of millions or even hundreds of millions of yuan nationwide. Relevant consumers can complain to the Consumer Council, sue to the court, or apply to the Bank Insurance Regulatory Bureau for rights protection. At present, Mr. Wu has asked Ping An Bank for the agreement signed when handling the "Dinghuotong" business, but the bank has been unable to provide it. However, President Zheng of Fuzhou Gutian Sub branch of Ping An Bank has met with Mr. Wu for consultation and said that he would properly resolve the matter. It seems that the success of Mr. Wu's rights protection is expected. However, how many "Mr. Wu" in the country have a stake in this policy? Are they currently informed? Will you be "dumb" under the banner of "central bank policy"? Southeast Network will continue to pay attention.

|

e1392e7e-6734-493d-ba19-5d09d6da8e29.jpg)

7ad71161-bfcd-40d6-83e2-af22c97158cf.jpg)