The following article comes from Databao, written by Zhang Juanjuan

Databao

Databao - Smart original new media of the Securities Times, a leading brand of big data new media in China's stock market, relies on the financial database of the Securities Times and the authoritative information of the media designated by the CSRC to disclose information, so that you can also get useful decision information support from massive data with your mobile phone. Data is a treasure, and there is less trouble in stock speculation!

Recently, Beishang capital continued to flee from China's stock market, with a total net outflow of more than 120 billion yuan from August to September; In addition, the market is full of various negative rumors such as "BlackRock has decided to go away and Norwegian sovereign funds have decided to lose", which has caused great distress and impact on the investor sentiment in the A-share market.

So is it true that foreign capital represented by qualified foreign investors (QFII) has withdrawn from A-shares, or is it the exaggeration of malicious short sellers? We use data to break these "lies".

Truth 1: The number of shareholding companies at the end of the second quarter of 2023 is higher than that at the end of 2022

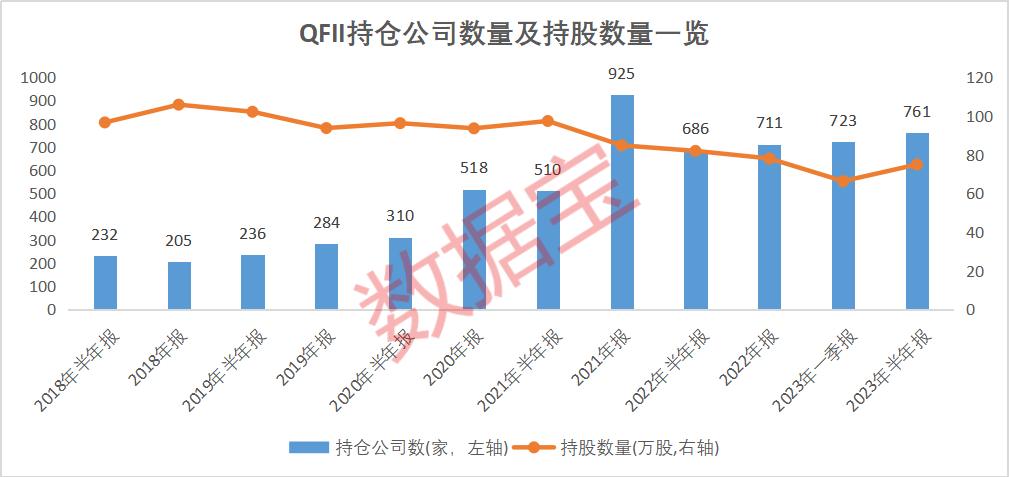

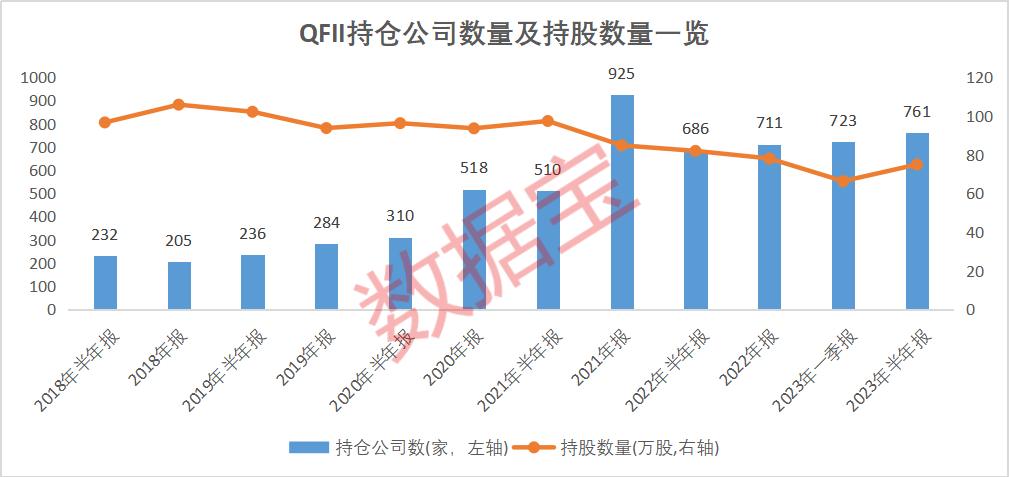

According to the data disclosed in the semi annual report of 2023, QFII holds a total of 9.667 billion shares of circulating capital stock of 761 A-share companies. The number of shares held by QFII is lower than that at the end of 2022, but higher than that at the same time last year; The number of shareholding companies increased by 50 compared with the end of 2022; The median shareholding ratio is 0.91%, slightly higher than that at the end of 2022.

According to the proportion of outstanding shares held, QFII increased its position by 146 shares at the end of the second quarter of 2023 compared with the end of 2022, with Northrop Grumman, Man Kun Technology, Shu Yu Minmin, etc. ranking first in terms of the increase in positions; Reduction of 188 shares, such as Optech, Hangke Technology, Ruifeng New Material, etc.

In fact, QFII also reduced its position long ago. Faced with the complicated international situation, the number of QFII holding companies and the number of outstanding shares held by QFII at the end of 2018 also declined significantly compared with the end of the second quarter of 2018. At the end of the second quarter of 2022, the number of shareholdings and the number of shareholdings also decreased compared with the end of 2021.

By the end of the second quarter of 2023, the market value of QFII positions had remained above 120 billion yuan, down about 10% from the end of 2022. Assuming that QFII withdraws significantly from July to September, the liquidity and valuation of A-share may change dramatically. The data shows that the price earnings ratio of Shanghai Stock Exchange Index and Shanghai Shenzhen 300 Index has fluctuated in a narrow range in the past three months, and the turnover rate has declined significantly.

On the whole, the so-called "foreign capital withdrawal" may only be QFII's position adjustment behavior. It cannot be denied that QFII's position at the end of the second quarter of 2023 was 143.253 billion yuan, a decrease of more than 25 billion yuan compared with the end of 2022. However, some public information shows that some foreign institutions have suffered losses in investing in A-shares, so the decline in the market value of their positions may be related to the decline in share prices.

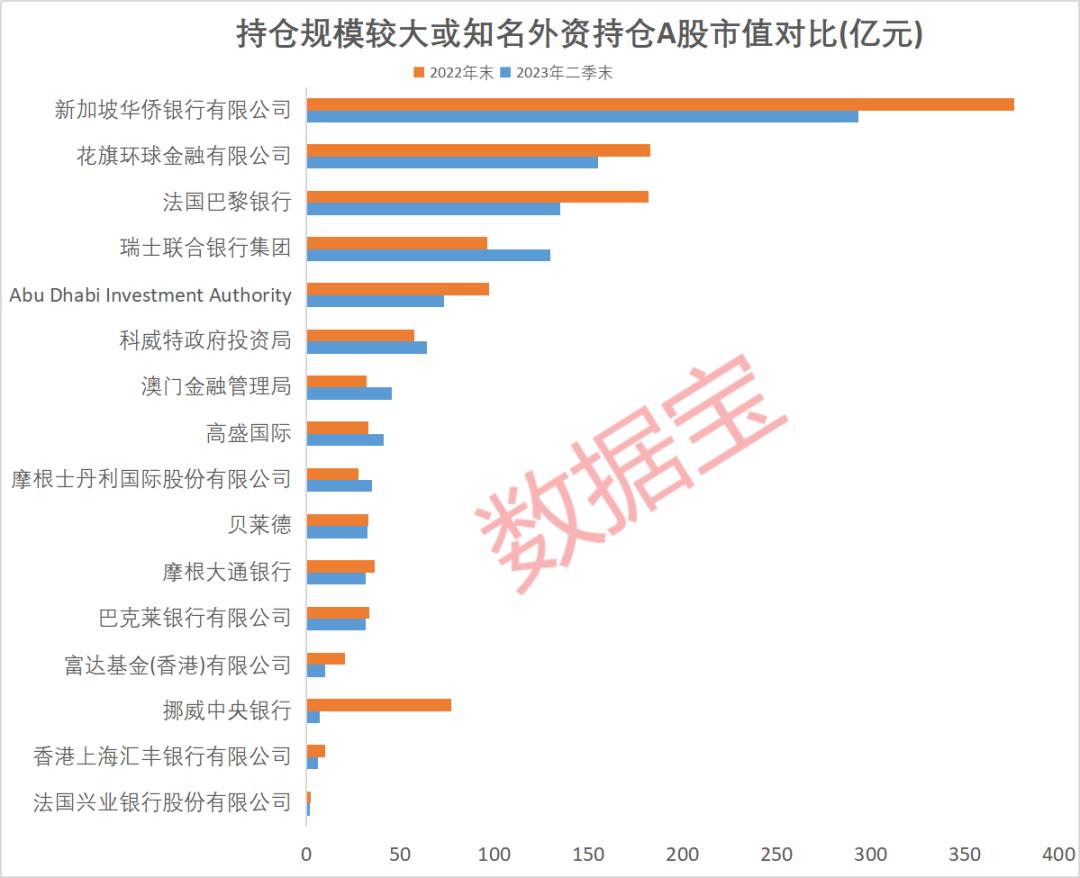

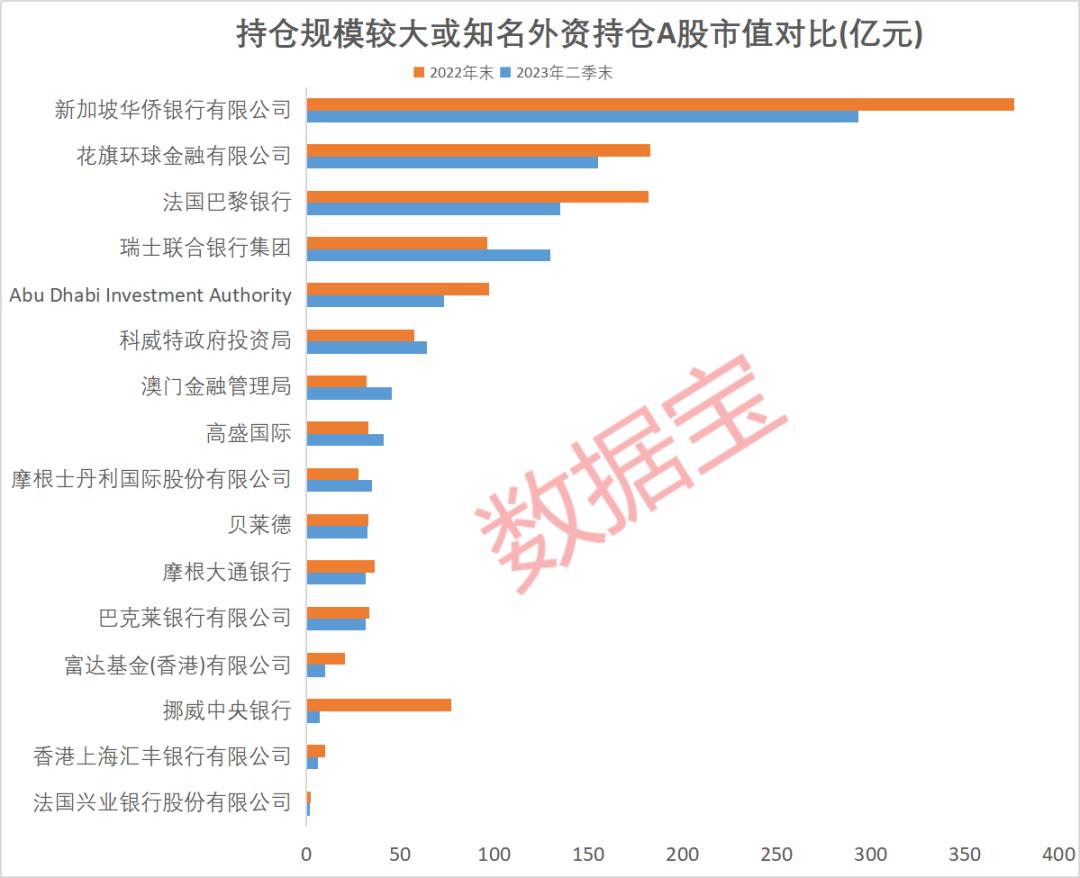

Truth 2: Foreign funded institutions have not withdrawn their capital. The Norwegian Central Bank: investment in China remains unchanged

Among many foreign-funded institutions, the positions of asset management institutions with large assets or high reputation are the most concerned by investors. From the perspective of 16 foreign-funded institutions with large positions or high popularity, the market value of positions of 5 QFII institutions, including UBS, Kuwait Government Investment Agency and Goldman Sachs International, at the end of the second quarter of 2023 increased from the end of 2022. Overseas Chinese Bank of Singapore, Citigroup Global Finance Co., Ltd. and BNP Paribas ranked among the top three in terms of the market value of their positions, which continued to exceed 10 billion yuan. Among them, the market value of Citigroup Global Finance Co., Ltd. increased significantly compared with the same period last year.

The market value of BlackRock Global Fund, a product of BlackRock, the world's largest asset management company, exceeded 3.2 billion yuan at the end of the second quarter of 2023, a slight decrease from the end of 2022. The market value of the position and the number of shares held by the Central Bank of Norway, known as "Odin" in the investment sector, both declined significantly. As of the end of the second quarter of 2023, its market value of the position was only 693 million yuan. Among the latest 5 shares held, 4 shares including Hisense Appliances were added, while the position of Junda shares remained unchanged.

What needs to be added is that BlackRock was mistakenly thought by the market to withdraw A-shares because of the closure of China's flexible stock fund. On September 7, BlackRock responded that "because the scale of the above fund has shrunk to only about $21 million, BlackRock had previously closed this fund in consideration of management costs and other issues", and the information about the withdrawal from China was untrue; In addition, the official website of Norges Bank Investment Management, a Norwegian sovereign wealth fund, shows that "the process of closing the Shanghai representative office has been started. Our investment in China remains unchanged." The agency said that this decision was for operational reasons and would not affect the investment strategy of the fund and its investment in China.

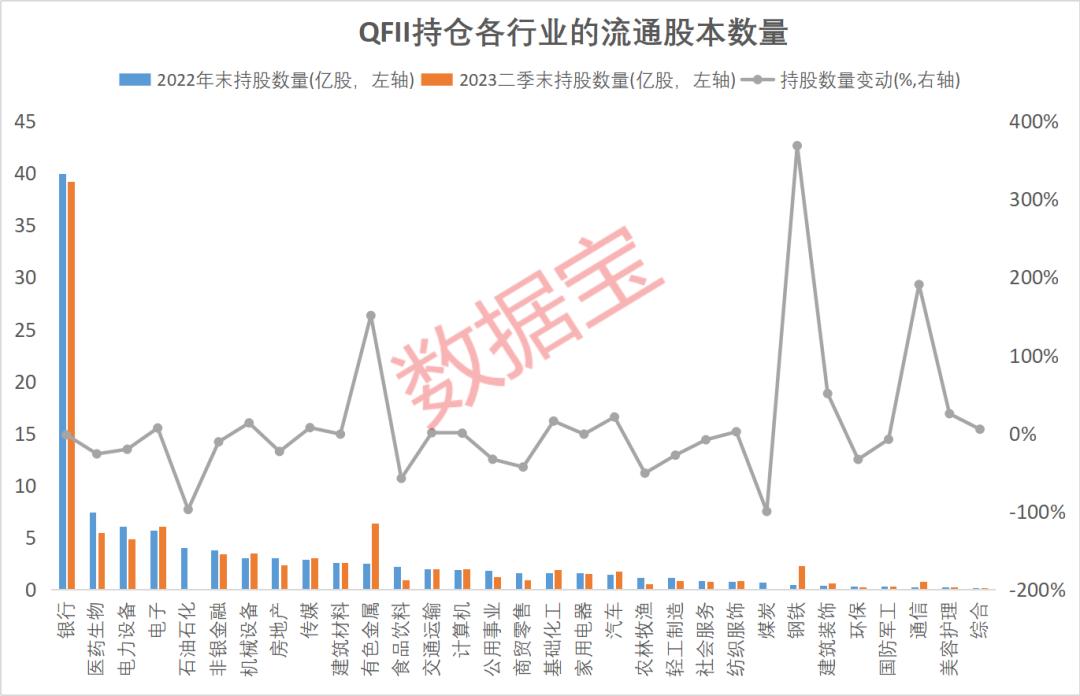

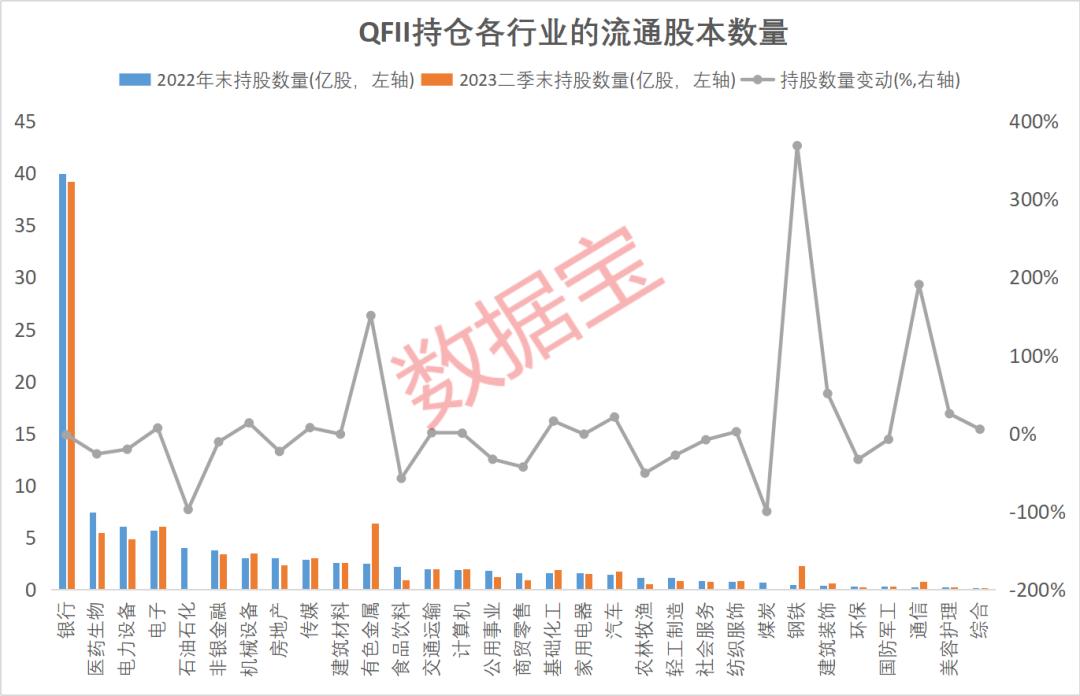

Truth 3: QFII has significantly adjusted its position, the big financial consumption has been reduced, and the technology and manufacturing industries have gained popularity

Historical data research shows that QFII positions have been dominated by large market and blue chip for several periods. At this stage, it is still heavily positioned in the big finance and big consumption sectors. However, from the data of the latest quarter, QFII has significantly adjusted its positions, and big finance and big consumption have been significantly reduced. The technology and manufacturing industries have gained popularity and increased their positions significantly.

Specifically, at the end of the second quarter of 2023, QFII held 607 million shares in the electronic industry, an increase of nearly 7% over the end of 2022; Mechanical equipment and basic chemical industry increased by more than 10%; The automobile industry increased by more than 20%; Non ferrous metal industry shares increased by more than 150% over the same period; The number of shares held by the telecommunications industry increased by nearly 200% over the same period; The number of shares held by the steel industry increased by more than 350% over the same period. Five industries, including nonferrous metals and mechanical equipment, have been continuously added by QFII.

At the same time, at the end of the second quarter of 2023, the number of shares held by QFII in the food and beverage, medicine and biology, and real estate industries decreased by more than 20% compared with the end of 2022; The non bank financial industry declined by more than 10%, and the banking sector declined by nearly 2%. Among them, QFII continued to reduce the positions of big finance and household appliances.

Judging from the position changes of Kuwait Government Investment Bureau (hereinafter referred to as "Kuwait") and Goldman Sachs International, Kuwait added positions in machinery equipment, automobile, electronics and other industries; In the reduction stocks, pharmaceutical and biological, food and beverage companies are clustered; New positions of Goldman Sachs International include Hangke Technology, Jinpan Technology, Shanghai Hugong and other power equipment and mechanical equipment companies.

Reasonably view the withdrawal of foreign capital, A-share still has investment value

In view of the current reduction of positions by some foreign institutions, does A-share have investment value?

The stock strategy team of Goldman Sachs Research Department issued a report saying that the Chinese stock market is expected to have an upward trading opportunity by the end of 2023, maintaining an over allocation of Chinese stocks. The above shows that the market value of Goldman Sachs' international positions has increased by more than 800 million yuan. Goldman Sachs believes that there are five major factors supporting its view, including the acceleration of easing policy, cyclical improvement, good market technology orientation, undervaluation and low position.

As one of the representatives of "smart capital", QFII has been concerned since it entered the A-share market. As Warren Buffett said, only buy stocks that you can understand. The trend of QFII position adjustment is not only a judgment of China's future development direction, but also a affirmation of China's technology and manufacturing industry. Therefore, the view of "foreign capital withdrawal" is too one-sided.

At present, China's capital market is still opening up to the outside world. In the short term, it is really troubled by the low turnover and market sentiment. We should not only rationally look at the impact of foreign capital position reduction, but also see the potential and attraction of China's stock market.

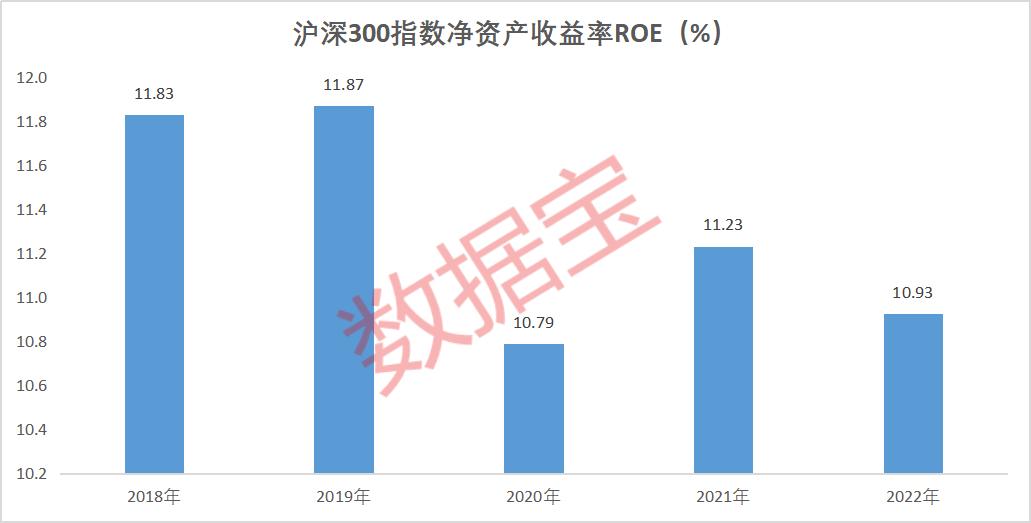

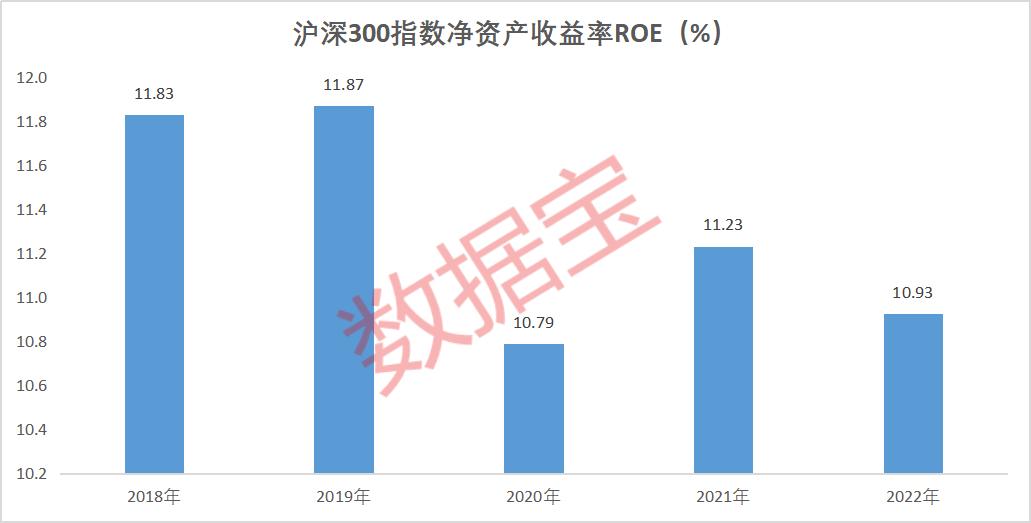

First, profitability remains stable. Taking the CSI 300 index as an example, the weighted return on equity (ROE) of its constituent stocks in 2022 is close to 11%, which is basically the same as that in the past two years, about 1 percentage point lower than that in 2019, that is, the profitability of the relevant constituent stocks has not declined significantly.

Secondly, the P/E ratio is lower than the historical median. The latest price earnings ratio of the CSI 300 index is 11.52 times, far lower than the median PE of 13.31 times in the past 20 years.

Finally, the resilience is still good. According to the data of the National Bureau of Statistics, the prosperity of the manufacturing industry has expanded. As of September, the PMI of the manufacturing industry has rebounded for four consecutive months, rising to the expansion range for the first time since April this year; The expansion of non manufacturing industry has been strengthened, the production and operation of enterprises have been improved, and manufacturing enterprises and non manufacturing enterprises have strong confidence in the recent industry development and market recovery.

Confidence is like gold. At present, the supervision of A-share market is becoming stricter, the new regulations on shareholding reduction are strictly implemented, and illegal shareholding reduction is strictly investigated; The continuous repurchase and shareholding increase of shareholders of listed companies is of positive significance for stabilizing the governance of listed companies, improving the activity of the secondary market, protecting the rights and interests of investors and boosting investor confidence.

Original title: Large scale withdrawal of foreign capital? Three sets of data show the truth

Read the original text